- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|---|

| 1 | Income Inequality and External Wealth of Nations / 2024 / Journal of Globalization and Development / vol.15, no.1, pp.47 / |

| 2 | Financial Literacy, Fintech, and Risky Financial Investment in Urban Households—An Analysis Based on CHFS Data / 2024 / Mathematics / vol.12, no.21, pp.3393 / |

Article View

East Asian Economic Review Vol. 25, No. 2, 2021. pp. 175-203.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2021.25.2.395

Number of citation : 2Financial Market Integration and Income Inequality

|

Graduate School of International Studies, Sogang University |

|

|

School of Economics, Hongik University |

Abstract

Over the past decades, financial markets have been integrated across countries while income inequality has increased in most countries. This paper studies the effect of financial market integration on income inequality and investigates whether this effect varies with the degree of financial market development. We find empirical evidence that financial market integration and financial market development interact to change income inequality. Specifically, the effect of financial market integration on income inequality is nonlinear, and the degree of financial market development plays an important role. Opening financial markets worsens income inequality in the countries holding the underdeveloped state of financial markets, however, the effect of capital account openness on income inequality is statistically insignificant in the countries with developed financial markets.

JEL Classification: F36, D63, O11

Keywords

Financial Market Development, Financial Market Integration, Income Inequality

I. Introduction

Over the past decades, financial markets have become integrated across countries. Benefits of financial market integration include cheaper and alternative options of saving and borrowing for households and entrepreneurs. In the global financial market, asset choices for households widen so that individuals can manage their idiosyncratic income risk more effectively. On the other hand, financial market integration makes investors who hold foreign assets more vulnerable to global financial shocks. In the global financial crisis of 2007-2008, financial market distress which initially arose in the U.S. had an enormous impact on the peripheral countries. This example shows that the strong shock propagation occurs via the integrated financial markets.

The existing literature shows that financial market integration has a sizable impact not only on business cycles in the short run but also on economic growth in the long run. However, there has been little attention on income distribution, specifically related to financial market integration. In this paper, we fill the void in the literature by focusing on the following two stylized facts: income inequality has been exacerbated in most countries over the past two decades, and the financial market has been integrated across countries during the same period.1 In particular, we answer two research questions to investigate the relationship between the two facts. First, how does financial market integration affect income inequality? Second, how do financial market integration and financial market development interact to change income inequality?

Why does financial market development matter to understand the effect of financial market integration on economic systems? Since interest rates in developing countries are mostly higher than the interest rate of the international bond market, financial market integration of emerging countries into the global financial market is considered as lowering an interest rate due to more accessible credit. In this sense, financial market openness would work similarly to domestic financial market development affects economies. Also, financial market integration introduces more diverse financial securities to households that can deal with so that the financial market would become more complete. Households have more buffer to idiosyncratic income shock in the more complete financial market so that income inequality can be improved.

Nevertheless, there is a controversy in empirical studies on the relationship between financial market integration and income inequality, specifically, it is about whether the financial market integration and development have the same effect on economic systems and the distribution of income in the systems. Some empirical studies show that financial globalization is associated with an increase in income inequality while others find counter-evidence. At least, it is hard to tell that the effect of financial globalization on income inequality is linear.

How the effect of financial market integration on income inequality can be different from that of financial market development on income inequality? First, even the effect of financial market development on inequality is unclear due to different mechanisms of operating across borrowers and lenders. Following Demirgüç-Kunt and Levine (2009), separating margins of financial market development is useful to understand the different mechanisms. The intensive margin of financial market development rises because cheaper credit becomes available for people who have already participated in the financial market. Inequality gets worsen because of the intensive margin effect. On the other hand, financial market development allows newly available financial services for borrowers or lenders who have been excluded from the financial market. The extensive margin effect enhances inequality.

Financial market openness also works on the extensive and intensive margins. As conventional economic theory suggests, cheaper and more credit from the international market can enrich potential market participants who have not been employing financial services with new access to financial markets. When financial market participation structure is conservative, financial market integration allows households and firms that have already employed financial services to have diverse sources of insuring risks, while others who were not benefited from the financial market face further income risks without hedging tools. In addition, even among domestic market participants, participation in foreign markets varies because of entry barriers such as information costs of international investment.2 In this case when the intensive margin effect overwhelms the extensive margin benefit of financial market integration, income inequality is likely to worsen.

We test hypotheses that the effect of financial market openness on inequality is conditional on the level of domestic financial market development when the financial market opens, and the overall effect of financial market integration on income inequality is nonlinear. Financial market integration creates the intensive and extensive margins of credit supply which may depend on the development level of financial markets disproportionally.3 This paper finds novel empirical evidence that financial market integration and financial market development interact to change income inequality. Specifically, the effect of financial market integration on income inequality is nonlinear and depends on financial market development. Opening financial markets worsens income inequality in the countries holding the underdeveloped state of financial markets, however, the effect of capital account openness on income inequality is statistically insignificant in the countries with developed financial markets.

The idea behind the hypotheses is that financial market openness does not guarantee more abundant credit in domestic credit markets. In general, capital inflow from foreign markets to domestic markets takes place. Capital outflow also occurs especially when domestic agents prefer foreign assets to domestic assets for some reasons. As domestic financial markets become more developed and deeper, capital inflow tends to be larger while capital outflow tends to be smaller. Net capital inflow can be negative when domestic financial markets are underdeveloped so it tends to exclude current participants in credit markets and the cost of funds can rise even with integrated financial markets. The effect may be more severe to marginal participants in financial markets.

This point echoes Broner and Ventura (2016) that shed light on the importance of domestic financial market depth in the globalization period. In their model, the probability of “capital flight” from domestic markets depends on domestic financial depth. They argue that “Globalization not only adds new foreign sources of financing that are cheap but risky, also subtracts domestic source of financing that were expensive but safe.” That happens because financial market integration occurs twoways: opening to not only foreign investors but also domestic investors. Since the preference over risks is different between domestic and foreign investors, opening financial markets may result in net capital inflow or net capital outflow depending on domestic financial market quality and development level. In this setting, large domestic saving or financial market depth fosters foreign capital inflows. Broner and Ventura (2016) emphasize that financial market openness actually benefits emerging economies only if the countries hold relatively better institutions, more developed domestic financial markets, and high initial income per capita.4

The structure of the rest of this paper is as follows. The next section surveys the related literature. In Section III, we conduct an empirical study to find a relationship between inequality and financial market openness and perform robustness check tests to rebut possible claims on empirical specification. Section IV concludes.

1)

2)Several studies found evidence of “home-bias” in the international investment decision.

3)See

4)

II. Related Literature

The relationship between inequality and economic growth is one of the oldest economic research questions in economic history but it still attracts the attention of economists. Kuznets (1955 and 1963) pioneers the research on this uncovered question with economic data. Recently, Lundberg and Squire (2003) investigate the relationship between inequality and economic growth and find fundamental variables that influence both inequality and growth simultaneously.

The relationship between globalization and inequality has been recently highlighted in the economic literature as the world economy has been more integrated. Most literature that studies the effect of globalization on inequality focuses on the effect of goods market openness, i.e., international trade on inequality. There is a long line of literature studying the relationship between trade and inequality.5 Recent research focuses on the channel of international trade affecting income across industries, occupations, and locations, as the impact of international trade on jobs has surged as one of the most controversial issues in politics over the recent decade. Davidson et al. (1999), Helpman and Itskhoki (2010), Helpman et al. (2010), and many other papers introduce search and matching friction in the labor market to traditional international trade model that assumes frictionless adjustment in factor inputs and to find a mechanism how trade changes sectoral productivity and demands for input, so that affects income distribution and unemployment.

A few recent studies examine the effect of both trade and financial openness on inequality. Jaumotte et al. (2013) find mostly insignificant effects of globalization in trade and finance on income inequality with a panel of 51 countries over a period from 1981 to 2003. They explain the insignificance comes from that trade and financial liberalization have offsetting effects: While technological progress and trade tend to decrease inequality, financial liberalization has the opposite effect, i.e., inequality worsened. Asteriou et al. (2014) also empirically find that trade openness narrows inequality, but capital account openness and stock market capitalization have widened inequality in the EU-27 countries since 1995. Kim et al. (2017) survey the literature on inequality and globalization and use country-level panel data to show trade liberalization improves income distribution in South Korea while capital liberalization increases income share of top percentile so that inequality has deteriorated.

Recent studies on the relationship between financial market integration and inequality consider complicated relationships between financial market integration, financial market development, and income inequality together. Abiad et al. (2008) empirically find financial liberalization strengthens the efficiency of allocation in a financial market, more than financial market deepening so that inequality narrows as financial markets open. A few recent papers discover similar nonlinear relationships between financial market integration, financial market development, and income inequality to the current study, but with different structures and measures. de Haan and Sturm (2017) find that financial liberalization increases income inequality depending on the level of financial development and the banking crisis measure. Furceri and Loungani (2018) empirically show a positive effect of capital account liberalization on income inequality in the short and medium term especially in countries with weak financial institutions during financial crises.

Kunieda et al. (2014) and Bumann and Lensink (2016) are two of the closest studies to the current study. Kunieda et al. (2014) perform a cross-sectional analysis and a panel study with a sample of more than 120 countries since 1985 to investigate the effect of financial market development measured by the relative size of private credit to GDP on income inequality. They provide evidence that that financial market development widens income inequality if the domestic financial market is categorized as an open economy which has a sufficiently higher financial openness index, i.e., the relative size of foreign asset and liabilities to GDP, suggested by Lane and Milesi-Ferretti (2007), while income inequality is reduced as the financial market matures in a closed economy. Bumann and Lensink (2016) empirically find that capital account liberalization, measured by a

Our work differs from these two studies as follows. First, we adopt a fundamental relationship between a country’s income and inequality, called the Kuznets hypothesis and the finding of Picketty and Saez (2003) with the inverse-S curve of the relationship between GDPs per capita and income inequality. It is important because financial markets in richer countries are tended to be more developed. Omitting the country’s income variables bias the estimated effect of financial market development and financial market integration together on income inequality. We also cross-check the relationship with several different indicators of financial market integration as well as financial market development. As Kose et al. (2010) discuss, there is a debate about the advantages and disadvantages of

5)See

III. Empirical Study

The panel data used comprise 174 countries for the period 1995-2017. We examine the impact of capital account openness on income inequality and investigate whether this effect varies with the degree of financial market development.

1. Variables and Data

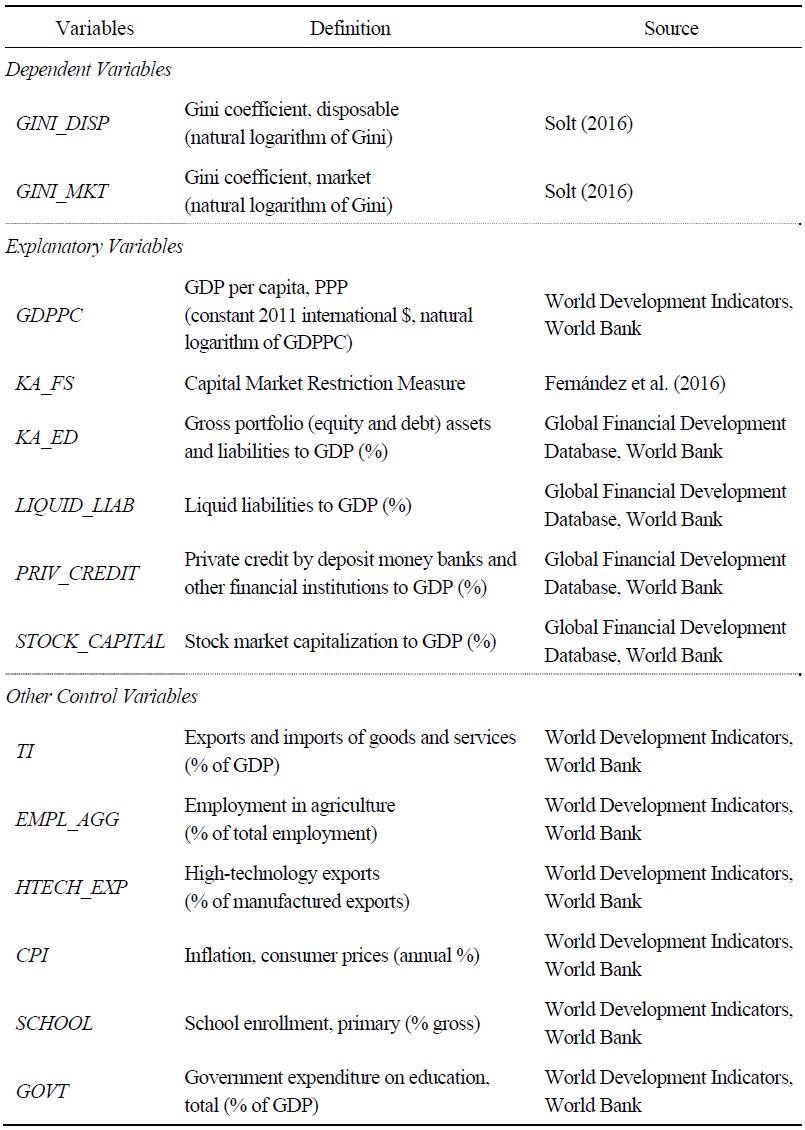

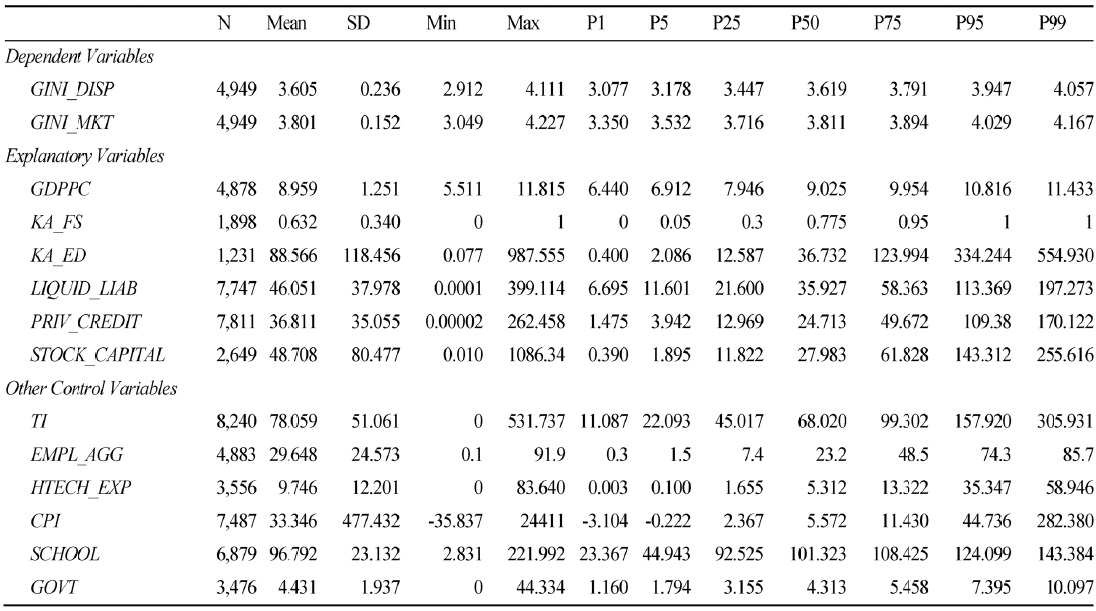

The income inequality measure used in the analysis is the Gini coefficient. We collect the Standardized World Income Inequality Database (SWIID) from Solt (2016). There are two types of Gini coefficients: market income Gini coefficient and disposable income Gini Coefficient. The Gini coefficient based on disposable income is used in our baseline empirical model, and the market income base Gini coefficient is used for a robustness test.

Main explanatory variables are capital account openness and financial development measures. We use a

Variables measuring the financial development level are liquid liabilities in the baseline model, and private credit and stock market capitalization are used in the robustness test. Those are all expressed in terms of the percentage of GDP. Other control variables that might affect income inequality are trade integration, employment in the agriculture sector, the export ratio of high technology products, CPI inflation rate, primary school enrollment, and government expenditure on education. The description and source of variables are presented in Table 1.

2. Empirical Specification

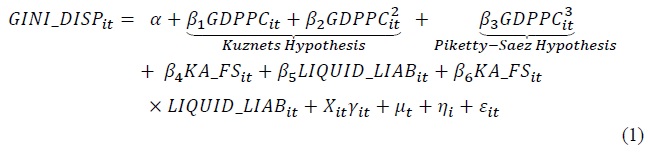

The empirical model specification is given by Equation (1). The square term of GDP per capita,  is included to test the Kuznets hypothesis. According to Kuznets (1955), the relationship between states of economic development and income inequality is nonlinear. Income inequality gets worsen at the early stages of economic development, but income inequality gets improved as an economy reaches its steady state. Kuznets hypothesis expects the inverse-U shape relationship of Gini coefficient and GDP per capita, which result in a positive estimate for

is included to test the Kuznets hypothesis. According to Kuznets (1955), the relationship between states of economic development and income inequality is nonlinear. Income inequality gets worsen at the early stages of economic development, but income inequality gets improved as an economy reaches its steady state. Kuznets hypothesis expects the inverse-U shape relationship of Gini coefficient and GDP per capita, which result in a positive estimate for

In addition to the Kuznets hypothesis, Piketty and Saez (2003) find that income inequality has worsened in most advanced countries since the 1970s. To capture the finding of Picketty and Saez (2003), we include the cubic term of GDP per capita,  as expecting to have a positive coefficient with a sufficient condition on other terms in our model specification.

as expecting to have a positive coefficient with a sufficient condition on other terms in our model specification.

The subscript

3. Main Results

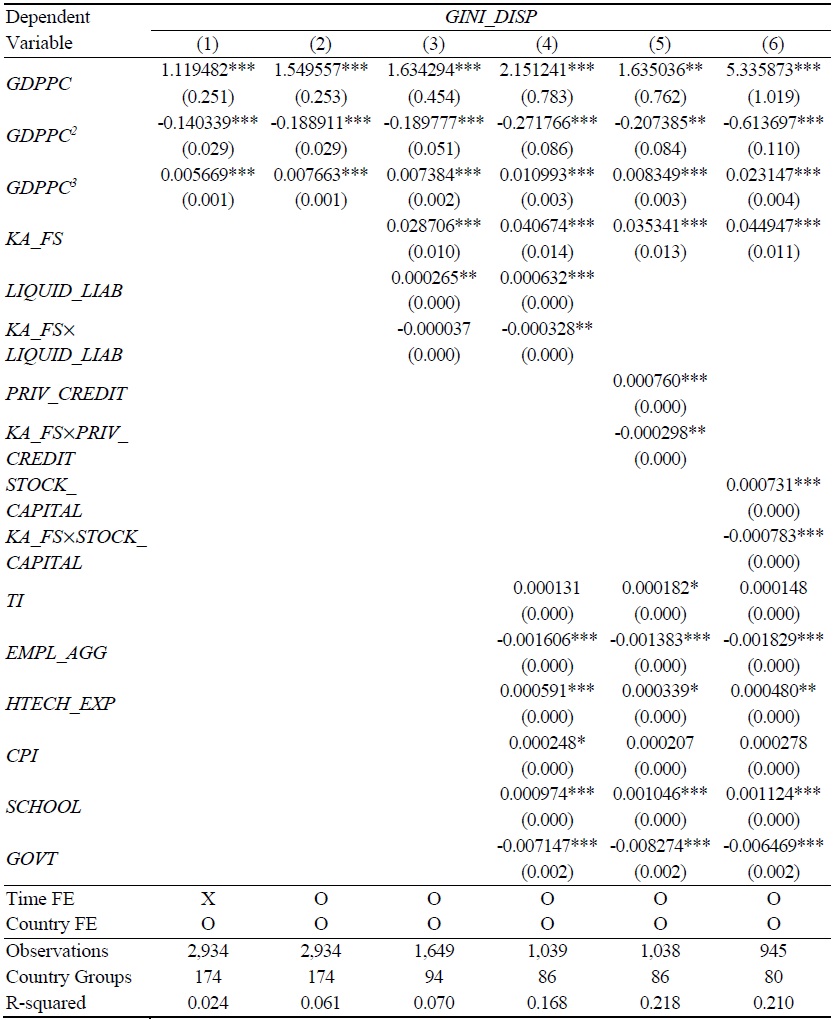

In Section III, we discuss the empirical result based on Equation (1). This empirical model includes the financial development measure (

The main empirical result based on Equation (1) is presented in Table 2. The result confirms the Kuznets hypothesis and the finding of Picketty and Saez (2003) with the inverse-S curve of the relationship between GDPs per capita and Gini coefficients. For instance, model (1) has  which has three real roots with a positive coefficient on the cubic term.6

which has three real roots with a positive coefficient on the cubic term.6

The result shows that financial development measured by

The result also shows that capital account openness is associated with increased income inequality. However, the estimated coefficient of interaction terms of financial development and capital account openness turns out to be negative. This means that the positive effect of capital account openness on income inequality is more pronounced in the countries with relatively low degrees of financial market development. This supports our research hypothesis.

Broner and Ventura (2016) may help to understand a mechanism of the relationship between financial market integration and income inequality. In their model, the probability of “capital flight” from domestic markets depends on domestic financial depth because foreign investors who are risk-loving may introduce financing sources to the domestic market while domestic investors who are more risk-averse prefer putting their savings in the foreign market. Since the preference over risks is different between domestic and foreign investors, opening financial markets may result in net capital inflow or net capital outflow depending on domestic financial market quality and development level. In this setting, large domestic saving or financial market depth fosters foreign capital inflows. The key point is that in less developed financial markets but opened to foreign markets, non-participants in domestic and international financial markets suffer more risks but are not buffered by buying financial assets. They do not enjoy the benefit of integrated markets but burden its cost. On the other hand, participants in domestic and international financial markets enjoy the benefit of financial markets integrated with foreign markets.

We can calculate a threshold point of the degree of financial market development to change the effect of financial market openness on income inequality when other things are fixed. For example, in Model (4) solving

The size of estimates seems small, which are thousands or less, but it is important to notice that the estimates are statistically significant, and most dependent variables are measure in percentages. For example, the Gini coefficient in the country with 95th percentile of Liquid Liability/GDP (=113.4%) is higher than the Gini coefficient in the country with 5th percentile of Liquid Liability/GDP (=11.6%) by 0.027, which is relatively large compared to the mean of Gini coefficient as of 3.605.

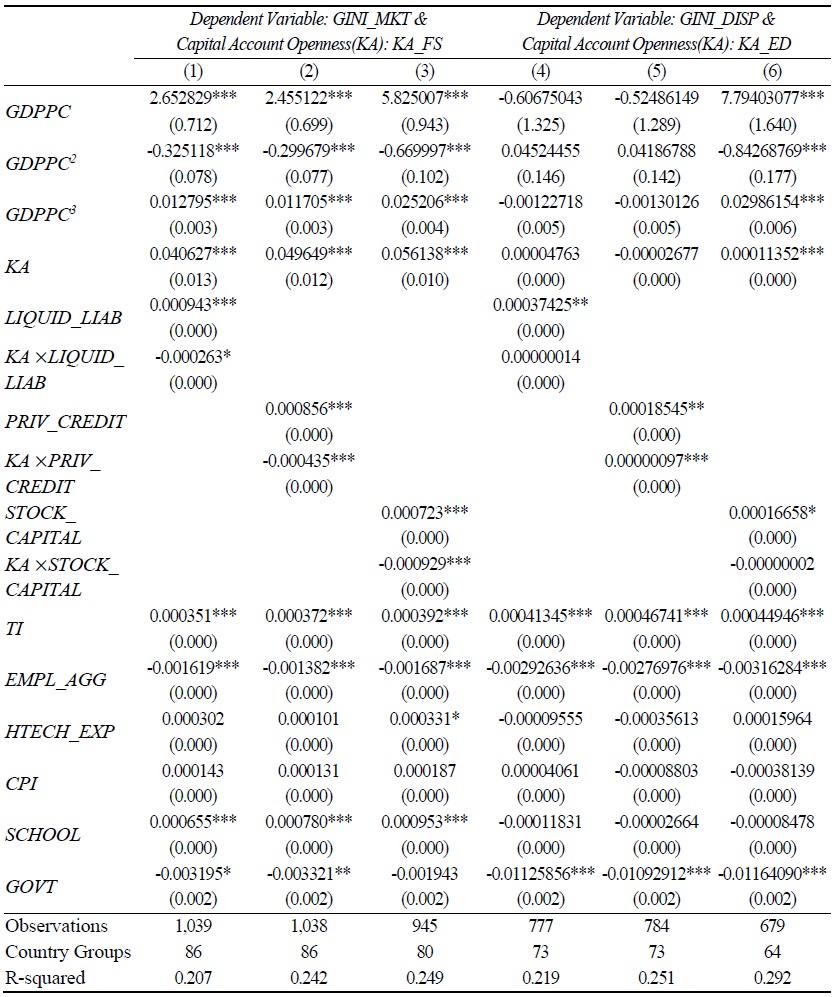

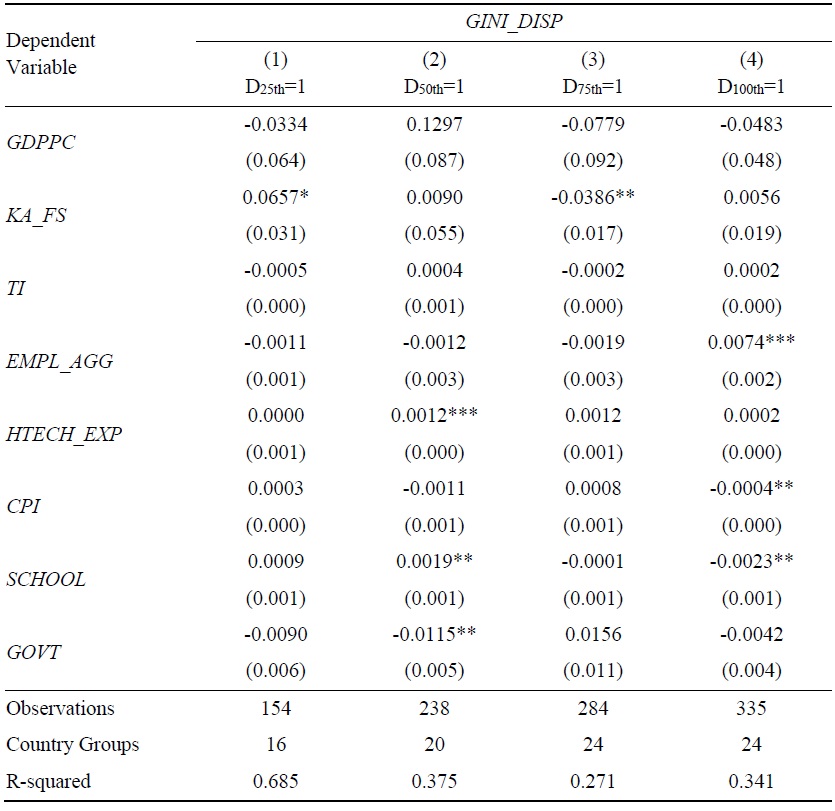

As Table 3 shows, the main result stays consistent when we use the Gini coefficient evaluated in market values (

4. Robustness Tests

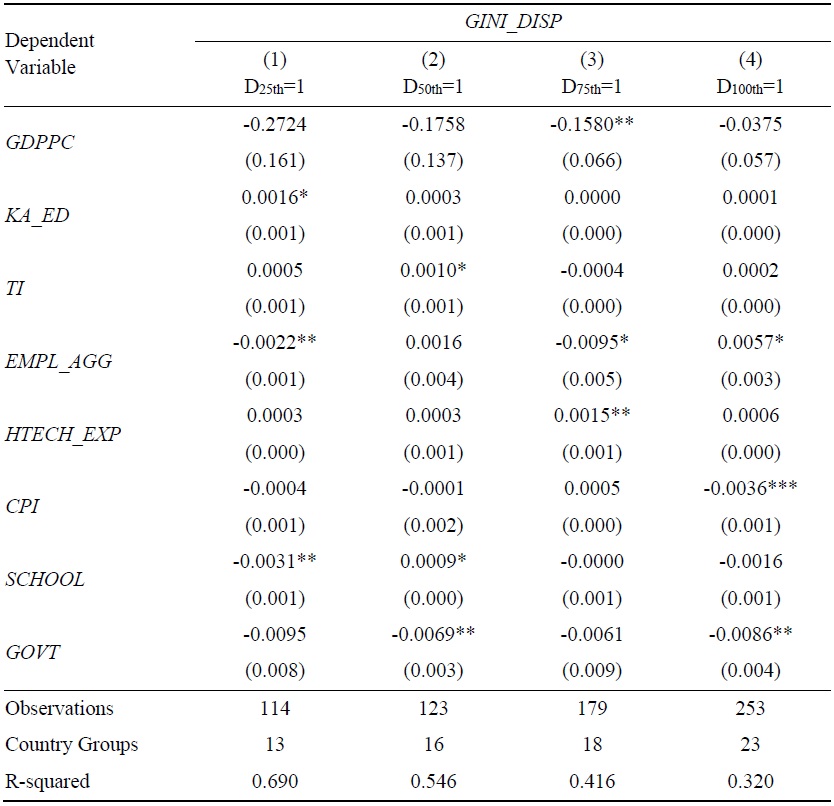

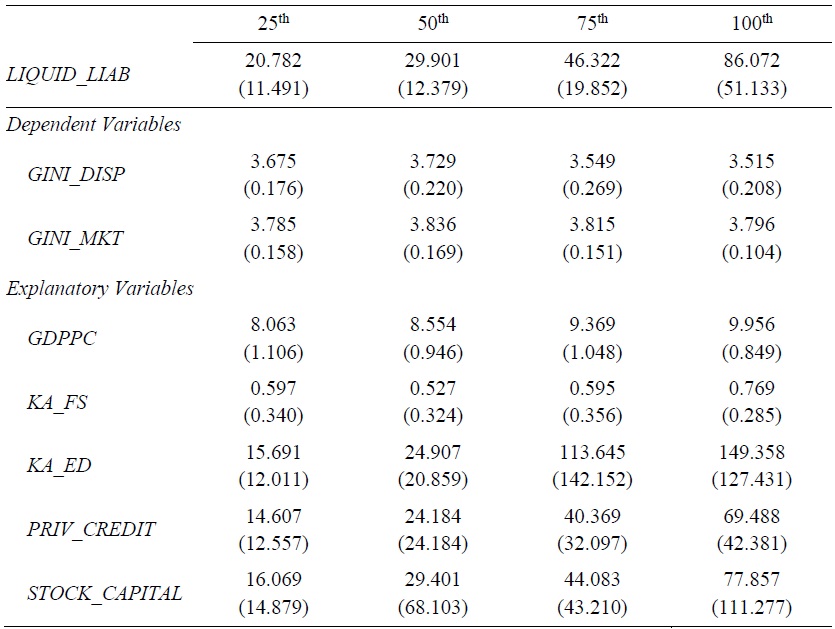

We conduct two robustness tests. First, we conduct a panel regression in which sample countries are divided into four groups by degree of financial development measured by

(1) Panel Regression by Country Group with Alternative Measures

We divide sample countries into four groups by the degree of financial development. In doing so, we use the 5-year (1990~1994) averages of

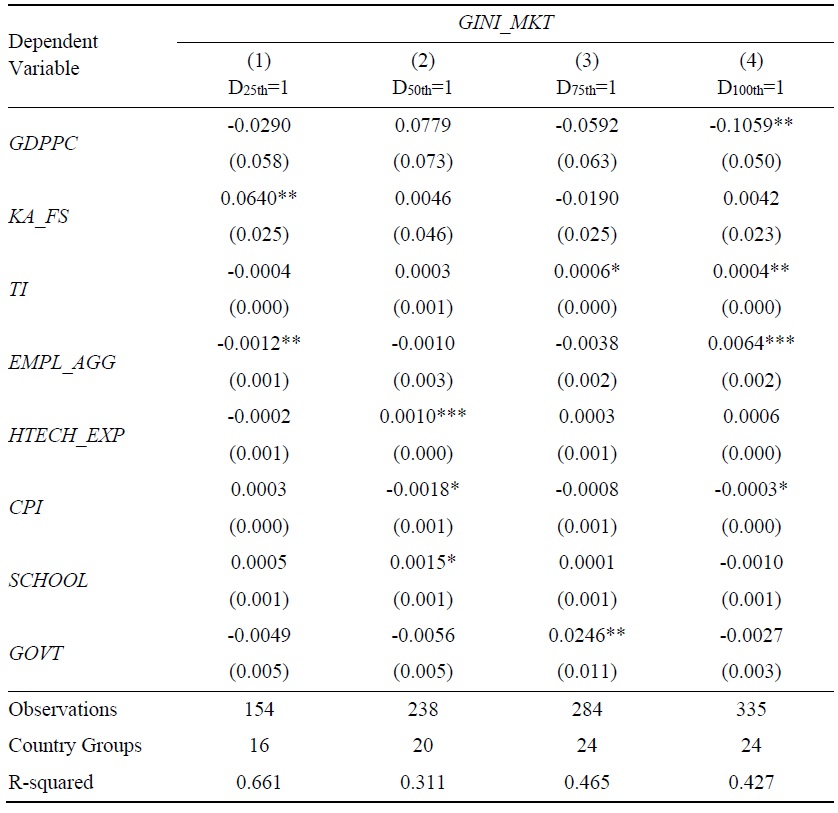

Table 4 shows that the impact of capital account openness on income inequality is positive and statistically significant only in the first quartile of the degree of financial development. In other words, opening capital markets is negatively associated with income inequality in the country group with relatively low degree of financial development. This result is consistent with the main empirical result which shows that the positive effect of capital account openness on income inequality is more pronounced in the countries with relatively low degrees of financial market development.

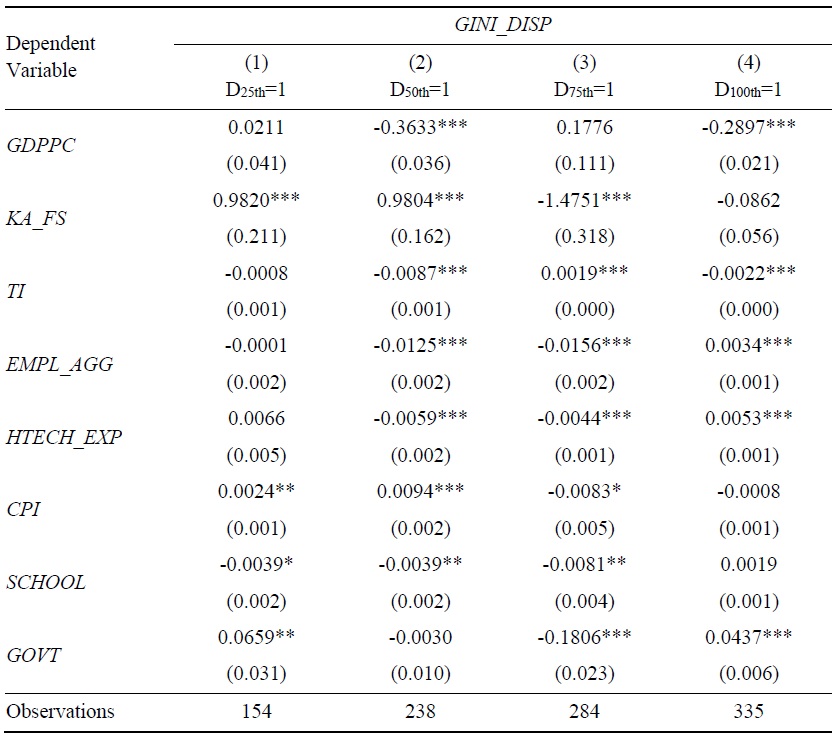

In the baseline empirical model, the Gini coefficient based on disposable income (

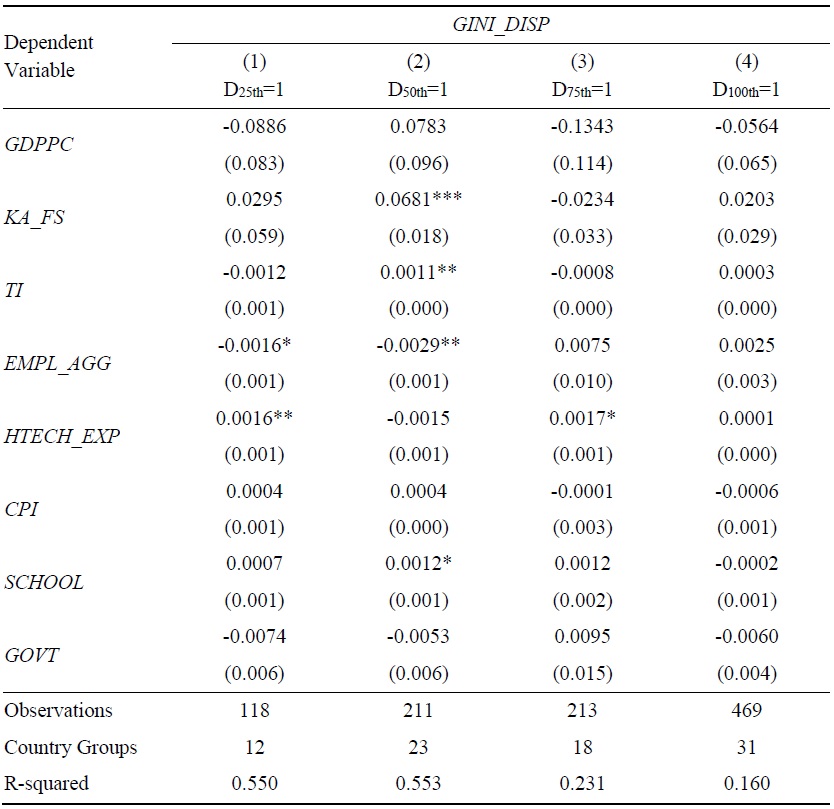

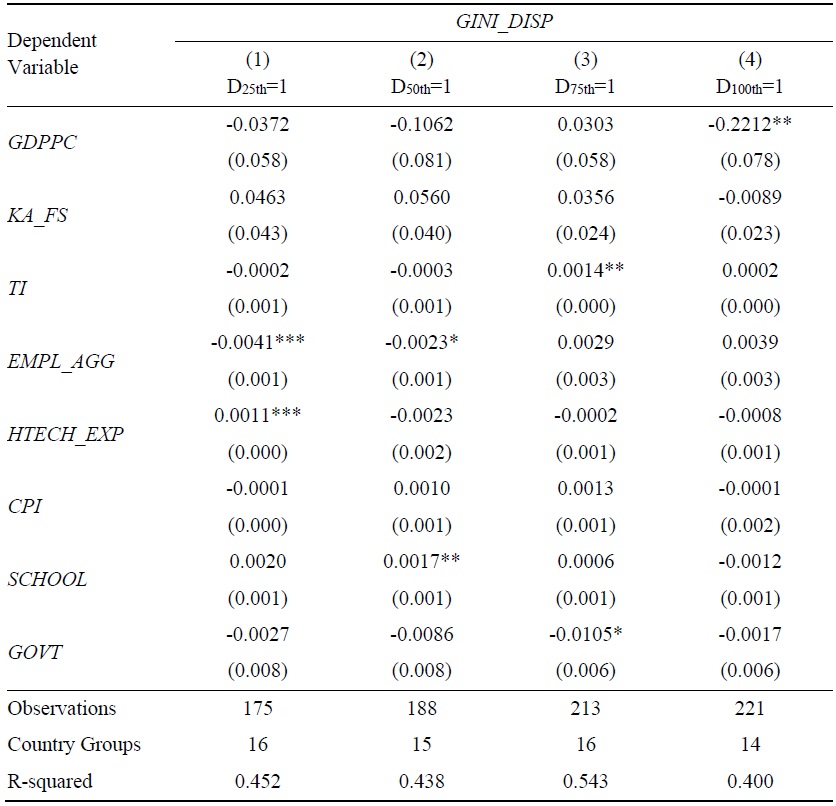

We also conduct the robustness test to check whether our main empirical results alter with different financial development measures. Those alternative measures are private credit to GDP ratio (

Additionally, we conduct the robustness test with an alternative capital account openness measure which is

(2) Alternative Model Specifications

We use instrumental variables (IVs) to address potential endogeneity problems.8 One of the concerns is the reverse causality that the dependent variable, the Gini coefficient may affect explanatory variables, in particular, capital account openness which is our main explanatory variable of interest. If there is a systemic tendency that countries with different level of Gini coefficients have greater or smaller capital account openness, estimates can be biased. To test whether the potential endogeneity issue alters the main results, we introduce IVs regression.

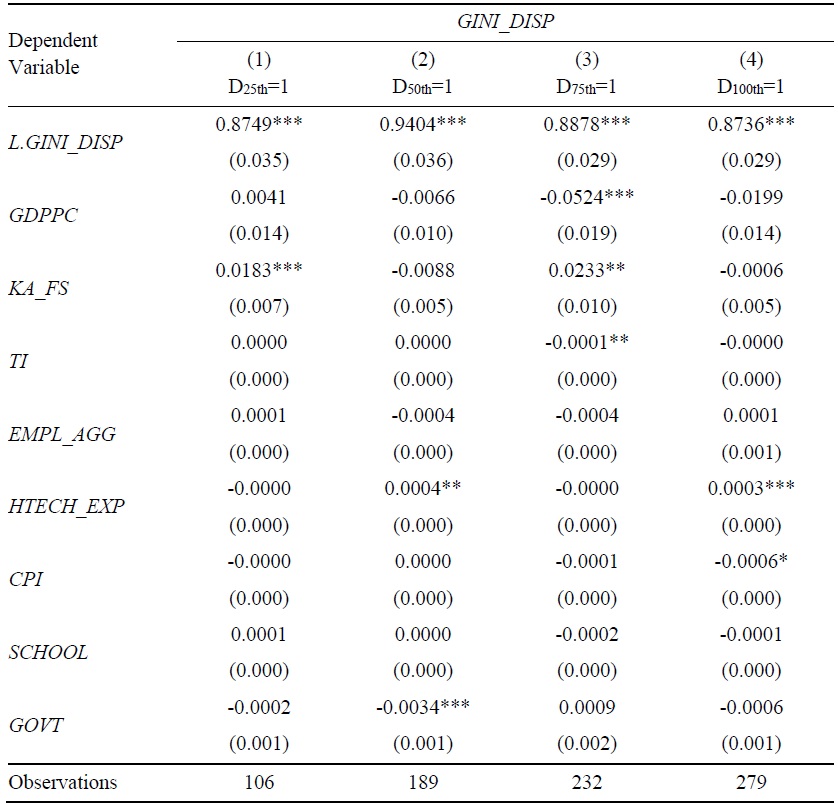

IVs used are dummy variables for legal system origin classified into English common law, French commercial code, German commercial code, Scandinavian commercial code, and socialist laws from La Porta et al. (1999). Since IVs are time-invariant country-specific characteristics, those cannot be estimated in the model with the country-fixed effects. Thus, we exclude the country-fixed effects. The IV regression result is presented in Table 9, which shows that the capital account openness worsens income inequality in the first and second quartile of country groups, which is consistent with the main result.

Lastly, we conduct the second robustness test with respect to the alternative model specification. To this end, a dynamic panel regression is taken into consideration. In the dynamic panel model, the lagged dependent variable is included in the set of explanatory variables. The result shows that opening capital markets worsens income inequality in the countries with low financial development, which is also consistent with the main result.

6)The necessary condition of the Kuznets-Picketty-Saez hypothesis is  and

and

7)In

8)A correlation between

V. Conclusions

This paper studies the effect of financial market integration on income inequality within a country that opens the financial market. We find novel empirical evidence that financial market integration and financial market development interact to change income inequality. Specifically, the effect of financial market integration on income inequality is nonlinear and depends on the financial market development level. When financial markets are underdeveloped, income inequality gets worse as financial markets open. Opening financial markets, however, may have an ambiguous effect on income inequality in countries with developed financial markets.

As discussed earlier, it is hard for the conventional economic model that considers financial market integration similar to financial market development to address the nonlinear and conditional effect of financial market openness on inequality. Heterogeneous holding of foreign assets across income and asset levels can be considered in the future theoretical study to understand a mechanism of the interaction of financial market openness and domestic market development on the distribution of income in a country.

Tables & Figures

Table 1.

Variable Definition and Data Source

Table 2.

Panel Regression with Time and Country Fixed Effects

Notes: Standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 3.

Panel Regression with Alternative Gini Coefficient and Financial Openness

Notes: Time and country fixed effects are included. Standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 4.

Panel Regression by Country Group

Notes: Year and country fixed-effects are included. Dx th denotes country group of which the financial market development measured by the liquid liabilities to GDP (%) is less than x th quantile but greater than x-25th quantile. Robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 5.

Panel Regression with Alternative Gini Coefficient

Notes: Year and country fixed-effects are included. Dx th denotes country group of which the financial market development measured by the liquid liabilities to GDP (%) is less than x th quantile but greater than (x-25)th quantile. Robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 6.

Panel Regression by Alternative Financial Development:

Notes: Year and country fixed-effects are included. Dx th denotes country group of which the financial market development measured by the private credit to GDP (%) is less than x th quantile but greater than (x-25)th quantile. Robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 7.

Panel Regression by Alternative Financial Development:

Notes: Year and country fixed-effects are included. Dx th denotes country group of which the financial market development measured by the stock market capitalization to GDP (%) is less than x th quantile but greater than (x-25)th quantile. Robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table 8.

Panel Regression by Alternative Capital Account Openness:

Notes: Two-year lagged

Table 9.

IV Regression

Notes: Year fixed-effects are included. Instrument variables are dummy variables for legal system origin, classified into English common law, French commercial code, German commercial code, Scandinavian commercial code, and socialist laws from

Table 10.

Dynamic Panel

Notes: Year and country fixed-effects are included. Dx th denotes country group of which the financial market development measured by the liquid liabilities to GDP (%) is less than x th quantile but greater than (x-25)th quantile. Robust standard errors are reported in parentheses. *, **, and *** indicate significance at the 10%, 5%, and 1% levels, respectively.

Table A1.

Summary Statistics

Table A2.

Country Group by Liquid Liability

Note: Country groups are divided into four based on average of liquid liabilities (% of GDP) in 1990 ~ 1994.

Table A3.

Averages of Variables by Quartile Country Groups

Note: Standard deviations are reported in parentheses.

References

-

Abiad, A., Oomes, N. and K. Ueda. 2008. “The Quality Effect: Does Financial Liberalization Improve the Allocation of Capital?”

Journal of Development Economics , vol. 87, no. 2, pp. 270-282.

-

Asteriou, D., Dimelis, S. and A. Moudatsou. 2014. “Globalization and Income Inequality: A Panel Data Econometric Approach for the EU27 Countries,”

Economic Modeling , vol. 36, pp. 592-599.

-

Azzimonti, M., de Francisco, E. and V. Quadrini. 2014. “Financial Globalization, Inequality, and the Rising Public Debt,”

American Economic Review , vol. 104, no. 8, pp. 2267-2302.

-

Beck, T. 2002. “Financial Development and International Trade: Is There a Link?”

Journal of International Economics , vol. 57, no. 1, pp. 107-131.

-

Broner, F. and J. Ventura. 2016. “Rethinking the Effects of Financial Globalization,”

Quarterly Journal of Economics , vol. 131, no. 3, pp. 1497-1542.

-

Bumann, S. and R. Lensink. 2016. “Capital Account Liberalization and Income Inequality,”

Journal of International Money and Finance , vol. 61, pp. 143-162.

-

Chinn, M. D. and H. Ito. 2006. “What Matters for Financial Development? Capital Controls, Institutions, and Interactions,”

Journal of Development Economics , vol. 81, no. 1, pp. 163-192.

-

Davidson, C., Martin, L. and S. Matusz. 1999. “Trade and Search Generated Unemployment,”

Journal of International Economics , vol. 48, no. 2, pp. 271-299.

-

de Haan, J. and J.-E. Sturm. 2017. “Finance and Income Inequality: A Review and New Evidence,”

European Journal of Political Economy , vol. 50, pp. 171-195.

-

Demirgüç-Kunt, A. and R. Levine. 2009. “Finance and Inequality: Theory and Evidence,”

Annual Review of Financial Economics , vol. 1, no. 1, pp. 287-318.

-

Fernández, A., Klein, M. W., Rebucci, A., Schindler, M. and M. Uribe. 2016. “Capital Control Measures: A New Dataset,”

IMF Economic Review , vol. 64, no. 3, pp. 548-574.

-

Furceri, D. and P. Loungani. 2018. “The Distributional Effects of Capital Account Liberalization,”

Journal of Development Economics , vol. 130, pp. 127-144.

-

Goldberg, P. K. and N. Pavcnik. 2007. “Distributional Effects of Globalization in Developing Countries,”

Journal of Economic Literature , vol. 45, no. 1, pp. 39-82.

-

Greenwood, J. and B. Jovanovic. 1990. “Financial Development, Growth, and the Distribution of Income,”

Journal of Political Economy , vol. 98, no. 5, pt. 1, pp. 1076-1107.

-

Guiso, L., Jappelli, T. and D. Terlizzese. 1996. “Income Risk, Borrowing Constraints, and Portfolio Choice,”

American Economic Review , vol. 86, no. 1, pp. 158-172. -

Helpman, E. and O. Itskhoki. 2010. “Labour Market Rigidities, Trade and Unemployment,”

Review of Economic Studies , vol. 77, no. 3, pp. 1100-1137.

-

Helpman, E., Itskhoki, O. and S. Redding. 2010. “Inequality and Unemployment in a Global Economy,”

Econometrica , vol. 78, no. 4, pp. 1239-1283.

-

Jaumotte, F., Lall, S. and C. Papageorgiou. 2013. “Rising Income Inequality: Technology, or Trade and Financial Globalization?”

IMF Economic Review , vol. 61, no. 2, pp. 271-309.

- Jung, J. W. and K. Kim. 2018. Financial Market Integration and Income Inequality. KIEP Working Papers, no. 18-02, Korea Institute for International Economic Policy.

- Kim, Y. G., Nahm, S., Keum, H. Y. and N.-N. Kim. 2017. A Study on the Effects of Economic Openness on Korea’s Income Distribution. KIEP Policy Analyses, no. 17-22, Korea Institute for International Economic Policy. (in Korean)

-

King, R. G. and R. Levine. 1993. “Finance, Entrepreneurship and Growth Theory and Evidence,”

Journal of Monetary Economics , vol. 32, no. 3, pp. 513-542.

-

Kose, M. A., Prasad, E. S. and A. D. Taylor. 2011. “Thresholds in the Process of International Financial Integration,”

Journal of International Money and Finance , vol. 30, no. 1, pp. 147-179.

-

Kose, M. A., Prasad, E. S., Rogoff, K. and S.-J. Wei. 2010. “Chapter 65: Financial Globalization and Economic Policies.” In Rodrik, D. and M. Rosenzweig. (eds.)

Handbook of Development Economics, volume 5 . Amsterdam: North-Holland. pp. 4283-4359. -

Kunieda, T., Okada, K. and A. Shibata. 2014. “Finance and Inequality: How Does Globalization Change Their Relationship?”

Macroeconomic Dynamics , vol. 18, no. 5, pp. 1091-1128.

-

Kuznets, S. 1955. “Economic Growth and Income Inequality,”

American Economic Review , vol. 45, no. 1, pp. 1-28. -

Kuznets, S. 1963. “Quantitative Aspects of the Economic Growth of Nations: VIII. Distribution of Income by Size,”

Economic Development and Cultural Change , vol. 11, no. 2, pp. 1-80.

-

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. and R. Vishny. 1999. “The Quality of Government,”

Journal of Law, Economics, and Organization , vol. 15, no. 1, pp. 222-279.

-

Lane, P. R. and G. M. Milesi-Ferretti. 2001. “The External Wealth of Nations: Measures of Foreign Assets and Liabilities for Industrial and Developing Countries,”

Journal of International Economics , vol. 55, no. 2, pp. 263-294.

-

Lane, P. R. and G. M. Milesi-Ferretti. 2007. “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970-2004,”

Journal of International Economics , vol. 73, no. 2, pp. 223-250.

-

Levine, R. and S. Zervos. 1998. “Stock Markets, Banks, and Economic Growth,”

American Economic Review , vol. 88, no. 3, pp. 537-558. -

Lundberg, M. and L. Squire. 2003. “The Simultaneous Evolution of Growth and Inequality,”

The Economic Journal , vol. 113, no. 487, pp. 326-344.

-

Piketty, T. and E. Saez. 2003. “Income Inequality in the United States, 1913-1998,”

Quarterly Journal of Economics , vol. 118, no. 1, pp. 1-39.

- Sanelli, A. 2018. “Financial Income and Wealth Taxation in Italy: Efficiency and Equity Issues.” In Presentation-the OECD Conference on Wealth Inequalities: Measurement and Policies, 26 April 2018. Organisation for Economic Co-operation and Development.

-

Solt, F. 2016. “The Standardized World Income Inequality Database,”

Social Science Quarterly , vol. 97, no. 5, pp. 1267-1281.

-

Townsend, R. M. 1978. “Intermediation with Costly Bilateral Exchange,”

Review of Economic Studies , vol. 45, no. 3, pp. 417-425.

-

Townsend, R. M. 1983. “Theories of Intermediated Structures,”

Carnegie-Rochester Conference Series on Public Policy , vol. 18, pp. 221-272.