- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 25, No. 3, 2021. pp. 273-309.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2021.25.3.398

Number of citation : 0Institutional Quality, Regulatory Environment and Microeconomic Performance: Evidence from Transition and Non-transition Developing Countries

Abstract

The development of regulatory systems varies between transition and non-transition economies. This suggests that they provide different incentives for entrepreneurial development and could have varied effects on the economy because they have different methods to deal with market failure. However, limited empirical evidence exists to prove the assumption of dichotomy. Using comprehensive data for institutional quality, labor market and financial market development, this research sought to analyze their effect on employment growth at micro level. The results show that the quality of institutions in transition economies are poorer relative to those in non-transition economies, but their financial and labor markets are more developed than the latter. Further analysis for the transition sample shows that the three variables are individually positively related with employment growth. For the non-transition sample, institutional quality and labor market flexibility bear a positive and significant effect on employment. Financial market development enters the model with a negative coefficient when regressed alone, but a joint test of significance finds that all the variables have a positive effect on employment growth. This result could imply that there is interdependence between institutional quality, labor flexibility and financial market development in firm-employment-growth relationship, or complementarity between regulations and the quality of institutions. Alternatively, this finding suggests that a stringently regulated credit market in non-transition economies have a selection effect-allocating credit only to entrepreneurs who already demonstrate strong growth potential. In sum, despite differences in the evolution of regulatory environment between the two samples, both of them complement employment growth at firm level. The overall implication of these findings is that less rigid regulations and coherent policies that are enforced with impartiality provide incentives for firms to expand.

JEL Classification: D02, J08, D23

Keywords

Institutional Quality, Labor Market Flexibility, Financial Market Development, Transition Economies, Non-transition Economies

I. Introduction

The dynamic theories of firms usually emphasize the role of the firm level characteristics in economic growth. Nevertheless, other perspectives are critical of treating the firm level variables as the key determinants of employment growth. These theories emphasize that the contribution of various categories of firms to job creation are strongly dependent on national characteristics. These characteristics include a country’s technology, resource endowments, market size and institutions (Hallberg, 2000; Snodgrass and Biggs, 1996 and Kumar et al., 2001). These proposals are in sync with the regulatory environment view which underscores the role of the business environment in facilitating the contribution of firms to economic growth. The regulatory environment encompasses the intensity of barriers to firm entry and exit, well-defined property rights, enforcement of contracts, access to finance and the rule of law1 (Beck et al., 2005 and Kumar et al., 2001).

In addition, there is a large body of theories pointing to the differences in the evolution of the regulatory systems between transition and non-transition economies. This literature argues that costly regulatory environment continues to impede entrepreneurial development in transition economies relative to non-transition economies. However, there is little empirical research on how these factors affect job creation at micro level. Studies that have attempted to investigate this subject rely on very narrow definitions of regulatory variables. Some research use the absence of corruption as the measure of institutional quality. Other academic works use incomplete data which only captures the perception of managers about the quality of regulations. The main limitation of relying on managers’ perception is that those whose firms are already performing poorly might have a distorted view of the intensity of government regulations. This implies that their views may not convey the reality of regulatory burdens. Such analyses are then amenable to biases. Moreover, while some research are country-specific, others suffer from the omitted variable problem. More importantly, little is known about how these effects vary between transition and non-transition economies.

This paper fills this gap by giving an empirical evaluation of how the regulatory environment affects job creation at firm level, and how they compare between the two groups of countries. In this way, the study also highlights the relationship between the micro level variables and net job creation while the regulatory environment is held constant. Three regulatory variables adopted in the analysis are institutional quality, labor market regulation and financial market development. The study uses comprehensive measures of regulatory environment. Government integrity is a newly built index measuring institutional quality. It incorporates additional sub-variables which makes it a comprehensive measure of the quality of governance. Besides, contrary to the narrow definition of institutional quality simply as lack of corruption, this study uses a more exhaustive proxy that combines the components of government integrity and effective enforcement of property rights. These two institutions have been highlighted as the most critical to entrepreneurship (Boettke and Coyne, 2003). Other regulatory variables are constructed in a similar manner. The data captures the views of entrepreneurs as well as experts, which makes it a better estimate of regulations. Finally, the paper uses the largest possible sample of developing countries in both the manufacturing and non-manufacturing sectors.

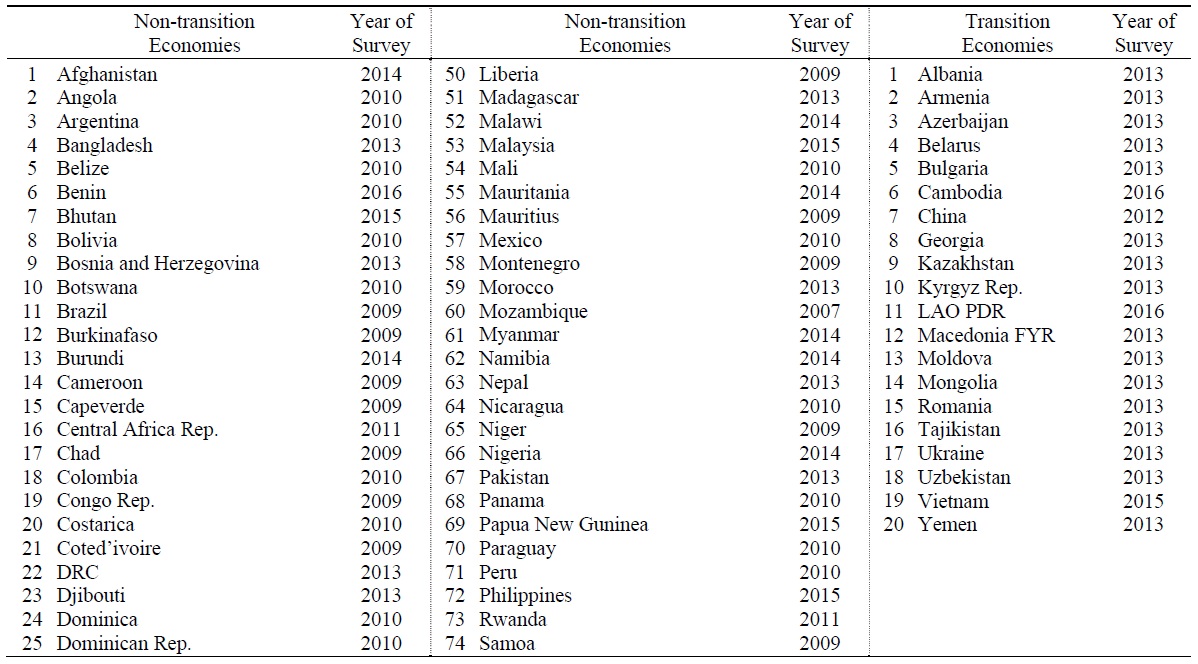

Transition economies are countries that were previously Socialist or Communist states. They are also referred to as non-matured market economies or post-socialist economies. In total, 20 countries are classified as transition economies, most of them were members of Commonwealth of Independent States (CIS). The comparative category includes economies that are capitalist in origin or market economies. They are also called non-transition or mature market economies. The sample has a total of 98 countries in the latter category.

1)This definition is broad as it puts institutions and regulations together. Other literature distinguish between institutions and regulations. Therefore the terms institutions and regulations can be used simultaneously. See for example

II. Theoretical Framework

1. Economic Regulation

Regulation and its attendant impact on economic performance have been increasingly addressed in the literature. Loayza and Servén (2010) define regulation as a set of rules that restrain the actions of economic agents in order to meet social goals. Shleifer (2005) identifies four theories of regulation. The public interest or ‘helping hand’ theory asserts that markets often fail because of the problems related with monopoly or externalities (Pigou, 1938). As a result, benign governments correct these market failures through regulation. In line with this theory, the government can control prices so that monopolies do not overcharge, prescribe workplace safety standards to avert accidents or regulate job market to limit employer monopoly power over employees.

However other associated theories have censured the validity of public interest theory. Competition and private orderings theory holds that the extent of market failure that is not mitigated by market competition is extremely limited, which implies the scope of government intervention must similarly be kept limited. The theory assumes that competition for labor, for example, would ensure that employers provide safe working conditions for their employees lest they lose them to their competitors. Additionally, monopolies are always subject to the threat of potential entry and competition. But even when competition is not effective, private orderings or private governance tends to curb market failures. For instance, industry players can develop an internal set of rules, sanctions and institutions to guarantee quality and penalize the offenders (Bernstein, 1992).

This is further supported by the theory of impartial judiciary. Coase (1960) affirms that when competition fails to address market failures, impartial courts can remedy the anomaly by enforcing contracts. For example, employers could offer employment contracts that stipulate what employees are entitled to in case of accidents. According to this view, as long as the courts enforce property rights and contracts, the need for government regulation is limited. A related theory of regulatory capture postulates that the process of regulation is vulnerable to capture by influential industry players (Stigler, 1971). The implication is that government regulation could end up reinforcing monopoly power rather than restraining it. For instance, regulators may help enterprises to limit new entrants in the industry (Djankov and Glaeser et al., 2003). Moreover, even when regulation is purposes to maximize social welfare, those who enforce them are incompetent and often fail (Peltzman et al., 1989). Nonetheless, the latter theories have also been subjected to criticism. According to Shleifer (2005), private governance can lead to the anarchy of private enforcement, whereby the wealthy benefit more than the poor. Similarly, Coase (1960) holds that courts can remedy market failures, while Djankov and La Porta et al. (2003) show that courts in many countries are often extremely inefficient, politically influenced, slow and corrupt.

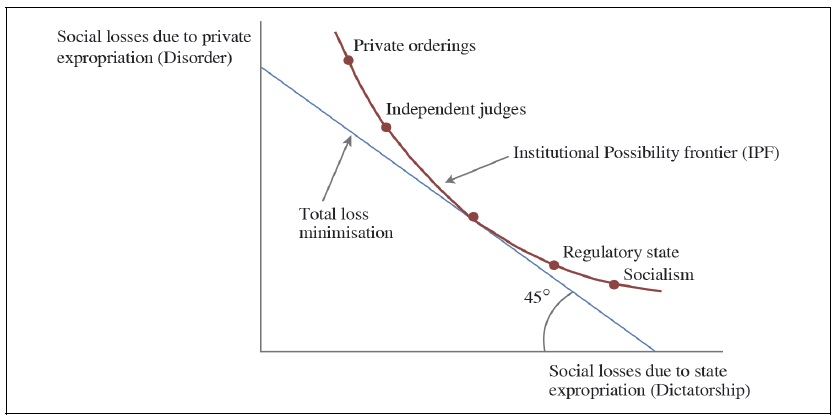

Following this, Djankov and Glaeser et al. (2003) developed a framework for analyzing institutional efficiency. They classify strategies of market regulation into four categories, namely market discipline, private litigation, public enforcement through regulation, and state ownership. These strategies involve a growing power of the state and a diminishing private control. This is shown in Figure 1. In the same vein, these strategies involve a trade-off between disorder and dictatorship; the disorder is when individuals and their property are at the risk of private expropriation. In contrast, dictatorship is the risk that individuals and their property can be expropriated by the state (Djankov and Glaeser et al., 2003). Optimal institutional arrangements often involve a choice among the four strategies, depending on country characteristics, sectors and objectives (Djankov and Glaeser et al., 2003 and Shleifer, 2005). For example, deregulation is necessary where market discipline and competition can be more effective. Furthermore, regulation is often excessive in developing countries and more often leads to inefficient and poor outcomes.

2. Theories of Regulatory Environment and Economic Performance

In this section, the paper describes specific regulatory variables included in the study. The specific measures institutional quality examined in the paper are government integrity and enforcement of property rights. The other areas of regulation assessed are labor market flexibility and financial market development.

(1) Institutional quality

The role of Institutions in economic performance has been distinctly elaborated by North (1990). He defines institutions as humanly designed constraints to govern human interactions, specifically political, economic and social interactions. They include informal constraints: sanctions, taboos, customs, traditions, and codes of conduct, and formal rules, such as constitutions, laws and property rights.

The quality of institutions has been a subject of great interest because of its effects on economic outcomes. A fair amount of previous inquiries on institutions focused on the determinants of institutional quality and their effect on the aggregate economy. North (1989) contrasts North America and Latin America on the basis heritages. He argues that the success of the North American is due to the superior English institutional heritage that upheld property rights. In Latin America, he argues, poor institution evolved because it inherited Spanish tradition which was entrenched on bureaucracy. Nonetheless, Engerman et al. (2002) refer to the vital role of factor endowments or initial conditions in influencing institutional variances even among countries with similar legal and cultural heritages. Contrasting Latin America and North America, they corroborate that the climate and soil in Latin America favored efficient and large scale production of high value agricultural products. This created extreme social, economic and political inequalities that in turn, produced poor institutions with long term effect on the regions’ economic performance. On the other hand, Acemoglu et al. (2001) posit that the high mortality rates experienced by European settlers shaped their settlement patterns and consequently, the quality of institutions formed. The differences in institutions and property rights, they submit, lead to divergent economic outcomes. Additionally, Easterly and Levine (1997) demonstrate that ethnic fragmentation and conflicts account for the evolution of poor institutional quality.

Institutions could also have a discernible effect on venture activities. Bowen and De Clercq (2008) show that the type of institutions in a country impact the economy by lending support to entrepreneurial activities and by directing entrepreneurial endeavors toward certain activities. As a result, it is not possible to explain how entrepreneurship drives economic growth without reference to institutions, especially strong property rights and the rule of law (Boettke et al., 2003). In concurrence, Baumol (1990) states that the prevailing institutional framework directs economic outcomes by allocating entrepreneurial resources towards activities that are either productive or unproductive. According to this supposition, the supply of entrepreneurial talent exists in every society at all times, but rules change from time to time. These rules determine the direction of entrepreneurial activity. Therefore, the way an entrepreneur acts is dependent upon rules of the game-the reward structure in the economy which decides the relative pay-offs of various entrepreneurial activities. For example, if the rules of the game retard wealth creation through activity Y, entrepreneurs will tend to channel their efforts to other activities, say Z. This allocation of entrepreneurial talents between productive and unproductive or even destructive economic ventures can have significant implications: For instance, if activity Z contributes less to employment growth, directing entrepreneurs’ resources towards this activity slows down expansion of jobs. Furthermore, it can affect the innovativeness of the economy; it is plausible that a system of payoffs that directs entrepreneurial talents to unproductive activities will impede industrial innovation. Indeed Boettke et al. (2003) observe that without a conducive institutional environment, innovation cannot be realized. The unproductive entrepreneurial endeavors exist in the form of rent-seeking behavior, including through litigation, appropriation of firms and tax evasion. The lack of secure property rights, for example, discourages investors from investing in visible capital stocks for fear of forcible expropriation of their property (Baumol, 1990). On the other hand, corruption breeds uncertainty which makes it strenuous for new firms with strong growth potential to emerge. This is because when corruption and complex procedures are what characterize interaction with government, entrepreneurs get discouraged from engaging in high-risk high-growth activities because they face an environment that is unpredictable. Moreover, since investments with high growth potential are subject to greater payoffs, high-growth entrepreneurs are likely to be more exposed to corruption directed at appropriating such payoffs, thereby aggravating the risk of losing their investments. Indeed Johnson et al. (2002) found that entrepreneurs in post-socialist economies are less inclined to reinvest their retained earnings when property rights are weak. The aggregate effect is slow employment growth.

Other scholars argue that institutional constraints and bad policies hinder legal firm creation, thereby resulting in a large informal sector. Furthermore, while this phenomenon cuts across all developing countries, they are more common in postsocialist countries where, for instance, property rights are neither adequately defined nor protected by the law (De Soto, 2000). Djankov et al. (2002) confirm that countries with better institutions have less restrictive regulations of new firm formation. Equally, Dollar et al. (2005) advanced that if local governments are characterized by high levels of bureaucracy and corruption, firms cannot get dependable services. This leads to low and uncertain returns on investment, resulting to a low accumulation of capital and slower growth of the firms. He demonstrated that regions with good institutions and business environment can afford high returns on investment and capital accumulation, which spurs the growth of firms. This implies that bureaucracy and poor institutional framework divert resources from productive use.

The channels through which good institutions work include creating incentives for the firms to adopt better technology and invest in knowledge creation and transfer. Institutions also function through their effect on transaction and production costs, as well as by encouraging firms to operate on large scales and with long-term strategies (Aron, 2000). For example, transaction cost is likely to be higher when property rights are weak or when the rule of law is unpredictable. This discourages firms from operating in large scales. Likewise, production cost may rise significantly because unenforceable contracts force firms to resort to cheap technology, operate less efficiently and with short-term horizon (Aron, 2000). In fact, Yasar et al. (2011) claim that strong property rights can enable firms to make performance-improving decisions. In their view, the firms’ performance could be augmented with good institutions that support the firms’ growth strategies and competitiveness. Nevertheless, it is worth to note that the effects of institutional quality could also vary by sectors. For instance, corruption is likely to be prevalent in the construction industry where large infrastructure investments and complex contracts are involved (Doh et al., 2003).

(2) Labor market regulation

The concern about labor market regulation focuses on balancing between averting exploitation of employees and curbing a reduction in productivity or employment due to excessive regulation (Nataraj et al., 2014). Some regulations also aim to redistribute income to workers (Betcherman, 2014). Labor market regulations often prescribe the type acceptable employment contracts, including minimum wages, severance pay, hours of work, union membership and mandatory conscription. The extent of these regulations is varied across countries and even industries. The justification for such laws flows from imperfect information, unequal power between employers and employees, discrimination, and the market’s inability to give insurance for risks associated with employment. Yet, the effect of labor market regulation on job creation remains highly contentious.

Critics of regulations contend that labor market regulations produce distortions in the labor market by reducing flexibility. According to Fallon and Lucas (1991), regulations that grant employees strong labor rights, such as job security, limit the employers’ ability to adjust swiftly to fluctuations in market conditions. In addition, when it becomes costly to lay off workers during economic recessions, firms will be less willing to hire during economic recovery, hence resulting in a decline in employment growth. Similarly, job security increases turnover costs which in turn can promote substitution of labor intensive processes with capital intensive methods, thereby resulting in lower demand for employees (Stiglitz, 1974). However, the effect of regulation on overall employment could be ambiguous because regulations often have a compensating effect between formal and informal sector employment. This connotes that when stringent regulations reduce formal sector employment, they have the opposite effect on informal sector employment. This is because informal labor markets are not covered by labor market regulations (Nataraj et al., 2014).

Some literature focuses on the effect of minimum wages on employment. Jones (1997) documents that the enactment of minimum wage laws lead to a decline in employment levels of the formal sector, while concurrently increasing employment in the informal sector. This is consistent with Carneiro (2004) who demonstrates that an increase in minimum wages has a negative impact on formal sector employment both in the short run and long run, with a reverse effect in the informal sector. At the firm level, the effect of labor market policies on job creation could diverge depending on firm size. According to Hallberg (2000), small enterprises may be exempted from certain labor laws, for instance, minimum wage policies or social security contributions. This allows them to hire labor more reasonably than large firms. Additionally, the drop in demand for workers across industries could be accentuated where private sector is predominant (Fallon and Lucas, 1991). However, Gindling and Terrell (2009) showed that minimum wages reduce employment in both small and large firms in Honduras, but bear no effect on public sector employment. In developing countries where regulations are often accompanied by imperfect enforcement and high cost of monitoring, these regulations create a strong incentive for firms to avoid laws relating to payroll taxes, health and safety rules (Almeida and Carneiro, 2009). Firms that are unwilling to comply with stringent regulations limit their size because when they grow, they become more exposed to regulatory authorities. This produces the ‘missing middle’- a phenomenon in which there are too many micro and small firms on the one hand, and extremely large firms on the other, but only a few medium firms (Tybout, 2000).

More importantly, the extent of labor market regulations is also dependent on the legal origin (La Porta et al., 2008). This implies that the effect these regulations on employment could vary between post-socialist and matured market economies as they have different ways of dealing with market failure. For instance, Botero et al. (2004) demonstrate that countries with socialist heritage have excessive amounts of labor laws. Nevertheless, since labor regulations are a relatively new phenomenon, it is not clear whether economic systems would greatly impact the way they are structured.

It is similarly contested whether the effect of labor regulations on employment in developing countries could be similar to the effect they bear in developed countries. Botero et al. (2004) asserted that labor regulations have an unfavorable effect on employment only in countries where they are enforced, especially in developed countries. Given the nature of employment in developing countries, along with limited administrative and enforcement capacity, it is uncertain how such regulations work. Specifically, due to the fact that developing countries may have larger informal sectors, the effect of labor laws may be limited because of non-compliance (Betcherman, 2014). Other scholars also argue that strict labor regulations could, in fact, have a positive impact on employment growth. According to Henrekson (2014), a certain level of job protection may be important. For example, job protection fosters worker commitment and creates incentives to acquire firm-specific skills.

(3) Financial market regulation (Development)

Market-based institutions, especially legal and financial systems, are considered salient in explaining long-run economic growth (Beck et al., 2003 and Levine, 1999). Nonetheless, the paucity of financial intermediation in developing countries hinders the transfer of limited resources to productive investment (Stern, 2002). Credit risk owing to inadequate or costly institutional infrastructure for financial intermediation is of primary concern. Efficient financial markets are expected to allocate resources efficiently to encourage growth. But for an economy to allocate resources efficiently, all market players should have the relevant information. Adverse market failures, such as information asymmetry often place small economic units at a greater disadvantage. For these reasons, Beck at al. (2004) posit that small and medium firms are the most constrained in terms of access to formal finance. This is particularly because it is difficult or costly for financial institutions to get information regarding the creditworthiness of small and medium firm clients. Given this imperfect information, credit institutions may perceive a higher risk of lending to such firms than the actual risk. As a result, lenders are inclined to charge higher interest rates or avoid lending to them altogether. In situations where SME credit risk can be correctly priced, government laws capping interest rates prohibit banks from charging sufficient interest rates to cover the high costs of transacting with small firms (Hallberg, 2000).

Besides, small firms often lack the collateral requirements for accessing external finance (Beck and Demirguç-Kunt, 2006). For the most part, laws underpinning the use of the property as guarantee usually preclude moveable property such as machinery or livestock, which constitute a significant share of assets owned by SMEs relative to large firms. Further research shows that well-defined property rights and efficient legal systems improve access to external finance by SMEs and mitigate growth constraints (Beck et al., “The Influence,” 2006). This implies a linkage between institutional quality and financial market development in small firm-employment-growth relationship, and the complementary nature of institutions (Henrekson and Johansson, 2008). In developing countries, small firms attempt to overcome information asymmetry and weak contract enforcement by establishing private governance systems based on longstanding business relationships, business networks, family and friends (Biggs and Shah, 2006). Allen et al. (2004) find that alternative financing mechanisms, such as those based on reputation and relationships encourage private sector growth. On the other hand, Van Biesebroek (2005) asserts that loans obtained from informal sources are often not tied to any performance metrics. The implication is that firms without the potential to grow and create jobs are likely to turn to such sources as a last resort.

Despite the emphasis on SME-credit-growth relationship, Kumar et al. (2001) and Beck et al. (2003) underscore that less developed finance and legal institutions affect both small firms and large firms by limiting their growth to minimum efficient size. The authors point out that firms are larger in countries with better credit and institutional development. On the contrary, entrepreneurs in countries with poor access to finance operate on very small scales because they cannot capture enough resources to expand to optimal size (Garcia-Santana and Ramos, 2012). In addition to firm size, Beck et al. (“The Determinants,” 2006) demonstrated that age and ownership determine the firm’s access to finance; old and foreign owned firms are likely to be less constrained in accessing finance. Following these arguments, firm size, age and ownership should be controlled when analyzing the effect of finance on employment growth at the firm level.

Similarly, the impact of financial market development on job creation could vary between transition and non-transition economies. The slow pace of institutional development and higher regulatory cost that are unfavorable to private sector development in transition economies are well documented in past literature. Due to the expected variances, Ayyagari et al. (2008) argue that countries with Socialist legal tradition should be treated separately when examining the role of law and finance in growth. La Porta et al. (1998) also underscored the crucial role of legal origin in financial market development. According to Cojocaru et al. (2016), despite the achievements in the development of financial systems, the process of aligning it with market-based principles is still ongoing. For instance, in some transition economies, building institutional capacity for various forms of financial intermediation remains a crucial impediment in the provision of credit (De Nicoló et al., 2003). The low levels of financial intermediation are partly due to lack of confidence in the banking system by the depositors and weak enforcement of lending contracts. The challenge is compounded by the absence of requisite deposit insurance laws and auditing and accounting standards. This makes the public to keep their savings in cash and impedes the accumulation of savings and the subsequent provision of credit to the private sector. On the lending side, weak institutional framework means banks cannot effectively monitor the credit worthiness of their clients.

The other concerns centers on the structure and ownership of banks. It is observed that several transition economies have relatively small banks. Consequently, it is difficult to exploit economies of scale, thus lowering banking efficiency. Similarly, in some of transition economies, banks may be subject to significantly higher regulatory costs, which are then transmitted to borrowers in the form of higher interest rates. Additionally, the lack of transparent ownership prevalent in some of these economies leads to connected lending. This heightens risks or crowding out of available funds to finance the most productive activities. Furthermore, while state ownership of banks has been associated with slower financial development (La Porta et al., 2000), the practice is still pervasive in some transition economies. The main drawback of this phenomenon is that when state owned banks control a large share of the financial markets, they may rely on their power and subsidies to take excessive risks (De Nicoló et al., 2003).

However, some transition economies have made substantial progress in restructuring banks. As a result of market liberalization, foreign banks gained significant entry into these economies. Indeed, foreign-owned banks have been central in the development of financial infrastructure in the transition economies (Stemmer, 2017). The presence of these banks has increased transparency, competition, efficiency and expansion of loans (Cojocaru et al., 2016 and Fries and Taci, 2002). The privatization process also precipitated the development of equity markets in transition economies, which implies additional sources of finance (Bonin and Wachtel, 2003).

Based on the foregoing, increasing the sharing of credit information should be positively related to net job creation. Additionally, limiting the government’s perverse control of the financial sector that result in inefficiency should enhance net job creation at the firm level. Importantly, due to the circumstances surrounding the development of financial markets in transition economies, it is unclear how their financial markets affect job creation and whether this effect diverges from that which materializes in non-transition economies.

III. Data and Methodology

1. Data

The dependent variable used in this analysis is the rate of net job creation. This variable and firm level characteristics are obtained from World Bank enterprise survey which covers different countries in different years. The survey uses stratified random sampling with replacement for all eligible firms to arrive a representative sample of all non-agricultural firms in each country. The stratification is based on three dimensions namely, Firm size, sector and location, while age and ownership are random variables. The sector classification is based on International Standard Industrial Classification (ISIC) revision 3.1. The survey further provides sampling weights which account for the probability of being selected in each stratum.

The paper focuses on three independent variables, namely institutional quality, labor market regulation, and financial market development. The variables measuring the quality of institutions and government regulations are country-level data. The variable measuring the depth of credit information is from World Bank doing business index. The two variables measuring institutional quality and labor market flexibility are obtained from the heritage foundation’s index of economic freedom. The index measures the degree of economic freedom on a scale of 0 to 100, with higher values representing greater freedom or better performance by the country in that particular variable. The main advantage of heritage foundation data is that it is ideal for constructing a composite index of each variable concerned. This means it is more comprehensive as it considers many relevant aspects of the variable measured. The data is built from several sources which eliminates the risk of biases of a single source. It combines survey data with independent experts’ evaluation of the relevant laws to provide a score for the variables. Furthermore, the data is available for many countries over several years. However, the number of countries included in each regression for non-transition sample varies depending on the variable being used. Given that regulation takes time to change, the index used in the analysis is the average of the indices for 2002 to 2015. This is consistent with Loayza et al. (2004) who argue that the effect of regulations remains constant for over a long period. However, to avoid the endogeneity problem between regulation variables and institutional quality variable, the index for institutional quality is lagged by two years.

The variable for institutional quality captures the extent to which the rule of law is prevalent in a country. Some studies rely on the absence of corruption as the measure of institutional quality. However, this measure ignores important aspects of quality of governance, particularly property rights institutions and the effective enforcement of rules to secure private property which bestows confidence on entrepreneurs and enables them to make long-term investment decisions. To cure this limitation, this paper adopts a composite index combining the components of property rights with those of government integrity. Moreover, government integrity is a newly built index that includes additional sub-components. It is therefore a more exhaustive way of measuring this dimension of institutional quality in contrast to freedom from corruption component which was initially used in its place. Accordingly, the variable for the quality of institution is a simple average of property rights and government integrity variables. The property rights variable is built from five sub-components thus, physical property rights, intellectual property rights, the degree of investor protection, risk of expropriation of private property and the quality of land tenure. Government integrity index is derived from six sub-components measuring the degree of irregular payments and bribes, government transparency in policy making, transparency of government and civil service, the absence of corruption, the perception of corruption and public trust of political leaders. The proxy for labor market flexibility measures the degree to which labor regulations in a country allow firms to adjust their employment levels without extensive government constraints. The index, hence, includes seven sub-components, namely, laws governing minimum wages, constraints to hiring additional employees, rigidity of working hours, regulations on employee layoffs, legally required notice period, severance pay, and finally, labor participation rate. The depth of credit information variable is the extent to which credit information is available through private and public registries to facilitate lending in a country. This includes positive and negative information, distribution of data for firms and households, availability of data from trade creditors and other financial institutions, historical data covering more than two years and distribution of data for loans below 1% of income per capita. The final component is the right of borrowers to access data about them from the registries. Thus, the index reflects the rules affecting the scope, availability and quality of credit information. It is ranked on a scale of 1 to 6, with higher values implying the existence of and easy access to higher quality credit information.

In addition to the main independent variables, the paper incorporates in the analysis four control variables which have been theorized to have an influence on job creation. These include firm age, firm size, firm ownership orientation, and sector. All the control variables are from the World Bank Enterprise Survey data.

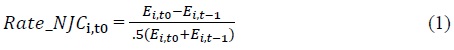

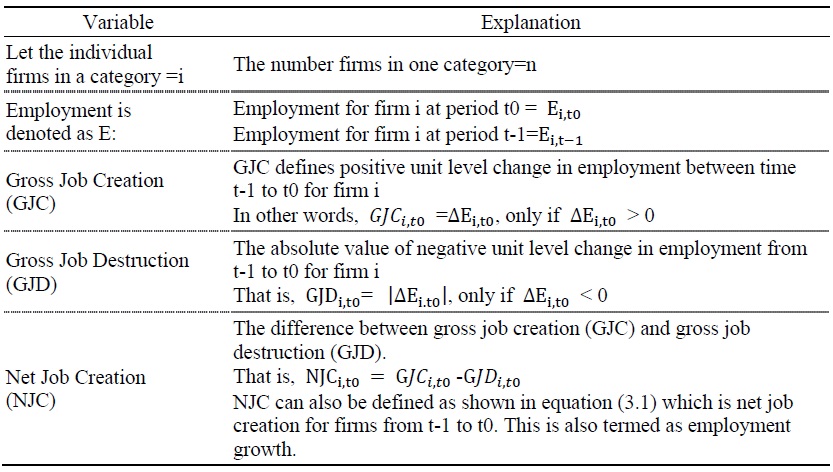

2. Conceptualizing Job Creation

For the purpose of this research, the dependent variable is net job creation rate. From the definitions, the dependent variable can be mathematically expressed as the ratio of net change in employment between the periods under investigation divided by average employment. This can be shown as:

3. Methodology

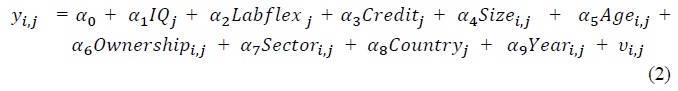

In order to examine the role of institutional quality and government regulations in job creation, the following model is applied:

where

4. Descriptive Analysis

(1) Correlation analysis

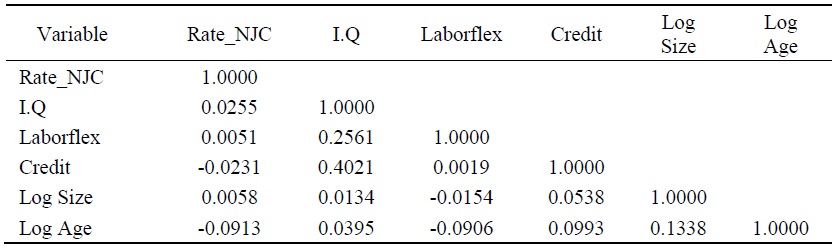

Table 2 shows correlation analysis among variables. As anticipated the correlation between Institutional quality and regulation variables is certainly high. However, this correlation is highest between credit information index and quality of institution. On the other hand, the correlation between credit information and labor regulation is not very high. Furthermore, the dependent variable is not highly correlated with either institution or regulatory variables.

(2) Descriptive statistics

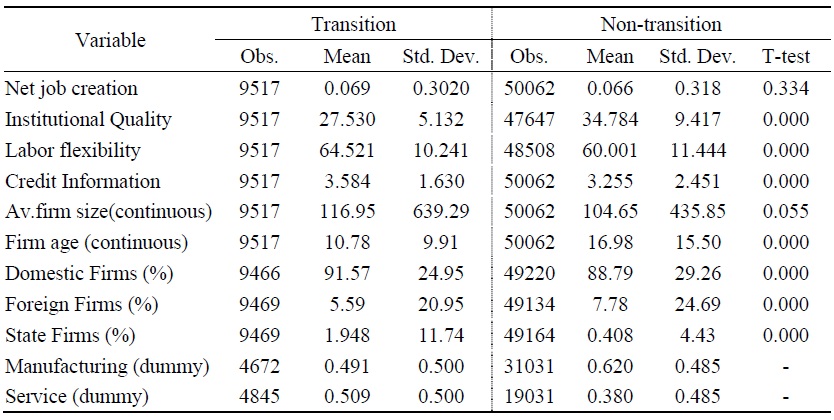

Table 3 shows descriptive analysis of key variables of the study. The t-statistics column tests whether the mean of the variables in the two samples is significantly different. It is observable that non-transition economies have better quality of institutions on average than transition economies. The t-statistic is significant at 1%. This result is consistent with the views of scholars who point to weaker institutions in transition economies. On the other hand, transition economies have a higher degree of labor market flexibility than the non-transition sample. The variation on the quality of credit information between the two samples is very marginal but significantly different. This implies that financial market is better than those in non-transition category. Hence, despite the propositions that regulations in transition economies may be imposing higher regulatory costs on firms than those in non-transition countries, these assertions are not fully verified from these results. However, literature asserts that institutions matter more than regulations, as they determine the overall context in which firms operate. Therefore, it is possible that firms in the transitions economies still face more hurdles than those in the comparative group. The analysis also show that firms in transition sample are younger compared to those in non-transition group. Private domestic ownership of firms in the transition sample is higher, whereas the share of firms owned by foreign individuals or firms is comparatively less. The transition sample also has a higher share of firms owned by the state relative to those in the non-transition group.

IV. Econometric Analysis

This section provides econometric analysis for the effects of institutional quality, labor market flexibility and financial market development on employment growth at the firm level. The analysis will proceed in a systematic manner, whereby each institution or regulation variable is first entered individually to examine their individual correlation with net job creation. In the subsequent analysis, multiple regressions are performed where all regulation variables are included in the model simultaneously to check their joint statistical significance. This is based on the theoretical presupposition that analysis with regulatory variables should use multiple regression method. The implication is that even though individual regulations may be favorable to economic agents, they may not have a positive effect on the economy when institutions are poor. Hence, it is insightful to test how these regulations work jointly when the quality of institutions is accounted for in the model. Furthermore, regulations reinforce each, thus functioning as a package (Loayza et al., 2010). Nonetheless, even in cases where individual institution or regulation variable used, the firm level variables are controlled in all the regressions.

The assumption about institutional quality is that better institutions, which includes impartiality in the provision of services, freedom from corruption and effective property rights should lower the cost of transactions, instill confidence in entrepreneurs and support investment in growth-promoting entrepreneurial endeavors. Since institutions are the rules of the game, they also determine the relative payoffs for different activities, thereby affecting the investment decision of entrepreneurs. On the other hand, the theories behind labor flexibility argue for limited government intervention in the labor market. Excessive regulation is seen as a hindrance to growth. Thus, pervasive government intervention, such as through minimum wage laws, mandatory severance pay, the rigidity of hours worked stifles the employers’ ability to hire and fire labor force. This may negatively impact employment growth at the firm level. For example, firms will not hire additional workers if the cost of adjusting labor is high. Finally, financial market development can affect the ability of lenders to provide loans efficiently and at affordable costs. Moreover, the effects of the institution and government regulations on job creation may also depend on a country’s economic origin because post-socialist and matured market economies have different ways of dealing with market failure. Therefore, it is more informative to study the impact of these factors on job creation by disaggregating transition and non-transition countries into distinct samples.

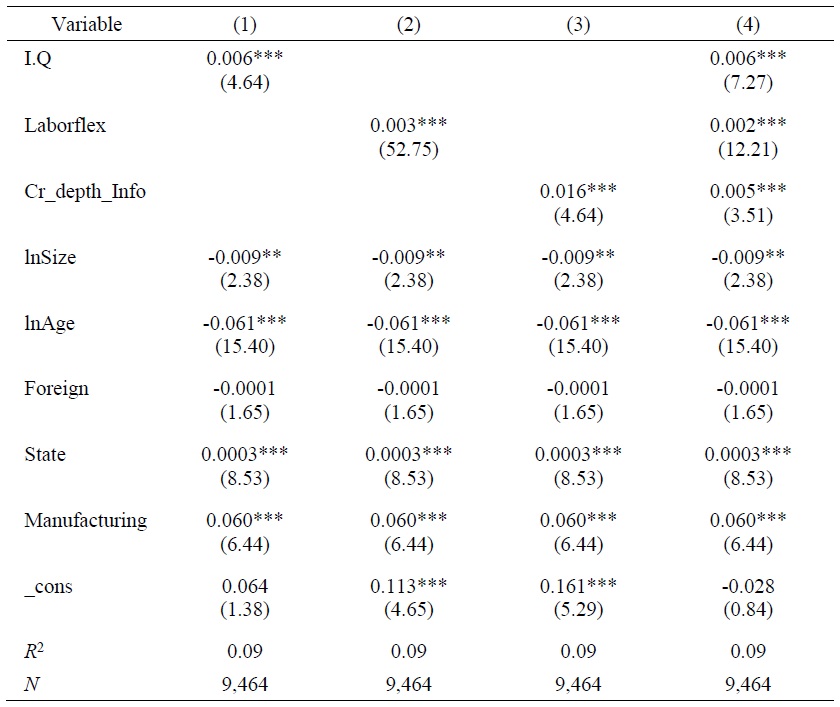

1. Results for All Firms

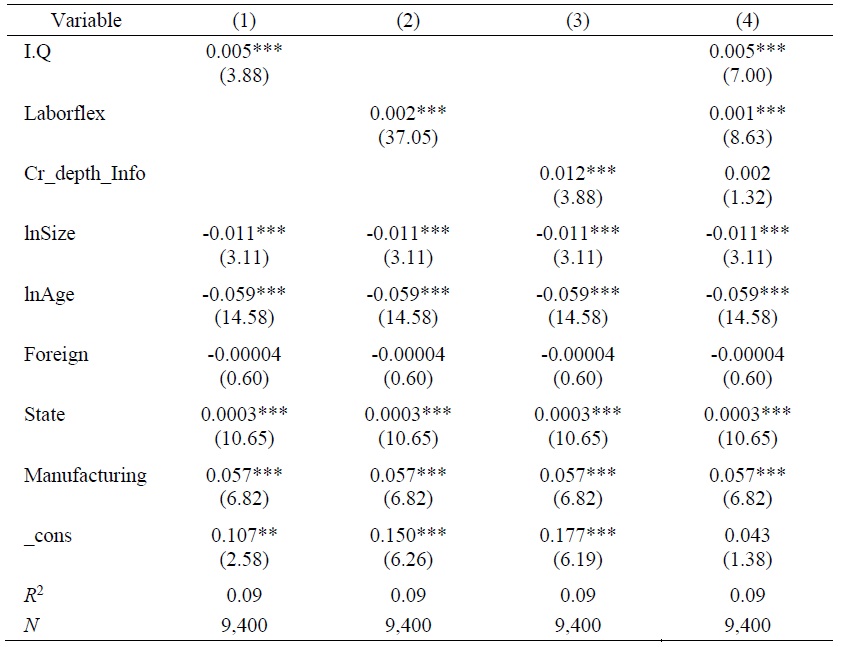

Table 4 displays the estimation results for transition economies. Column 1 shows the results for the relationship between institutional quality and net job creation. The results reveal that institutional quality is significant and positively related with net job creation when controlling for the firm level characteristics and sector. This indicates that reducing corruption as well as improving property rights is essential in stimulating job creation at the firm level. In column 2, the relationship between labor market regulation and net job creation is examined. The analysis finds a positive and statistically significant relationship between labor flexibility and net job creation. This implies that fewer government constraints in the labor market allow firms to hire more labor force. In column 3, the analysis further establishes that the depth of credit information variable has a positive effect on employment growth. The implication of this finding is that increasing the quality and accessibility of credit information enable firms to create more jobs. Finally, column 4 presents the results when institutional and regulation variables are incorporated in the analysis at once, together with firm-level determinants of job creation. The previous results remain robust; the quality of country institutions has a positive and significant impact on net job creation when labor market regulation and credit market development are controlled for. Similarly, labor market flexibility and the depth of credit information positively affect net job creation, even if controlling for the quality of institutions, firm size, age, ownership and sector.

Furthermore, the analysis supports the proposition that firm size, firm age, ownership and sector are important determinants of job creation, even if the quality of government regulations is controlled. Size is inversely related with job creation which implies that small firms experience a higher net job creation rate relative to large ones. Correspondingly, age is statistically significant and negatively associated with net growth, implying that young firms have a higher net effect on job creation than old ones. State-owned firms also manifest a higher net job creation effect relative to domestic private firms. However, their coefficient remains so small in all the models specified, such that it makes no economic difference. On the other hand, foreign ownership shows a negative but insignificant association with net job creation in reference to domestic private firms.

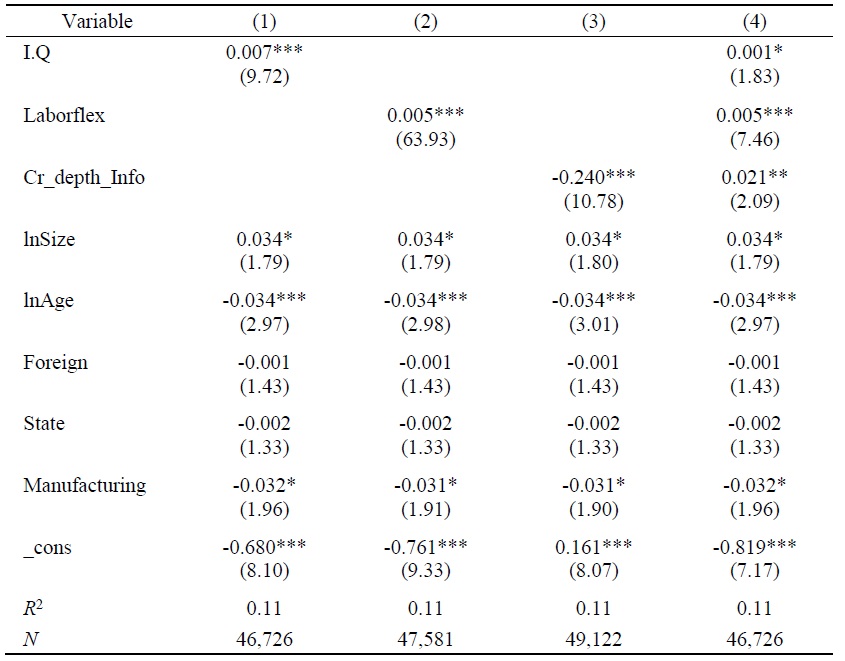

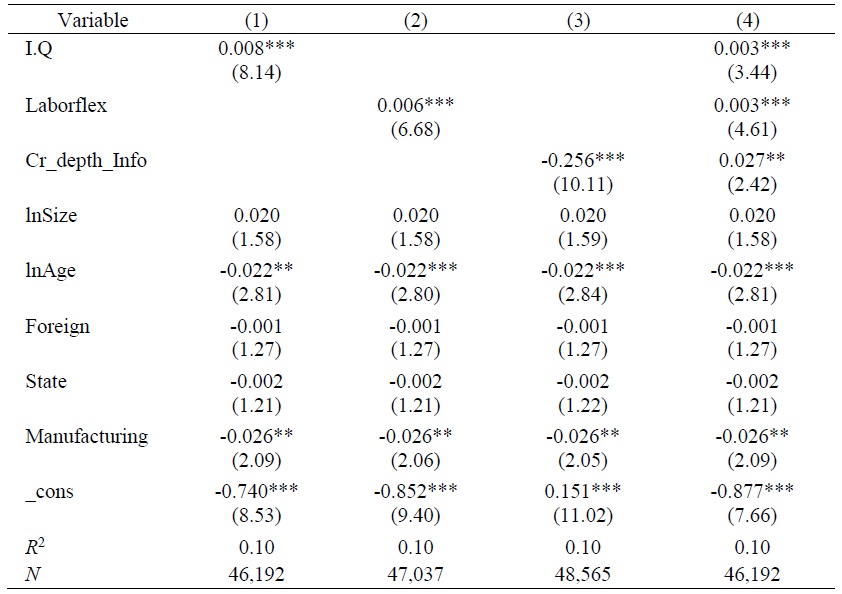

Table 5 presents the results for non-transition economies. The analysis in column 1 shows that institutional quality has a positive and statistically significant association with net job creation. Column 2 tests the relationship between labor market flexibility variable and net job creation. The result is positive and significant, which indicates that labor market flexibility has a positive effect on net job creation, after controlling for other firm-level characteristics. Column 3 shows the relationship between the depth of credit information and employment growth. The finding reveals a negative and significant association between the two variables.

In column 4, the three variables, as well as, firm-level explanatory variables are simultaneously allowed in the equation. The result confirms that net creation increases as the quality of institutions improves even after controlling for labor market regulation and depth of credit information in addition to firm-level attributes. The result for labor flexibility is also consistent, meaning that labor flexibility exerts a positive effect on net job creation after controlling for institutional quality, financial market development, along with firm size, age, and ownership. The analysis in column 4 also shows that the depth of credit information index is positively correlated with net job creation when institutional quality and labor market regulations are controlled for. This contrasts with the finding in column 3 which showed a negative association between the two variables. The implication of this finding is that, while credit information might be important in employment growth at the firm-level, this variable should be augmented with better quality institutions and a flexible labor market in non-transition economies. This implies that there is interdependence between institutional quality, labor flexibility and financial development in firm-employment-growth relationship, or complementarity between regulations and the quality of institutions as suggested by Henrekson and Johansson (2008). Alternatively, this finding suggests that a stringently regulated credit market in non-transition economies could have a selection effect-allocating credit only to entrepreneurs who already have strong growth potential. Therefore, when it becomes too easy to access credit, financial institutions may not adequately evaluate entrepreneurs’ growth plans to determine firms that will make a significant contribution to employment growth.

The results further corroborate that firm-level attributes are equally important in explaining employment growth in non-transition countries. This is true even when country characteristics such as institutions, labor market characteristics and credit market development are controlled for. For example, in column 1- 4, the size of the firm is positive and statistically significant, which corroborates that in non-transition economies, net job creation increases with the size of the firm even after accounting for the quality of institutions, labor market regulation, and the credit information. On the other hand, there is a robust and negative association between age and net job creation when institutional quality, labor market, and credit information are controlled for. Finally, the results show that firms in different sectors contribute differently to net job creation when government regulations are accounted for. In particular, firms in the manufacturing sector contribute less to net job creation relative to their counterparts in the non-manufacturing sector. Ownership variables are indifferent in all the models specified in the regression.

Everything considered, despite differences in economic origin, the results for both transition and non-transition economies support the hypothesis that the quality of institutions and labor market flexibility are positively correlated with employment growth at the firm level. Moreover, increasing the quality and availability of credit information are equally important. However, while this variable has an independent positive influence on job creation in transition economies, it does not have a similar effect in non-transition sample, except when it is augmented with better institutional quality and a flexible labor market. In sum, these results are consistent with the hypothesis that controlling corruption, strong property rights and less government involvement in the labor market give entrepreneurs the incentive to make growth-enhancing decisions. The initial negative association between depth of credit information and net job creation in non-transition countries seems to be counterintuitive. Nonetheless, the association between the two variables changes once institutional quality and labor regulation quality are included in the model. This confirms the assertions of interdependence between credit market and institutional quality in firm-job-creation relationship (Henrekson and Johansson, 2008).

2. Results for Firms with Net Job Creation <=1

The analyses in Tables 4 and 5 include all firms in the regression. Some of the firms in the sample report more than 100% increase in net job creation during the period studied. Such firms are exceptionally rare and may represent high-growth firms, also called gazelles. Furthermore, different actors may be affected differently by the institutions (Henrekson and Johansson, 2008). It is thus plausible that the way institutions and regulatory environment affect high growth is different from the way they affect ordinary firms. High growth firms often possess certain talents or characteristic that distinguish them from others. For instance, they are more often willing to take higher financial risks than average-growth entrepreneurs (Bosma and Stam, 2012). Researchers equally document that high-growth entrepreneurs are likely to be more educated (Stam et al., 2012). Given their unique features and growth potential, including them in the analysis could lead to biased estimates. Hence, in the next analysis, firms that report more than 100% change in net job creation are dropped from the samples.

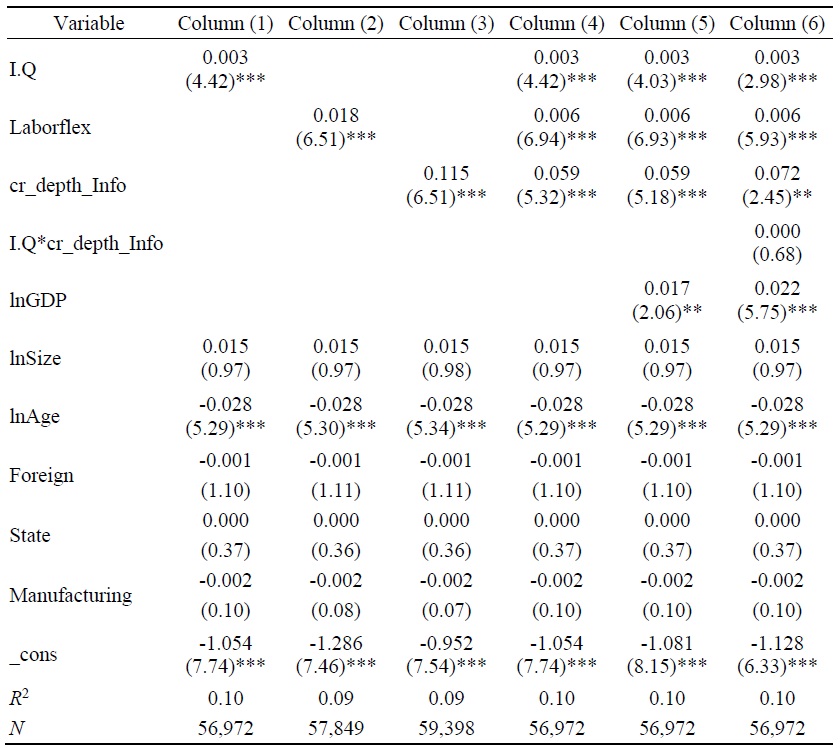

Table 6 shows the results for transition economies when high-growth firms are dropped from the sample. The results for the estimation with institutional quality in column 1 present a positive and statistically significant coefficient. Furthermore, the coefficient is not very different from the regression before dropping high-growth firms. Therefore institutional quality has a positive correlation with net job creation. In column 2, labor market flexibility also exhibits a positive and significant correlation with net job creation. It is equally observed in column 3 that the depth of credit information has a positive correlation with net job creation. The results in column 4 further confirms that when financial development and labor market regulations are controlled for, along with the firm-level determinants of job creation, better quality institution still has a positive correlation with net job creation. Similarly, labor flexibility and financial market development all retain positive coefficients at the inclusion of the proxy for institutional quality in the model. This indicates that less stringent labor market as well as better quality information on credit foster employment growth at the firm level. It is also illuminating that even when high-growth firms are omitted from the analysis, small firms in transition economies still have a higher net job creation rate than large firms. In the same way, young firms add jobs at a faster rate than old ones. Finally, state-owned firms present a positive coefficient, as does the manufacturing sector firms.

Table 7 provides the estimates for non-transition economies after excluding high growth firms. In column 1, the proxy for institutional quality shows a significant and positive correlation with net job creation. A similar result is observed in the relationship between labor market regulation and net job creation as shown in column 2. On the other hand, increasing access to credit by easing access to credit information bears a negative and significant coefficient. This suggests that alone, this variable lowers net job creation even among average entrepreneurs. Column 4 shows a joint test of significance for institutional quality, labor regulation and credit information. The coefficients for institutional quality and labor flexibility are similar to the previous analyses in columns 1 and 2 respectively. The coefficient for credit information index is also positive and significant, again implying the complementary behavior between credit market regulation, institutional quality and labor market characteristics. Firm-level characteristics are also still salient; while size of the firm remains positive, it loses significance. Age of the firm remains significant and inversely associated with net job creation. In addition, even after dropping high growth firms, manufacturing firms in this sample contribute less to net job creation in comparison to firms operating in the services sector.

In Table A1 in the appendix, further robustness check is performed when the two samples are combined. A new variable, GDP per capita, is also introduced in the analysis to control for country level characteristics that can affect the quality of institutions and regulations available in a country. When the analysis is performed, all the variables remain significant. Moreover, the results show that GDP is also positivvely and significantly correlated with job creation. An interaction term between institutional quality and access to credit credit is insignificant.

3. Discussions

The subject of economic regulation has been studied extensively at the macro level. The profundity of regulatory environment lies in the fact that it affects the competitiveness of the economy. This, in turn, determines the behavior of economic agents, thereby bearing on the overall growth of the economy. Most of the theories relating to the regulatory environment assert that, while government regulation of economic activities is crucial, it should be kept minimal. These arguments, however, suggest that the essential role of the state should be the provision of coherent laws that are enforced effectively and impartially, along with protection of private property rights. Numerous academic literature has also pointed out that the development of regulatory systems varies across countries depending on their economic origins. This is mainly because post-socialist economies and matured market economies have different methods of resolving market failures. However, existing studies have fallen short of providing insights into the effect of the regulatory environment at the micro level, and variances of its effects between transition and non-transition economies. This research sought to contribute to understanding this dichotomy, that is, the effects of the regulatory environment on employment growth at micro level, and secondly, whether there are differences on how these factors affect firms in transition and non-transition economies. The paper adopted three comprehensive variables to proxy the intensity of regulatory environment. That is, institutional quality, labor market flexibility and financial market regulation. These variables are chosen because they are most crucial for firms that are already in operation. Since the analysis is based on continuing firms, these variables are most suitable for the study. Institutional quality captures the components of both government integrity and effective enforcement of property rights. Both of these variables have been singled out as necessary for spurring entrepreneurial development.

Overall, most developing countries in this study are still characterized by poor regulatory environment, defined as stringent regulations. From the descriptive statistics, it is informative that the disparities between transition and non-transition economies in terms of the intensity of regulations are not profound. However, it is observed that the quality of institutions in transition economies is still poorer than that in the non-transition sample.

The regression results for both transition and non-transition sample demonstrate that all of the three variables have a positive correlation with the firm’s employment growth. However, some scholars have argued that regression with regulatory variables should use multiple regression model. Thus, further analysis was performed when the variables are simultaneously allowed in the model. The results for institutional quality are consistent with those of Yasar et al. (2011) who found a significant and positive relationship between Institutional quality an firm performance, further establishing that the relationship is independent of firm characteristics. Similarly, an initial study by Almeida and Carneiro (2009) proved that stricter labor regulation constrains firm size and leads to higher unemployment. Financial market development initially bears a negative sign when entered alone in the regression model for non-transition economy. However, when the additional analysis is performed with all the three variables, all of them are jointly significant and positive. On the whole, this result has the implication that there is a complementarity between institutional quality, labor market flexibility and financial market development, a fact consistent with the proposition by Henrekson and Johansson (2008). It further supports literature which suggests that analysis with regulatory variables should use multiple regression approach. The basis of these arguments is that regulations reinforce each other. For instance, if the government makes regulations that lower barriers to entry into the economy, but fails to enforce laws make it easy to access credit in the market, the overall effect would be a higher death rate for firms that enter the economy but need external financing to expand their activities. In the previous studies, Rajan and Zingales (1998) demonstrated that financial market development fosters not only the growth of continuing firms, but also the creation of new firms, which rely on external credit.

The initial analysis in this study included all firms, some of which record more than 100% change in net job creation. Such high growth firms are unique and may not be constrained by the regulatory environment in the same way as average firms. For example, high growth firms are often less risk averse, meaning they are willing to take greater financial risks (Bosma and Stam, 2012). Hence, additional analysis is performed after dropping them from the sample. All the results remain robust. These results are also instructive in that, despite assertions that transition economies might be implementing regulations that retard private sector growth, the evidence proves otherwise. In both country categories, government policies on the labor market, financial market and institutional development contribute positively to job creation among firms. In fact, the extent of labor market flexibility and financial market development are better in transition sample than in non-transition group.

V. Conclusion

The regulatory environment view has gained traction from scholars and development experts. There is a universal consensus that government regulations and institutions impact economic outcomes. Their effects bear upon not only domestic private investments but also on foreign investments. Nevertheless, there are also concerns that developing countries do not have the capacity to efficiently enforce regulations even if they existed. This study provides insightful findings on how the regulatory environment affects firm-level employment growth. The results of the study confirm the validity of regulatory environment theories. This implies that institutional quality, which includes government integrity and effective enforcement of property rights, less corruption can lower transaction costs, impart confidence on entrepreneurs and encourage them to make growth-enhancing investment decisions.

Similarly, the study shows that flexible labor markets are important. The merits of flexible labor market include the fact that it enables employers to adjust employment level to economic circumstances without incurring significant costs. On the other hand, high-quality credit information enables lenders to properly assess the credit history of borrowers. In the absence of credit information, lenders often perceive higher lending risks which are usually offset by charging higher interest rates. This proves to be a major setback for small and young firms, most of which rely on external credit. However, caution is needed when interpreting the effect of credit on net job creation. While it may suggest that the availability of credit information augment net job creation, it is could also be as a result of selection effect. This implies that lenders could be giving credit only to firms that demonstrate strong growth potential. The general implication of this study is that less extensive regulation of economic activities can promote job creation in these countries. Nonetheless, the results of this study are limited given that due to lack of consistent alternative data, it was not possible to conduct sensitivity analysis to validate all the findings. Other firm level variables such as productivity could also possibly have a bearing on the results, but were not included as control variables due to lack of data.

Tables & Figures

Figure 1.

Institutional Possibilities

Source:

Table 1.

Conceptualizing Job Creation

Table 2.

Correlation Analysis

Table 3.

Descriptive Statistics of Key Variables

Table 4.

Effects of Regulatory Environment on Net Job Creation in Transition Economies-All firms

Notes: *

I.Q=Institutional Quality (Includes property rights and government integrity)

Laborflex=Labor market flexibility

Cr_depth_Info=Depth of credit information

Table 5.

Effects of Regulatory Environment on Net Job Creation in Non-transition Economies-All firms

Notes: *

Table 6.

Effects of Regulatory Environment on Net Job Creation in Transition Economies-Firms with Net Job Creation<=1

Notes: *

Table 7.

Effects of Regulatory Environment on Net Job Creation in Non-transition Economies-Firms with Net Job Creation<=1

Notes: *

APPENDIX A

APPENDIX B

Appendix Tables & Figures

Table A1

Robustness Check with Aggregated Sample and GDP Variable

Notes: *

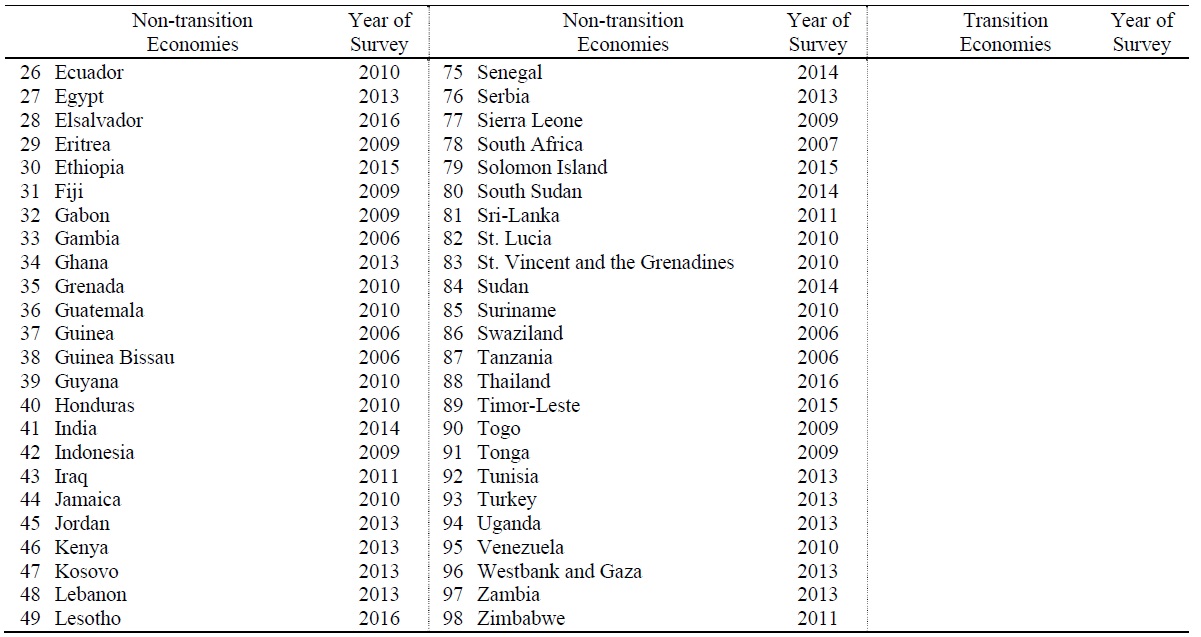

Table B1.

List of Countries by Economic Origin

Table B2.

Continued

Notes: The table shows the countries included in the study. In total there are 20 Transition economies and 98 Non-transition economies. The countries were surveyed in different years. The column for year of survey indicates the year each country was surveyed.

References

-

Acemoglu, D., Johnson, S. and J. A. Robinson. 2001. “The Colonial Origins of Comparative Development: An Empirical Investigation,”

American Economic Review , vol. 91, no. 5, pp. 1369-1401.

-

Allen, F., Qian, J. and M. Qian. 2004. “Law, Finance, and Economic Growth in China,”

Journal of Finance and Economics , vol. 77, no. 1, pp. 57-116.

-

Almeida, R. and P. Carneiro. 2009. “Enforcement of Labor Regulation and Firm Size,”

Journal of Comparative Economics , vol. 37, no. 1, pp. 28-46.

-

Aron, J. 2000. “Growth and Institutions: A Review of the Evidence,”

World Bank Research Observer , vol. 15, no. 1, pp. 99-135.

-

Ayyagari, M., Demirgüç-Kunt, A. and V. Maksimovic. 2008. “How Well Do Institutional Theories Explain Firms’ Perceptions of Property Rights?”

Review of Financial Studies , vol. 21, no. 4, pp. 1833-1871.

-

Baumol, W. J. 1990. “Entrepreneurship: Productive, Unproductive, and Destructive,”

Journal of Political Economy , vol. 98, no. 5, pp. 893-921.

-

Beck, T. and A. Demirgüç-Kunt. 2006. “Small and Medium-size Enterprises: Access to Finance as a Growth Constraint,”

Journal of Banking & Finance , vol. 30, no. 11, pp. 2931-2943.

- Beck, T., Demirgüç-Kunt, A., Laeven, L. and V. Maksimovic. 2004. The Determinants of Financing Obstacles. WB Policy Research Working Paper, no. 3204. World Bank.

-

Beck, T., Demirgüç-Kunt, A., Laeven, L. and V. Maksimovic. 2006. “The Determinants of Financing Obstacles,”

Journal of International Money and Finance , vol. 25, no. 6, pp. 932-952.

-

Beck, T., Demirgüç-Kunt, A. and R. Levine. 2003. “Law and Finance: Why Does Legal Origin Matter?”

Journal of Comparative Economics , vol. 31, no. 4, pp. 653-675.

-

Beck, T., Demirgüç-Kunt, A. and R. Levine. 2005. “SMEs, Growth, and Poverty: Cross-Country Evidence,”

Journal of Economic Growth , vol. 10, no. 3, pp. 199-229.

-

Beck, T., Demirgüç-Kunt, A. and V. Maksimovic. 2006. “The Influence of Financial and Legal Institutions on Firm Size,”

Journal of Banking & Finance , vol. 30, no. 11, pp. 2995-3015.

-

Bernstein, L. 1992. “Opting Out of the Legal System: Extralegal Contractual Relations in the Diamond Industry,”

Journal of Legal Studies , vol. 21, no. 1, pp. 115-157.

-

Betcherman, G. 2014. “Labor Market Regulations: What Do We Know about Their Impacts in Developing Countries?”

World Bank Research Observer , vol. 30, no. 1, pp. 124-153.

-

Biggs, T. and M. K. Shah. 2006. “African SMEs, Networks, and Manufacturing Performance,”

Journal of Banking and Finance , vol. 30, no. 11, pp. 3043-3066.

-

Boettke, P. J. and C. J. Coyne. 2003. “Entrepreneurship and Development: Cause or Consequence?”

Advances in Austrian Economics , vol. 6, pp. 67-87. -

Bonin, J. and P. Wachtel. 2003. “Financial Sector Development in Transition Economies: Lessons from the First Decade,”

Financial Markets, Institutions & Instruments , vol. 12, no. 1, pp. 1-66.

- Bosma, N. and E. Stam. 2012. “Local Policies for High-Employment Growth Enterprises.” Report prepared for the OECD/DBA International Workshop on High-growth Firms: Local Policies and Local Determinants, 28 March 2012. Organisation for Economic Cooperation and Development.

-

Botero, J., Djankov, S., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2004. “The Regulation of Labor,”

Quarterly Journal of Economics , vol. 119, no. 4, pp. 1339-1382.

-

Bowen, H. and D. De Clercq. 2008. “Institutional Context and the Allocation of Entrepreneurial Effort,”

Journal of International Business Studies , vol. 39, no. 4, pp. 747-768.

-

Carneiro, F. G. 2004. “Are Minimum Wages to Blame for Informality in the Labor Market?”

Empirica , vol. 31, pp. 295-306.

-

Coase, R. H. 1960. “The Problem of Social Cost,”

Journal of Law & Economics , vol. 3, pp.1-44.

-

Cojocaru, L., Falaris, E. M., Hoffman, S. D. and J. B. Miller. 2016. “Financial Systems Development and Economic Growth in Transition Economies: New Empirical Evidence from the CEE and CIS Countries,”

Emerging Market Finance and Trade , vol. 52, no. 1, pp. 223-236.

- De Nicoló, G., Geadah, S. and D. L. Rozhkov. 2003. Financial Development in the CIS-7 Countries: Bridging the Great Divide. IMF Working Papers, no. 03/205. International Monetary Fund.

-

De Soto, H. 2000.

The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else . London: Bantam Press. -

Djankov, S., Glaeser, E., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2003. “The New Comparative Economics,”

Journal of Comparative Economics , vol. 31, no. 4, pp. 595-619.

-

Djankov, S., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2002. “The Regulation of Entry,”

Quarterly Journal of Economics , vol. 117, no. 1, pp. 1-37.

-

Djankov, S., La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2003. “Courts,”

Quarterly Journal of Economics , vol. 118, no. 2, pp. 453-517.

-

Doh, J., Rodriguez, P., Uhlenbruck, K., Collins, J., Eden, L. and S. Shekshnia. 2003. “Coping with Corruption in Foreign Markets [and Executive Commentary]”

Academy of Management Executive , vol. 17, no. 3, pp. 114-129. <https://www.jstor.org/stable/4165987 > (accessed August 1, 2021) -

Dollar, D., Hallward-Driemeier, M. and T. Mengistae. 2005. “Investment Climate and Firm Performance in Developing Economies,”

Economic Development and Cultural Change , vol. 54, no. 1, pp. 1-31.

-

Easterly, W. and R. Levine. 1997. “Africa’s Growth Tragedy: Policies and Ethnic Divisions,”

Quarterly Journal of Economics , vol. 112, no. 4, pp. 1203-1250.

-

Engerman, S., Sokoloff, K., Urquiola, M. and D. Acemoglu. 2002. “Factor Endowments, Inequality, and Paths of Development among New World Economies [with Comments]”

Economía , vol. 3, no. 1, pp. 41-109.

-

Fallon, P. R. and R. Lucas. 1991. “The Impact of Changes in Job Security Regulations in India and Zimbabwe,”

World Bank Economic Review , vol. 5, no. 3, pp. 395-413.

- Fries, S. and A. Taci. 2002. Banking Reform and Development in Transition Economies. EBRD Working Paper, no. 71. European Bank for Reconstruction and Development.

- Garcia-Santana, M. and R. Ramos. 2012. Dissecting the Size Distribution of Establishments across Countries. CEMFI Working Paper, no. 1204. Center for Monetary and Financial Studies.

-

Gindling, T. H. and K. Terrell. 2009. “Minimum Wages, Wages and Employment in Various Sectors in Honduras,”

Labor Economics , vol. 16, no. 3, pp. 291-303.

- Hallberg, K. 2000. A Market-Oriented Strategy for Small and Medium Scale Enterprises. IFC Discussion Paper, no. 40. World Bank-International Finance Corporation.

-

Henrekson, M. 2014. How Labor Market Institutions Affect Job Creation and Productivity Growth. IZA World of Labor. <

http://dx.doi.org/10.15185/izawol.38.v2 > (accessed August 1, 2021) - Henrekson, M. and D. Johansson. 2008. Competencies and Institutions Fostering Highgrowth Firms. IFN Working Paper, no. 757. Research Institute of Industrial Economics (IFN).

-

Johnson, S., McMillan, J. and C. Woodruff. 2002. “Property Rights and Finance,”

American Economic Review , vol. 92, no. 5, pp. 1335-1356.

- Jones, P. 1997. The Impact of Minimum Wage Legislation in Developing Countries Where Coverage is Incomplete. CSAE Working Paper Series, no. WPS 98-2. Centre for the Study of African Economies.

- Kumar, K. B., Rajan, R. G. and L. Zingales. 2001. What Determines Firms Size? CRSP Working Paper, no. 496. Center for Research in Security Prices.

- La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2000. Government Ownership of Banks. NBER Working Papers, no. 7620.

-

La Porta, R., Lopez-de-Silanes, F. and A. Shleifer. 2008. “The Economic Consequences of Legal Origins,”

Journal of Economic Literature , vol. 46, no. 2, pp. 285-332.

-

La Porta, R., Lopez-de-Silanes, F., Shleifer, A. and R. W. Vishny. 1998. “Law and Finance,”

Journal of Political Economy , vol. 106, no. 6, pp. 1113-1155.

-

Levine, R. 1999. “Law, Finance, and Economic Growth,”

Journal of Financial Intermediation , vol. 8, no. 1-2, pp. 8-35.

-

Loayza, N. V. and L. Servén. 2010.

Business Regulation and Economic Performance . Washington D.C.: World Bank Publication. - Loayza, N. V., Oviedo, A. M. and L. Servén. 2004. Regulation and Macroeconomic Performance. WB Policy Research Working Paper, no. 3469. World Bank.

-

Nataraj, S., Perez-Arce, F., Kumar, K. B. and S. V. Srinivasan. 2014. “The Impact of Labor Market Regulation on Employment in Low-income Countries: A Meta-analysis,”

Journal of Economic Surveys , vol. 28, no. 3, pp. 551-572.

-

North, D. C. 1989. “Institutions, Economic Growth: An Historical Introduction,”

World Development , vol. 17, no. 9, pp. 1319-1332.

-

North, D. C. 1990.

Institutions, Institutional Change, and Economic Performance . Cambridge: Cambridge University Press. -

Peltzman, S., Levine, M. and R. G. Noll. 1989. “The Economic Theory of Regulation after a Decade of Deregulation,”

Brookings Papers on Economic Activity: Microeconomics , vol. 1989, pp. 1-59.

-

Pigou, A. C. 1938.

The Economics of Welfare (4th ed.). London: Macmillan. -

Rajan, R. G. and L. Zingales. 1998. “Financial Dependence and Growth,”

American Economic Review , vol. 88, no. 3, pp. 559-586. -

Shleifer, A. 2005. “Understanding Regulation,”

European Financial Management , vol. 11, no. 4, pp. 439-451.

-

Stam, E., Bosma, N., van Witteloostuijn, A., de Jong, J., Bogaert, S., Edwards, N. and F. Jaspers. 2012. Ambitious Entrepreneurship- A Review of the Academic Literature and New Directions for Public Policy. Report for the Advisory Council for Science and Technology Policy (AWT) and the Flemish Council for Science and Innovation (VRWI). <

https://www.bvekennis.nl/wp-content/uploads/documents/14-0058.pdf > (accessed August 1, 2021) -

Stemmer, M. A. 2017. Revisiting Finance and Growth in Transition Economies. CES Working Papers, no. halshs-01524462 (HAL id). Centre d’Economie de la Sorbonne. <

https://halshs.archives-ouvertes.fr/halshs-01524462/document > (accessed August 1, 2021) -

Stern, N. 2002.

A Strategy for Development . Washington, D.C.: World Bank Publications. -

Stigler, G. J. 1971. “The Theory of Economic Regulation,”

Bell Journal of Economics and Management Science , vol. 2, no. 1, pp. 3-21.

-

Stiglitz, J. E. 1974. “Alternative Theories of Wage Determination and Unemployment in LDC’s: The Labor Turnover Model,”

Quarterly Journal of Economics , vol. 88, no. 2, pp. 194-227.

-

Snodgrass, D. R. and T. Biggs. 1996.

Industrialization and the Small Firm: Patterns and Policies . San Francisco, CA: ICS Press. -

Tybout, J. R. 2000. “Manufacturing Firms in Developing Countries: How Well Do They Do, and Why?”

Journal of Economic Literature , vol. 38, no. 1, pp. 11-44.

-

Van Biesebroeck, J. 2005. “Firm Size Matters: Growth and Productivity Growth in African Manufacturing,”

Economic Development and Cultural Change , vol. 53, no. 3, pp. 545-583.

-

Yasar, M., Paul, C. J. M. and M. R. Ward. 2011. “Property Rights Institutions and Firm Performance: A Cross-country Analysis,”

World Development , vol. 39, no. 4, pp. 648-661.