- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

Article View

East Asian Economic Review Vol. 24, No. 4, 2020. pp. 349-388.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2020.24.4.384

Number of citation : 55How the United States Marched the Semiconductor Industry into Its Trade War with China

Abstract

The US-China trade war forced a reluctant semiconductor industry into someone else’s fight, a very different position from its leading role in the 1980s trade conflict with Japan. This paper describes how the political economy of the global semiconductor industry has evolved since the 1980s. That includes both a shift in the business model behind how semiconductors go from conception to a finished product as well as the geographic reorientation toward Asia of demand and manufactured supply. It uses that lens to explain how, during the modern conflict with China, US policymakers turned to a legally complex set of export restrictions targeting the semiconductor supply chain in the attempt to safeguard critical infrastructure in the telecommunications sector. The potentially far-reaching tactics included weaponization of exports by relatively small but highly specialized American software service and equipment providers in order to constrain Huawei, a

JEL Classification: F10, F12, F13

Keywords

Export Restrictions, Supply Chains, National Security, Semiconductors, Huawei, SMIC, US–China Trade Relations

I. INTRODUCTION

The US–China trade war thrust the semiconductor industry back into the geopolitical spotlight. A reluctant participant this time around, US companies were no longer the provocateurs leading the charge into a foreign trade conflict, as they had with Japan in the 1980s. In the intervening decades, demand for semiconductors shifted to Asia, the business model of how to make semiconductors fragmented, and US companies came to rely heavily on global markets. This time around, US policymakers interjected the industry in a trade fight against its wishes.

Two separate US policy actions highlight key differences between the 1980s and the current period. In July 2018, the United States imposed 25 percent tariffs on semiconductors imported from China. A core issue involved allegations that unfair trade practices by China hurt a variety of US–headquartered companies, including in the semiconductor industry. Tit-for-tat government actions resulted in new tariffs covering over $450 billion, or more than half, of bilateral trade between the two countries by the end of 2019. Although semiconductors were one of the first Chinese products the US government targeted with tariffs, integrated circuits and the equipment required to manufacture semiconductors were conspicuously absent from China’s extensive retaliation list. Through 2020 and despite the trade war, China continued to increase its imports of these products from the United States.

The second, and arguably more economically disruptive, line of conflict for the industry began in 2019, with a series of US export controls targeting the global semiconductor supply chain. Initially, US policy was motivated by national security concerns. Limiting US semiconductor sales was aimed at keeping Huawei—a Chinese national champion and

Although sympathetic to the underlying concerns with China, the US industry came out against both US policy actions. This position was much different from its stance in the early 1980s conflict with Japan, when US companies pushed for a highly interventionist trade policy. In that era, the industry wanted additional tariffs on Japanese imports, restraints on Japanese exports, and an agreement by the Japanese government to facilitate US semiconductor companies’ efforts to reach market share targets in Japan. The industry’s demands culminated in the Semiconductor Trade Agreement of 1986, an agreement that the US government went on to enforce with 100 percent tariffs.

The period following the 1986 agreement led to industry change. When prices for semiconductors went up following the restrictions on Japan’s foreign sales, firms in South Korea and Taiwan took advantage of new market access opportunities. Over the next 15 years, as these companies expanded, they, too, often found themselves part of trade conflicts driven by the US industry. Yet trade tensions were managed, including through use of World Trade Organization (WTO) dispute settlement. By 2019, semiconductors made up nearly one third of Taiwan’s total goods exports and almost a fifth of South Korea’s. For the US industry, foreign consumers also became increasingly important. More than a third of US industry revenue came from sales to companies in China, and more than a fifth came from semiconductor sales to Chinese device makers alone.1

The modern US–China conflict has highlighted how the definition of an “American” semiconductor came to mean something fundamentally different in the decades since the 1980s. The global reduction of trade barriers and transport costs, the integration of China into the global economy, and the reorganization of the types of firms that make the chips, resulted in many American semiconductors being manufactured in third countries. Under a new business model, manufacturing was often handled under contract and at arm’s length rather than through foreign direct investment (FDI). Economically, what mattered was who held the intellectual property rights to a product, not where or even who ended up physically manufacturing it.

These developments created legal challenges for US policymakers intent on exploiting leverage over foreign firms during the US–China trade and technology conflict. As 1980s-style tariffs had become mostly ineffective, they moved to exert US–domiciled companies’ potential market power on the supply side. Only after they had made the controversial decision to weaponize the semiconductor industry’s supply lines in an attempt to protect the critical infrastructure of 5G networks did they grasp its limitations.

Implementing that strategy would turn out to be legally complex and accompanied by considerable unintended consequences. Initial US export controls on semiconductors misfired because of their limited reach—and potentially sizable costs to US firms. Even to increase the chances of achieving the national security objective, US policymakers were forced to follow up with additional rounds of export controls on US–provided

The semiconductor industry has become a case study for the changing political economy of trade policy in light of global value chains. This paper presents key industry details in order to showcase how and why governments turned to different policy instruments, even if only to achieve noneconomic objectives. Making sense of the modern conflict requires explaining the industry’s starting point and the US–Japan trade conflict of the 1980s, as well as how the sector and policy evolved over the intervening period. Given that policy actions in the modern US–China conflict appear far from over, it is too early to draw a full set of lessons from this episode. Instead, the last section offers some tentative implications as well as additional questions for investigation.

1)See

II. THE EVOLUTION AND POLITICAL ECONOMY OF THE SEMICONDUCTOR INDUSTRY

Semiconductors are the tiny chips that drive smartphones, computers, automobiles, data centers, telecommunications hardware, weapons systems, and more. The industry is characterized by two sets of fixed costs. The first is research and development (R&D), including product and process innovation—coming up with new products as well as learning by doing to produce existing products more efficiently. The second is capital equipment. Semiconductor manufacturing involves building plants—known as

The modern industry’s headline products are integrated circuits, which made up more than 80 percent of all semiconductor sales in 2019 (SIA 2016, 2020b).2 Logic and memory chips, each accounting for about a quarter of global semiconductor revenues, were the top two categories of integrated circuits. Logic chips are at the leading edge, with applications in artificial intelligence and graphics. They include the microprocessors and central processing units found in smartphones and computers. Memory chips are critical for the storage of information. In terms of end uses, communications equipment, computers, and other electronics accounted for 75 percent of semiconductor consumption in 2019 (SIA, 2020b). The other 25 percent was used in automotive and industrial applications or by governments.

The most extensively researched segment of the semiconductor industry is memory, particularly dynamic random access memory (DRAM). In their seminal study, Irwin and Klenow (1994) examined 7 generations of DRAMS, manufactured by 32 firms located in the United States, Japan, Europe, and South Korea over 1974–92.3 They found an average learning rate of roughly 20 percent—that is, per unit production costs fell 20 percent every time cumulative output doubled. Even in that era—which featured FDI, although supply chains were less fragmented and globalized than in 2020—they found evidence that some learning that took place outside of the firm crossed borders and was acquired by firms in other countries.

1. Semiconductor’s American Beginnings

The transistor was invented at Bell Labs in 1947; its inventors won the Nobel Prize in 1956.4 In the 1950s, researchers at Fairchild Semiconductor and Texas Instruments invented ways of putting multiple transistors on a single flat piece of material thereby creating the integrated circuit.

The US industry grew rapidly in the 1960s, with initial demand driven by the US military and space programs. The sector was concentrated primarily in California (Silicon Valley), Arizona, Texas, and New York.

By the 1980s, two business models dominated US production. The first was “captive” production, in which IBM, Hewlett-Packard, and AT&T made semiconductors for their own uses—for computing hardware or telecommunications equipment that they sold to end consumers, for example. The second was integrated device manufactures (IDMs), including smaller companies like Intel, Micron, and AMD (Advanced Micro Devices), which produced semiconductors for sale at arm’s length to consumer electronics and computer companies.5 Hybrids included Motorola and Texas Instruments, which made semiconductors both for their own downstream products (such as phones and calculators) and to sell to others.

The first FDI in semiconductors took place in 1961, when Fairchild Semiconductor outsourced to Hong Kong the process of taking a manufactured silicon wafer and then assembling and packaging it into the semiconductor chips to be sent to end-user firms. This relatively labor-intensive part of the supply chain led to considerable outbound foreign investment by US firms in the 1960s and early 1970s, as companies moved assembly to countries in Asia with an abundance of lower-cost labor.6

2. Competition from Japan

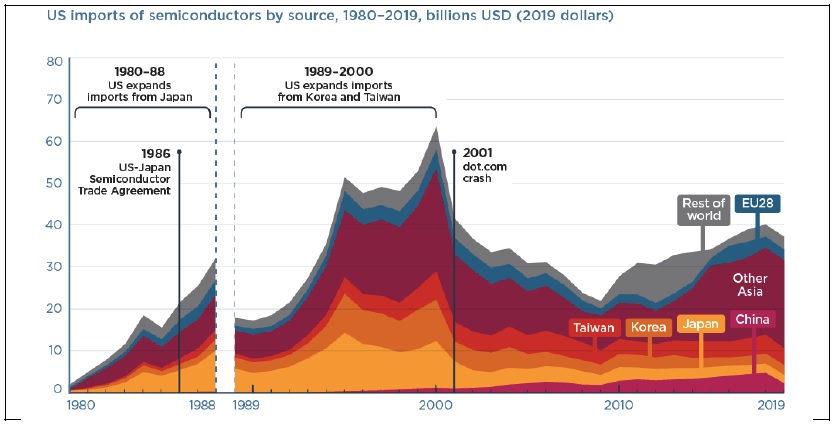

Japanese companies began to enter the US market through trade in the 1970s. US semiconductor imports from Japan nearly doubled every year from 1981 through 1984, partially retrenching only during an industry downturn in 1985 (figure 1).

Irwin (1996) points to a number of factors behind the rise of Japanese semiconductors. First, Japan’s burgeoning consumer electronics industry was an important source of local demand. In the United States, roughly half of US shipments of semiconductors went to the military in the early 1960s; that share declined to a mere 10 percent by 1981. The fastest-growing source of semiconductor demand was not only located outside the United States; major Japanese electronics firms—such as NEC, Toshiba, Hitachi, Sony, and Sanyo—were structured like the “captive” US semiconductor companies. According to Okimoto (1987), 50 percent of Japan’s total semiconductor consumption came from 10 Japanese firms, which also accounted for 80 percent of Japan’s semiconductor production. American IDMs found it difficult to break into the Japanese market to sell them chips. Furthermore, American captive (and hybrid) firms faced new competition in downstream product lines from Japanese imports of consumer electronics, crimping local demand for their semiconductors. At the request of Motorola, in the early 1980s the US government even imposed tariffs on imports from Japan of pagers and cellular phones, after finding that their low prices were hurting the US industry.

Differences in investment also played an important role. Japanese firms outspent their American competitors in order to scale up production capacity, partly because Japanese companies were often bigger and affiliated with a large bank as part of a

The Japanese government was also earlier than the United States to pool basic R&D across firms in order to potentially limit redundant spending. Japan’s Ministry of International Trade and Industry (MITI) sponsored its Very Large Scale Integration (VLSI) program from 1976 to 1979. It took until 1987 for the US semiconductor industry to develop its own R&D consortium, called SEMATECH (Semiconductor Manufacturing Technology).

Two other important macroeconomic forces challenged the US industry in the early 1980s. The first was the relatively high cost of capital that emerged when the Federal Reserve raised interest rates in the face of double-digit inflation. The second was the resulting appreciation of the US dollar, which made imports from Japan cheaper and potential US export sales to customers abroad more expensive.

3. The US–Japan Semiconductor Trade Conflict of the 1980s

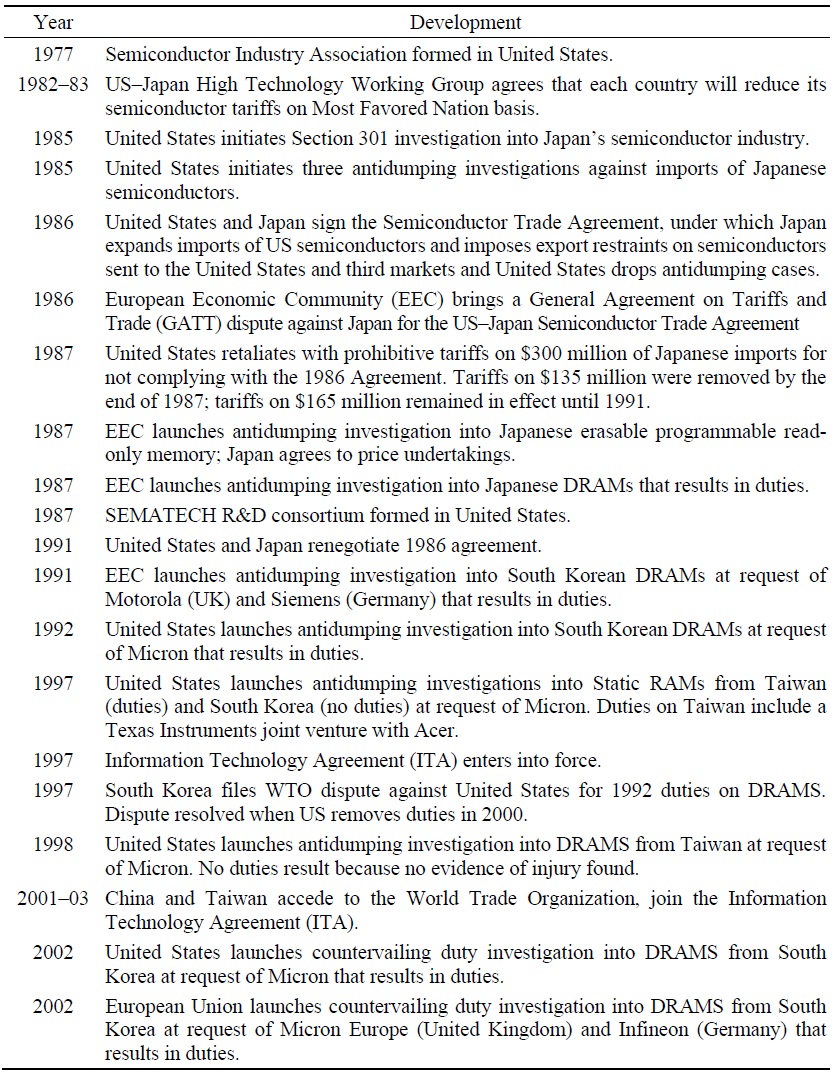

The 1980s began a period in which semiconductors were central to major trade conflicts. In contrast to today, the US industry was the instigator of the fight. The sector began to organize itself politically when Intel and four other IDMs formed the Semiconductor Industry Association (SIA), in 1977.7 Table 1 provides a timeline of key policy events starting then.

In 1981–82, the semiconductor industry fell into a cyclical downturn in the midst of a US recession. Japanese firms enjoyed major gains, especially in the DRAM market. The SIA pressed the US government for action, blaming Japanese nontariff barriers and subsidies. The response was a US–Japan High Technology Working Group, which negotiated over 1982 and 1983 for greater US participation in the Japanese market. The limited policy change to emerge from the negotiations was that each country agreed to reduce its Most Favored Nation (MFN) tariffs on semiconductors.8 As industry conditions improved, US concerns with Japan temporarily went away.

The industry began to suffer again in 1985, however, and the SIA became more aggressive in demanding government action. With the continued appreciation of the dollar and a growing trade deficit, the Reagan administration became more hospitable to the industry’s demands, seeing semiconductors as one more in a long series of trade concerns with Japan.9 In June 1985, the SIA officially filed a petition under Section 301 of the Trade Act of 1974, voicing three issues. The main complaint was that the US industry lacked access to Japanese firms using semiconductors. Despite Japan’s removal of quotas beginning in 1975 and its later reduction of its tariffs, the US industry remained stuck at little more than 10 percent of the Japanese market. The other two complaints involved Japanese government policies that encouraged dumping by Japanese firms in the United States and in third markets.

Not everyone in the United States tied to the semiconductor supply chain was in favor of the Section 301 petition. US companies making the capital equipment to outfit semiconductor manufacturing facilities, for example, came out against. One official stated, “I can tell you that American semiconductor production equipment firms are being kept alive today only from Japanese orders. We have ‘zero’ orders from US semiconductor manufacturers. If it weren’t for the Japanese manufacturing expansion, many US equipment firms would be out of business.”10

Following the filing of the Section 301 petition, three related antidumping petitions over memory chips emerged against Japanese firms. Micron filed the first against one type of DRAM. Intel, AMD, and the National Semiconductor Corporation filed the second against another type of memory chip. Then, in an uncommon maneuver under this law, the Reagan administration initiated a third antidumping investigation into imports of more advanced varieties of DRAM. In each case, the Department of Commerce subsequently found evidence of dumping, and the International Trade Commission found evidence of injury. This combination meant the United States would impose duties unless the Reagan administration and Japanese governments negotiated a deal.

In July 1986, the governments of the United States and Japan came up with a Semiconductor Trade Agreement that at least tangentially addressed all three US concerns. To head off US antidumping duties, the Japanese firms agreed to a suspension agreement—US trade law language for a voluntary export restraint—limiting their sales to the US market, and the Japanese government promised to address its firms’ dumping in third markets. On the third issue, the two sides agreed to a secret side letter—albeit with vaguely worded language—in which the Japanese government acknowledged the US semiconductor industry expected its sales would reach 20 percent of the Japanese market within five years.11

Despite the deal, concerns quickly arose. Without a way to facilitate the cartel-like arrangement, Japanese companies were slow to voluntarily cut back on selling into third markets, and Japanese consuming firms were slow to buy American semiconductors. Frustrated by the lack of progress, in April 1987 the Reagan administration imposed 100 percent tariffs on $300 million of imports from Japan, including imports of major semiconductor consuming industries such as computers and televisions.12 Of the retaliation, $135 million was for third-country dumping and $165 million for lack of market access. Over the rest of 1987, the Japanese government convinced its firms to cut back on output, the third-country dumping let up, and the US phased out some of the tariffs by November. The tariffs on $165 million of imports remained in place until 1991, however, when Japan finally neared the 20 percent target, and the agreement was renegotiated and revised.

From the beginning, the European Economic Community (EEC) was concerned with the discriminatory nature of the agreement in Japan, as well as its potential impact on third markets. In 1986, the EEC filed a formal General Agreement on Trade and Tariffs (GATT) dispute against Japan complaining that the (20 percent) market access target for US firms in Japan implicitly discriminated against European exporters. The EEC also began two antidumping investigations of semiconductors from Japan, worried that its agreement to limit third-market dumping could lead to price increases that hurt European semiconductor-consuming firms. In one, the Europeans negotiated their own agreement whereby Japanese companies would raise prices. In the other, the EEC imposed duties on DRAMS. If DRAM prices were to increase in the European market, the quota rents would be shifted to European tariff collectors and away from the profits of Japanese firms.

4. The Entrance of South Korea and Taiwan and the Emergence of More Tariffs

A number of knock-on effects emerged as the US–Japan agreement increasingly began to bind after the US tariff retaliation in 1987. Higher prices hurt US consuming firms, such as the computer industry. Some Japanese semiconductor manufacturers used the profits from the cartel-like arrangement to fund R&D and capital expenditures needed for the next generation of semiconductors, improving their own competitiveness. With Japanese supply constrained and the US industry (aside from Micron and Texas Instruments) having largely exited the DRAM market, there was a shortage of memory chips. This opportunity arguably accelerated the development and entry of other semiconductor companies, first in South Korea and later in Taiwan.

South Korea’s market entry was led by Samsung and later Hyundai Electronics and Goldstar.13 The semiconductor supply chain first arrived in South Korea in the 1960s, through FDI by US firms. Initially, the Korean firms handled only assembly, testing, and packaging. In 1983, Samsung, already a successful consumer electronics firm, decided to enter into DRAM production by licensing technology from Micron. When DRAM prices increased in the aftermath of the US–Japan agreement, and US imports from Japan were constrained, South Korea expanded its share of the US import market from roughly 8 percent in 1988 to 15 percent in 1989 (see again figure 1).14 Its export growth would continue, peaking at 16–18 percent of the US import market in 1995–2000.

The new entrants from South Korea soon found themselves part of trade conflicts in US as well as third-country markets. In 1992, Micron—which had licensed DRAM technology to Samsung less than a decade earlier—filed an antidumping petition against Samsung, as well as against Hyundai and Goldstar. The US government imposed antidumping duties against Korean DRAM chips in 1992. (In 1997, the Korean government had to file a WTO dispute to prod for their removal.) In the early 1990s, at the request of Motorola’s UK subsidiary as well as the German firm Siemens, the EEC began its own antidumping investigation into DRAMS from South Korea. Under the threat of tariffs, Samsung, Hyundai, and Goldstar agreed to raise prices. That arrangement remained in place until 1997.

Shortly after South Korean companies made inroads, Taiwan’s industry followed suit. Taiwan first entered the semiconductor supply chain in the 1960s, when foreign firms such as General Instrument, Philips, and Texas Instruments set up assembly and packaging plants on the island.15 The Taiwanese government helped support the industry by establishing an export-processing zone and investing in technical universities and research consortia, as well as in Taiwan’s first foundries, including the United Microelectronic Corporation (UMC), which was spun out of the state-owned Industrial Technology Research Institute (ITRI) in 1980.

Another critical development involved the Taiwanese government’s decision in 1987 to provide $100 million to help develop the Taiwan Semiconductor Manufacturing Company (TSMC). The idea—pushed by Morris Chang, who moved to Taiwan after a long career as an executive at Texas Instruments in the United States—was to combine forces with Philips and construct a foundry for hire that would manufacture chips under contract. The business model involved foundries working with smaller semiconductor design companies, which had enough funding to cover R&D, and thus intellectual property, but not enough to build a manufacturing facility. TSMC became an industry pioneer for the contract manufacturing model. As described below, it also played an important role in the US-China conflict.

Taiwan’s semiconductor exports to the United States grew steadily over the 1990s, with a nearly fivefold increase between 1989 and 1997, by which point it attained 9 percent of the US import market (see again figure 1). In response to the new competition, in 1997, Micron filed a dumping case against imports of a memory product—Static RAM —from Taiwan. The US investigation found dumping and injury caused by Taiwanese firms like UMC as well as by a joint venture between Texas Instruments and the Taiwanese computer company Acer (Acer bought out Texas Instruments from the venture in 1998.) The United States imposed duties of more than 90 percent on Taiwanese semiconductors. They remained in place until 2002.16

The dot.com crash of the broader US information technology (IT) industry led to another downturn in 2000. US semiconductor imports peaked that year (see again figure 1), before beginning a period of decline. By that point, consolidation had resulted in 80 percent of the DRAM segment of the global market being served by four companies: Micron, Infineon (a spinoff of Siemens), Samsung, and Hynix (a company created in 1999 by merging the semiconductor operations of Hyundai and LG, formerly Goldstar). With the industry recession, Hynix began to receive bailouts from its creditor banks, which, having been nationalized during the 1997 Asian financial crisis, were owned by the South Korean government. Government control over the Korean banks provided the link to subsidies that Micron and its foreign affiliates would legally rely on to motivate countervailing (anti-subsidy) duty investigations against the two Korean suppliers in the US, European, and Japanese markets beginning in 2002.17 Samsung and Hynix suddenly faced new duties in all three markets, and the Korean government was forced to file three separate WTO disputes to seek their removal. The US, EU, and Japanese countervailing duties remained in place until the late 2000s.

At this historical juncture, there were at least two competing implications of FDI. Philips’ role in the creation of TSMC and Texas Instruments’ joint venture with Acer are examples of FDI contributing to the global expansion of semiconductor manufacturing and cross-border supply chains. But other firms’ FDI—such as Motorola’s investments in the United Kingdom and Micron’s investments in the United Kingdom and Japan—contributed to subsequent increases in protection.18 The FDI provided these US–domiciled companies with legal standing abroad, allowing them to join with other local firms to petition for higher tariffs under antidumping or countervailing duty laws. This protection resulted in at least temporary periods of lower trade in the memory segment of the industry.

US policy across government agencies was also inconsistent during this period. At about the time that the US government agreed, in Micron’s countervailing duty cases, that its competitors were pricing too low and that prices should rise, the Department of Justice was investigating the highly concentrated DRAM segment of the industry for alleged price fixing. Between April 1999 and June 2002, the US government became worried that DRAM manufacturers were colluding to raise prices in ways that hurt computer companies such as Dell, Compaq, Hewlett-Packard, Apple, IBM, and Gateway. In 2003, a Micron executive pled guilty to an obstruction of justice violation; he and others were sentenced to prison terms. Infineon, Hynix, and Samsung also ultimately agreed to guilty pleas and paid fines (US DOJ, 2005).

The price-fixing charge would not be the last time that competition authorities intervened in the industry. But the mid-2000s marked the end of a 20-year period in which US–headquartered firms aggressively used unfair trade laws to slow import competition, including in foreign markets.

5. The Shift of Demand and Supply to Asia, the Entrance of China, and the Emergence of New Concerns

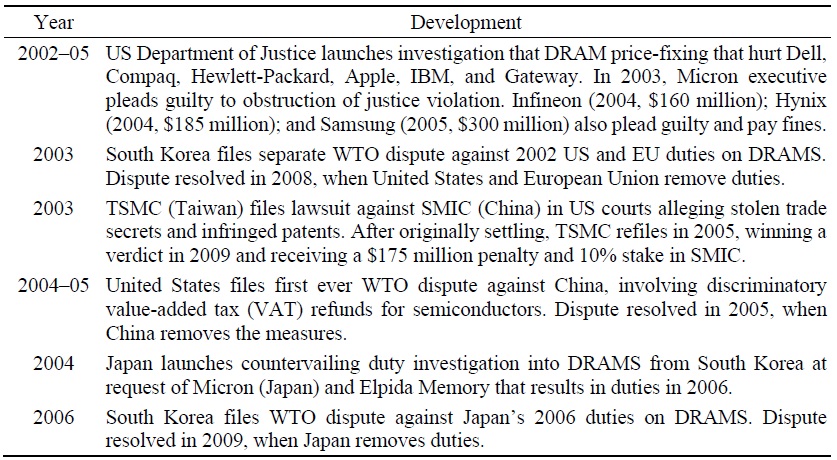

Despite the antidumping and countervailing duties, the global trend beginning in the late 1980s was to liberalize tariffs, both for semiconductors and for the capital equipment used to manufacture the chips (figure 2). The EEC, South Korea, and others cut tariffs as part of the Uruguay Round Agreement, which ushered in the WTO in 1995. The Information Technology Agreement (ITA) of 1997 resulted in further tariff cuts for a number of products. Both China and Taiwan lowered their tariffs over the 1990s, and shortly after their WTO accessions, in 2001 and 2002, respectively, each joined the ITA.

Another important policy development around this time was the entry into force of the Trade-Related Aspects of Intellectual Property (TRIPS) agreement. For the first time, an agreement provided a global minimum baseline level of protection for intellectual property rights holders that was enforceable through formal dispute settlement and even trade sanctions.

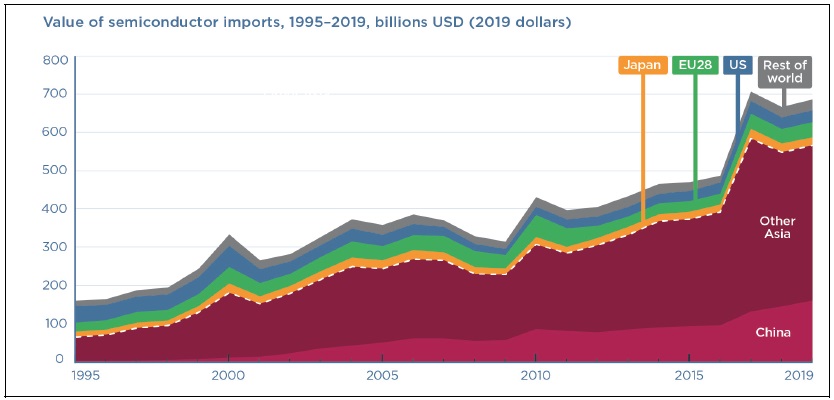

One reason why the US–Japan fights of the 1980s, as well as those that spilled over to the European and Japanese markets by the early 1990s and into the 2000s, petered out was that their import markets became relatively less important. The US share of world semiconductor imports dropped from 27 percent in 1995 to 5 percent in 2019. The European Union went from a 15 percent to a 6 percent share over this period. Japan’s share fell from 8 percent to 3 percent, as import demand from other countries in Asia rose (figure 3).

By 2005, China had become the world’s largest consumer of semiconductors; by 2012, it was purchasing more than half of world consumption of semiconductors (PwC, 2017). Recent estimates suggest that 90 percent of all smartphones, 67 percent of all smart televisions, and 65 percent of all personal computers are made in China.19 China’s share of total world imports grew from 1 percent to 23 percent between 1995 and 2019 (see figure 3).

Over time, China has also become an increasingly important supplier of semiconductors.20 Like South Korea and Taiwan, China first entered the market through assembly and packaging, relying on its abundance of lower-skilled labor to turn wafers manufactured elsewhere into finished semiconductors.

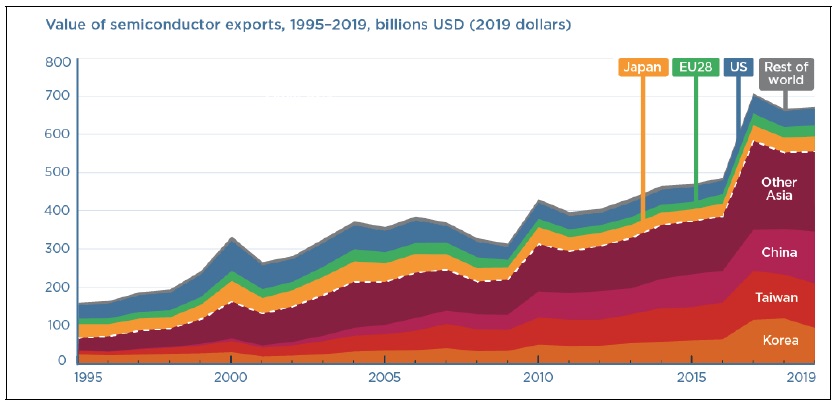

China was also the recipient of substantial FDI. Foreign firms operating in China included TSMC in Nanjing, Intel in Dalian, SK Hynix in Wuxi, and Samsung in Xian.21 In 2000, the city of Shanghai helped finance the Semiconductor Manufacture International Corporation (SMIC), which would become a major foundry in the mold of TSMC. China became a substantial manufacturer (in addition to assembler) of semiconductors, with 20 percent of world semiconductor exports by 2019 (figure 4).

What these data do not reveal, however, are key differences between the semiconductors that China imported and the semiconductors it exported. On the import side, device makers in China relied on leading-edge semiconductors as inputs into their assembly of smartphones, telecommunications equipment, and consumer electronics. On the export side, it produced lower-end semiconductors, manufacturing chips that remained at least a generation or two behind the global technology frontier.22

Several policy concerns began to arise not long after China began manufacturing semiconductors. SMIC quickly ran into problems with TSMC, which filed a lawsuit in US courts in 2003 alleging that the Chinese company had infringed on patents and stolen its trade secrets, including by hiring away engineers and other employees. The case was initially settled, but it reemerged when TSMC claimed that SMIC had violated the terms of the agreement. In 2009, TSMC won a verdict over SMIC in California courts that awarded it $175 million and passive shares in 10 percent of the company.

Taiwan, an economic source for potential FDI, was wary from the start and imposed controls to limit direct investment by Taiwanese semiconductor firms in China.23 One concern was national security. Another was economic security and the loss of some of its high-tech industry, including segments that had received considerable government support over the decades.

Another emerging fear involved China’s industrial policy goals and the scale and type of subsidies its government provided to the semiconductor industry. The very first WTO dispute brought against China involved semiconductors. In 2004, the United States alleged that China was providing implicit subsidies to encourage domestic manufacturing by partially refunding its own, but not others’, value-added tax (VAT) payments. In 2005, China agreed to get rid of the system.

More recent concerns have turned to whether China’s long-term objective is industry self-sufficiency. Its 2014 National Integrated Circuit Plan, as well as the Made in China 2025 Plan released in 2015, make clear China’s goal of substantially increasing the share of locally produced semiconductors in domestic consumption. Reducing reliance on foreign inputs also appears to be a critical element of the “dual-circulation” strategy at the heart of the five-year plan for 2021–25.24 Given China’s share of more than 50 percent (and growing) of world consumption of semiconductors, such a policy goal could mean big changes for other semiconductor-producing countries.

Globally, the semiconductor industry long benefited from government support, including in countries at earlier stages of industrial development. But this support generally took the form of subsidies for R&D, such as what Japan (VLSI), Taiwan (ITRI), South Korea (the Electronics and Telecommunications Research Institute) and the United States (SEMATECH) provided through pre-competitive research institutes and consortia.25

Concerns involved both the size and nature of the Chinese subsidies, which were not simply transparent payments from governments to firms. In its study of the semiconductor global value chain over 2014–18, OECD (2019) used firm-level analysis to examine the role of below-market financing, i.e., the failure of government-invested firms to generate returns for taxpayers comparable to the returns achieved by private firms. The study found that this particularly opaque form of subsidy was economically sizable and the preferred form of subsidy granted to major Chinese manufacturers such as SMIC and Tsinghua Group.

To what extent did China’s subsidies pose economic problems for other countries? What were the economic channels through which such negative spillovers arose? These remained open questions. For economists, the evolution of the industry’s structure resulted in an imperfect fit with off-the-shelf game-theoretic models of subsidies and strategic trade policy from which to draw clean insights.26

2)Other types of semiconductors include discrete semiconductors (used to control electric current) and optoelectronics and sensors (used to sense light in cameras or traffic lights). In 2019, semiconductor sales were dominated by integrated circuits (81 percent), followed by optoelectronics and sensors (13 percent) and discrete semiconductors (6 percent), according to

3)For other approaches to studying learning by doing and memory chips during this period, see

4)

5)At the time, IDMs selling at arm’s length were often referred to as “merchant” firms

6)For a discussion, see

7)In 1982, SIA membership was expanded to include captive firms like IBM, Hewlett-Packard, Digital Equipment Corporation (DEC), and AT&T

8)As the world’s two largest suppliers, the United States and Japan expected to be the primary beneficiaries, although there was some concern that European and South Korean firms would benefit without reducing their tariffs. At the time, their tariffs remained higher, at 17 percent and 30 percent, respectively.

9)Other US sectors facing increased import competition from Japan in the 1970s and early 1980s included automobiles, motorcycles, steel, clothing, and footwear

10)

11)See the discussion in

12)In 1986, US total goods imports from Japan were $81.9 billion. The tariffs thus targeted less than 0.4 percent of US goods imports from Japan.

13)

14)The shift in the US tariff classification system from the Tariff Schedule of the United States Annotated (

15)See

16)Another investigation that Micron initiated against the three Korean firms in 1997 found no evidence of injury and so did not result in duties.

17)Bad blood arose as a potential merger between the two companies—negotiated since December 2001 and tentatively agreed to in April 2002—in which Micron would acquire Hynix semiconductor business was scuppered by a veto from the Hynix board in May

18)Motorola (UK) had been part of one of the EEC’s antidumping investigations of Japanese semiconductors in the 1980s as well.

19)Bernstein Research, as quoted in Li Tao, “How China’s ‘Big Fund’ Is Helping the Country Catch up in the Global Semiconductor Race,”

20)For discussions, see

21)See IC Insights, “China IC Production Forecast to Show a Strong 15% 2018–2023 CAGR. However, China’s Indigenous IC production Is Still Likely to Fall Far Short of Government Targets,”

22)For a discussion, see

23)

24)Simon Rabinovitch, “China’s ‘Dual-Circulation’ Strategy Means Relying Less on Foreigners,”

25)SEMATECH was set up by 14 leading US firms, each of which was required to contribute 1 percent of its semiconductor sales revenue, and the US government, which contributed $100 million in annual funding.

26)On subsidies and strategic trade policy, the profit-shifting literature started with

III. THE GLOBAL SEMICONDUCTOR INDUSTRY TODAY

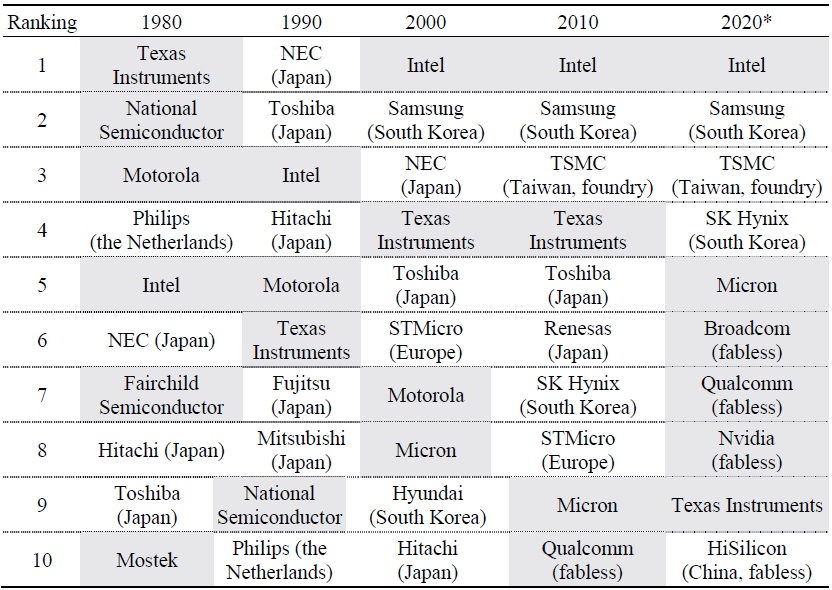

Much has changed in the 40 years since the onset of the US–Japan trade conflict. In both 1980 and 2020, 6 of the top 10 firms were domiciled in the United States, but only 2 – Intel and Texas Instruments – were in the top 10 both years (table 2). Japanese companies dominated the industry in 1990, but in 2020 none were in the top 10, having been replaced by entrants from South Korea, Taiwan, and China. US firms continued to lead industry sales in 2020, but less than 15 percent of the world’s manufacturing capacity resided geographically in the United States.27

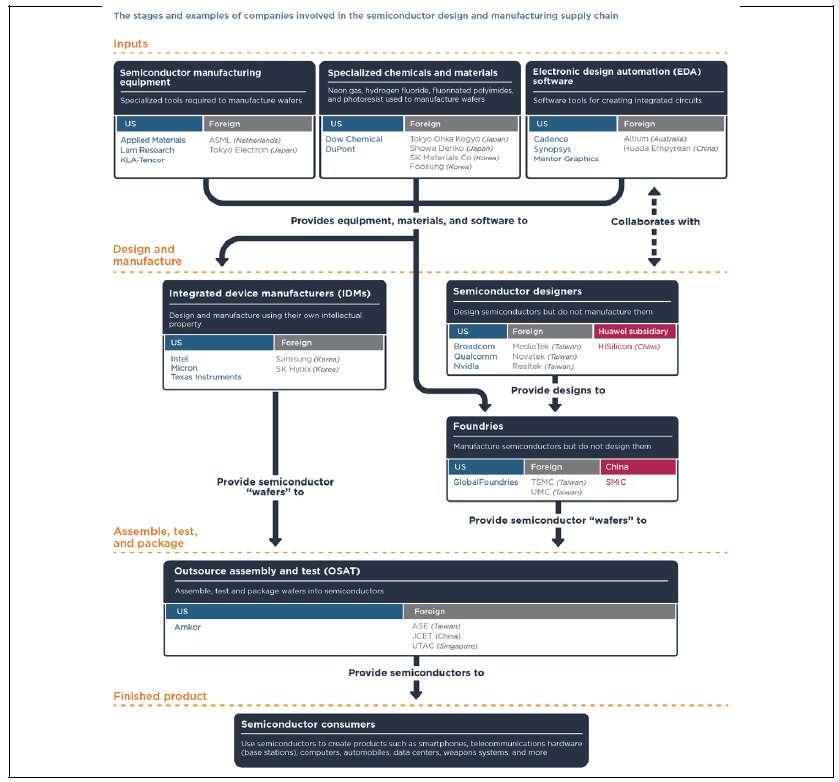

Two main models formed the backbone of the modern global semiconductor industry (figure 5). The first involved the surviving IDMs. Intel, for example, continued to design and manufacture its own chips to sell to downstream using companies. Micron had grown from a much smaller firm to thrive in the ever-consolidating memory segment. Other IDMs, including Samsung, maintained downstream consumer electronics as part of their business model, but they, too, sold chips to other using companies. The other dominant model of the 1980s—represented at the time by “captive” firms like IBM and AT&T that designed and manufactured semiconductors primarily for their own consumption—no longer led the way.

FDI is one reason why the semiconductors of US–domiciled companies were often never physically present in the United States. This development was not new: Already in the late 1980s and early 1990s, some of the European and Japanese antidumping actions were partially triggered by local subsidiaries of US companies. In 2019, more than 55 percent of US–headquartered firms’ wafer capacity was located outside the United States, mostly in Singapore, Taiwan, Europe, and Japan (SIA, 2020b). (Conversely, some foreign IDMs, including Samsung, built fabs and continued to manufacture chips in the United States.)

The second way that US companies led global sales without physically manufacturing in the United States arose through the emergence of the fabless-foundry model (see figure 5). “Fabless” companies like Broadcom, Qualcomm, and Nvidia designed, marketed, and sold chips. But they did not own or operate plants that manufacture semiconductors; they contracted out production of wafers to foundries such as TSMC, SMIC, and GlobalFoundries. Even by the late 2000s, this model was sufficiently mature that the first fabless firms (Qualcomm) and foundries (such as TSMC) cracked the top 10 of global revenues. Although not on the manufacturing side, US firms were critical to this model: US–domiciled semiconductor design companies made up 65 percent of fabless global sales in 2019.28

Four additional elements of the semiconductor supply chain became critical to modern policy developments. Each touches on both the IDM and fabless-foundry models. The first three involve inputs (see again figure 5).

Electronic design automation (EDA) is an essential class of software for the industry. US–based companies Synopsys, Cadence Design Systems, and Mentor Graphics sell or license software services as inputs to many US and foreign chipmakers. The three companies have been estimated to supply 85 percent of the global EDA market.29

A second class of critical inputs is the specialized capital equipment required by semiconductor manufacturing fabs. Three California-based companies—Applied Materials, Lam Research, and KLA-Tencor—are estimated to hold more than 40 percent of global market share.30 ASML (the Netherlands) and Tokyo Electron (Japan) together account for another third of the market. Industry analysts report that even these figures may understate the degree of concentration, where four sets of equipment each have one dominant supplier with more than 50 percent of global market share. The canonical example has been lithography equipment, which reportedly cost a fab more than $120 million, and which ASML supplied 75 percent of the global market. Concentration is only slightly lower among suppliers of specialty equipment for chemical vapor deposition, etch and clean, and process control.31

Specialty chemicals and materials form the third set of inputs. Fabs need to combine them with capital equipment to manufacture wafers.32 Photolithography equipment, for example, uses

The last part of the supply chain occurs after a wafer is produced at a foundry or IDM. It involves back-end assembly, testing, and packaging of the wafer into the semiconductor—the first part of the supply chain to have been carved off from manufacturing in the 1960s.33 Most firms in this segment, referred to as OSAT (outsourced assembly and test), are located in Asia. They include ASE (Taiwan), JCET (China), and UTAC (Singapore). The US company Amkor is the second-largest globally by revenue. It has plants in China, Japan, South Korea, Malaysia, the Philippines, and Taiwan.34 This segment brings in only about 6 percent of global industry revenue.35

A combination of economic, policy, and technological developments since the 1980s fundamentally shifted the industry away from vertically integrated “captive” firms, beyond consolidation around the IDMs, and toward considerable take-up of the fabless-foundry model. With costs for new cutting-edge fabs increasing to more than $10 billion, manufactures could offset capital expenditures by working with multiple, fabless design firms. Firm entry into semiconductor design was also enabled by the availability of venture capital, as well as an emerging policy environment that was more supportive of intellectual property protection following implementation of the TRIPS agreement.36 The general reduction in trade barriers, policies encouraging FDI, and differences in skill intensity across the supply chain allowed comparative advantage to also play a role in how the industry fragmented across borders.

This economic reorganization was accompanied by an important political reorganization of the industry.37 By 2020, the SIA included not only IDMs like Intel and Micron but also the new fabless semiconductor design firms (firms such as Broadcom, Qualcomm, and Nvidia). Accommodating common interests of key input suppliers, SIA also garnered support from Amkor, Applied Materials, ASML, Cadence, Synopsys, KLA-Tencent, and Lam Research. SIA even allowed international members to play a role—including TSMC, Samsung, SK Hynix, Infineon, and MediaTek—companies with a significant presence in the United States but domiciled elsewhere. Notably absent from SIA membership were firms headquartered in China.

27)See

28)“US IC Companies Maintain Global Marketshare Lead,”

29)See

30)Thomas Alsop, “Semiconductor Equipment Manufacturers’ Market Share Worldwide 1Q'17 to 2018,”

31)In addition to ASML (lithography), other pieces of specialty equipment are dominated by Applied Materials (deposition), Lam Research (etch), and KLA-Tencor (process control). See Joshua Hall, “Overview of the Semiconductor Capital Equipment Industry,”

32)See

33)Back-end chip production involves some capital equipment used to test the wafers, cut them into chips, and package them.

34)Trendforce, “Packaging and Testing Industry Grows in 1Q20 Despite Seasonality, with Daunting Challenges ahead in 2H20,” May 14, 2020.

35)Estimate for 2015 are from

36)

37)SIA Members,

IV. SEMICONDUCTORS AT THE HEART AND PERIPHERY OF THE US–CHINA TRADE WAR

The economic and political reorganization of the industry led to two major changes starting in 2017. First, policymakers looked beyond tariffs and subsidies to some completely new instruments. Second, policies were often adopted against the explicit wishes of the industry. This section considers four classes of policies, summarized in table 3.

1. US Tariffs and China’s Unfair Trade Practices

In 2017, the US government self-initiated an investigation into China’s unfair trade practices under Section 301, the same law that ultimately led to the 1986 US–Japan Semiconductor Trade Agreement. Although the 2017 case investigated Chinese industries in addition to semiconductors, it highlighted policy concerns of relevance for the sector.

The US Trade Representative issued two reports in 2018 that articulated the main complaints.38 They alleged that, in addition to providing the subsidies described above, China required foreign firms to engage in joint ventures with local companies, which resulted in the forcible or below-market transfer of technology from US intellectual property–holders as a quid pro quo for access to the Chinese market. Other allegations included state-sponsored industrial espionage and theft of intellectual property.

As a result of the investigation, in 2018, the United States imposed 25 percent tariffs on semiconductor imports from China. Semiconductors were included in the first of many rounds of new US tariffs that by September 2019 covered more than $350 billion of imports from China. China retaliated by imposing tariffs of nearly $100 billion on US exports in 2018 and 2019, though it deliberately refrained from targeting integrated circuits or semiconductor manufacturing equipment.39

Although the US semiconductor industry shared concerns about Chinese policies, it came out strongly against the US tariff actions.40 This response was distinct from earlier periods, when US trade restrictions on semiconductor imports from Japan, South Korea, and Taiwan emerged from direct requests by US firms.

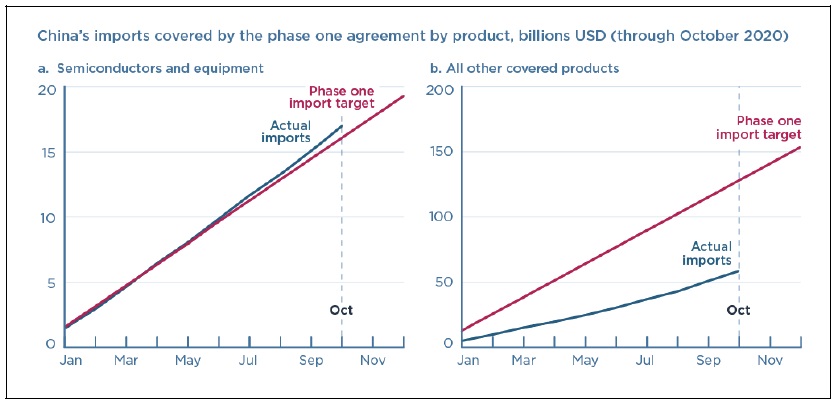

In February 2020, the United States and China implemented the Phase One agreement. The deal was seen as a temporary truce, as it did not remove either side’s newly imposed tariffs, covering $450 billion of bilateral trade. It did, however, include one element reminiscent of the 1986 US–Japan agreement. China committed to purchase an additional $200 billion of US goods and services over 2020 and 2021, and semiconductors as well as semiconductor manufacturing equipment were included on the list of products covered by the deal. Exact numeric targets for the sector were not made public, but China’s purchases of those products through October 2020 were higher, in relative terms, than for all other products covered by the agreement (figure 6). This more likely reflects the separate policy developments described in the next subsection, however, rather than any particular compliance with the Phase One agreement.

2. US Export Controls on the Semiconductor Industry

The United States applied an increasingly expansive series of export controls on the semiconductor industry supply chain beginning in 2019. The initial policy was based on national security concerns about critical infrastructure. The export controls targeted Huawei, a Chinese national champion with 2019 global revenues about as large as Microsoft’s.41 Although the developments represented a major escalation, US government problems with Huawei date back to at least the mid-2000s.42

Huawei had become a top global supplier of two different sets of products by 2019, both important sources of demand for semiconductors created by US companies.43 Huawei was a major smartphone supplier, with 20 percent of the global market.44 Huawei’s other main business was providing telecommunications infrastructure equipment, including for many countries’ 5G networks. This infrastructure was critical to enable remote surgery, autonomous vehicles, and the Internet of Things. In 2019, the global 5G base station market was dominated by Huawei (27.5 percent), Ericsson (30.0 percent, Sweden), Nokia (24.5 percent, Finland), and Samsung (6.5 percent).45 That there was no US national champion that could be promoted—through production subsidies or “Buy American” provisions, for example—limited US policy options.

Governments had at least two concerns with Huawei’s equipment.46 One was that China’s national security law could compel the company to collect and turn over to the Chinese government foreign data—personal, corporate, government, or military information, for example—that would flow over Huawei’s network equipment. (In one widely cited example, Huawei equipment was alleged to facilitate spying by the Chinese government on the African Union headquarters in Ethiopia.47)

A second was that the performance and reliability of Huawei’s low-cost equipment posed a separate worry about network vulnerabilities to independent hackers. A 2019 report to the UK government stated that “Huawei’s development and support processes are not currently conducive to long-term security risk management and, at present, the Oversight Board has seen nothing to give confidence in Huawei’s capacity to fix this” (HCSEC Oversight Board, 2019). In response, governments in the United States, the United Kingdom, Australia, France, and Sweden subsequently decided against procuring Huawei equipment for their countries’ 5G networks.

In a separate set of events, in January 2019, the US Department of Justice indicted Huawei for stealing US technology, laundering money, and helping Iran avoid sanctions involving the proliferation of weapons of mass destruction. Huawei denied the allegations,48 but the indictment provided the legal hook for the US government’s subsequent resort to export controls.

(1) The 2019 controls targeted semiconductors and software

The United States announced its first export controls in May and August 2019, when the Department of Commerce added Huawei and its affiliates to the Entity List. Under US law, the Entity List is the official catalogue of foreign companies for which it is illegal for Americans to provide a good or service without a government-designated license.49 Cutting off US–made inputs—of semiconductors to Huawei directly, of EDA tools to Huawei’s subsidiary chip designer HiSilicon to shut off access indirectly—was an attempt to cripple Huawei’s production of 5G equipment. In theory, doing so would leave the market to companies like Ericsson, Nokia, and Samsung, which did not pose a national security threat.

Two problems arose with the initial US export controls. They were potentially both too broad and too narrow, creating new problems while overlooking others.

The first problem was economic. By restricting sales of US semiconductors that do not threaten US national security, the export controls were potentially too broad. Huawei was a multiproduct company. If the concern derived only from its base stations, cutting off US semiconductors intended for its smartphones could be excessively costly to the US industry.

Ultimately more important to US policymakers was the second problem: the fact that its export controls were ineffective at protecting national security. The 2019 controls did not stop Huawei from buying the chips that fabless companies designed for TSMC to manufacture in Taiwan, and Huawei would not lose access to sales from companies like Samsung in South Korea. Indeed, the SIA issued a report in July 2020 explaining to US policymakers that most of the semiconductors Huawei needed to make base stations were widely available from manufacturers outside of the United States.50

Caught in the crosshairs of US national security policy, the industry expressed public concern with the new export controls.51 More than 20 percent of the US semiconductor industry’s annual revenues derived from sales to Huawei and other Chinese companies (Varas and Varadarajan, 2020). US exporters did not have market power, however, as their sales made up just 5 percent of China’s semiconductor imports; China bought much more from Taiwan and South Korea (figure 7).

(2) The 2020 controls targeted semiconductor manufacturing equipment

The United States imposed additional rounds of export controls beginning in May 2020 once it recognized that the 2019 restrictions were ineffective even at protecting national security. The new export controls were designed to coerce companies in foreign countries to also stop selling semiconductors to Huawei. To do so, the United States expanded the jurisdictional reach of its export controls through the foreign direct product rule (FDPR). Through the FDPR, the Department of Commerce would limit access of foreign chipmakers to the manufacturing equipment provided by US companies operating in a different part of the semiconductor supply chain (see figure 5).

The policy approach was to present foreign manufactures like TSMC and Samsung with a choice. To access US–made tools used to fabricate semiconductors, they would need to agree to no longer sell to Huawei. If they wanted to keep Huawei as a customer, they would have to find other manufacturing equipment. The bet was that foreign chipmakers would continue to buy the US tools.

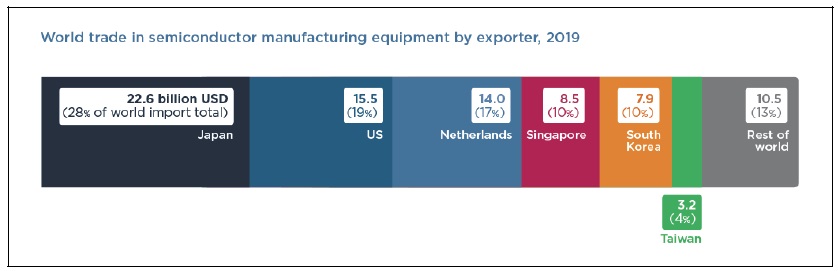

Like US semiconductor companies earlier, US equipment makers such as Applied Materials, Lam Research, and KLA worried that foreign-made substitutes could emerge that would not be subject to controls. Figure 8 highlights the possibility by illustrating world trade in semiconductor equipment.

By the summer of 2020, the toolmakers’ industry association (SEMI) noted that the May 2020 export controls alone had “already resulted in $17 million lost sales of US–origin items to firms unrelated to Huawei.” As the US administration began implementing even more controls in August 2020, SEMI predicted that the “restrictions will also fuel a perception that the supply of US technology is unreliable and lead non-US customers to call for the design-out of U.S. technology.” 52

The August 2020 export controls may not have been the last involving the semiconductor industry. In September, media reports emerged that SMIC, the Chinese foundry, could be shut off from buying US–made equipment, semiconductor designs, and software by also being added to the Entity List.53 The Trump administration confirmed these reports in December by announcing it was placing SMIC on the Entity List. China’s apparent approach to the looming export controls was to stockpile imports of semiconductors and equipment in 2020 (see figure 6).

3. Investment Restrictions and Antitrust Actions on the Organization of Firms

An additional concern described in the US government’s Section 301 reports of 2018 involved China’s state-sponsored acquisition of foreign technology companies. The Committee on Foreign Investment in the United States (CFIUS)—an interagency committee of the US government—has the legal authority to prevent foreign entities that pose a threat to national security from buying American companies. Just the threat of a CFIUS intervention can dampen potential attempts to negotiate mergers or acquisitions. Potential Chinese acquisitions of companies in the semiconductor industry have been subject to CFIUS review, or the threat thereof, since long before the recent escalation of US–China tensions.54 In 2018, the Foreign Investment Risk Review Modernization Act (FIRRMA) strengthened CFIUS’s legal authorities.

At times, Chinese antitrust authorities have also refused to allow foreign semiconductor firms to reorganize through mergers or acquisitions. In 2018, for example, China refused to approve Qualcomm’s potential acquisition of NXP, a semiconductor firm domiciled in the Netherlands. (Both also had operations in China.) The move followed shortly after the United States refused to greenlight the acquisition of Qualcomm by Broadcom, then domiciled in Singapore, on the grounds of national security.

4. Japan’s Export Controls on Semiconductor Chemicals Destined for South Korea

In a dispute unrelated to the US–China tensions, in July 2019 the Japanese government announced potential new export controls on inputs critical to semiconductor manufacturers in South Korea. The policy action was tied to escalation of long-running foreign policy concerns between Japan and South Korea involving atrocities committed during World War II.55

The 2019 announcement involved potential restrictions on exports of hydrogen fluoride, fluorinated polyimides, and photoresist—chemical inputs essential to South Korea’s semiconductor manufacturing industry (see again figure 5). The Korean International Trade Administration estimated that Korean imports from Japan of these products accounted for 12.6 percent of South Korea’s global imports and that Japan supplied more than 90 percent of South Korea’s imports of two of the three products.

Although Japan did not ultimately curtail the Korean industry’s access to the chemicals, the heavy reliance of Samsung and SK Hynix on seemingly innocuous imported inputs identified at least a short-term vulnerability to an industry representing nearly 20 percent of Korea’s total exports. The Korean government immediately filed a formal WTO dispute against Japan, and it faced calls for domestic subsidies to reduce reliance on Japanese suppliers. By 2020, SK Materials—a firm in the same

38)See

39)China did impose retaliatory tariffs on discrete semiconductors (HS code 8541), which made up only 10 percent of total US semiconductor exports to China in 2017.

40)See, for example, “SIA Statement on Trump Administration Tariff Announcement,” June 15, 2018.

41)This section borrows heavily from

42)For a recent US government perspective on the risks posed by Huawei, see

43)According to Huawei’s 2019 Annual Report, 35 percent of its revenue derived from its information and communications technology (ICT) “carrier business” and 54 percent derived from its “consumer business,” highlighted by 240 million smartphones shipped in 2019.

44)S. O’Dea, “Smartphone Market Share Worldwide by Vendor 2009–2020,”

45)Kelly Hsieh, “Competition in Mobile Base Station Market to Intensify as Global 5G Development Enters Upswing, Says TrendForce,”

46)Separate policy concerns, including those voiced by the European Commission, relate to Huawei receiving unfair subsidies from the Chinese government. See Shawn Donnan and Christian Oliver, “EU Commissioner Attacks China’s Telecoms Subsidies,”

47)John Aglionby, Emily Feng, and Yuan Yang, “African Union Accuses China of Hacking Headquarters,”

48)On January 28, 2019, Huawei stated: “We deny that we or our subsidiaries or affiliates have committed any of the asserted violations of US law set forth in each of the indictments.”

49)For details on the Entity List and legal developments on US export controls, see

50)The report concluded that “substitutes for US components exist for nearly every semiconductor product family required to build a complete RAN infrastructure. In fact, our analysis indicates that of the more than 50 critical semiconductor elements necessary to design, manufacture, and sell a competitive 5G RAN network, only 3 components could face supply constraints outside the United States in the event of an export restriction. For each of those three components, we have further concluded that alternatives are currently being deployed or under active development, especially within China by Huawei’s semiconductor design arm, HiSilicon”

51)See, for example, SIA Statement on the Scope of the Addition of Huawei to the Commerce Department’s Entity List, June 21, 2019.

52)Semiconductor Manufacturing Industry Association “SEMI Statement on New US Export Control Regulations,” Press Release, August 24, 2020. The SIA also came out against the action (see “SIA Statement on Export Control Rule Changes,” August 17, 2020).

53)Dan Strumpf, “US Weighs Export Controls on China’s Top Chip Maker,”

54)Eva Dou and Don Clark, “China’s Micron Bid Faces Great Wall of Scrutiny. Tsinghua UniGroup’s $23 Billion Bid for Micron Follows a Tumble in the US Firm’s Share Price,”

55)See Jennifer Lind, “The Japan–South Korea Dispute Isn’t Just about the Past,”

56)Yonhap News Agency, “SK Materials Begins Mass Production of Etching Gas,” June 17, 2020.

V. IMPLICATIONS AND REMAINING QUESTIONS

After a lengthy period out of the spotlight, the semiconductor industry found itself deeply involved in the US–China trade and technology conflict. Recent developments differed dramatically from events in the 1980s, however. This time, the US industry found itself fighting against trade policy intervention, in part because of its global integration. With significant value-added embodied in foreign-manufactured semiconductors—arising through software, design, and capital equipment in addition to more traditional FDI—the US industry had shifted from seeking import protection to wanting open markets. This result is consistent with broader evidence on one channel through which globalization has affected the determinants of trade policy (Blanchard, Bown, and Johnson 2016).

The US industry did not support the return to the 1980s-style tariffs imposed in 2018 under Section 301, even though it was concerned with Chinese policies. By the end of 2020, there was little evidence that the Phase One agreement had addressed concerns about China’s efforts to forcibly transfer US technology, subsidize its industry, and breach foreign intellectual property rights. The agreement’s purchase commitments were also at odds with the US administration’s own national security policy. One part of the US administration had demanded that China buy additional US exports of semiconductors and equipment while another part imposed limits on sales of those same products to the major firms in China that might naturally purchase them. As a policy matter, this contradiction seemed unsustainable.

The US government may have also changed its broader position on industrial subsidies as a result of prioritizing national security over economic objectives. With the potential for sharply lower semiconductor industry revenues because of new limits on sales to China, the National Defense Authorization Act of 2020 introduced federal subsidies for semiconductors. The legislation, which has not yet been finalized, signaled at least two potential shifts. The federal government was looking to establish a program to fund foundational R&D spending of use to the entire industry, in the spirit of the 1987 SEMATECH. Allied countries could potentially participate in the program, provided that they, too, were willing to control industry exports to China.57 The government also considered providing funding for the construction of new manufacturing facilities, such as support for TSMC’s plans for a new fab in Arizona (see table 3).

In the short run, the question was the impact of the US policy on Huawei. In November 2020, the company announced attempts to sell off some of its smartphone business, an implicit acknowledgment that the US policy limits on semiconductors had had some effectiveness.58 What other changes would the company make? Would Huawei survive?

More broadly, the new US export control policy raised a host of additional questions. Suppose that the purpose of the new US export control policy was to address a legitimate need to safeguard critical infrastructure. Was this the minimum policy required to achieve such an objective? Was it necessary to cripple Huawei because its smartphone business could be used to underwrite losses in its telecommunications infrastructure business? Or were there less costly ways—including to US semiconductorsupplying companies—to achieve the national security objective?

How possible was it for foreign semiconductor manufacturers—in Taiwan, South Korea, or China—to eventually “design out” US manufacturing equipment and EDA software? US companies became fearful that foreign customers would develop alternative suppliers once policymakers started weaponizing their sales to tackle concerns with Huawei. (In response to Japan’s export controls on chemicals, for example, South Korea seemed to adopt this strategy.) Over what time horizon might substitute suppliers be found, and at what cost?

Would a more rational US strategy have been to keep China “dependent” on American semiconductors? Suppose US firms had been permitted to sell all except the most sophisticated chips, but the US government maintained its restrictions on sales to China of semiconductor manufacturing equipment and EDA software. US semiconductor firms at least could have maintained the revenue and profits to continue to finance their own R&D without the need for federal subsidies. Without the foreign inputs, Chinese manufacturers would have been unable to upgrade to the smaller and faster chips at the technological frontier that many using industries demand. In the face of ongoing geopolitical conflict, would such an alternative strategy have been sustainable?

57)Brett Fortnam, “Congress Backs Multilateral Semiconductor Fund, Incentives for US makers,”

58)Dan Strumpf, “Huawei Sells Off Honor Phone Business as US Sanctions Bite,”

Tables & Figures

Figure 1.

Evolution of America’s semiconductor imports

Note: Data before and after 1988 are not directly comparable. Import statistics for 1980-88 are based on the Tariff Schedule of the United States Annotated (TSUSA) system and 1989-2019 are based on the Harmonized Tariff Schedule (HTS) system. Import values converted to constant (2019) USD using the Bureau of Labor Statistics Import price deflator.

Soure: Constructed by the author with US import data from Census.

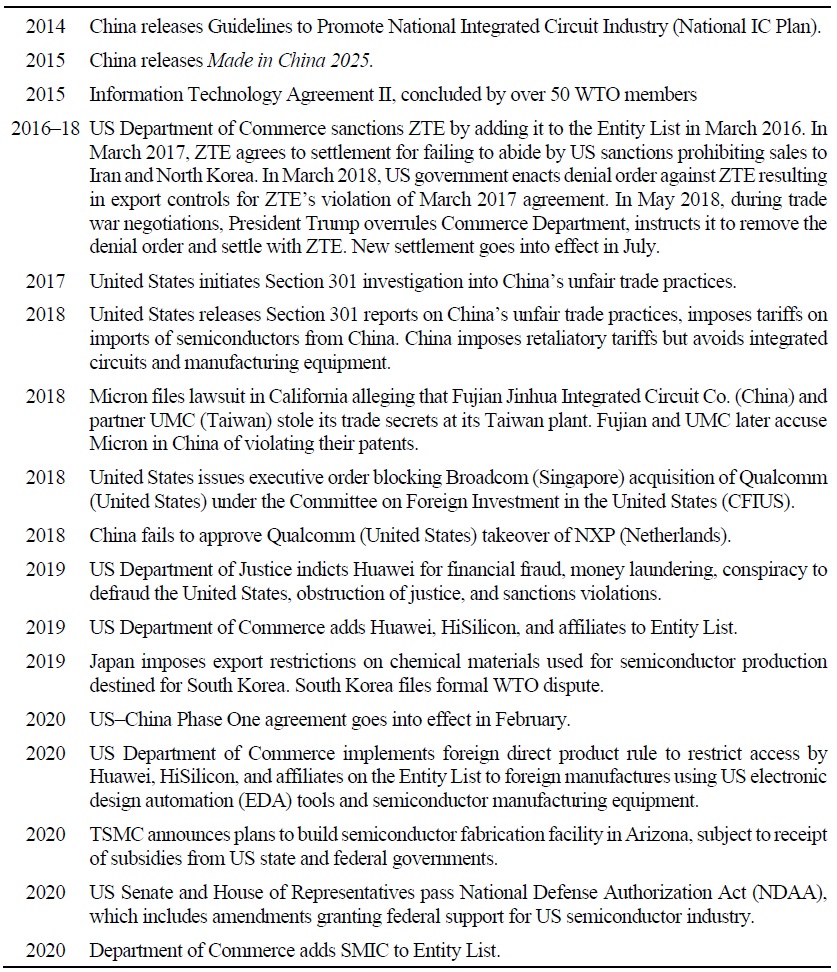

Table 1.

Key policy developments in the semiconductor industry, 1977–2006

Table 1.

Continued

Figure 2.

The global trend since 1988 has been to reduce import tariffs on semiconductors and manufacturing equipment

Note: Tariff rates are simple averages for semiconductor products (HS 8541 and 8542) and semiconductor manufacturing equipment (HS 8486). Dashed lines indicate missing data.

Sources: Constructed by the author with applied MFN import traiff data from World Integrated Trade Solution and World Trade Organization.

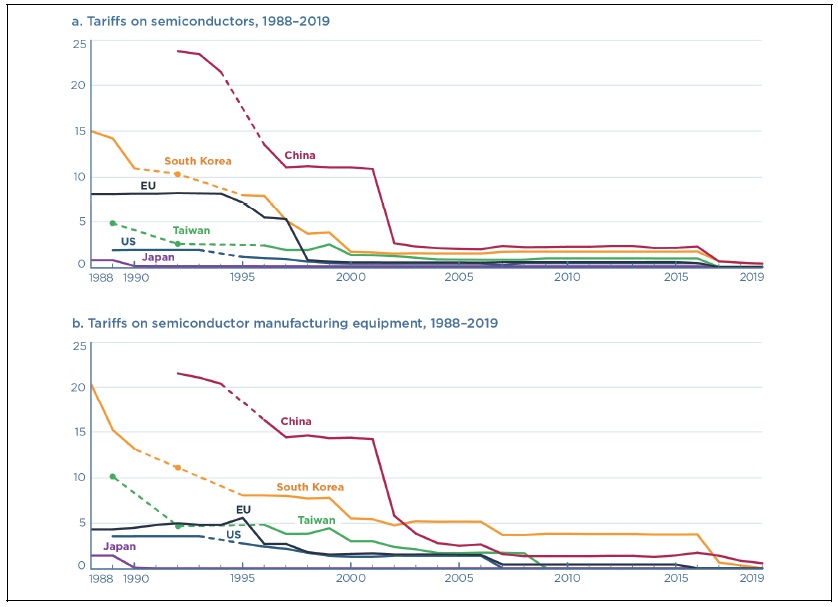

Figure 3.

Import demand for semiconductors stagnated in the US, EU and Japan, but surged in China and the reat of Asia

Note: Semiconductors defined as in Harmonized System codes 8541 and 8542. Import values converted to constant (2019) USD using the Bureau of Labor Statistics import price deflator.

Sources: Constructed by the author with data from

Figure 4.

South Korea, Taiwan, and China have emerged as major exporters of semiconductors

Note: Semiconductors defined as in Harmonized System Codes 8541 and 8542. Export values converted to constant (2019) USD using the Bureau of Labor Statistics price deflator.

Sources: Constructed by the autor with data from

Table 2.

Top 10 global semiconductor firms, by sales revenue, 1980–2020

Figure 5.

Modern semiconductor manufacturing is a globally integrated multi-stage process

Note: Examples of companies are illustrative.

Source: Constructed by the author.

Table 3.

Key policy actions involving semiconductors, 2014–2020

Figure 6.

China’s 2020 purchases of semiconductors and equipment outperformed other goods covered in the phase one agreement

Note: Constructing an estimated target for the semiconductor industry (Harmonized System Codes 8541, 8542, and 8486) and prorating the 2020 year-end target to a monthly basis is for illustrative purposes only. Nothing in the text of the agreement indicates China must meet anything other than the year-end targets. Estimated targets in panel a and b apportioned based on the share of each in total US exports to China in 2017 of goods convered by the purchase commitments.

Sources: Constructed by the author from Chinese import data from International Trade Centre (Trademap) for 2017 and Chinese customs for 2020, and product categories set out in Annex 6.1 of Economic and Trade Agreement between the United States of America and People’s Republic of China. See also Chad P. Bown. 2020. US-China phase one tracker: China’s purchases of US goods (as of October 2020). PIIE Chart, November 25.

Figure 7.

Taiwan and South Korea were China’s top foreign sources of semiconductors

Note: Semiconductors are defined as Harmonized System Codes 8541 and 8542. Total may not sum to 100 due to rounding.

Sources: Constructed by the author from Chinese import data from Chinese customs for 2020.

Figure 8.

American companies faced some global competition in semiconductor manufacturing equipment

Note: Semiconductor manufacturing equipment is defined as Harmonized System Code 8486.

Sources: Constructed by the author with world trade data from International Trade Centre (Trademap) for 2019.

References

-

Base pour l’Analyse du Commerce International (BACI). 2020. BACI: International Trade Database at the Product-Level. Paris: CEPII. <

http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=37 > (accessed May 21, 2020) -

Baldwin, R. E. and P. Krugman. 1988. “Chapter 7. Market Access and International Competition: A Simulation Study of 16K Random Access Memories. In R. Feenstra. (ed.)

Empirical Methods for International Trade . Cambridge, MA: MIT Press. -

Bergsten, C. F. and M. Noland. 1993.

Reconcilable Differences? United States–Japan Economic Conflict . Washington, DC: Institute for International Economics. - Blanchard, E. J., Bown, C. P. and R. C. Johnson. 2016. Global Value Chains and Trade Policy. NBER Working Paper, no. 21883.

-

Bown, C. P. 2020a. “How Trump’s Export Curbs on Semiconductors and Equipment Hurt the US Technology Sector,”

Peterson Institute for International Economics, Trade and Investment Policy Watch , September 28. <https://www.piie.com/blogs/trade-and-investment -policy-watch/how-trumps-export-curbs-semiconductors-and-equipment-hurt-us > (accessed May 21, 2020) -

Bown, C. P. 2020b. “Export Controls: America’s Other National Security Threat,”

Duke Journal of Comparative and International Law , vol. 30, no. 2, pp. 283-308. -

Bown, C. P. and J. A. Hillman. 2019. “WTO’ing a Resolution to the China Subsidy Problem,”

Journal of International Economic Law , vol. 22, no. 4, pp. 557-578. -

Brander, J. A. and B. J. Spencer. 1985. “Export Subsidies and International Market Share Rivalry,”

Journal of International Economics , vol. 18, no. 1-2, pp. 83-100.

-

Branstetter, L. G. and M. Sakakibara. 2002. “When Do Research Consortia Work Well and Why? Evidence from Japanese Panel Data,”

American Economic Review , vol. 92, no. 1, pp. 143-159.

-

Brown, C. and G. Linden. 2009.

Chips and Change: How Crisis Reshapes the Semiconductor Industry . Cambridge, MA: MIT Press. -

Chang, P.-L. and C.-T. Tsai. 2000. “Evolution of Technology Development Strategies for Taiwan’s Semiconductor Industry: Formation of Research Consortia,”

Industry and Innovation , vol. 7, no. 2, pp. 185-197. -

Dick, A. R. 1991. “Learning by Doing and Dumping in the Semiconductor Industry,”

Journal of Law and Economics , vol. 34, no. 1, pp. 133-159. -

Ezell, S. 2020. An Allied Approach to Semiconductor Leadership. September, 17. Information Technology & Innovation Foundation. <

https://itif.org/sites/default/files/2020-allied-approachsemiconductor-leadership.pdf > (accessed July 21, 2020) -

Flamm, K. and P. C. Reiss. 1993. “Semiconductor Dependency and Strategic Trade Policy,”

Brookings Papers on Economic Activity: Microeconomics , vol. 1993, no.1, pp. 249-333.

-

Ford, C. A. 2020. “US National Security Export Controls and Huawei: The Strategic Context in Three Framings,”

Arms Control and International Security Paper , vol. 1, no. 8. pp. 1-8. Washington: US Department of State. <https://www.state.gov/wp-content/uploads/2020/06/T-Paper-series-DPR-Formatted-508.pdf > (accessed August 20, 2020) -

Fuller, D. B. 2016.

Paper Tigers, Hidden Dragons: Firms and the Political Economy of China’s Technological Development . Oxford: Oxford University Press. - Goodman, S. M., Kim, D. and J. VerWey. 2019. The South Korea–Japan Trade Dispute in Context: Semiconductor Manufacturing, Chemicals, and Concentrated Supply Chains. Working Paper ID-062. Washington: US International Trade Commission Office of Industries.

-

Gruber, H. 1996. “Trade Policy and Learning by Doing: The Case of Semiconductors,”

Research Policy , vol. 25, no. 5, pp. 723-739.

-

Huawei Cyber Security Evaluation Centre (HCSEC) Oversight Board. 2019. Annual Report. National Security Adviser of the United Kingdom. <

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/790270/HCSEC_Oversight BoardReport-2019.pdf > (accessed August 20, 2020) -

Irwin, D. A. 1996. “Chapter 1. Trade Policies and the Semiconductor Industry. In Krueger, A. O. (ed.)

The Political Economy of American Trade Policy . Chicago: University of Chicago Press. -

Irwin, D. A. and P. Klenow. 1994. “Learning-by-Doing Spillovers in the Semiconductor Industry,”

Journal of Political Economy , vol. 102, no. 6, pp. 1200-1227.

-

Irwin, D. A. and P. Klenow. 1996. “High-Tech R&D Subsidies Estimating the Effects of SEMATECH,”

Journal of International Economics , vol. 40, no. 3-4, pp. 323-344.

-

Keller, D., Goodrich, J. and Z. Su. 2020. The U.S. Should Be Concerned with its Declining Share of Chip Manufacturing, Not the Tiny Fraction of US Chips Made in China. SIA Blog, July 10, Semiconductor Industry Association. <

https://www.semiconductors.org/the-largestshare-of-u-s-industry-fab-capacity-is-in-the-united-states-not-china-lets-keep-it-that-way > (accessed September 21, 2020) -

Kim, S. R. 1998. “The Korean System of Innovation and the Semiconductor Industry: A Governance Perspective,”

Industrial and Corporate Change , vol. 7, no. 2, pp. 275-309.

- Manyin, M. E., Cooney, S. and J. J. Grimmett. 2003. The Semiconductor Industry and South Korea’s Hynix Corporation. Congressional Research Service Report, no. RL31238.

- Organisation for Economic Co-operation and Development (OECD). 2019. Measuring Distortions in International Markets: The Semiconductor Value Chain. OECD Trade Policy Paper Series, no. 234.

-

Okimoto, D. I. 1987. “Outsider Trading: Coping with Japanese Industrial Organization,”

Journal of Japanese Studies , vol.13, no. 2, pp. 383-414.

-

Ossa, R. 2011. “A ‘New Trade’ Theory of GATT/WTO Negotiations,”

Journal of PoliticalEconomy , vol. 119, no. 1, pp. 122-152. -

PwC. 2017. China’s Impact on the Semiconductor Industry: 2016 Update. January. <

https://www.pwc.com/gx/en/technology/chinas-impact-on-semiconductor-industry/assets/chinaimpact-of-the-semiconductor-industry-2016-update.pdf > (accessed September 21, 2020) -

Semiconductor Industry Association (SIA). 2016. Beyond Borders: the Global Semiconductor Value Chain Spurs Innovation and Growth. May 6, 2016. <

https://www.semiconductors.org/wp-content/uploads/2018/06/SIA-Beyond-Borders-Report-FINAL-June-7.pdf > (accessed September 21, 2020) -

Semiconductor Industry Association (SIA). 2020a. The 2020 SIA Factbook. <

https://www.semiconductors.org/wp-content/uploads/2020/04/2020-SIA-Factbook-FINAL_reduced-size.pdf > (accessed September 21, 2020) -

Semiconductor Industry Association (SIA). 2020b. 2020 State of the U.S. Semiconductor Industry. <

https://www.semicon ductors.org/wp-content/uploads/2020/07/2020-SIA-State-of-the-Industry-Report-FINAL-1.pdf > (accessed September 21, 2020) -

Semiconductor Industry Association (SIA). 2020c. 5G Wireless Infrastructure Semiconductor Analysis. <

https://www.semiconductors.org/wp-content/uploads/2020/07/SIA-5G-Report_2.pdf > (accessed September 21, 2020) -

Thurk, J. 2020. Outsourcing, Firm Innovation, and Industry Dynamics in the Production of Semiconductors. Department of Economics, University of Notre Dame, Notre Dame, IN. <

https://static1.squarespace.com/static/5f62428af514a02c346d9c90/t/5f6384012836bb63 df6b0a00/1600357383489/OutsourcingPaper_v2.pdf > (accessed September 21, 2020) -

Tyson, L. D. 1992.

Who’s Bashing Whom? Trade Conflict in High Technology Industries . Washington: Institute for International Economics. -

US Department of Justice (US DOJ). 2005. Samsung Agrees to Plead Guilty and to Pay $300 Million Criminal Fine For Role in Price Fixing Conspiracy. Press release, October 13. <

https://www.justice.gov/archive/atr/public/press_releases/2005/212002.htm > (accessed September 21, 2020) -

US Trade Representative (USTR). 2018a. Findings of the Investigation into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974, March 22. <

https://ustr.gov/sites/default/files/Section%20301%20FINAL.PDF > (accessed September 21, 2020) -

US Trade Representative (USTR). 2018b. Update Concerning China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property, and Innovation. November 20. <

https://ustr.gov/sites/default/files/enforcement/301Investigations/301%20Report%20Update.pdf > (accessed September 21, 2020) -

Varas, A. and R. Varadarajan. 2020. How Restrictions to Trade with China Could End US Leadership in Semiconductors. Boston Consulting Group. <

https://image-src.bcg.com/Images/BCG-How-Restricting-Trade-with-China-Could-End-US-Semiconductor-Mar-2020tcm9-240526.pdf > (accessed September 21, 2020) -

Varas, A., Varadarajan, R., Goodrich, J. and F. Yinug. 2020. Government Incentives and US Competitiveness in Semiconductor Manufacturing. Boston Consulting Group and Semiconductor Industry Association. <

https://www.semiconductors.org/wp-content/uploads/2020/09/Government-Incentives-and-US-Competitiveness-in-Semiconductor-Manufacturing-Sep-2020.pdf > (accessed September 21, 2020) -

VerWey, J. 2019a. “Chinese Semiconductor Industrial Policy: Past and Present,”

Journal of International Commerce and Economics , July 2019. <https://www.usitc.gov/publications/332/journals/chinese_semiconductor_industrial_policy_past_and_present_jice_july_2019.pdf > (accessed September 21, 2020) -

VerWey, J. 2019b. “Chinese Semiconductor Industrial Policy: Prospects for Future Success,”