- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 28, No. 2, 2024. pp. 143-174.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2024.28.2.433

Number of citation : 0Investing Abroad, Transforming at Home: An Empirical Study of Outward Foreign Direct Investment and Korean Manufacturing’s Servicification

|

Sogang University |

|

|

Sogang University |

Abstract

This paper empirically examines the relationship between outward foreign direct investment (OFDI) of Korean manufacturing firms and the servicification of domestic employment using a firm-level panel data. In this study, considering the issue of low productivity in the Korean service sector, we categorize service employment into core and non-core services and investigate their relationship with OFDI using the firm-fixed effects model. The empirical results show that the share of core service employment exhibits a positive correlation with the extensive OFDI. On the other hand, the share of non-core service employment, which is expected to generate relatively low valueadded, does not show a significant relationship with the extensive OFDI. When we divide the samples based on host countries and the type of subsidiaries, the impact on servicification varies depending on the technological capabilities of host countries and their participation in global value chains. Our study suggests that Korean manufacturing firm’s internationalization strategies may facilitate a transition from labor-intensive employment, like the cases in advanced countries, to technology-intensive employment through OFDI and other means.

JEL Classification: F23, F66, D22

Keywords

Servicification of Manufacturing, Outward Foreign Direct Investment, Multinational Enterprise, Fixed Effects Model

I. Introduction

With the expansion of global value chains (GVCs), multinational enterprises (MNEs) such as Apple Inc. and Nike, Inc. have relocated their manufacturing operations to lower-cost countries while reinforcing high value-added service functions within their home countries.1 The so-called ‘Servicification’2 is one of the strategies employed by traditional manufacturers in advanced countries to create additional value. This paper focuses on servicification in emerging countries like Korea and empirically analyzes the impact of outward foreign direct investment (OFDI) on the employment of manufacturing firms using firm-level panel data.

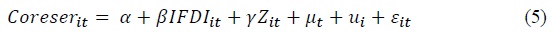

Previous empirical studies, which have primarily focused on major advanced economies such as the US, Japan, and Europe, have suggested a positive correlation between servicification and average income levels or improved firm performance (Crozet and Milet, 2017; Morikawa, 2016; Bronzini, 2015; Harrison and McMillan, 2011; Francois and Reinert, 1996). In recent years, progress in servicification has also been observed in Korea (Lee, 2023; Chun et al., 2021; Lee and Choi, 2020). However, contrasting perspectives on servicification exist in Korea, with some studies highlighting positive aspects while others raise concerns. From an optimistic perspective, Hur et al. (2019) have indicated that Korean MNEs have a bias towards high-skilled workers, who are expected to earn higher wages and display greater productivity compared to other domestic firms and exporters. Additionally, empirical results suggest superior performance among Korea’s factoryless goods producers (Hur and Yoon, 2022; Jun et al., 2020). Nonetheless, concerns arise from the relatively low value-added contribution of the service sector to the Korean economy which may impede overall productivity improvement in Korea (Lee and Choi, 2020; Lee, 2012). As shown in Figure 1, while in major countries the employment share of service sector generally aligns with its value-added share, Korea exhibits a growing gap between these two factors, implying lower service sector productivity in the country.3

To address these differing viewpoints, this study classifies service employment into two categories: core service employment and non-core service employment.4 Given Korea’s positioning between advanced and emerging countries, the progression of servicification within Korean manufacturing firms can vary, either towards core services or non-core services, depending on the host countries and subsidiary types.5 When considering OFDI to advanced countries, such as when Korean MNEs establish R&D centers in technologically advanced nations to acquire new technologies, the share of core service employment in the home country may decrease. Alternatively, a higher level of service in the home country may be required to compete with highly skilled competitors or support skilled foreign workers. The dynamics differ when examining OFDI directed towards emerging economies. When contemplating OFDI to emerging countries, such as when manufacturing firms relocate production to lowerwage countries, an expected decline in the number of manufacturing employees in the home country and a potential increase in the proportion of core service employment resemble trends observed in advanced countries. Conversely, companies might need to deploy skilled workers from the home country due to the local workforce’s inability to meet required service standards. Taking these factors into consideration, we tailor our research accordingly and examine the relationship between OFDI and the share of service employment within manufacturing firms, distinguishing among host countries and subsidiary types. This approach provides a comprehensive evaluation of the servicification phenomenon, allowing us to discern the direction of change within Korean manufacturing firms and to ascertain related concerns and policy implications.

In this study, we utilize the Survey of Business Activities (SBA), a comprehensive firm-level panel dataset provided by Statistics Korea. The SBA offers not only financial information about companies, but also provides data on the locations and investment amounts of domestic and foreign subsidiaries, making it an invaluable resource for research on OFDI. We employ a firm-fixed effects model, leveraging the characteristics of panel data.

The main findings of this study reveal a positive correlation between the extensive OFDI and the share of core service employment. In contrast, no significant relationship was observed between the extensive OFDI and the share of non-core service employment, which is typically expected to generate lower value-added. Upon dividing the samples based on host countries and subsidiary types, we discerned that the impact on servicification fluctuates contingent on the technological prowess of host countries and their engagement in GVCs. For instance, establishing manufacturing facilities in the US is positively correlated with the share of core service employment in Korea, while setting up manufacturing subsidiaries in China is positively linked with the share of non-core service employment in Korea.

In the upcoming session, we discuss various prior studies related to our topic. In the third section, we outline our methodology and data for our empirical study, presenting the main results obtained through the firm-fixed effects model. Additionally, we check the robustness of the main results and explore additional economic implications. In the final section, we summarize our discussion, highlighting the contribution, policy implications, limitations, and future tasks of this research.

1)For instance, Apple Inc. and Nike, Inc., well-known suppliers of electronic and sports goods respectively, represent the US, but are often classified as service companies within the US. Apple Inc. employs a strategy of outsourcing through emerging countries such as China, Vietnam, and India, and Nike’s manufacturing employment in the US accounts for only 0.3% (4,154 individuals) out of a total of 1.2 million manufacturing workers, according to information from their official website reported in December 2022 (

2)The concept of “Servicification of Manufacturing” can be examined from both an input and output perspective. While there is not complete consensus in academia, it is commonly referred to as “Servicification” when manufacturing companies increase the use of service activities in their production processes, and “Servitization” when the proportion of services in a manufacturing company’s sales revenue increases

3)For further details, refer to the Appendix: 1. Impact of Service Employment on Income and Firm Performance and 2. Korean Service Sector Productivity: Core vs Non-core Service.

4)According to the classification of core service and non-core service defined based on the approach of

5)Korean manufacturing firms’ OFDI to the US is likely to take the form of service investment, while OFDI to China is more likely to be in the form of manufacturing investment. In this regard, dividing them based on country and subsidiary type may not be necessary. However, based on the SBA from 2006 to 2016, Korean manufacturing MNEs’ OFDI increased by approximately 3.3 times. Within this, manufacturing investment increased by 2.3 times, and service investment increased by 4.0 times. Interestingly, manufacturing investments directed towards China increased by 1.8 times, and manufacturing investments directed towards the US increased by 2.2 times. In the case of service investments, OFDI to China experienced a growth of 4.2 times, while the OFDI to US saw a growth of 3.2 times. The steeper increase in service investments in China, in contrast to manufacturing investment in the US, could have various implications for research.

II. Literature Review

Antras and Helpman (2004) provide a theoretical framework for the global sourcing strategies of MNEs using the North-South Model. The theory suggests that a firm’s core services are always produced in the home country, where productivity is relatively high, while intermediate inputs can be produced in either a relatively low-wage foreign country or the home country through outsourcing or in-house production. Grossman and Rossi-Hansberg (2008) also present a theoretical basis for the expansion of offshoring in the manufacturing sector based on the development of logistics and information and communication technologies. They focus on the trade in tasks, which refers to the exchange of job functions between home and foreign countries and analyze the resulting changes in employment patterns in both home and foreign locations.

Indeed, numerous empirical studies have been conducted based on these theoretical foundations (Crozet and Milet, 2017; Bronzini, 2015; Blinder and Krueger, 2013; Harrison and McMillan, 2011; Blinder, 2009; Jensen et al., 2005; Autor et al., 2003). Crozet and Milet (2017) utilized firm-level data from France and revealed that a significant portion of French manufacturing companies not only engage in manufacturing but also sell services. Particularly, they found that firms exhibiting this servitization phenomenon tended to have superior firm performance. Bronzini (2015) used panel data from Italian companies to analyze the impact of both extensive and intensive OFDI on domestic employment in MNEs. The study indicated that the OFDI was positively correlated with domestic employment, albeit with a two-year lag. Harrison and McMillan (2011), drawing on firm-level data from the US, demonstrated that, overall, offshoring to low-wage countries replaced domestic employment. However, for companies performing job functions significantly distinguishable between their home and foreign operations, domestic and foreign employment were complementary. This finding suggests a connection with the trend of MNEs in the US reducing manufacturing employment domestically while strengthening service-related tasks.

Research on the servicification of the economy has predominantly focused on advanced economies. Studies focusing on the Korean economy have often centered around the overall changes in employment (Kwon, 2022; Jang and Hyun, 2012; Kang et al., 2010; Hong, 2009). However, as the servicification trend has also been observed in emerging economies like Korea (Lee and Choi, 2020), recent studies have started examining the servicification of manufacturing employment in Korean manufacturing firms. Lee (2023) examined the factors influencing the servicification of Korean manufacturing employment using data from the SBA, employing pooled OLS, least squares with dummy variable, and system GMM. According to the research of Lee (2023), in all models, the establishment of foreign subsidiaries was positively correlated with the share of core service employment. Chun et al. (2021) matched data from the SBA and the Census on Establishments, reaching similar conclusions. Their findings suggest that Korean MNEs have shifted their domestic employment structure toward an increase in the proportion of service workers.

This study has the following novelties. First, this study addresses concerns about the low value-added contribution of the Korean service sector by distinguishing service employment into core service and non-core service. Depending on whether servicification leans toward one side, the perception of the issue and its policy implications can differ. This differentiation can provide insights into the direction of servicification.

Second, it distinguishes between OFDI’s extensive margin and intensive margin. Establishing entirely new facilities (extensive margin of OFDI) and making additional investments in existing production facilities (intensive margin of OFDI) fundamentally differ in scale and nature, which can lead to varying effects on employment composition (Matsuura, 2015). However, previous studies either focused solely on extensive OFDI (Lee, 2023) or did not differentiate between intensive and extensive margins (Jang and Hyun, 2012) or used MNEs as binary variables (Chun et al., 2021).

Finally, it examines the employment effects of OFDI by distinguishing between host countries and subsidiary types from the perspective of comparative advantage in production factors. While Lee (2023) and Chun et al. (2021) provided empirical evidence that OFDI promotes the servicification of Korean manufacturing firms in aggregate terms, Lee (2023) primarily focused on identifying factors related to servicification without further subdividing OFDI, and Chun et al. (2021) categorized host countries into advanced and developing countries without delving into subsidiary types. Given that the nature of subsidiaries can impact the employment composition in the home country, investigating subsidiary types is also meaningful.

III. Empirical Study

1. Data and Methodology

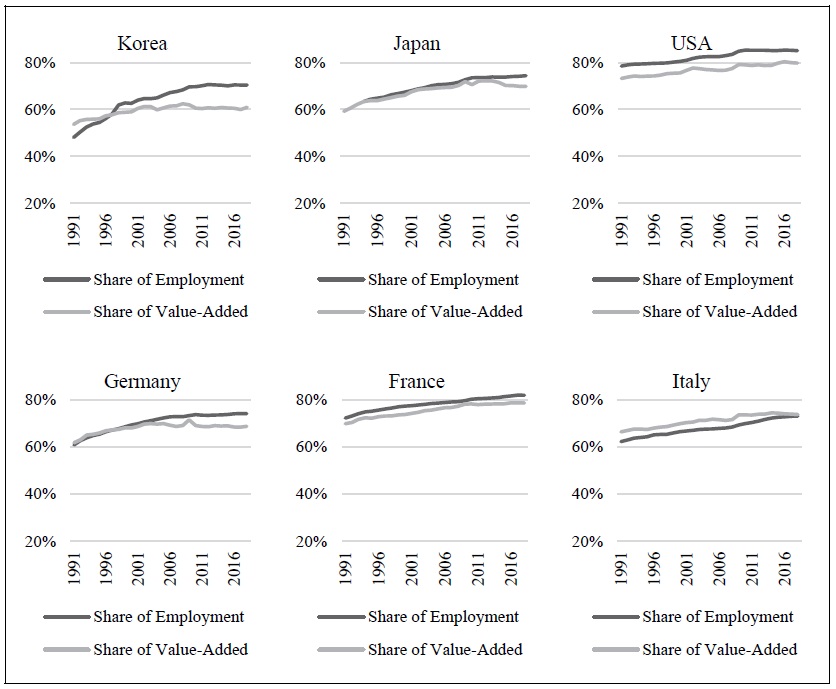

This study utilizes data from the SBA conducted by Statistics Korea. The survey is an annual panel survey that covers all firms with 50 or more employees and a capital of 300 million KRW or more in Korea. It provides a wealth of information required for this study, including investment amounts in domestic and foreign subsidiaries, location of foreign subsidiaries, employment by occupation, firm’s performance, and financial structure. The SBA is representative as it includes manufacturing firms that account for approximately 82% of the total value-added in the Korean manufacturing industry as of 2009 (Son and Hur, 2017). The period of our study covers from 2006, when data became available, to 2016. It is important to note that this timeframe predates the implementation of the 10th revision of the Korean Standard Industrial Classification (KSIC) in 2017. Furthermore, starting from 2017, significant changes occurred in the landscape of Korean OFDI due to trade tensions between the US and China. These trends could have potentially impacted the patterns and dynamics of Korean OFDI, making our chosen study period more appropriate for capturing the relationship of OFDI with servicification of employment in Korean manufacturing firms up to that point in time. The dataset consists of a total of 63,529 observations, and the descriptive statistics for each variable are presented in Table 1.

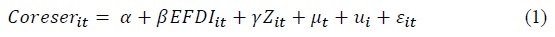

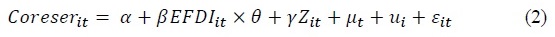

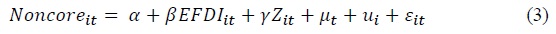

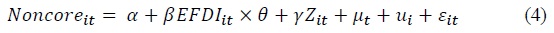

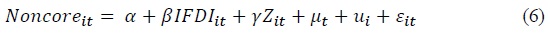

To examine the OFDI of Korean manufacturing firms and the servicification of domestic employment, we set up the following linear estimation equations and intend to conduct empirical analysis:

where

The first dependent variable,

2. Main Results

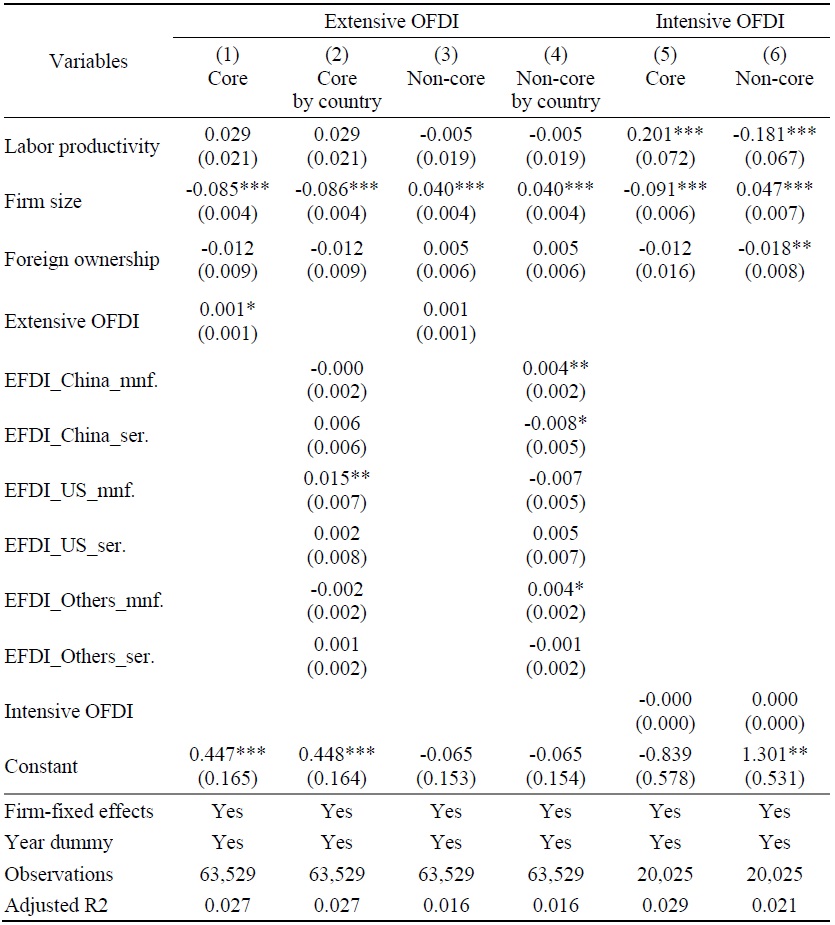

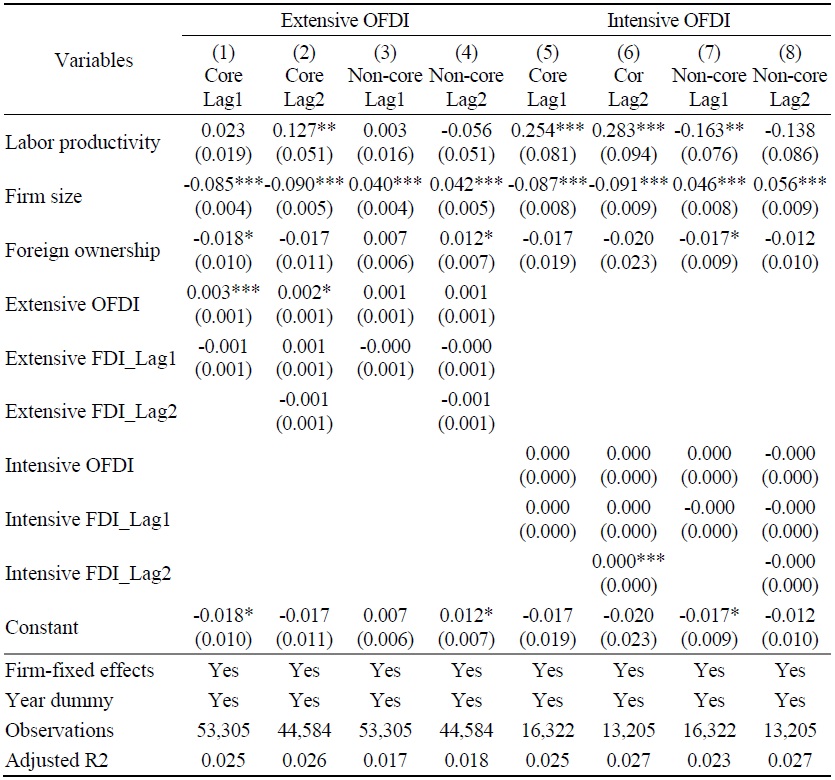

Table 2 presents the estimation results using the firm-fixed effects model. As Hausman Test indicated the presence of endogeneity,8 we adopted the firm-fixed effects model employing within-group transformations. Columns (1) to (4) present the results of estimations using the extensive OFDI as an explanatory variable, while models in columns (5) and (6) employ the intensive OFDI as an explanatory variable. The dependent variable in columns (1), (2), and (5) is the employment share of core service workers, while columns (3), (4), and (6) focus on the share of non-core service workers. Columns (2) and (4) provide results disaggregated by host country (China, the US, and Others) and subsidiary type (Manufacturing, Service). To account for heteroscedasticity in the error terms, firm-clustered standard errors were applied.

According to the estimation results, a significant positive correlation emerged between extensive OFDI of Korean manufacturing firms and the share of core service employees. In contrast, no statistically significant correlation was found between the share of non-core employees and extensive OFDI. This suggests the possibility that, as is the case in advanced countries, Korean manufacturing firms are reshaping their overall employment structure through OFDI. Furthermore, Son et al. (2023) demonstrated a significant correlation between the establishment of overseas service subsidiaries by Korean manufacturing firms and the utilization of 4th industrial revolution technologies. 9 Considering that the deployment of such advanced technologies often necessitates the input of core service personnel, this finding aligns with the results of this study.

To track the contribution of OFDI by Korean manufacturing firms to the servicification, we divided overseas subsidiaries into 3 groups based on their locations —China, the US, and other countries—and categorized them into manufacturing and service sectors. We found that when Korean manufacturing firms established manufacturing subsidiaries in the US, there was a significant positive correlation with the share of core service employees at the headquarters in Korea. However, in other regions and types of subsidiaries, no statistically significant correlation was observed. It is widely known that during this period, many Korean firms moved their production facilities from China to regions like Southeast Asia.10 This shift might influence the results of our empirical study. Additionally, the share of non-core service employees exhibited a positive correlation with OFDI to China for manufacturing subsidiaries. Conversely, a negative correlation was found with OFDI to China for service subsidiaries, while it was not statistically significant in other cases.

These results may imply that when Korean manufacturing firms establish new manufacturing facilities in the US, there is an increased demand at the headquarters for core service personnel who support overseas production bases utilizing advanced technologies. After investing in the US, it can be hypothesized that core service employment may be substituted in Korea, where the level of services is relatively lower. However, there may still be a demand for core services in Korea to support and collaborate with high-skilled employees in the US. Choi and Lee (2022) demonstrated using OECD data that foreign affiliates in high-income countries contribute to the development of domestic value chains. Furthermore, Joe et al. (2023) highlighted that key sectors such as semiconductors and batteries, which are significant for Korea’s investments in the US, feature supply chains that are either segmented by country from production to sales or engage in horizontal FDI. This scenario underscores a continuing need for high-tech manpower in Korea, implying a sustained demand for innovation activities and core service employment within the country even after making investments in the US.

On the other hand, OFDI in manufacturing to China and other countries11 likely complements the low-skilled employment in the home country. Korean manufacturing firms, even when establishing overseas manufacturing plants in other Asian regions, are known to transfer a part of manufacturing instead of the entire production process in terms of GVCs (Chun et al., 2020). It might be estimated that there is an increased demand for relatively low-level service employment, such as trade documentation management, simple bookkeeping, and warehouse management, in the process of this supply chain. Furthermore, OFDI in service to China showed a positive correlation with the share of non-core service employees. Considering that China is expected to have a lower overall level of service sector compared to Korea and a larger market size, the establishment of service subsidiaries may primarily involve the creation of sales corporations. This could have led to a decrease in employment in domestic sectors such as simple retail or distribution due to the establishment of sales corporations within China.

Intensive OFDI did not show a significant correlation with all service employment shares. Investments by manufacturing firms are primarily made in land, buildings, and machinery or equipment. In this case, intensive OFDI is likely to be observed in the machinery or equipment sector due to the replacement of old equipment or technological generational changes, rather than in large-scale land or building sectors. Such cases often occur on a relatively small scale and are related to maintenance and might not be significantly impact the employment structure in the home country.

Lastly, we delve into the other explanatory variables. Labor productivity, as estimated for the entire sample—estimations using extensive OFDI—was not statistically significant. However, in the estimation for MNEs—estimations using intensive OFDI12—it showed a positive correlation with the share of core service workers and a negative correlation with the share of non-core service workers. In other words, in the sample that includes domestic companies, exporters, and MNEs, labor productivity is likely to be unrelated to the employment structure in services. On the other hand, when considering only MNEs, firms with higher labor productivity tended to have a higher share of core service workers. Generally, MNEs tend to have larger and well-organized structures, so there is a high likelihood that they are maintaining their employment structure to maximize labor productivity. Additionally, firm size exhibited a negative correlation with core service workers.

3. Robustness

To ensure the robustness of our main research results, we conducted the following additional analyses. First, to account for the relatively stable nature of employment, we included a 1-year lag of the dependent variable as an explanatory variable. To address the endogeneity issue arising from this, we employed a one-step difference GMM. Second, we classified industries based on their R&D intensity and examined the estimation results to gain a more nuanced understanding of the direction of servicification, Third, to demonstrate that servicification is driven by an increase in service workers relative to the total number of regular employees, we changed the dependent variable to the proportion of manufacturing workers relative to total regular workers. Fourth, considering prior research suggesting that the employment effects of OFDI may occur with a time lag, we added lag variables of 1 to 2 years to the analysis. Fifth, to address concerns related to the choice of the sample period, we extended the sample period until 2020 and examined the estimation results. Lastly, to investigate long-term changes within the panel, we transformed the dependent variables and the key explanatory variables into difference variables with a 5-year time lag and conducted estimations.

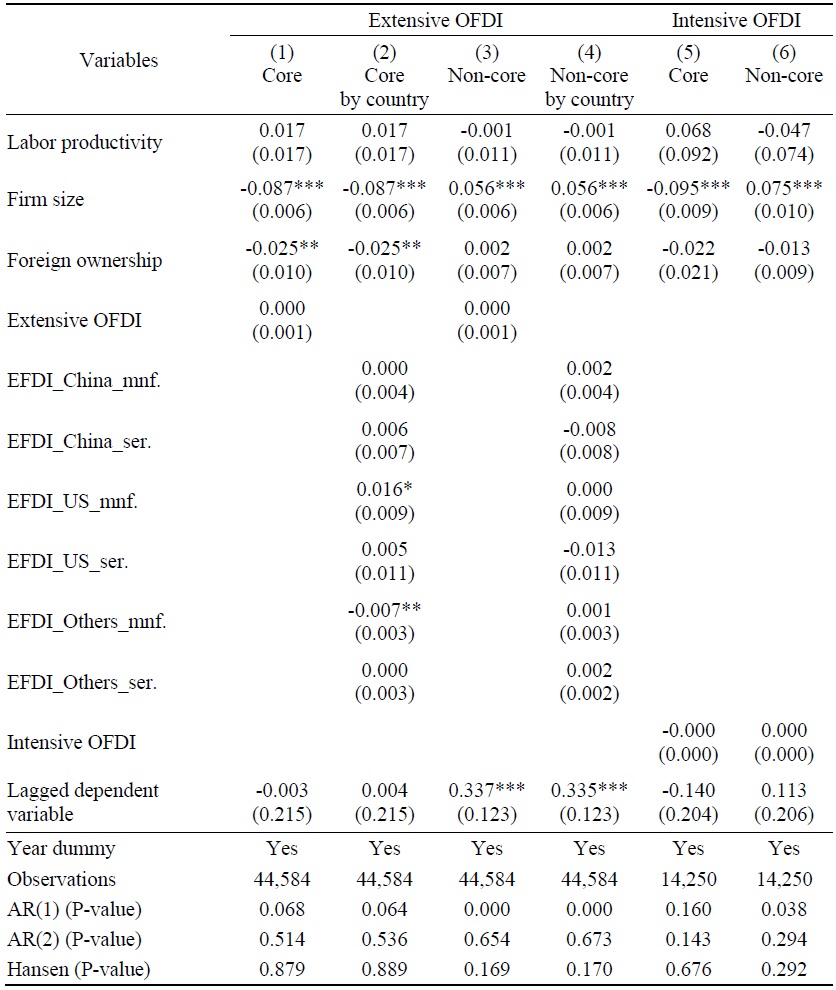

(1) One-step difference GMM

The dependent variables are in fractional form, and due to the stable nature of employment, there may be issues of base effects and autocorrelation in the dependent variables. In this case, adding the 1-year lag values of the dependent variables to the explanatory variables can alleviate the problem, but it may lead to an endogeneity issue. To tackle the endogeneity issue arising from incorporating lagged values of the dependent variable in the model, we opted for the one-step difference GMM proposed by Arellano and Bond (1991). The specific rationale for choosing the one-step difference GMM is discussed in the appendix,13 and the outcomes of the regression analysis employing the difference GMM are presented in Table 3.

Regarding the model specification, the serial correlation of the residuals was tested to assess the suitability of using lagged explanatory variables as instruments (AR(1), AR(2)).14 In cases where there is no serial correlation, lagged explanatory variables can be used as instruments (Eun, 2015). The test results indicate that the null hypothesis of no second-order autocorrelation is not rejected at the 10% significance level for all models in the AR(2) test, implying that the error terms in the specified models are independent. Furthermore, to alleviate the issue of overidentification, lagged values of the dependent variable up to 4 periods prior were used as instruments in all estimations. The validity of these instruments was tested using the Hansen-J test, and in all models, the P-values were above 0.1, indicating that appropriate instruments were used.

The estimation results through the difference GMM did not show a significant correlation between total extensive OFDI and both core and non-core service employment shares. However, when extensive OFDI was separated by country and subsidiary type, it was observed that, consistent with our main results, having more manufacturing subsidiaries in the US has a positive correlation with the share of core service workers. Additionally, there was a negative correlation between extensive OFDI to other countries, primarily representing emerging economies in Asia, and the share of core service workers in the manufacturing sector. MNEs often choose to enter emerging countries to take advantage of lower labor costs. Therefore, in such cases, it might be expected that the home country’s service capabilities would be enhanced. However, the estimation results from the difference GMM indicate a negative correlation between establishing manufacturing subsidiaries in other countries and the share of core service employment. This suggests that in Asian emerging countries where the level of available services is relatively low and sourcing core services locally may be challenging, companies may opt to dispatch personnel for core services directly from their home country.

The coefficients for labor productivity were not statistically significant in this model. And the estimation results for firm size were similar to those in the firm-fixed effects model. Foreign ownership showed a negative correlation with the core service worker. It suggests that when foreign parent companies are present, their employment structure strategy aims at sourcing core service workers in their home countries.

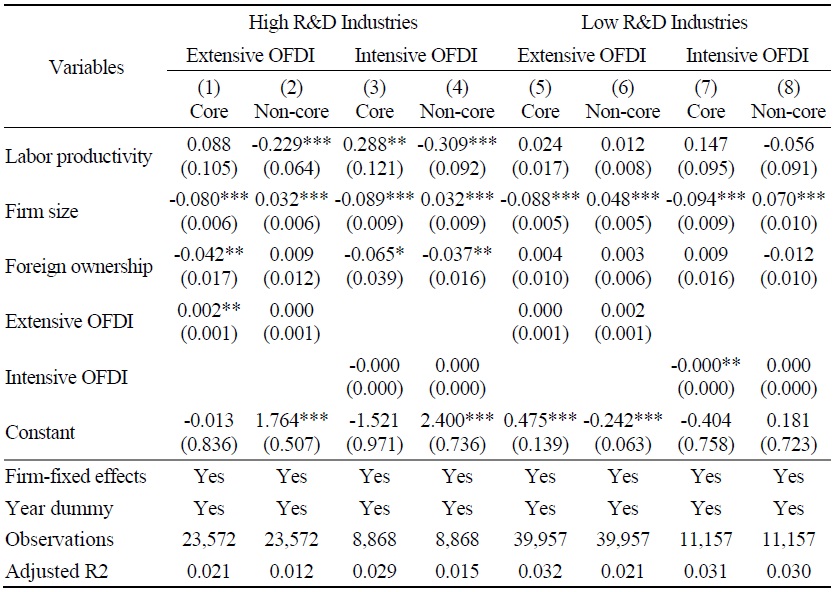

(2) Industry classification by R&D intensity

To pinpoint the origins of servicification within the Korean manufacturing sector, we followed the approach outlined by Son et al. (2023) that categorized the top 5 industries with the highest R&D intensity as “High R&D Industries”. while classifying the remaining industries as “Low R&D Industries” based on the 2016 Survey of Research and Development in Korea. Subsequently, we scrutinized the estimation results for each sample in Table 4.

The outcomes unveiled a noteworthy positive correlation between extensive OFDI and the share of core service workers, predominantly within the high R&D industries. This implies that the march towards servicification, with a particular emphasis on core services, is chiefly unfolding within the high R&D industries. In line with these findings, Son et al. (2023) illuminated that MNEs possessing service subsidiaries within the high R&D industries tend to embrace and employ the advanced technologies like 4th industrial revolution technologies more extensively. Consequently, our results harmonize with the context presented in their study.

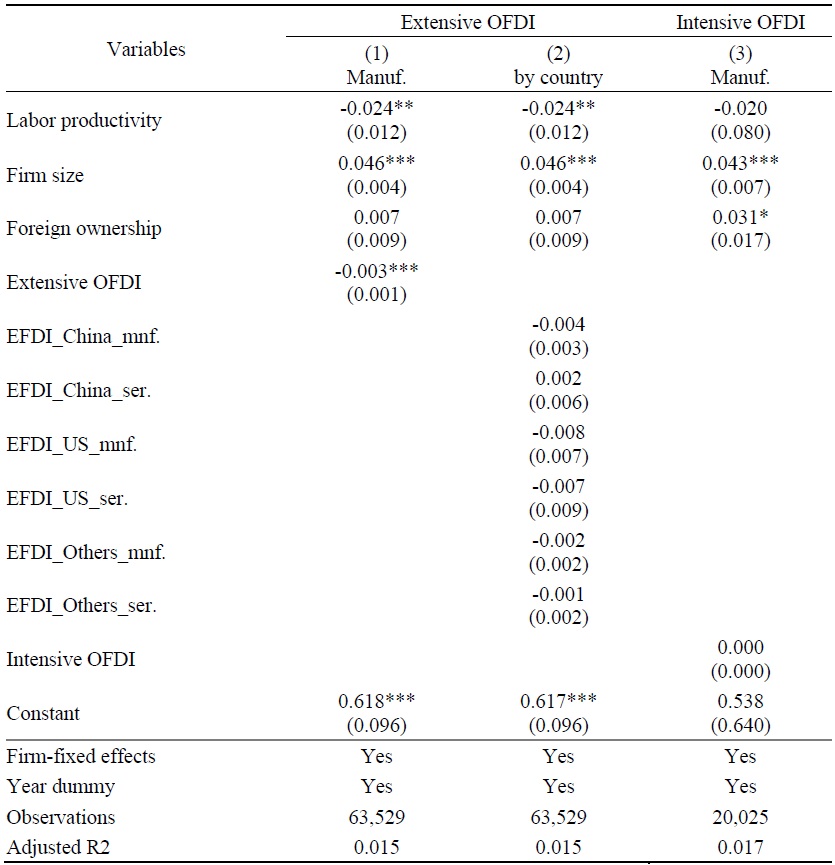

(3) Proportion of manufacturing workers

We redefined the dependent variable as the share of manufacturing-related workers to total regular workers and examined it. Extensive OFDI exhibited a negative correlation with the proportion of manufacturing workers. Considering the results in Table 2, an increase of one foreign subsidiary was associated with an increase in the proportion of core service workers while showing no significant correlation with non-core service workers. Given that, by definition, the sum of the shares of core service workers, non-core service workers, and manufacturing workers is equal to 1, the results in Table 5 imply changes in the dependent variables due to actual increases in core service workers and decreases in manufacturing workers, rather than changes resulting from alterations in the denominator (total regular workers). However, when extensive OFDI was classified by destination and subsidiary type, statistical significance was not identified.

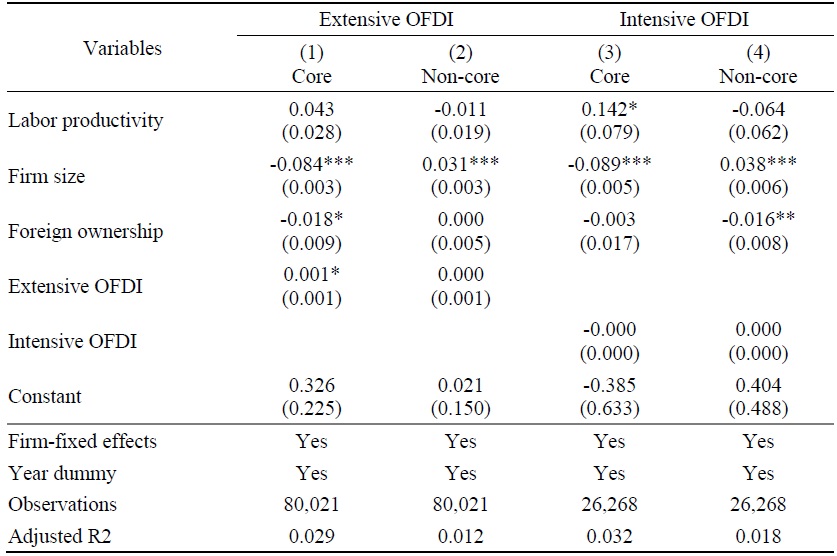

(4) Time lag analysis

There is the possibility of a time lag between the establishment of foreign subsidiaries and the actual commencement of production processes, even when foreign investment is reported. Various factors such as pre-production preparations, administrative procedures, and procurement challenges can contribute to this lag. Additionally, some previous studies have suggested that the employment effects of Korean OFDI may not materialize immediately due to factors like the rigidity of employment practices (Jang and Hyun, 2012; Hyun et al., 2010).

To address potential time lag issues, inspired by Jang and Hyun (2012) and Hyun et al. (2010), who reported on 1-2 year lags, we incorporated 1-year and 2-year lag variables for our primary explanatory variables into our analysis. However, our findings in Table 6 revealed that, even with the inclusion of these lag variables, statistical significance was observed for extensive OFDI only in the current year. The other lag variables did not demonstrate statistical significance.

These results suggest that time lag effects related to the extensive OFDI might not be observable in our analysis. This interpretation is rooted in the idea that labor is considered more as a production factor rather than an outcome of OFDI. As for intensive OFDI, when lag variables were included up to 2 years, statistical significance was observed for the share of core service workers. However, the coefficient value effectively converged to zero.

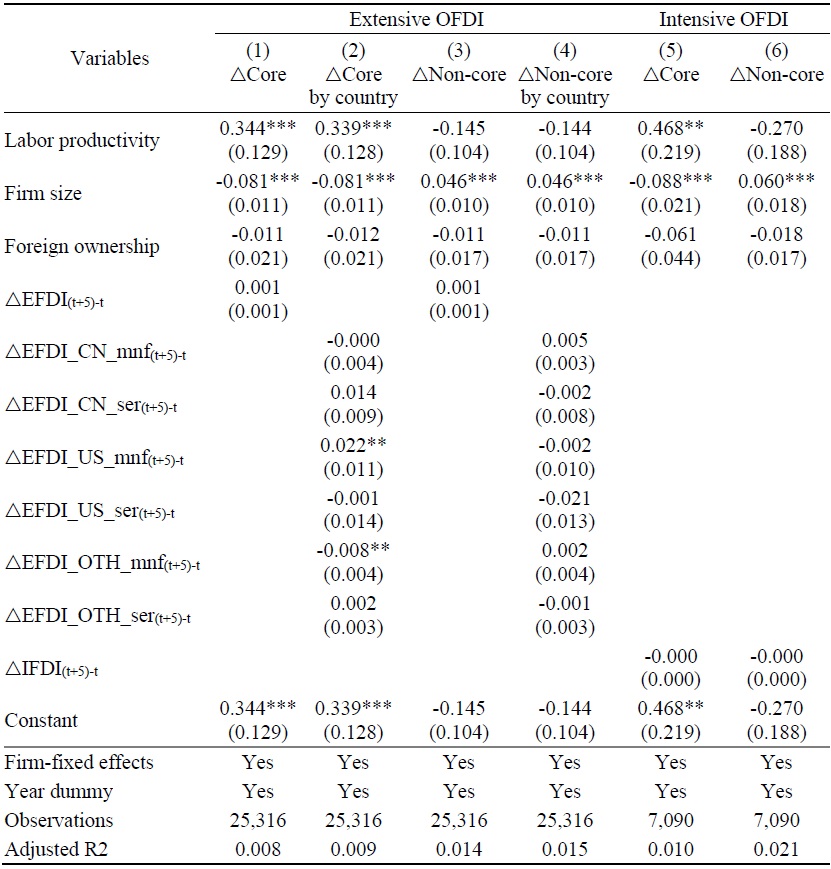

(5) Extended sample period

We selected the research period from 2006 to 2016. The reason why we have limited the period span is associated with technical changes in the industry classification codes since the adoption of KSIC 10 in 2017, as well as the significant shifts in OFDI patterns of Korea due to the US-China trade dispute and the COVID-19 pandemic from 2017. These external shocks were expected to have a substantial impact, leading us to select the study period from 2006 to 2016.

To address concerns related to the selected period, we extended the analysis to include data up to 2020.15 However, to maintain consistency and avoid potential issues related to code changes, we excluded 7,909 observations corresponding to 7 double-digit industry codes16 that were either added or modified during the 9th to 10th revision of the KSIC. We excluded cases where a 3-digit or more-digit industry code moved to a different 2-digit code but retained those where 3-digit or more-digit codes remained within the same 2-digit industry category.

The total number of observations for the entire period from 2006 to 2020 was 87,930. After excluding the newly added or changed 2-digit industry codes, which accounted for approximately 9% of the data, we had 80,021 observations. Our main results remained consistent in the robustness analysis presented in Table 7.

(6) Difference variables for long-term trends

To examine long-term changes within the panel, we transformed the dependent variables and OFDI variables into difference variables with a 5-year interval. For instance, we calculated the difference between the dependent variables and main explanatory variables for firms existing in 2006 and their values in 2010 to create a new panel dataset. In this way, we established a new panel dataset spanning from 2006-2010 to 2012-2016. Other explanatory variables, except for OFDI, were controlled for at the t-year value.

The results of the model presented in Table 8 were similar to the results of the difference GMM presented in Table 3. Changes in overall extensive OFDI and changes in the total core service share were not statistically significant. However, changes in manufacturing investment in the US showed a positive correlation with changes in the core service share, while extensive OFDI in manufacturing in other countries showed a negative correlation with changes in share of core service workers. This finding provides further support for our research results in the long-difference model.

6)Following

7)

8)As we differentiated the dependent variable into core service and non-core service, and separately examined OFDI as extensive OFDI and intensive OFDI, we conducted the Hausman test for a total of 4 cases. The p-value of the Hausman test was less than 1% in all cases. Therefore, it can be deemed appropriate to use the fixed effects model in our study. The Hausman test results were not included in the paper, but the results are available upon request.

9)AI, bigdata, blockchain, IoT, 5G, and robotics.

10)According to SBA, the proportion of total OFDI by Korean manufacturing firms in China decreased from 46% in 2006 to 30% in 2016. Meanwhile, the proportion in the US increased from 15% to 18%. Given that manufacturing OFDI grew approximately 3.3 times from 2006 to 2016, the absolute change in OFDI flow in each country is significant.

11)Except for Japan, most of the ‘other countries’ category consists of emerging economies in the Asian region. According to the SBA data from 2006 to 2019, the top 10 countries with the highest cumulative OFDI amount from Korean manufacturing firms are, in descending order: China (including Hong Kong), Vietnam, the US, India, Indonesia, Brazil, Malaysia, Thailand, the Czech Republic, and the Philippines. These countries collectively account for 83% of the total cumulative OFDI amount.

12)The estimation model using intensive OFDI as an explanatory variable is limited to cases where overseas subsidiaries exist. Therefore, the panels within this sample consist of MNEs with one or more overseas subsidiaries.

13)For further details, refer to the Appendix 3. Model Selection on Generalized Method of Moments (GMM) Estimation.

14)In cases where there is second-order autocorrelation (AR(2)), it means that

15)Considering the impact of the global financial crisis, we proceeded with additional analysis using data from 2010 to 2016. The correlation coefficient between total extensive OFDI and the share of core service employment was positive, but the statistical significance was slightly lacking. When classified by host countries and subsidiary types, the results were similar to our main estimation results. Although these results are not included in this paper, they are available upon request.

16)The 7 industries are (1) Manufacture of Clothing, Clothing Accessories, and Fur Products (code: 14, obs.: 2,527), (2) Manufacture of Leather, Luggage, and Footwear (code: 15, obs.: 628), (3) Printing and Reproduction of Recorded Media (code: 18, obs.: 978), (4) Manufacture of Coke, Refined Petroleum Products, and Nuclear Fuel (code: 19, obs.: 176), (5) Manufacture of Non-metallic Mineral Products (code: 23, obs.: 2,721), (6) Manufacture of Other Products (code: 33, obs.: 840), and (7) Repair of Industrial Machinery and Equipment (code: 34, obs.: 39)

IV. Conclusion

In conclusion, this study has shed light on the intricate relationship between OFDI by Korean manufacturing firms and the servicification of their domestic employment. The empirical analysis, conducted using the firm-level panel data and employing the firm-fixed effects model, has provided valuable insights.

The primary findings of this study illuminate a compelling connection between the extensive OFDI by Korean manufacturing firms and the augmentation of core service employment within their home country. This implies that these firms, mirroring the strategies of MNEs in advanced economies, are actively reshaping their domestic employment structures by strengthening their high value-added service functions. Interestingly, no significant correlation emerged between the extensive OFDI and non-core service employment, which is anticipated to yield relatively lower value-added.

Further stratifying the analysis by host countries and subsidiary types revealed nuances in the relationship. Notably, when Korean manufacturing firms established manufacturing subsidiaries in the US, a positive correlation with the share of core service workers in Korea was observed. Conversely, when these firms expanded their manufacturing operations in other countries, particularly emerging economies in Asia, the share of core service employment in Korea exhibited a negative correlation. This suggests that the impact of OFDI on servicification is contingent on factors such as host country’s technological capabilities and participation in GVCs.

Considering these findings, OFDI may play a pivotal role in shaping the employment landscape of Korean manufacturing firms. Nevertheless, this impact varies depending on the nature of the investment, host countries, and subsidiary types. These results provide empirical grounding for policymakers and business leaders seeking to understand and navigate the dynamics of servicification in the context of Korean manufacturing firms.

This study adds valuable insights to the ongoing discourse surrounding servicification within emerging economies, emphasizing the necessity for nuanced approaches in tackling the challenges and opportunities it presents. However, it is important to acknowledge that due to dataset limitations, we were unable to precisely distinguish between various job roles.17 Furthermore, while we categorized services into core and non-core according to the categories provided by the SBA, it should be noted that what may be considered a core service in one company could be a non-core service in another due to individual company characteristics.18 Additionally, as times change, roles that were once auxiliary could potentially transform into core service roles. Having access to information regarding the employment composition of overseas subsidiaries could have strengthened our empirical evidence. Regrettably, due to data constraints, this aspect remained unexplored. Future research endeavors can delve deeper into the underlying mechanisms governing these relationships and examine their implications for overall economic productivity and competitiveness.

17)For instance, some non-core service employees such as within research institutes might fall into the category of core service workers.

18)In this regard, the policy implications of this paper should be carefully considered, and further research with a more detailed dataset or developed methodology is suggested.

Tables & Figures

Figure 1.

Employment and Value-Added Share of Service Sector

Source: Author’s calculation based on OECD Stat (accessed on March 13, 2023).

Table 1.

Descriptive Statistics

Notes: The above statistics show value of manufacturing firm (code: C) in the SBA. Extensive OFDI is defined as the number of foreign subsidiaries for individual firms. The EFDI variables are further disaggregated by country (China, the US, and Others), and subsidiary type (Manufacturing, Service). Intensive OFDI is defined as the real investment amount per foreign subsidiary.

Source: The Survey of Business Activities 2006-2016.

Table 2.

Estimation Results from Firm-Fixed Effects Model

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors.

Table 3.

Robustness Check: One-Step Difference GMM

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are heteroskedasticity and autocorrelation robust standard errors.

Table 4.

Robustness Check: Industry Classification by R&D Intensity

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors. Based on the 2016 Survey of Research and Development in Korea,

Table 5.

Robustness Check: Proportion of Manufacturing Workers

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors. We redefined the dependent variable as the share of manufacturing-related workers to total regular workers and employed the firm-fixed effects model in this estimation.

Table 6.

Robustness Check: Time Lag Analysis

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors. We employed the firm-fixed effects model in this estimation.

Table 7.

Robustness Check: Extended Sample Period

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors. 7 double-digit industry codes (7,909 observations) that were either added or modified during the 9th to 10th revision of the KSIC were excluded from the dataset 2006-2020. The excluded codes are (1) Manufacture of Clothing, Clothing Accessories, and Fur Products (code: 14, obs.: 2,527), (2) Manufacture of Leather, Luggage, and Footwear (code: 15, obs.: 628), (3) Printing and Reproduction of Recorded Media (code: 18, obs.: 978), (4) Manufacture of Coke, Refined Petroleum Products, and Nuclear Fuel (code: 19, obs.: 176), (5) Manufacture of Non-metallic Mineral Products (code: 23, obs.: 2,721), (6) Manufacture of Other Products (code: 33, obs.: 840), and (7) Repair of Industrial Machinery and Equipment (code: 34, obs.: 39). The firm-fixed effects model was employed in this estimation.

Table 8.

Robustness Check: Difference Variables for Long-term Trends

Notes: ***p<0.01, **p<0.05, *p<0.1. The numbers in parentheses are firm-clustered standard errors. We transformed the dependent variables and OFDI variables into difference variables with a 5-year interval to examine long-term changes within the panel, employing the firm-fixed effects model in this estimation.

APPENDIX

1. Impact of Service Employment on Income and Firm Performance

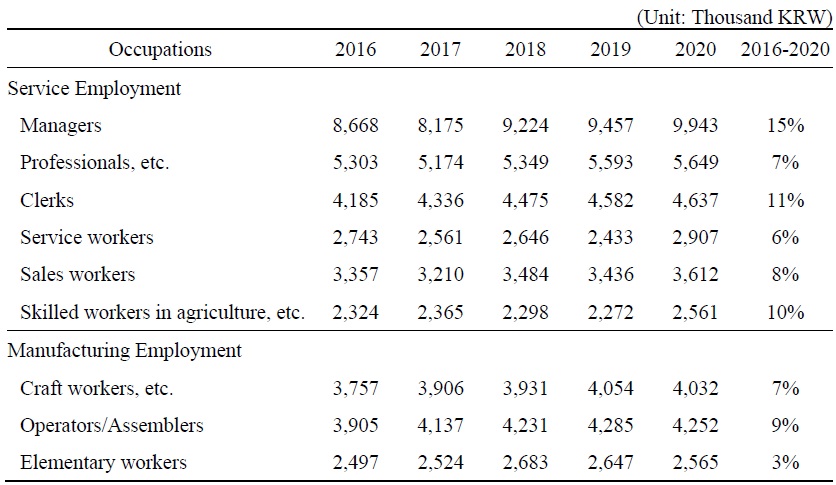

Real wages per capita in the Korean manufacturing industry by occupation are shown in Table A1. During the investigation period from 2016 to 2020, service-related employees such as managerial, professional, and clerical workers received relatively higher levels of real wages compared to manufacturing workers like equipment/machine operators and assemblers. Additionally, the growth rate of real wages for service employment was primarily higher than that for manufacturing employment. This suggests that increasing the number of service workers within manufacturing firms could potentially improve overall average income levels for all employees within these companies.

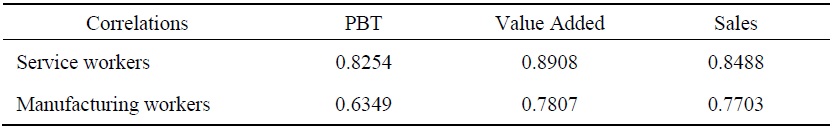

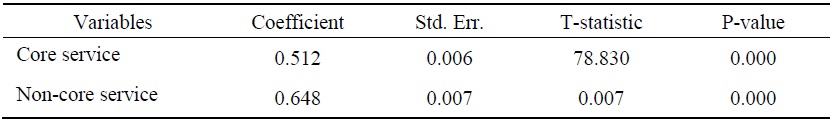

Table A2 presents the results of a correlation analysis between the number of service or manufacturing workers and firm performance indicators such as profit before tax (PBT), value-added, and sales revenue. The number of service workers demonstrates higher correlations with all aspects of these performance indicators. The largest difference in correlations is observed with respect to PBT, suggesting that service workers may contribute significantly not only to primary sales-generating activities within manufacturing companies but also to non-operating profits from sources like patents or indirect investments.

2. Korean Service Sector Productivity: Core vs Non-core Services

Figure 1 represents the share of employment and value-added in the service sector of major countries, using data from the OECD. According to the data, the employment shares of Korea’s service sector experienced a significant increase from 49% in 1991 to 70% in 2016. However, since the mid-1990s, Korea’s value-added share in service sector has been converging at around 60%. Although these proportions vary by country characteristics, both shares are generally moving in similar directions with Korea being an exception. In 2016, the gap between employment and value-added shares was 7 percentage points for Korea but only around 4-5 percentage points for Japan and the US. Particularly in Korea, this gap is increasing which implies lower productivity within its service sector.

While this data reflects the entire service sector and there may be differences with respect to service input into manufacturing industries, it is important to note that bringing such a low-productivity service sector into manufacturing (servicification) could potentially hinder growth.

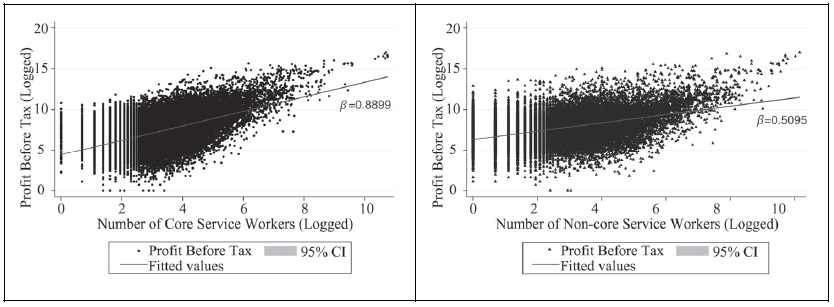

For these reasons, this study distinguishes service employment between the core services, where high value-added creation is expected, and non-core services, where relatively low value-added creation is anticipated. Figure A1 presents scatter plots of the log values of the number of core service workers and non-core service workers we defined against the log values of PBT, using data from the SBA for 2006-2016. When examining the coefficients of linear fitted values represented in each scatter plot, we found that core services have a coefficient value of 0.8899 and non-core services have a coefficient value of 0.5095. This indicates that the number of core-service workers has a stronger positive correlation with PBT than does the number of non-core service workers.

3. Model Selection on Generalized Method of Moments (GMM) Estimation

When explanatory variables include a lagged dependent variable, even after within transformation, there exists an endogeneity problem as explanatory variables are still correlated with the within-transformed error term. In such cases, estimation should be carried out using appropriate instrumental variables. Arellano and Bond (1991) proposed the difference GMM, which efficiently utilizes instrumental variables through the moment function. However, when the coefficient of AR(1) is close to 1, the difference GMM may suffer from a weak instrument problem (Han, 2021). To address this, Arellano and Bover (1995) and Blundell and Bond (1998) proposed the system GMM. System GMM utilizes the level variables of lagged dependent variables and lagged values of differenced dependent variables as instrumental variables. It assumes that once the dependent variable reaches mean stationarity, its level depends on

In this study, the AR(1) coefficients for the dependent variables

In many cases where GMM is employed, two-step GMM is often used more than one-step to enhance efficiency (Hwang and Sun, 2018). This is because when the error term is not independent and identically distributed, i.e., when the sample is not randomly drawn, the estimators from one-step GMM are consistent but not efficient (Han, 2021). Two-step GMM uses a weighting matrix to improve efficiency over one-step GMM estimators. However, Hwang and Sun (2018) caution against estimation uncertainty in the nonparametrically estimated time-series setting. In other words, using two-step GMM should be considered over one-step GMM only when the benefits clearly outweigh the costs (Hwang and Sun, 2018).

The SBA used in this study covers all firms with 50 or more employees or a capital of 300 million KRW or more in Korea, accounting for approximately 82% of the total value-added in the Korean manufacturing industry as of 2009 (Son and Hur, 2017). Therefore, there is no clear evidence to suggest that the error term is not independently and identically distributed. Hence, we adopted the one-step difference GMM and checked the robustness of the model.

Appendix Tables & Figures

Table A1.

Real Wages by Occupations in Korean Manufacturing Companies

Notes: The figures represent the sum of monthly salary (including overtime pay) of June of each year and special bonus (year-end bonus) divided by 12. The figures are realized using the Producer Price Index of the Bank of Korea.

Source: Author’s calculation based on the Survey Report on Labor Conditions by Employment Type 2016-2020.

Table A2.

Correlations between Occupational Groups and Firm Performances

Source: Author’s calculation based on the SBA 2006-2016.

Figure A1.

Scatter Plots of Occupational Groups and Profit Before Tax

Source: Author’s calculation based on the SBA 2006-2016.

Table A3.

AR(1) Model Results

Note: Firm-clustered standard errors were used.

References

-

Antras, P. and E. Helpman. 2004. “Global Sourcing.”

Journal of Political Economy , vol. 112, no. 3, pp. 552-580.

-

Arellano, M. and O. Bover. 1995. “Another Look at the Instrumental Variable Estimation of Error-components Models.”

Journal of Econometrics , vol. 68, no. 1, pp. 29-51.

-

Arellano, M. and S. Bond. 1991. “Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Employment Equations.”

Review of Economic Studies , vol. 58, no. 2, pp. 277-297.

-

Autor, D. H., Levy, F. and R. J. Murnane. 2003. “The Skill Content of Recent Technological Change.”

Quarterly Journal of Economics , vol. 118, no. 4, pp. 1279-1333.

-

Blinder, A. S. 2009. “How Many US Jobs Might be Offshorable?”

World Economics , vol. 10, no. 2, pp. 41-78.https://www.world-economics-journal.com/Papers/How-Many-USJobs-Might-be-Offshorable.aspx?ID=376 -

Blinder, A. S. and A. B. Krueger. 2013. “Alternative Measures of Offshorability: A Survey Approach.”

Journal of Labor Economics , vol. 31, no. 2, pp. S97-S128.

-

Blundell, R. and S. Bond. 1998. “Initial Conditions and Moment Restrictions in Dynamic Panel Data Models.”

Journal of Econometrics , vol. 87, no. 1, pp. 115-143.

-

Bronzini, R. 2015. “The Effects of Extensive and Intensive Margins of FDI on Domestic Employment: Microeconomic Evidence from Italy.”

B.E. Journal of Economic Analysis & Policy , vol. 15, no. 4, pp. 2079-2109.

- Choi, M. S. and H. D. Lee. 2022. “A Study on the Effects of Multinational Production on Global and Domestic Value Chains Following Trade Restructuring and Corresponding International Economic Policies.” KIEP Working Paper, no. 22-02. Korea Institute for International Economic Policy.

-

Chun, H., Hur, J. and N. S. Son. 2020. “Hollowing Out or Filling In? The Effects of Multinational Enterprises on Domestic Plant Turnover and Job Growth in Factory Asia.”

Korean Economic Review , vol. 36, no. 2, pp. 285-317. -

Chun, H., Hur, J. and N. S. Son. 2021. “Global Value Chains and Servicification of Manufacturing: Evidence from Firm-level Data.”

Japan and the World Economy , vol. 58, pp. 1-10. -

Crozet, M. and E. Milet. 2017. “Should Everybody be in Services? The Effect of Servitization on Manufacturing Firm Performance.”

Journal of Economics & Management Strategy , vol. 26, no. 4, pp. 820-841. -

Eun, S. 2015. “A Comparative Study on the Effect of Education and Social Policies on Fertility Rates: Using System-GMM Estimation on 26 OECD Countries for 18 Year Panel Data.”

Health and Social Welfare Review , vol. 35, no. 2, pp. 5-31. (in Korean)

-

Francois, J. and K. A. Reinert. 1996. “The Role of Services in the Structure of Production and Trade: Stylized Facts from a Cross-country Analysis.”

Asia-Pacific Economic Review , vol. 2, no. 1, pp. 35-43. -

Grossman, G. and E. Rossi-Hansberg. 2008. “Trading Tasks: A Simple Theory of Offshoring.”

American Economic Review , vol. 98, no. 5, pp. 1978-1997.

-

Han, C. 2021.

Lectures on Panel Data Analysis . Pak-Young-Sa. (in Korean) -

Harrison, A. and M. McMillan. 2011. “Offshoring Jobs? Multinationals and US Manufacturing Employment.”

Review of Economics and Statistics , vol. 93, no. 3, pp. 857-875.

-

Hong, J. 2009. “Home Country Effect of Foreign Direct Investment: Evidence from Korean Electronic and Automobile Industry.”

Journal of Korean Economy Studies , vol. 27, pp. 69-95.http://www.akes.or.kr/wp-content/uploads/2018/03/3.hjp_.pdf (in Korean) -

Hur, J., Yoon, H. and T. Ahn. 2019. “Occupational Composition Within Multinational Firms: Evidence from Korean Employer-Employee Matched Data.”

Global Economic Review , vol. 48, no. 2, pp. 144-160.

-

Hur, J. and J. Y. Yoon. 2022. “Multinational Factoryless Goods Producers and Expansion of the Wholesale & Retail Industry in Korea.”

International Economic Journal , vol. 36, no. 4, pp. 461-476.

-

Hwang, J. and Y. Sun. 2018. “Should We Go One Step Further? An Accurate Comparison of One-step and Two-step Procedures in a Generalized Method of Moments Framework.”

Journal of Econometrics , vol. 207, no. 2, pp. 381-405.

- Hyun, H., Jang, Y., Kang, J., Kim, H. and C. Park. 2010. “Korean MNEs and Domestic Economic Activity.” KIEP Policy Analysis, no. 10-02. Korea Institute for International Economic Policy. (in Korean)

-

Jang, Y. and H. Hyun. 2012. “Industry Specificity, Outward FDI and Employment: Evidence from Korea.”

Journal of Korean Economy Studies , vol. 30, no. 1, pp. 99-119.http://www.akes.or.kr/wp-content/uploads/2018/03/4.장용준현혜정.pdf (in Korean) -

Jensen, J. B., Kletzer, L. G., Bernstein, J. and R. C. Feenstra. 2005. “Tradable Services: Understanding the Scope and Impact of Services Offshoring.”

Brookings Trade Forum , vol. 2005, pp. 75-116.

-

Joe, D., Moon, S. and Y. J. Yoon. 2023. “Analysis of Firms’ Reactions to the US Government’s Supply Chain Reorganization Policies.” KIEP Policy Analyses, no. 23-03.

https://www.kiep.go.kr/gallery.es?mid=a10101010000&bid=0001 (in Korean) -

Jun, H., Lee, Y. H., Yun, J. and J. Hur. 2020. “Spillover Effects of Multinational Factoryless Goods Producers in Wholesale and Retail Industries: An Empirical Analysis using a Spatial Regression Model.”

Korean Journal of Industrial Organization , vol. 28, no. 4, pp. 63-93.https://doi.org/ 10.36354/KJIO.28.4.2 (in Korean)

-

Jung, J. W. and H. Kim. 2022. “Servitization and Manufacturing Firms’ Performance: Korean Firm-Level Data Evidence.”

East Asian Economic Review , vol. 26, no. 4, pp. 257-277.https://dx.doi.org/10.11644/KIEP.EAER.2022.26.4.413

-

Kang, H., Kim, H. J. and S. Park. 2010. “Foreign Direct Investment and Domestic Production and Employment: The Case of Korea’s IT Industry.”

Journal of International Trade and Industry Studies , vol. 15, no. 2, pp. 95-117. (in Korean) -

Kwon, S. 2022. “The Effect of Overseas Direct Investment on Employment.”

Journal of Eurasian Studies , vol. 19, no. 2. pp. 1-29.https://doi.org/10.31203/aepa.2022.19.2.001 (in Korean) -

Lee, S. 2012. “An analysis on Causal Relationship between Employment and Productivity in Service Sector.”

Journal of Social Science , vol. 38, no. 2, pp. 153-176.http://riss.khu.ac.kr/contents/bbs/bbs_content.html?bbs_cls_cd=002001&cid=12091114485136&bbs_type=B (in Korean)

-

Lee, S. 2023. “What Determines In-house Service Activities within Manufacturing Firms: Firm-level Evidence from Korea.”

Korean Economic Review , vol. 39, no. 2, pp. 445-468. -

Lee, S. and Y. Choi. 2020. “Tertiarization of the Economy and its Trade Policy Implications.” KIEP Long-term Trade Strategies Study Series, no. 20-02.

https://www.kiep.go.kr/gallery.es?mid=a20305000000&bid=0001&tag=&b_list=10&act=view&list_no=9437&nPage=5&vlist_no_npage=0&keyField=&keyWord=&orderby=&act=view&list_no=9437&cg_code= (in Korean) - Matsuura, T. 2015. “Impact of Extensive and Intensive Margins of FDI on Corporate Domestic Performance: Evidence from Japanese automobile parts suppliers.” RIETI Discussion Paper Series, no. 15-E-032. Research Institute of Economy, Trade and Industry.

-

Miroudot, S. and C. Cadestin. 2017. “Services in global value chains: From inputs to valuecreating activities.” OECD Trade Policy Papers, no. 197.

https://doi.org/10.1787/465f0d8b-en -

Morikawa, M. 2016. “Factoryless Goods Producers in Japan.”

Japan and the World Economy , vol. 40, pp. 9-15.

- Son, N. S., Cho, J. and J. Hur. 2023. “Building Bridges to Digital Transformation: The Role of Foreign Service Affiliates in Fostering Advanced Digital Technology.” Working paper.

-

Son, N. S. and J. Hur. 2017. “Empirical Analysis of the Relationship between Inward and Outward Foreign Direct Investment of Manufacturing Firms.”

Korean Journal of Economic Studies , vol. 65, no. 2. pp. 137-169. (in Korean)