- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|---|

| 1 | Emerging trend on international capital flows and global value chains reconstruction under post COVID-19: a review / 2022 / Transnational Corporations Review / vol.14, no.3, pp.271 / |

| 2 | Further Evidence on China’s B&R Impact on Host Countries’ Quality of Institutions / 2022 / Sustainability / vol.14, no.9, pp.5451 / |

| 3 | Global Flow of Foreign Aid and Change in Recipients’ Local Labor Institutions / 2024 / Discrete Dynamics in Nature and Society / vol.2024, no.1, |

Article View

East Asian Economic Review Vol. 24, No. 4, 2020. pp. 441-468.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2020.24.4.387

Number of citation : 3On the Role of Projected FDI Inflows in Shaping Institutions : The Longer-Term Plan for Post-Pandemic Investment Reboot

|

Research Center of Finance, Shanghai Business School |

|

|

College of Business and Economics, Shanghai Business School |

|

|

School of Economics, Utrecht University; and CEPR |

Abstract

Capital inflows have a strong presence that influences destination countries’ development of institutions, which can in turn help resuscitate a stopped economy and re-attract capital that was lost during crises such as the recent public health crisis. While the previous literature emphasizes the mechanism that foreign investors press or even threaten the local government for change, this paper explores empirically whether institutional improvement can be achieved through the channel that host countries voluntarily reform institutions in anticipation of potential investments predicted by the exogenous geographical and cultural characteristics of the recipient countries. Given that countries with better institutional quality can accumulate larger FDI stocks, we still find that the need for more FDI, in contrast to FPI and debt, gives higher incentives to host countries to strategically improve their institutions before seeking capital overseas. Moreover, the predicted FDI exerts more prominent impacts on institutions on constraining elite than those involved in launching a business, enforcing contracts, and protecting properties. The results imply that a long-run plan for upgrading elite constraint institutions is crucial for a post-pandemic FDI reboot.

JEL Classification: E02, F21, F34, F40, P48

Keywords

Foreign Direct Investment, Foreign Portfolio Investment, Debt Investment, Legal Institutions, Contract Enforcement, Executive Constraints, Property Rights

I. INTRODUCTION

Regarding the consequences of foreign direct investment (FDI), the determinants of quality institutions, as well as the interactions between capital flows and institutions, the extant literature has established several important results. First, FDI inflows contribute to the host country’s subsequent economic performance (Moran et al., 2005), and play key roles in improving the quality of local institutions (e.g., Ahlquist and Prakash, 2010; Ali et al., 2011; Long et al., 2015) that are crucial to long-run growth (Acemoglu et al., 2005). Second, besides FDI, other international activities such as foreign portfolio investment (FPI), debt financing, trade, and even social globalization can also have a profound impact on the development of local institutions (Bhattacharyya, 2012; Akoto, 2013; Levchenko, 2013; Bergh et al., 2014). Finally, countries with superior institutions are often rewarded with an increasing amount of foreign investment (Alfaro et al., 2008; Ali et al., 2010). However, these results provide fewer policy implications for resuscitating the stopped global economy (Cakmakli et al., 2020) and re-attracting lost capital flows (Singh, 2020) after the COVID-19 pandemic. Long-run institutional improvement measures can help as complement to short-run monetary or fiscal tools as examined in Beirne et al. (2020).1

Therefore, since the pandemic is still in progress, we rely on pre-pandemic data to ask a related but slightly different question. Given that a country expects itself to receive more FDI based on favorable characteristics of its economy (i.e., the actual amount of FDI is currently at low levels due to external shocks like the recent COVID-19 public health shock), whether there exists a strong incentive for that country to strategically improve its institutions before seeking foreign capital? If the answer to this question is yes, then two follow-up questions naturally emerge. For one, as different types of institutions are involved in the whole process of FDI, which type of them will be affected most by FDI? For another, do FPI and debt inflows exhibit similar traits?

This paper hence explores the impact of forecasted foreign investment on foreign-investment-related institutions. This is an important issue because it is widely hoped that more foreign funds can improve the quality of many sets of institutions in the local country, including starting a business, contract enforcement, constraining elites, and protecting property rights, through a variety of channels, including providing financial resources, delivering advanced technological or managerial expertise, and creating an environment that engenders institutional reforms. We argue that the benefits of FDI may well function not through the traditional channels listed above but through a new mechanism of host countries catering to investors’ needs for better institutions ex-ante. More importantly, greater governance efforts would be devoted to areas of institutions that are most valued by foreign investors.

To test these predictions empirically, we must first identify which countries are more likely to attract a larger size of FDI inflows in the future. Specifically, we have constructed a measure of predicted FDI following a strategy similar to Kleinert and Toubal (2010). The key idea is to use non-institutional non-economic variables specific to each country to predict its inward investment, by expanding the gravity model of Frankel and Romer (1999) used to forecast trade. A country’s predicted FDI inflow is shown to be a robust determinant of institutions in a pool of 139 countries for more than a decade. We find that countries that due to their past investment and geography have the potential to attract more FDI will strive for better institutions, particularly much better executive constraint institutions, holding all else equal. FPI and debt, however, have smaller institution-building effects. These results are robust to the inclusion of a collection of controls, the use of an instrumental variable (IV) approach, and various subsamples.

This paper contributes to the following three strands of literature. The first stand investigates whether actual FDI activities that occurred and other alternative international investment vehicles utilized by foreign investors are associated with the advancement of local institutions. For example, Long et al. (2015) employ cross-sectional firm-level data in China to study how FDI can positively affect regional institutional quality, which is measured by firms’ ratings of the degree of the tax burden and the strength of creditor right protection in a survey conducted by the World Bank. Their proposed underlying mechanism is that existing foreign investors improve regional institutions via lobbying collectively and threatening to leave. In contrast, our paper adopts a panel dataset at the country level to emphasize the following mechanism: host-country governments are more eager to upgrade the elite constraint institution voluntarily, among other institutions, before attracting foreign investments. Ahlquist and Prakash (2010) study the effects of FDI on the quality of contracting institutions, which is proxied by several indicators taken from the World Bank Doing Business dataset. Their empirical methodology is to apply ordinary least square (OLS) to a cross-section of variables averaged over several years. Like Long et al. (2015), these authors also believe that their results are driven by multinational corporations wishing for a better contracting environment and legislative bodies responding to their wishes, especially in more indebted countries.

Complementary to the institution-building effects from existing foreign investors, Bhattacharyya (2012) hypothesizes that trade openness could also lead to lower expropriation and contract repudiation risks. The author relies on Fuller modified Limited Information Maximum Likelihood to test this hypothesis with panel data of four five-year averages calculated over the period from 1980 to 2000. The underlying mechanism is that variations in institutions can be explained by trade liberalization tools like reducing tariffs or quantitative restrictions and setting up export processing zones. In addition, Bergh et al. (2014) find a strong correlation between the institutional quality index from the World Governance Indicators (WGI) and the lagged economic and social globalization index from the KOF Swiss Economic Institute, using a panel data of five four-year averages during 1992-2010. Further, this effect of globalization on institutions is found to be much stronger for the sample of high-income countries. The current paper is thus a part of this growing literature. Compared to all previous studies, we examine the role played by predicted capital flows in incentivizing the improvement of different sets of institutions.

Since the first strand of literature fails to identify the host country’s intention to improve institutions, we resort to the second strand of literature that attempts to solve this problem by exploring how projected levels of cross-border economic activities can foreshadow future developments in local institutions. Concerning debt financing, Akoto (2013) studies how the projected shift of global debt relief architecture affects the motivation of politicians in debtor countries to strategically improve institutions prior to seeking debt relief, where the institutional quality is measured by WGI indices on government effectiveness, regulatory capability, and social freedom. As for trade, Levchenko (2013) shows both theoretically and empirically that countries having a predisposition to export in contract-intensive products tend to have better equilibrium institutions. Following their perspectives, this paper attributes a noticeable part of institutional development to the predicted equity capital flows in addition to predicted debt relief and trade volumes.

Thirdly, an FDI-induced increase in productivity can motivate institutional improvement. On the one hand, according to models of institutional change,2 institutions upgrade via governments’ optimizing behavior to take advantage of historical productivity patterns and expected technological breakthroughs (Neyapti, 2013). On the other hand, it is well understood that FDI can positively affect productivity. For example, Javorcik (2004) finds that FDI generates positive knowledge spillovers on domestic firms’ productivity across industries. Furthermore, although Fons-Rosen et al. (2013) document that the aggregated impact of foreign investment on country-level productivity growth is fairly small, Alfaro and Charlton (2009) point out that the impact becomes larger as the host country’s financial system grows more mature. In sum, when local governments is anticipating an increase in productivity caused by future foreign investments, they will adjust their institutions in advance. Consequently, this paper adds to this literature by establishing a new connection between FDI and institutions through the productivity channel. As a last note to theorists, this paper fills the gap that no empirical studies have evaluated the relative importance of predicted FDI inflows in shaping a variety of institutions. We, therefore, provide implications for novel models that try to unbundle institutions.

The rest of this paper is organized as follows. Section 2 discusses the conceptual issues related to FDI’s institution-building effects, based on which we develop our hypotheses. In section 3, first of all, we specify the empirical model adopted to investigate how predicted FDI inflows can facilitate the development of different types of institutions; second, we describe the construction of measures for projected FDI inflows; third, we introduce readers to data sources; fourth, we present baseline results, followed by several robustness checks. Section 4 concludes.

1)According to recent statistics provided by the Organization for Economic Co-operation and Development (OECD), in addition to health problems, the COVID-19 outbreak has triggered major economic and financial consequences: GDP is expected to contract by 6% globally in 2020, and FDI flows are expected to fall by around 40%.

2)See

II. CONCEPTUAL ISSUES

Extant empirical studies on the impact of foreign investments on institutions simply associate some measures of capital flows with selected measures of institutional quality. This association is essentially a joint effect of two distinct mechanisms. One mechanism operates through the channel of actual FDI that has already been invested in host countries, and these investors have incentives to press local governments for change or even threaten to leave. Intuitively speaking, an investor who invests in multiple countries probably would have about the same incentive to persuade all countries in his or her portfolio into building better institutions. Another mechanism functions through the incentive of the local governments themselves, i.e., improving institutional quality to attract potential FDI that should be in presence conditional on host country characteristics. In other words, countries that for some reason cannot capture productivity gains from FDI by improving their institutions would have no incentive to do so.

The potential-FDI mechanism is the focus of this paper. And it directly leads to our first hypothesis: countries with a higher probability of attracting and profiting from potential FDI will improve their institutions more. After decomposing entangled economic institutions and considering alternative investment tools, we develop our second hypothesis: the predicted FDI inflows can exert an institution-building effect that is larger in magnitude for elite constraint institutions than other institutions less relevant to FDI. Moreover, since FPI and debt are subject to less risk of properties being seized by local executives, the predicted FPI and debt inflows should not display such prominent effects as in the case of FDI.

In terms of the theoretical framework, our hypotheses are rooted in the literature on modeling the determinants of institutional change. For example, Puga and Trefler (2014) construct a model that highlights the role played by the evolution of income distribution via trade in facilitating institutional improvements. Jiao and Wei (2017) also present a simple theory in which a country’s intrinsic level of openness (such as demographic and geographic factors, and exogenous economic opportunities) affects its incentives in investing in better institutions. Following their works, our study takes a step further by providing empirical evidence that FDI serves as one of the most important practical mechanisms for the operation of such institution-building effects.

III. EMPIRICAL EVIDENCE

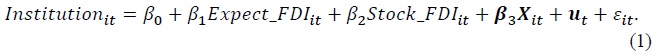

To test these hypotheses, this paper constructs a measure that captures the extent to which the country would have been able to attract FDI inflows and analyzes how this measure affects different types of institutions involved in the process of FDI. With the new measure, we estimate the following equation by pooled OLS in 139 countries over the period 2004-2017:

The dependent variable,

To mitigate the endogeneity problem caused by reverse causality 3 and the multicollinearity problem caused by high correlations among explanatory variables, this predicted variable is constructed without accounting for the country’s real-life institutional quality, actual FDI, or actual economic growth patterns. See the next subsection for a detailed explanation. If our hypotheses hold, we should observe significantly positive

Thus, the empirical strategy is based on the view that the current institutions are the result of government optimal choice and are subject to influence by countries’ probability of receiving FDI based on non-economic non-political characteristics. A caveat in the above setup is that, although conventional country variables are included, the pooled OLS may omit unobservable factors that would be otherwise incorporated in a country-fixed-effect specification. The reason we still use OLS estimators is that a country’s institutional quality is a very slow-moving variable. Hence, it is insensitive to time, and it will compromise the benefits of having country-fixed effects estimated. To deal with such an issue, papers on institutional quality often adopt cross-sectional data or time-series averages. We choose the pooled OLS specification for the longest available sample period because our main purpose is to exploit the variation in predicted FDI and to identify its effect on institutional changes over time. Nevertheless, as indirect and suggestive evidence, we find similar results in a cross-sectional way of treatment and time-series average over fixed time intervals.

1. Predicted Level of FDI Inflows

Before estimating equation (1), we need to find out the predicted amount of FDI,

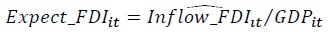

We begin by estimating the following:

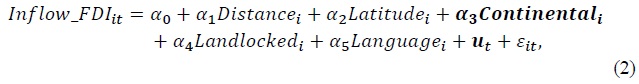

where

After equation (2) is estimated, we can then use all the estimated coefficients to compute the main explanatory variable in equation (1) for each country.

Summing up, the statistic used in this analysis,

2. Data Sources

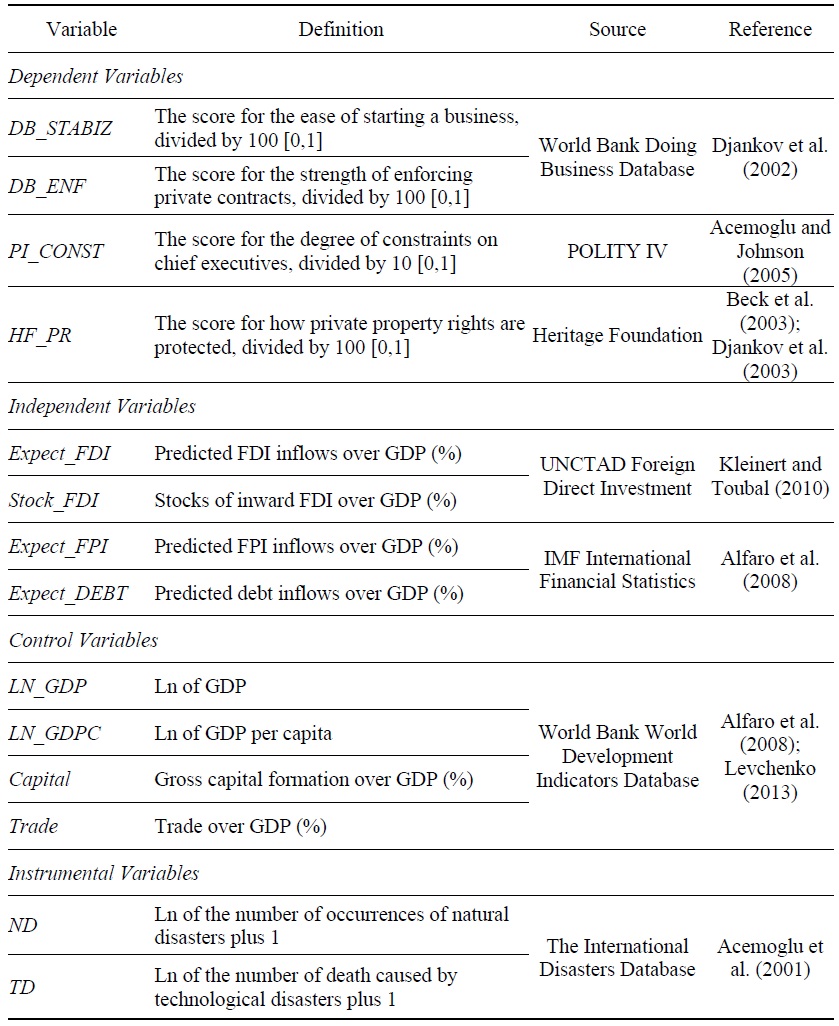

As for the dependent variable, the quality of FDI-related institutions is proxied by four measures, each of which corresponds to one set of institutions that will influence FDI throughout its entire investment course. First of all, foreign investors who invest in a majority of equity shares would be attracted to destination countries in which launching new operations is less costly in terms of time and money. To quantify the convenience provided by institutions in this regard, we use scores on the ease of starting a business from the World Bank Doing Business dataset (Djankov et al., 2002). This score ranges from 0 to 100, with a higher rate equating to greater convenience. We normalize the original scores by dividing by 100 and obtain our measure of starting a business (

Secondly, upon the new establishment of a foreign-invested company, the owners and managers of this company care about how private contracts are enforced by the host country’s courts. The World Bank Doing Business dataset provides another score called enforcing contracts, which is based on survey responses by experts on how the local legal system performs in assuring smooth fulfillment of contractual obligations. Similarly, the ratings also have the lowest value of 0 and the highest value of 100. The larger the number of judges and lawyers and the more efficient are judicial procedures, the lower the enforcement costs, and hence the higher the score. Therefore, we construct a [0,1] proxy (

Next, elites in host countries such as government officials and politicians may interfere with the operation of foreign-invested firms by participating in market activities themselves. If such interventions are not constrained institutionally in a country, then the local market is deemed to lack efficiency (Karakas, 2017). To account for this particular type of institution, we employ the index of constraint on chief executives (

Last but not least, we focus on private property rights protection institutions. Following La Porta et al. (1997), Beck et al. (2003). and Djankov et al. (2003), the private property score published by the Heritage Foundation is used to measure the extent to which private properties are protected from expropriation by the central government and other public entities. As usual, a higher score implies more protection, and the original range [0,100] is divided by 100 to arrive at a measure of institutional quality on property rights (

Of course, these four measures might overlap with each other. But they do differ a lot in terms of timing and function from the perspective of foreign equity investors. Alfaro and Charlton (2009) find that entangled institutions play distinct roles in many decisions made by a multinational company’s foreign subsidiaries, including decisions on location, ownership structure, operation activity, and production specialization. For example, when deciding where to locate and how to structure capital, foreign investors would value the institutional benefits of doing business in host countries. When deciding whether to specialize in production, owners of FDI would value property rights protection institutions most: if it is weak, they choose to outsource; otherwise, they will choose to internalize. All in all, countries anticipating future FDI flows should improve all four types of institutions to realize such anticipations.

Concerning the main independent variables, the predicted level of FDI (

With respect to control variables, we first include the natural log of GDP (

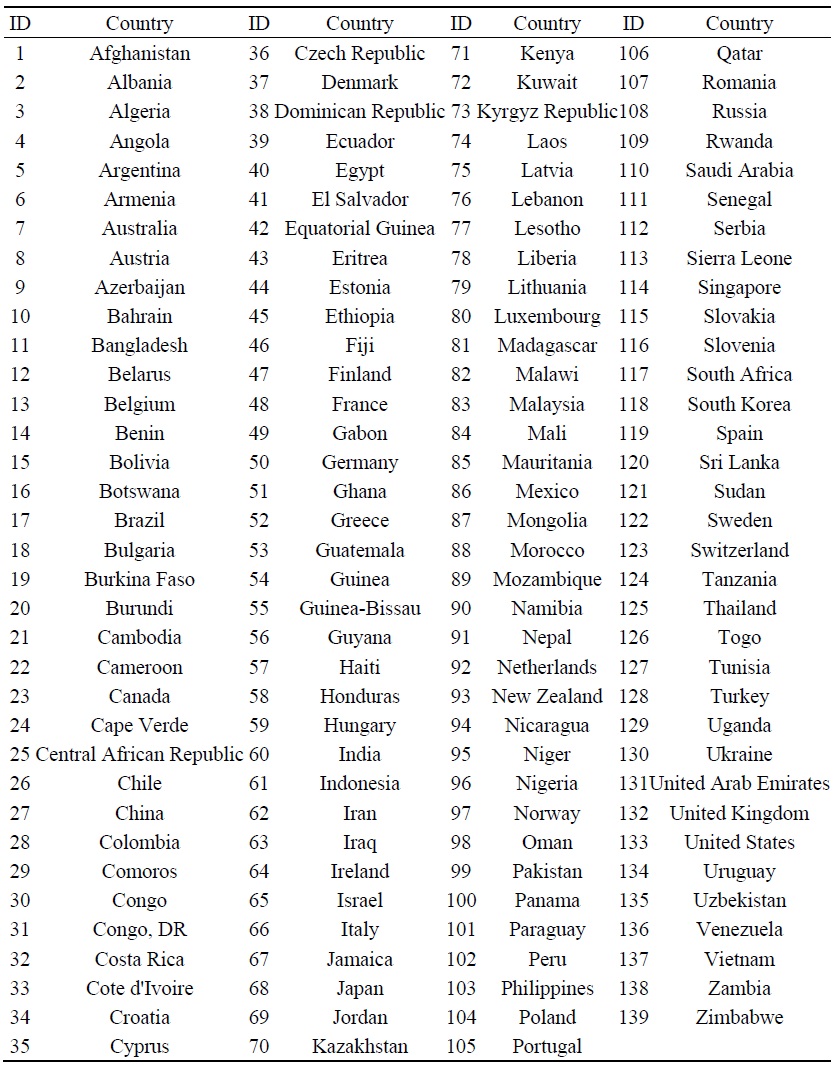

Our final sample is a panel of 139 countries (see Appendix Table 1A) spanning from 2004 to 2017 with a total of 1,866 observations. The original sample is slightly larger. But when merging different databases, we have removed a few countries whose values for FDI or institutions are missing, since retaining them would make our results subject to backfilling errors. And we have also deleted several countries that encountered a breakup, invasion, or civil war during our sample period, as the development of their institutions was disrupted randomly, biasing our results.

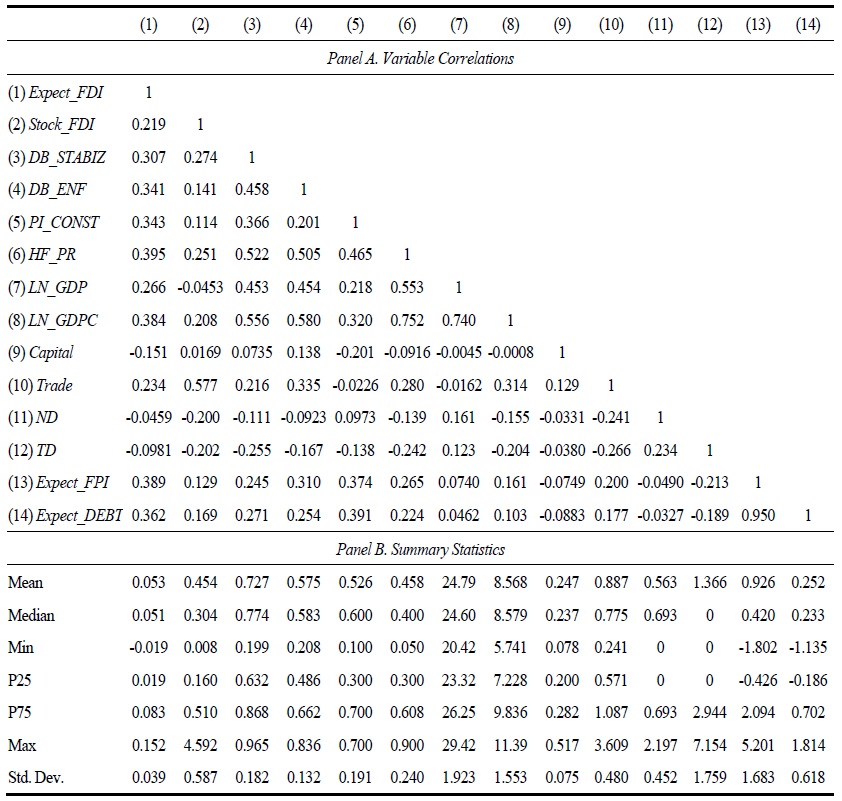

Table 1 lists the information for all variables with the corresponding notation, definition, data source, and reference. Panel A of Table 2 is a correlation matrix. As can be seen, measures for capital investments are positively associated with measures of institutional quality. Specifically, the predicted FDI inflows exhibit relatively higher correlations than the actual FDI stock, implying that the expectation-induced institutional improvement initiated by local governments might be larger than the improvement in institutions led by lobby groups of existing investors. The predicted FDI inflows also have higher correlations with institutions than do the predicted FPI and debt inflows. The reason might be that FDI requires long-term financing which is much more institution-sensitive than speculative short-term investment vehicles. Nevertheless, our main explanatory variables are not strongly correlated with each other. So, there should be no worries about multicollinearity. Combining these facts, we find preliminary evidence for our hypotheses.

Panel B of Table 2 presents the summary statistics. The forecasted level of FDI inflows on average accounts for 5.3% of GDP, with the maximum proportion ranging up to 15.2%; while the average actual stock of FDI is almost half of GDP. FDI has become an increasingly important way for financing economic development. This motivates local governments to improve their institutions to further attract long-run foreign capital. For measures of institutional quality,

3. Results

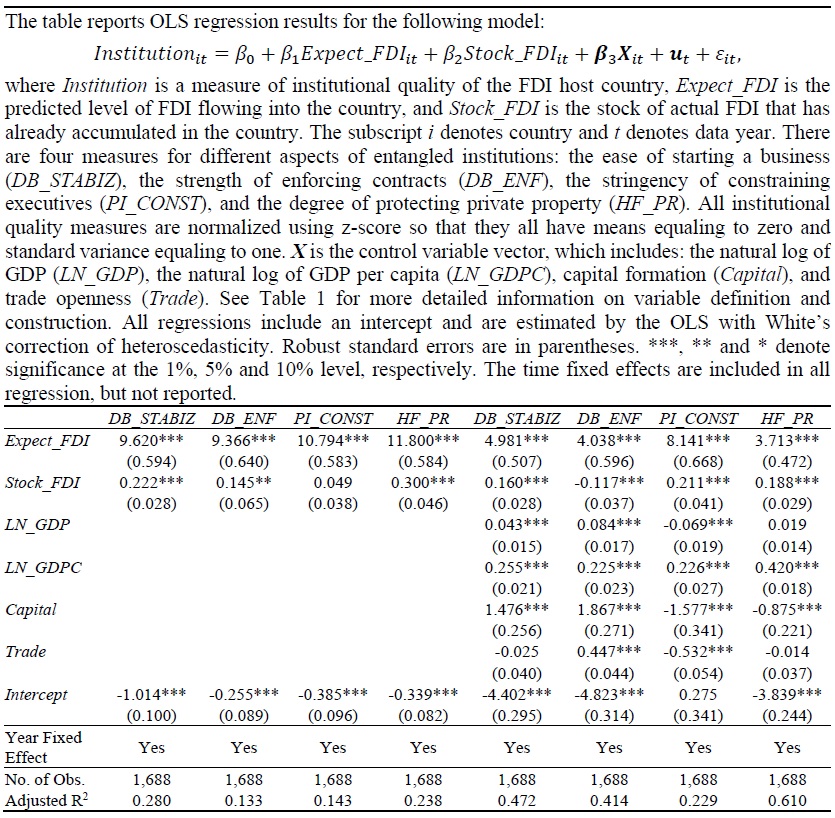

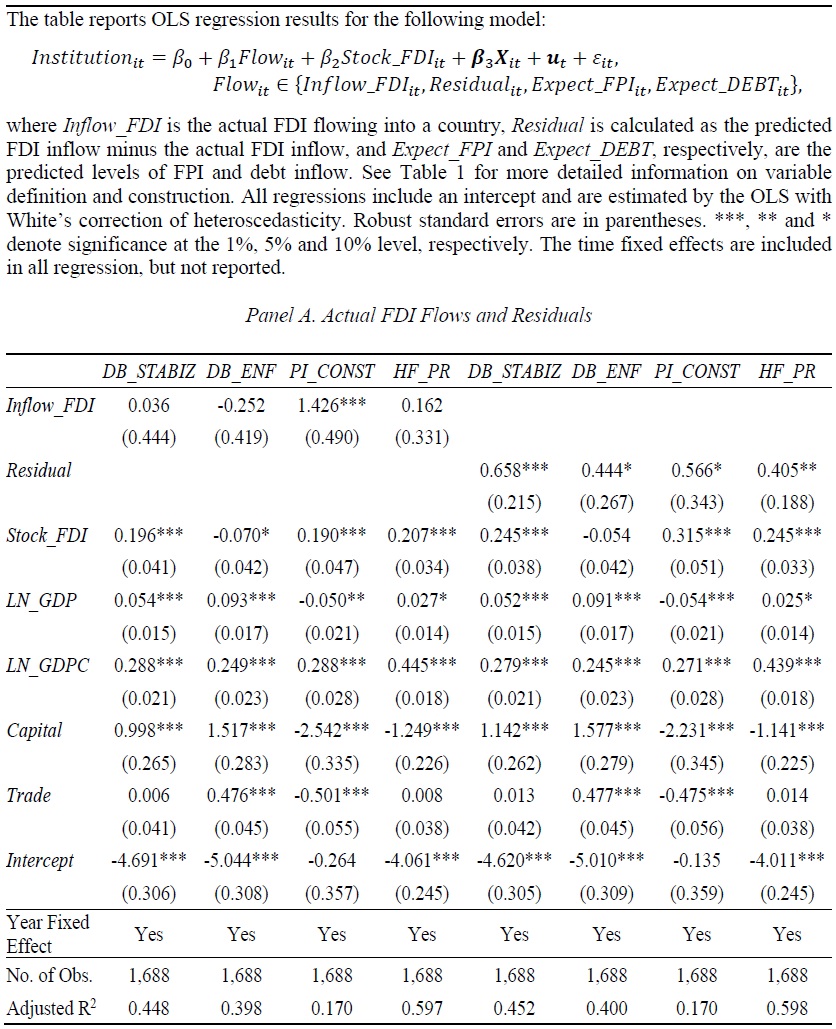

Before estimating equations (1)-(2), all variables are winsorized at the 1% and 99% level to address problems caused by small denominators and to control for the effect of potential outliers. Table 3 summarizes our baseline results. The first four columns regress institutional quality measures on predicted FDI inflows with only actual FDI stock and year fixed effects being controlling for. The last four columns repeat these exercises by adding other controls. For each specification in Table 3, there is a positive and strong relationship between institutions and predicted FDI inflows, delivering a fairly large R2. In the presence of additional controls, while the coefficients on

Recall that our measures of institutional quality correspond to institutions governing different stages of production of foreign-owned firms. At the very early stage, the institutions facilitating the launch of businesses play an important role in determining the amount of fixed costs expended. At the expansion stage, the contracting institutions affect the efficiency of operation and sales, while the elite-constraining institutions influence the competitiveness of the market. At the mature stage, property rights institutions are crucial for foreign investors who own private equities and properties in the destination countries. Therefore, before conducting FDI, foreign capitalists will carry out due diligence to rate all above institutions. So, to attract more FDI with better institutional quality, local governments have to improve their institutions from these four aspects of institutions.

To get a sense of the magnitude of efforts made by governments, when the predicted level of FDI rises by 1%, without additional controls, the quality of institutions on protecting private property will improve the most by 11.8%. But when controls are included, a 1% increase in the predicted level of FDI will lead to an 8.1% increase in the quality of institutions prohibiting politicians and elites from taking advantages of foreign investors, a 4.0%-5.0% improvement in the institutional quality of starting a business and strengthening private contract enforcement, and only a 3.7% improvement in the institutions on property rights institutions. Therefore, since our institutional measures are normalized to have comparable means and variances, these results support our second hypothesis --- the institution-building effect of predicted FDI is relatively stronger for changing elite constraint institutions. Therefore, the baseline results imply that a long-run governmental plan for upgrading elite constraint institutions plays a crucial role in re-attracting FDI lost during crises such as the recent one caused by COVID-19. We continue to validate the results in what follows.

4. Robustness Checks

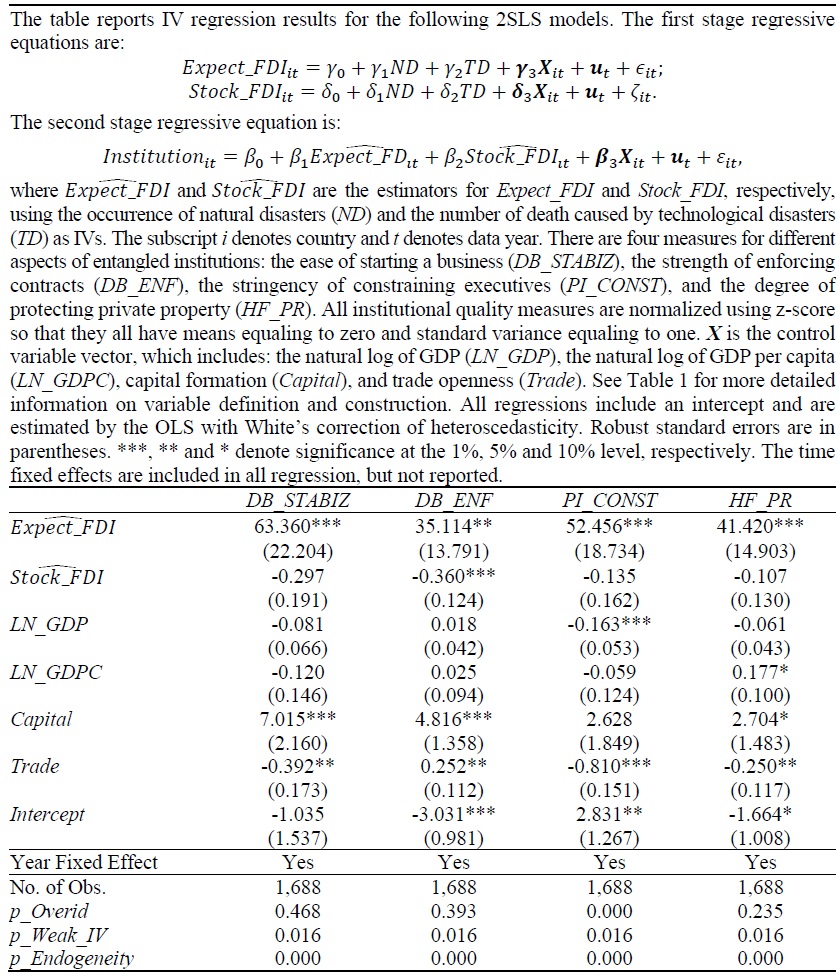

In this subsection, we check the robustness of our results in several ways. First of all, one may worry about measurement errors in our analysis. To mitigate this concern, we choose two IVs from the International Disasters Database, namely, the number of occurrences of natural disasters (

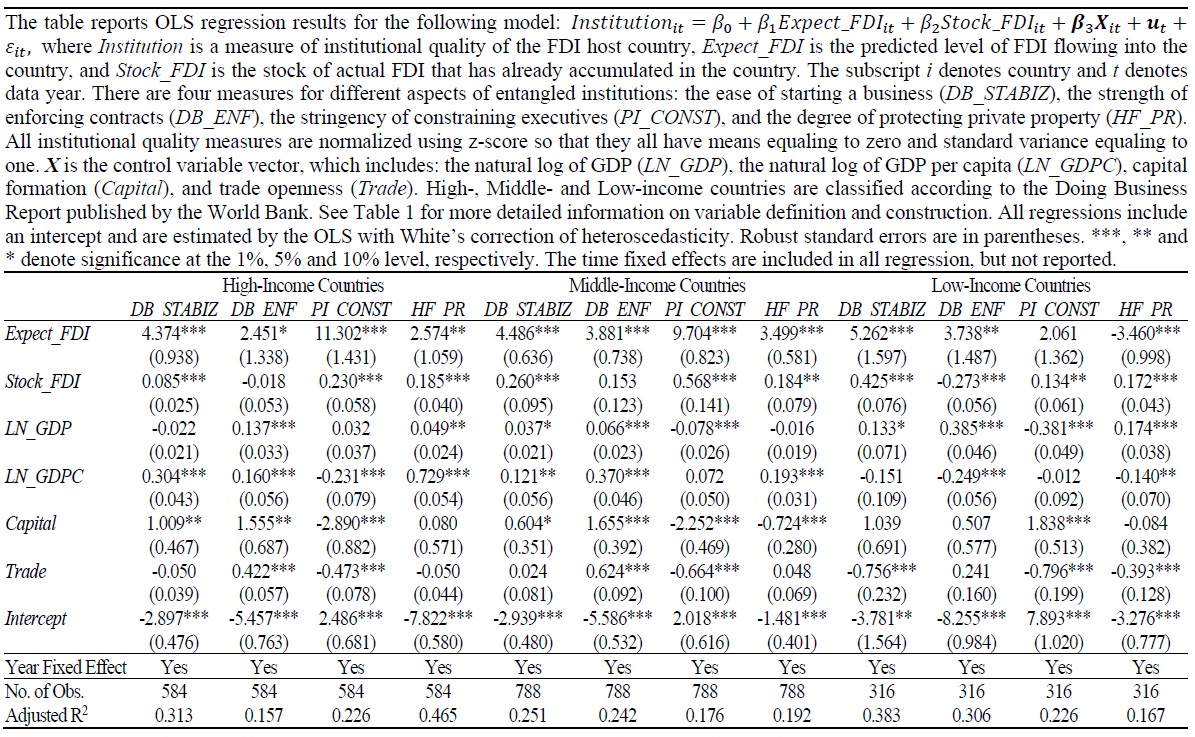

As a second robustness check, Table 5 re-runs our baseline regressions in three subsamples: high-, middle- and low-income countries. Theoretically speaking, FDI occurs more often for foreign firms with high production efficiency and in host countries with low entering costs. Therefore, high-income countries should have fewer opportunities left for new FDI projects, and low-income countries without necessary features are less attractive to foreign investors that are capable of conducting direct investments. According to the UNCTAD statistics, among the top fifteen FDI destination countries, six of them are categorized as middle-income countries. China is ranked in the 2nd place, Brazil the 3rd place, Indian the 9th place, Mexico the 11th place, Russian the 13th place, and Indonesia the 13th place. As can be seen from Table 5, our coefficients on predicted FDI for the middle-income-country subsample (the middle four columns) are more significant and closer to the baseline results than those estimated using either the high- or low-income subsamples (the first and last four columns).

Third, Table 6 presents the results of using alternative dependent variables including the actual inward FDI flows (

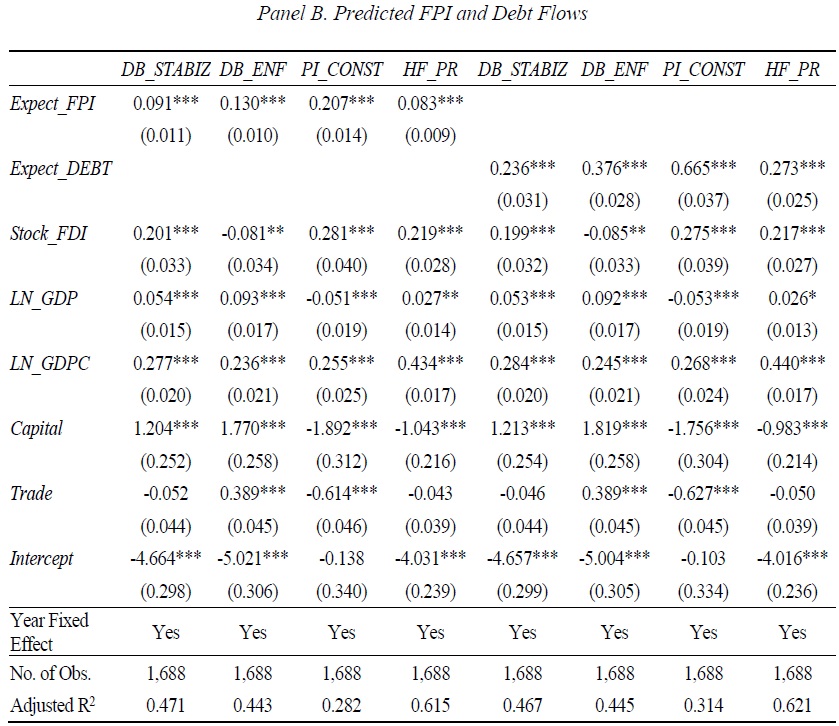

While FDI is presumed to be more stable and less prone to reversals, FPI and debt are considered more volatile. Consequently, these two alternative capital inflows might have smaller institution-building effects than FDI. Panel B of Table 6 confirms smaller effects for FPI and debt, nonetheless statistically significant. Turning back to results in the first four columns of panel A, the actual inflow of FDI is, in general, insignificant but becomes significantly positive at the 1% level when

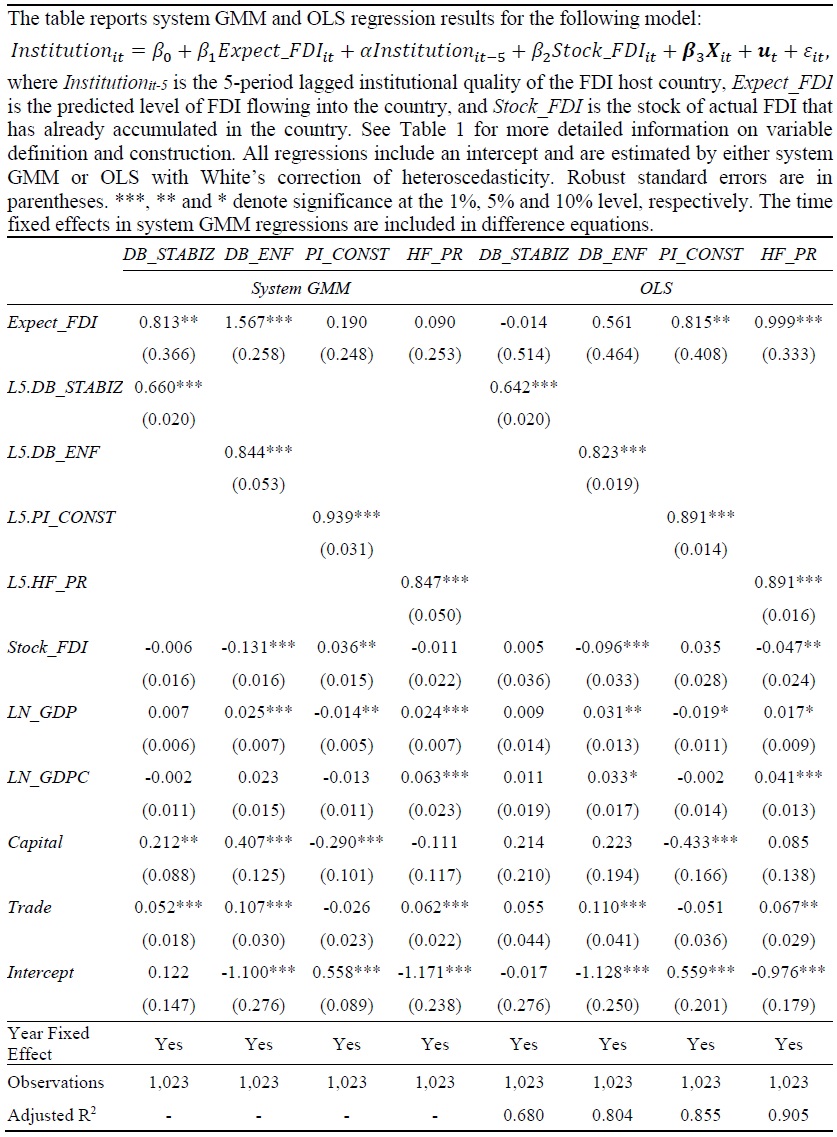

Finally, we validate our results in two other ways, making sure that they are not driven by lagged institutional quality measures or particular subsamples divided using features other than the national income level. We include the five-period lagged institutional variable in level as control in a system GMM and an OLS specification. Table 7 presents the corresponding results, which basically conform to the baseline results. It merits a note that expected FDI seems to have an insignificant effect on the annual change of institutions or when an institutional quality variable lagged less than five periods are included. The reason is that, while FDI flow is volatile depending on business cycles, the institution is a political and economic system that runs in the long term. As a result, our estimation captures the long-term trends of institutional improvement, not contemporaneous changes. Furthermore, our results are also robust to dropping OECD countries that have already possessed quality institutions, sub-Saharan African countries that had been colonized, Asian tigers that witnessed the fastest institutional improvement in the post-war period, and Latin American and the Caribbean countries that rely heavily on exporting natural and agricultural resources. These subsamples generate quite similar results as before; thus, they are not reported.

3)It is shown by

4)Given diverse sources and methodologies, our institutional quality measures may not be comparable. We thank the editor for pointing this out. As a result, we normalize these measures by using the zscore method. The normalized measures used in all estimations have the same mean and standard deviation. By doing this, the weights of proxies for institutions in our regression will not be artificially distorted.

6)According to the International Disasters Database, natural disasters include incidents of natural causes such as geophysical (e.g., earthquake and volcanic activity), meteorological (e.g., storm), hydrological (e.g., flood), climatological (e.g., wildfire), biological (e.g., epidemic and animal accident) and extraterrestrial (i.e., space weather) factors; and technological disasters are industrial (e.g., chemical spill and radiation), transport (e.g., accidents happened in the air, road, rail, and water) and miscellaneous (e.g., fire and explosion) accidents.

IV. CONCLUSION

Academia has long recognized the key role played by international activities in stimulating economic growth. Consider a small open economy with the output produced using capital, labor, and other factors via a constant-return-to-scale production function. This country itself can provide labor, human capital, and land. Its growth will not be hindered as long as international trade can provide the rest of the inputs (e.g., natural resources and intermediate goods), and global capital flows can provide financial capital or financing for physical capital. What is more, cross-border activities also affect the economy’s production through the channel of total factor productivity (TFP) indirectly. In this article, we assume that TFP contains technology as well as institutions. Acemoglu and Johnson (2005) deem the institution that matters most for economic outcomes is the one preventing state and elite expropriation.

While trade can improve technology (Alvarez et al., 2014) and institutions (Levchenko, 2013) simultaneously, the previous literature provides sparse evidence on the technology spillover effect of capital flows (Fons-Rosen et al., 2013). We contribute to the literature by proving that capital projection improves the quality of elite constraint institutions so that the weak technology-advancing effect of FDI can be partly remedied. Hence, institutional improvement induced by expected capital inflows may serve as a stimulus for post-pandemic investment reboot in the domestic economy. Particularly, our exercises answer the following questions. Which types of international capital have the most significant effect on what institutions? And how does this institution-building effect function?

We demonstrate that there exist at least two competing mechanisms for the most significant effect of FDI imposing on executive constraints. One mechanism works through existing FDI programs. Lobbyists representing investors that have already invested in the host country will (i) provide information on laws and regulations implemented in the developed world; and (ii) coerce policy-makers by threatening to leave if there is no improvement in institutional quality. Another mechanism works through potential FDI projects. Consider lobbyists representing domestic interest groups that will benefit from future higher FDI flows. Since countries with better institutions can often accumulate larger international capital stocks, the need for capital flows gives an incentive for domestic interest groups to strategically influence policymakers by urging them to improve institutions before seeking investment from overseas. Despite the lobbying actions, policymakers do have the concern that larger capital flows may cause centralized default on debt, reliance on FDI, and hot money outflow for FPI, all of which will lead to stagnant institutional improvement. Without formal analysis, it is hard to tell whether potential FDI will facilitate or hinder institutional change. All in all, this paper demonstrates it is a facilitative effect and this institution-building effect of predicted FDI inflows dominates that of actual FDI stocks. Consider countries lacking attractive characteristics or staying in uncertainty because of suffering from financial or pandemic crises. In the eye of foreign investors, to break the vicious cycle of poor institutional quality and less capital inflow expected and then even worse institutions, our implication is that their governments need to incentivize institutional improvement from other non-FDI aspects inside the country.

Tables & Figures

Table 1.

Description of the Variables

Table 2.

Correlations and Summary Statistics of the Variables

Panel A shows correlation coefficients for 14 variables constructed based on raw data from the World Bank Doing Business, POLITY IV, Heritage Foundation, UNComtrade Foreign Direct Investment, IMF International Financial Statistics, and the International Disasters Database.

Table 3.

Main Estimation Results

Table 4.

IV Estimation Results

Table 5.

OLS Estimation Results with Different Subsamples Based on Income Levels

Table 6.

OLS Estimation Results with Different Types of Capital Inflows

Table 6.

Continued

Table 7.

System GMM and OLS Estimation Results with Lagged Institution

Table 1A.

139 Economies in the Sample

References

-

Acemoglu, D., Johnson, S. and J. A. Robinson. 2001. “The Colonial Origins of Comparative Development: An Empirical Investigation,”

American Economic Review , vol. 91, no. 5, pp. 1369-1401.

-

Acemoglu, D. and S. Johnson. 2005. “Unbundling Institutions,”

Journal of Political Economy , vol. 113, no. 5, pp. 949-995.

-

Acemoglu, D., Johnson, S. and J. A. Robinson. 2005. “Institutions as the Fundamental Cause of Long-Run Growth.” In Aghion, P. and S. N. Durlauf. (eds.)

Handbook of Economic Growth . Volume 1A, Amsterdam: North Holland. -

Ahlquist, J. S. and A. Prakash. 2010. “FDI and the Costs of Contract Enforcement in Developing Countries,”

Policy Sciences , vol. 43, no. 2, pp. 181-200.

-

Alfaro, L. and A. Charlton. 2009. “Intra-Industry Foreign Direct Investment,”

American Economic Review , vol. 99, no. 5, pp. 2096-2119.

-

Alfaro, L., Kalemli-Ozcan, S. and V. Volosovych. 2008. “Why Doesn’t Capital Flow from Rich to Poor Countries? An Empirical Investigation,”

Review of Economics and Statistics , vol. 90, no. 2, pp. 347-368.

-

Ali, F. A., Fiess, N. and R. MacDonald. 2010. “Do Institutions Matter for Foreign Direct Investment?”

Open Economies Review , vol. 21, pp. 201-219.

-

Ali, F. A., Fiess, N. and R. MacDonald. 2011. “Climbing to the Top? Foreign Direct Investment and Property Rights,”

Economic Inquiry , vol. 49, no. 1, pp. 289-302.

- Alvarez, F. E., Buera, F. J. and R. E. Lucas. 2014. Idea Flows, Economic Growth, and Trade. NBER Working Paper, no. 19667.

- Akoto, W. 2013. Institutional Quality and Debt Relief: A Political Economy Approach. ERSA Working Paper, no. 340.

-

Beck, T., Demirguc-Kunt, A. and R. Levine. 2003. “Law, Endowments, and Finance,”

Journal of Financial Economics , vol. 70, no. 2, pp. 137-181.

- Beirne, J., Renzhi, N., Sugandi, R. and U. Volz. 2020. Financial Market and Capital Flow Dynamics during the Covid-19 Pandemic. ADBI Working Paper Series. no. 1158.

-

Bergh, A., Mirkina, I. and T. Nilsson. 2014. “Globalization and Institutional Quality- A Panel Data Analysis,”

Oxford Development Studies , vol. 42, no. 3, pp. 365-394.

-

Bhattacharyya, S. 2012. “Trade Liberalization and Institutional Development,”

Journal of Policy Modeling , vol. 34, no. 2, pp. 253-269.

- Cakmakli, C., Demiralp, S., Kalenku-Ozcan, S., Yesiltas, S. and M. A. Yildirim. 2020. COVID-19 and Emerging Markets: An Epidemiological Model with International Production Networks and Capital Flows. IMF Working Paper, no. 20/133.

-

Djankov, S., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2002. “The Regulation of Entry,”

Quarterly Journal of Economics , vol. 117, no. 1, pp. 1-37.

-

Djankov, S., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2003. “Courts,”

Quarterly Journal of Economics , vol. 118, no. 2, pp. 453-517.

-

Frankel, J. A. and D. H. Romer. 1999. “Does Trade Cause Growth?”

American Economic Review , vol. 89, no. 3, pp. 379-399.

- Fons-Rosen, C., Kalemli-Ozcan, S., Sorensen, B. E., Villegas-Sanchez, C. and V. Volosovych. 2013. Quantifying Productivity Gains from Foreign Investment. NBER Working Paper, no. 18920.

- Gurr, R. T. 1990. Polity II: Political Structure and Regime Change, 1800-1986. ICPSR Paper no. 9263. Inter-university Consortium for Political and Social Research.

-

Javorcik, B. S. 2004. “Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers through Backward Linkages,”

American Economic Review , vol. 94, no. 3, pp. 605-627.

- Jiao, Y. and S.-J. Wei. 2017. Intrinsic Openness and Endogenous Institutional Quality. NBER Working Paper, no. 24052.

-

Karakas, L. D. 2017. “Institutional Constraints and the Inefficiency in Public Investments,”

Journal of Public Economics , vol. 152, pp. 93-101.

-

Kingston, C. and G. Caballero. 2009. “Comparing Theories of Institutional Change,”

Journal of Institutional Economics , vol. 5, no. 2, pp. 151-180.

-

Kleinert, J. and F. Toubal. 2010. “Gravity for FDI,”

Review of International Economics , vol. 18, no. 1, pp. 1-13

- Kirabaeva, K. and A. Razin. 2011. Composition of International Capital Flows: A Survey, HKIMR Paper, no. 14/2011.

-

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. and R. W. Vishny. 1997. “Legal Determinants of External Finance,”

Journal of Finance , vol. 52, no. 3, pp. 1131-1150.

-

Levchenko, A. A. 2013. “International Trade and Institutional Change,”

Journal of Law, Economics, and Organization , vol. 29, no. 5, pp. 1145-1181.

-

Long, C., Yang, J. and J. Zhang. 2015. “Institutional Impact of Foreign Direct Investment in China,”

World Development , vol. 66, pp. 31-48.

-

Miguel, E., Satyanath S. and E. Sergenti. 2004. “Economic Shocks and Civil Conflict: An Instrumental Variables Approach,”

Journal of Political Economy , vol. 112, no. 4, pp. 725-753.

-

Moran, T., Graham, E. M. and M. Blomstrom. 2005.

Does Foreign Direct Investment Promote Development? Washington, DC: Institute for International Economics. -

Neyapti, B. 2013. “Modeling Institutional Evolution,”

Economic Systems , vol. 37, no. 1, pp. 1-16.

-

Puga, D. and D. Trefler. 2014. “International Trade and Institutional Change: Medieval Venice’s Response to Globalization,”

Quarterly Journal of Economics , vol. 129, no. 2, pp. 753-821.

-

Shi, W., Sun, S. L., Yan, D. and Z. Zhu. 2017. “Institutional Fragility and Outward Foreign Direct Investment from China,”

Journal of International Business Studies , vol. 48, no. 4, pp. 452-476.

- Singh, K. 2020. COVID-19: A Triple Whammy for Emerging Market and Developing Economies. Madhyam Briefing Paper, no. 36.