- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|---|

| 1 | Nexus between Ease of Doing Business and Foreign Direct Investment: Evidence from 130 Economies / 2023 / E3S Web of Conferences / vol.409, pp.06015 / |

Article View

East Asian Economic Review Vol. 26, No. 2, 2022. pp. 119-142.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2022.26.2.407

Number of citation : 1The Impact of Interfirm Linkages on Chinese MNEs’ Entry into Foreign Markets

|

Yeungnam University |

|

|

Yeungnam University |

Abstract

This paper uses social network theory and the internationalization process model (IPM) to determine how external network linkages influence the location choices of multinational enterprise from emerging economies (EMNEs); specifically, whether past alliance experience influences location choices and its impact on the subsequent entry of MNEs from emerging economies. This paper applies survival analysis using initial and secondary investments from 2,000 Chinese A-share listed companies that entered 90 countries between 1997 and 2018 to analyze both the initial and subsequent entries of Chinese outward foreign direct investments (OFDIs) in major host countries. The findings indicate that an MNE’s previous experience with a company from a particular country will increase the likelihood of an initial investment in that country. Previous alliance experience may accelerate the foreign investment process of EMNE and stimulate firms making a commitment to a position in a foreign network, regardless of cultural distance and stage of internationalization. Alliance before initial investment may increase the likelihood and speed of entering a host country as wholly owned subsidiaries and that network linkages not only significantly influence the internationalization process of small and medium-sized enterprises, as indicated by the IPM, but also that of large listed firms.

JEL Classification: F20, F21, F23

Keywords

Linkage, Strategic Alliance, Outward Foreign Direct Investment (OFDI), Location Choice, Internationalization Process Model (IPM)

I. Introduction

Numerous studies have focused on the location choices of MNEs from emerging economies such as China. Previous studies have shown that EMNEs (MNEs from emerging economies) are less hesitant than MNEs from developed economies in expanding into institutionally underdeveloped locations (Buckley et al., 2007; Duanmu, 2014; Kolstad and Wiig, 2012). At the same time, they often expand into developed economies to gain strategic assets and new knowledge rather than to simply exploit advantages, even at relatively early stages of their internationalization (Li et al., 2012).

According to Meyer and Thaijongrak (2013), MNEs from emerging economies face enormous knowledge gaps, and they prefer acquisitions to close these gaps (Luo and Tung, 2007; Luo and Wang, 2012; Mathews, 2006). Li et al. (2018) believed that the primary purpose of Chinese outward foreign direct investment (OFDI) is resourceseeking, followed by asset-seeking and strategic asset-seeking motives. Many EMNEs internationalize with the purpose of establishing ownership rather than exploiting ownership (Pananond and Giroud, 2016). There is also increasing evidence showing that the internationalization patterns of EMNEs are closely related to their past and current networks (Meyer and Thaijongrak, 2013).

The purpose of Chinese OFDI is aligned with its characteristics. Researchers have described Chinese OFDI as late comers, lacking strategic assets, while facing strong global rivals and domestic institutional constraints, political instability, inadequate business mechanisms, and resource constraints (Casanova and Miroux, 2016; Li et al., 2018). However, although different from the MNEs from developed economies, Chinese MNEs possess specific advantages such as support from local government and regulators, easier to adapt in uncertain and harsh environments, (Luo and Wang, 2012), and networking with key suppliers/buyers, government agents, financial institutions, leveraging ethnic linkages, and personal relationships (Li et al., 2018).

The features of the location choices of Chinese OFDI include both the character of Chinese OFDI and the purposes of their choices. For example, they follow a dual path, investing in developed (mainly for strategic asset-seeking reasons) and developing economies (mainly for market-seeking or natural resource-seeking motives) (Li et al., 2018).

Some factors that might cause great concern for others are of small impact for Chinese MNEs, such as high-level political risk in host country choices (Quer et al., 2012). Chinese MNEs do not shy away from investing in culturally distant countries. However, Chinese FDI in developed countries with great cultural distance is assisted by previously formed alliances with DMNEs (MNE from developed economies) invested in China, which are driven by the asset-seeking motive or established bilateral trade in culturally distant developing countries (Kang and Jiang, 2012). EMNEs are also affected by their own past experience or completed deals with MNEs from a similar background (Li et al., 2018).

According to research, external networking is extremely important in the location choices of EMNEs. To access strategic assets in developed economies, EMNEs from Taiwan pursued frequent interaction with local linkages (Chen et al., 2004). As for entering developing economies, due to the higher liability of foreignness caused by relatively weak institutions, the existence of external networks, such as ethnic ties or external relational linkages among top managers, also impacts the location choices of EMNEs significantly (Chen and Chen, 1998). Lei and Chen (2011) believed that EMNEs maximize the use of external network and then move to more distant foreign markets when they accumulate enough new networks.

Based on the analysis of the differences in the location choices of Chinese MNEs and MNEs from developed economies and the characteristics of Chinese MNEs, network relationships, or linkages, seem to be an important factor in Chinese MNE’s location choices. Chinese MNEs aim at seeking assets but lack an ownership advantage; instead, they have a relative advantage for building relationships with local actors, networking, and learning from past experiences. To utilize these advantages and realize the purpose of FDI, Chinese MNEs need to forge linkages and develop social capital to avoid ownership shortages and gain a competitive local advantage. According to the social network theory, social capital can be defined as network engagement, trustworthiness, and norms which lead to economic and political benefit. Therefore, how and with whom to build external linkages and their influence on the location choices of EMNEs are three important questions to be addressed when examining the internationalization of EMNEs.

Internationalization process model describes firms as businesses that are embedded in a network, where partnerships among firms are important for firms’ internationalization. A firm’s opportunities and difficulties in the global market are more of a network and relationship. Internationalization process model can explain the sequence of MNEs’ internationalization. The model suggests that an investing firm initially makes a commitment to a position in a network, more specifically, a business network in a foreign market. Previous literatures suggest that external linkages or ethnic ties among top managers are critical for the internationalization of MNEs from emerging economies. Chen and Chen (1998) believe that network linkage has significant impact on the location choice of MNEs from Taiwan. This paper believes that strategic alliance can be seen as a linkage, or a commitment with foreign market. Cross border commitments enable a firm to gain experiential knowledge about foreign business environments such as knowledge about customers, competitors and regulatory authorities. Local knowledge strengthens the firm’s ability to assess and evaluate its current business activities, the extent of its existing market commitment, and the chances for further investment (Johanson and Vahlne, 1990) such as purchasing an existing local distributor or building a new manufacturing plant in that particular market. In sum, this paper makes an empirical analysis by using a large number of Chinese enterprises' initial and secondary OFDI data, point out the importance of interfirm linkage on rapid growth and location choice of Chinese MNEs and survival of their subsidiaries in foreign markets from the perspective of social networks and the IPM.

II. Theoretical Background and Hypothesis Development

1. Influence of Previous Alliance Experience on the Location Choices of the Initial Entry of Chinese MNEs

Strategic linkages can improve the strategic capabilities of investors, which, in turn, reshape the course of their future actions and broaden the scope of their market opportunities (Chen and Chen, 1998). These linkages create a synergistic effect that enhances or reshapes the competitiveness of firms bonded by alliances. After forming an alliance, firms may develop abilities such as coordination, communication, and bonding that are of great help to selecting partners, negotiating contracts, managing cooperative relationships, and adapting to changing technological and market conditions. In addition, building strategic alliances can help firms gain social capital, such as mutual trust, respect, reputation and friendship, protect prosperity and willingness to pay. Transaction and coordination cost variables, such as interpersonal relationships, information asymmetries, language and culture, and the like, are more important than production-related variables in determining FDI locations (Dunning, 1997).

At the inter-organizational level, formal partnerships between enterprises create the type of strategic alliance that comprises corporate social capital. Strategic alliances establish interdependence between independent economic units, bringing tangible and intangible assets to a partner’s new interests, and they have an obligation to continue contributing to the partnership (Koka and Prescott, 2002).

Researchers have analyzed the advantages that strategic alliances can bring to companies in the sociological perspective. Self-organized corporate social capital includes the number of alliances with a group of changing organizations and the resources controlled by these partners. Partners’ resources may include financial assets, scientific knowledge, or expert advice; adapt new countries and cultures; organizational reputation; and trustworthiness (Knoke, 2009). Thus, this paper posits hypothesis 1a.

In order to test whether strategic alliance experience is transferable among countries or not, the paper posits hypothesis 1b.

The paper posits that a strategic alliance can be seen as a commitment to a foreign market that enables a firm to gain experiential knowledge about foreign business environments including customers, regulatory authorities, and competitors. Such local knowledge can enhance a firm’s ability to evaluate and assess its current business activities, the extent of its existing market commitment, and, more importantly, the chance for further investment (Johanson and Vahlne, 1990), such as purchasing an existing local enterprise or building a new manufacturing plant. The organization is able to gradually develop the required level of local capabilities and market knowledge to become an effective performer in that local context. Each commitment enables a greater opportunity for learning, which, in turn, drives opportunity identification, risk perception, and the cost of additional expansion (Peng and Meyer, 2011).

Knowledge can be shared within close networking relationships, despite the organizational boundaries between firms, under the condition that they have intensive interpersonal interactions (Peng and Meyer, 2011). Trust is an important ingredient for successful learning. Therefore, a strategic alliance can be the initial commitment that Chinese MNEs make in foreign markets.

There are three types of strategic alliances: Joint Venture, Equity Strategic Alliance, and Non-equity Strategic Alliance. Sample data adopted by this paper is categorized in joint venture and non-joint venture. Compared with non-joint ventures, joint ventures require closer interaction, which makes it easier to gain opportunities and build trust. According to Peng and Meyer (2011), a joint venture is one of the common forms of expansion for investors that require market-specific resources. Thus, the paper posits that a strategic alliance in the form of a joint venture can be seen as a commitment of a larger size and a deeper degree, especially in human resources, compared to a strategic alliance in the form of a non-joint venture. So, we can make the following conclusion about the initial entry of China’s MNEs:

2. Influence of Previous Alliance Experience on the Location Choices of Subsequent Entries of Chinese MNEs

As is stated by Kogut (1983), FDI decisions are not discrete but might be best understood as part of a series of decisions that determine the volume and direction of the resource flows between countries.

Choosing the location in which a firm has previously formed alliances may create many advantages for a firm in adapting to the host country, as previously stated. Based on the relationship between MNE and strategic alliances from host country, subsidiaries shall adapt local environment quickly and form their own local networks. The structures of these networks are more likely to be tightly connected to better mutual understanding and trust. Information and knowledge flow within tightly connected or clustered network will be of a high quality and easily adopted but highly homogenous.

Cluster networks can promote the closure of social capital in a structural dimension and increase the dependence of social activity participants on; social networks and the degree of resource specialization, thus creating the premise for the establishment of effective supervision. Closure determines the members’ dependence on the network, it indicates “the extent to which actors’ contacts are themselves connected facilitates the emergence of effective norms and maintains the trustworthiness of others, thereby strengthening social capital” (Coleman, 1988). In a multinational firm, if overseas subsidiaries in the host country follow the same rules and norms with suppliers, customers, competitors, and partners and trust each other or have a good credit mechanism, it will promote the relationship capital, cognitive capital, and capital structures. Cognitive capital exist through actors within the network share common language, codes or moral, and will in turn increase mutual understanding, better communication among actors and help information flow more efficiently.

As previous literature has suggested, a high degree of clustering may have a pathdependent effect, thereby reducing the possibility of establishing weak connections with outsiders. Therefore, on the one hand, the alliance relationship can help the subsidiary build a highly clustered network structure, which increases trust among network members, and fully adapt in the network rapidly. On the other hand, for firms that want to achieve a highly central position, focus on innovation, or intend to explore a new line of business, previous alliance experience may have limited or even a negative influence on the subsequent entry of Chinese MNEs because a cluster network may restrict firms’ motivation to look for weak ties. Firm rely too much on close relationship may be trapped in suboptimal, stable equilibria over time. Information frequently obtained from close relationship may not necessary be the most accurate or professional; it may reduce the richness of information, easily be isolated; and hinder firms’ ability of recognize opportunities (Musteen et al., 2010). Thus, previous alliance experience may have a positive influence on the subsequent entry of Chinese MNEs. Nevertheless, compared with the initial entry of Chinese MNEs, previous alliance experience may have a relatively lower hazard ratio on the subsequent entry of Chinese MNEs. In other words, previous alliance experience with the focal host country before an initial entry may increase the speed of subsequent entries of Chinese MNEs, but the speed will be presented as an inverse U shape. Based on this idea, we arrive at the second hypothesis:

Based on previous analysis, after these companies form a strategic alliance in the host country, their initial entry may rely more on the strategic alliance relationship to acquire knowledge and opportunities faster, thereby increasing the possibility of further investment faster. This is a gradual process that is aligned with the basic idea of the IPM.

However, there is another possibility that the strategic alliance is formed between initial entry and second entry into focal host country. The paper believe that if the alliance experience is gained between initial and second entry, instead of before initial entry of Chinese MNE to the focal host country, the value of the strategic alliance will be different, and thus the influence of alliance experience on second entry of Chinese MNE into focal host country will be different, this may because knowledge about the local market gained from that alliance experience will not be as efficient, and forming a strategic alliance after initial entry may indicate that the firm’s ability may not be sufficient to expand on its own or intend to expand new line of business. Thus, it will be highly unlikely for firms to invest further after forming a strategic alliance, at least not in the short term.

As is indicated by the IPM, once a company successfully enters the foreign market as a wholly owned subsidiary, it may be more willing to continue to enter with the same entry method under the same conditions. Johanson and Vahlne (1977) found that more experienced companies are more inclined than the partial ownership or contract models to form wholly owned subsidiaries (Agarwal and Ramaswami, 1992; Gomes-Casseres et al., 2006). Chang (1995) showed that MNEs often enter foreign markets in a sequential fashion, beginning with lines of business with which they have the strongest competitive advantage over local firms, and, over time, adding lines of business in which they have little or no competitive advantage.

In sum, firms form a strategic alliance between their initial and subsequent entries, or, in other words, firms pursue an initial entry in a foreign market in the mode of a wholly owned subsidiary and then pursue a joint venture or contractual mode. This may indicate that firms decided to set up a new line of business or pursue a line of business in which the firm had little or no competitive advantage. Thus, this article posits Hypothesis 2b.

III. Research Methodology

1. Data Collection and Process

To examine the relationship between Chinese MNEs’ past alliance experience with the focal host country and the internationalization trend of Chinese MNEs, this paper needed to collect firm-level information about Chinese MNEs, including past alliance experience, detailed information on OFDI, and other basic financial information about companies. Based on the huge sample size required, this study used secondary data. China Stock Market & Accounting Research (CSMAR) is one database that contains relatively complete information on Chinese A-share listed companies, including OFDI and other basic information. The Securities Data Company (SDC) database provides detailed information on alliance information from all over the world, including China. Thus, this study combined data from these two databases to generate the dataset required by this study. The data were processed as follows.

This study first uses A-share listed firms’ data from CSMAR, by selecting firms that have wholly owned subsidiaries in foreign countries, and then ordering the subsidiaries of each firm sequentially according to their date of appearance from 1997 to 2018. After eliminating tax haven countries, there were a total of 2,000 firms in 90 countries. The time range starts in 1997 because it is the earliest date recorded in the CSMAR database for Chinese A-share listed companies with foreign affiliations. This starting date was chosen to offset the left censored problem that might occur during the following analysis. Since the coronavirus pandemic, which had an enormous impact on global business, started in 2019, the dataset stops in 2018. This study focuses on initial alliances and foreign market entries from Chinese MNEs to different home countries to explain the reason behind rapid internationalization and the leap frog phenomenon, excluding the impact of previous internationalization experiences on the location choices of Chinese MNEs.

Second, alliances that feature China as participant from the SDC database, firms were selected that had alliances with A-share listed firms with a foreign subsidiary from the first step. There were a total of 3,000 alliance groups selected; 2,000 of these included foreign participants from 92 countries.

Third, based on the second step, the A-share listed firms that had a direct alliance relationship with foreign firms were compared with the dataset generated in the first step. Among those 2,000 listed firms, 560 had alliances with foreign firms, which had over 7,200 subsidiaries in 80 countries.

Fourth, each firm’s subsidiary appearance time and country were compared; 200 firms invested in the country in which it had formed an alliance from the focal country before the investment. Finally, there were a total of 560 A-share listed firms that had both foreign subsidiaries (from 80 countries) and foreign alliance partners (from 92 countries). Among these 560 firms, 200 invested in the country in which they had former alliance partners from the focal country.

2. Model Specification

To estimate the speed and likelihood of Chinese MNEs’ initial investment in a foreign market, this paper adopts the Cox hazard model for survival analysis. There are several reasons why this study adopts the Cox hazard model. First, a Cox regression can be applied to model the time until the event while simultaneously adjusting for influential covariates and accounting for problems such as attrition, delayed entry, and temporal biases. Furthermore, by extending the techniques used to model a single event, researchers can model the time until multiple events. In this paper, the Cox hazard model is chosen to investigate the temporal impact of previous alliance experience before entering the host country, while adjusting for other variables that may have an impact.

Second, a Cox regression can calculate the ‘relative risk’ type ratio, which is very useful for explaining the event risk of certain categories of independent variables, for example, in this paper, the main independent variables are binary. Cox hazard modeling does not allow for assumptions to be made about the parametric distribution of the survival times, making the method considerably more efficient. Researchers need only validate the assumption that the hazards are proportional over time because the variables used to describe the nature of firms can change overtime. The model includes time-depending covariates to extend a simple Cox regression to pursue more accurate results (Smith et al., 2003).

Survival function estimates stratified by exposure category levels can be created and output. These estimates correspond to the means of the explanatory variables for each stratum. Because each firm can have multiple initial entries in different countries, to obtain a more accurate hazard ratio, a stratified Cox hazard regression is used. This type of model not only allows the hazards to differ, but also obtains separate measures of the effectiveness of previous alliance experience in the focal host country. According to Cleves et al. (2016), a stratified estimation enables us to test whether previous alliance experience had an equal influence on all of the countries, regardless of the shape of the hazard for each country. Because each company has multiple events for different countries/regions, the standard Cox regression model may ignore the fact that different countries/regions may have different impacts on the location selection of a Chinese parent company. Therefore, we can illustrate the country-level impact on hazardous functions by stratifying the countries in the Cox model.

Besides, there are multiple investments by one firm; we need to adjust for each company’s investment homogeneity. Stratified data by country enables us to adjust the dataset to satisfy the Cox hazard model. This allows us to obtain hazard ratios based on different countries. Since there is no interactive stratified Cox hazard regression, it will obtain the same exact risk ratio, regardless of the stratified country. The paper calculate the hazard ratio based on different variables. The following is a summary and description of survival data, followed by the results of a stratified Cox hazard regression analysis. Thus, the formula used in this paper is specified as follows:

In the formula,

The paper uses Heckman’s two-stage estimation method because the sample dataset includes only the countries selected by Chinese MNEs, and the countries that Chinese MNEs did not choose as the receiving country are not included in the dataset. There may be unknown reasons why Chinese MNEs did not choose those countries. The standard regression model cannot control the endogenous bias associated with this problem.

The Heckman two-stage estimation is adopted in this paper for the purpose of correcting sample selection bias (Certo et al., 2016). In the first stage, Chinese listed companies with all possible host countries are used to perform the selection equation as the maximum likelihood probability model to analyze the tendency of Chinese MNEs selecting certain host countries and to calculate the inverse Mills ratio. The dependent variable is whether a firm invested in a certain country. The independent variables include all covariates from the original model and the ‘instrumental variable’ like culture distance that have strong influence on whether or not a focal host country is chosen, but no direct relationship with the speed of Chinese MNEs’ internationalization. In the second stage, the corrected regression equation is estimated using the Cox hazard model to examine the timing of Chinese MNEs entering focal host countries for the first time. The Cox regression is performed with the inverse Mills ratio from the first stage as a control variable. Heckman model first-stage estimation can be specified as a multi-level probit model as follows:

The host country choices of Chinese MNEs can be estimated using the model above. If a Chinese MNE enters the focal host country as the initial entry country,

3. Dependent Variables

Due to the character of the research topic and sample data, each firm may have multiple initial investments in different foreign markets; the event of the Cox hazard model would be disordered, multi-type, events. Disordered, multi-type, events make the events completely independent of each other; all objects face the risk of all events, and when the object experiences one of the events, it still faces the risk of all of the other events. Since the events in my dataset are discrete, the type of event can be separated by country, and there is no direct relationship between each event; therefore, unordered, multi-type events seem to be more accurate. Therefore, the duration of the Cox hazard model would be the duration between 1997 and the initial entry of each firm into each host country. As for firms that are established after 1997, the start date would be the establishment date of the firms instead of 1997. If the company enters the country for the first time, the event code is 1, otherwise it is 0.

To test the hypotheses for subsequent (secondary) entries, this paper includes all of the firms that have an initial entry into certain host countries. The event will be coded as 1 if the firm pursues a second entry in the focal host country and 0 otherwise.

4. Independent Variables

The independent variables are defined as follows.

To test Hypothesis 2b, the paper includes another main independent variable

5. Control Variables

This paper adopted both firm-level and country-level control variables. The paper includes variables such as the type of firm to describe whether the firms are manufacturing or not, and codes them as 1 if they are manufacturing firms and 0 otherwise. The paper posits that compared to non-manufacturing firms, manufacturing firms may need more information on resource endowment and therefore make more commitments when entering a foreign market. A state owned enterprise (SOE) was coded as 1 and 0 if the firm was not state owned. According to Ruzzier and Ruzzier (2015), Chinese SOEs are more ‘risk tolerating’ in their host country selection and invest in broader international locations than none SOEs.

Other firm characteristics also impacted their internationalization decisions. According to Hong and Lee (2015) and Ruzzier and Ruzzier (2015), firm size and sales ability are positively related to internationalization. As a result of globalization, the age of firms upon entry into foreign markets is negatively related to internationalization. Previous researches suggest that he elder the firm, the less activate the firm is in exporting. Under this consideration, the paper includes the following variables to represent firm characteristics: firm age, which can be calculated by the date of an event minus the date of establishment; cumulated granted patents, is used to describe firms’ R&D ability and is calculated by the number of patents granted to a firm every year. Based on Henisz and Macher (2004), there’s a positive relationship between R&D intensity and the probability of foreign market entry. Due to the large gap in the number of patents granted each year and missing values for some years, the paper calculates the annual cumulative number of patents granted; the log of total assets is adopted to describe firm size, generated by the log form of a firm’s total assets; the sales ratio describes the firms’ sales ability, calculated by the rate of advertising (sales) and total operational costs. The revenue growth rate represents enterprise development capacity; asset liability ratio represents debt servicing capacity of firms; fixed asset turnover represents the operational capacity of firms; and return on investment represents the profitability of firms. These financial indicators are expected to have positive influence on internationalization of Chinese MNEs. The raw data for these variables were derived from CSMAR.

As for country-level variables, the paper first adopts cultural distance and institutional distance, two commonly used variables in the FDI location choice literature. Cultural distance and institutional distance are generally considered to have a negative effect on the location choices of FDI (Du et al., 2012; Kuo and Fang, 2009). The paper also includes the attributes of countries as a country-level proxy to determine the location choices of Chinese MNEs, such as the gross domestic product (GDP), represent the market size of the country. Resource endowment factor is calculated by the percentage of ores and metals exports to total merchandise exports of the country. These attributes are expected to attract investment from EMNE. Economic freedom index is a composite index which is also expected to have positive relationship with Chinese OFDI.

The last country-level variable is the FDI in degree centrality of each country. In degree centrality indicates number of countries invests in the focal host country. This variable has seldom been used in previous internationalization studies, and it is therefore one of this paper’s innovations. It indicates the power of each country within the global network linked by FDI flow. The power possessed by each country may have a positive impact on the location choices of Chinese MNEs.

IV. Results

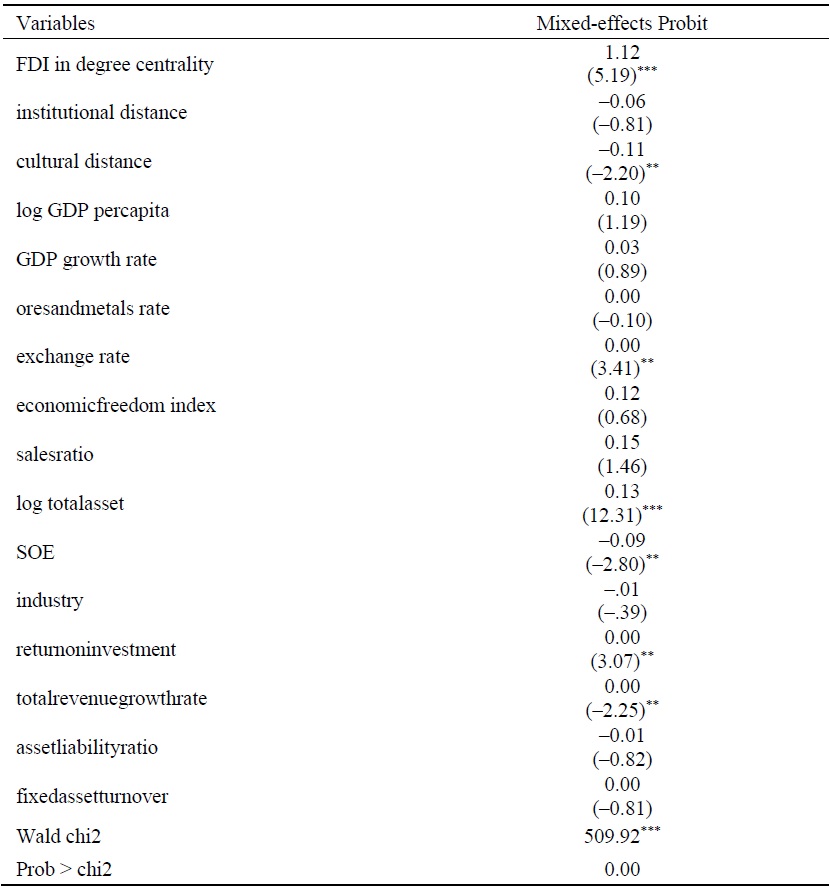

The first stage of Heckman’s two-stage estimation is a probability estimation to determine whether the company chooses a country as its receiving country. Thus, the variables used in the first-stage estimation must impact the location choices of Chinese MNEs. Variables used in the second-stage estimation include both the independent variables and the variables indicating firms’ characteristics that impact internationalization.

According to the binary regression result table, social capital, as indicated by the in degree centrality of FDI, is statistically significant and the coefficient of this variable is 1.12. This indicates that if the country has a higher FDI in degree centrality than another country, it will be more likely to attract investment from Chinese MNEs. As indicated previously, countries that have a higher in degree centrality have more power, which means more information, better technology, and more strategic assets. Investing in such countries may give firms more opportunities to gain resources or strategic assets and therefore help FDI operate more efficiently within the host country.

Based on the characteristics of Chinese MNEs, countries with high in degree centrality provide better environment to build firm-specific advantage within the host country. This is in line with the hypothesis of Li et al. (2018). For example, countries with high FDI in degree centrality will have a sounder institutional environment, a larger market size, a more hospitable investment environment (easier to accommodate the liability of foreignness), and a more competitive environment with various spillovers (Bolívar et al., 2019). Firms from emerging economies with less firmspecific advantages and are eager to gain ability to survive internationally, makes them perfect for investing in host countries of this kind.

Cultural distance between China and the potential host country has a statistically significant negative influence on the location decision-making of Chinese MNEs. This is in line with previous literature that suggested that MNEs tend to choose potential host countries that have close cultural distance. This suggests that cultural distance has the same influence on MNEs from emerging economies as on MNEs from advanced economies.

This result indicates that economic variables such as GDP per capita and GDP growth rate do not have a statistically significant influence on Chinese MNEs’ location choices. This result is not in line with previous literature. This may indicate that compared to social capital or psychic distance factors, economic factors do not have a similarly strong influence on Chinese MNEs’ location choices.

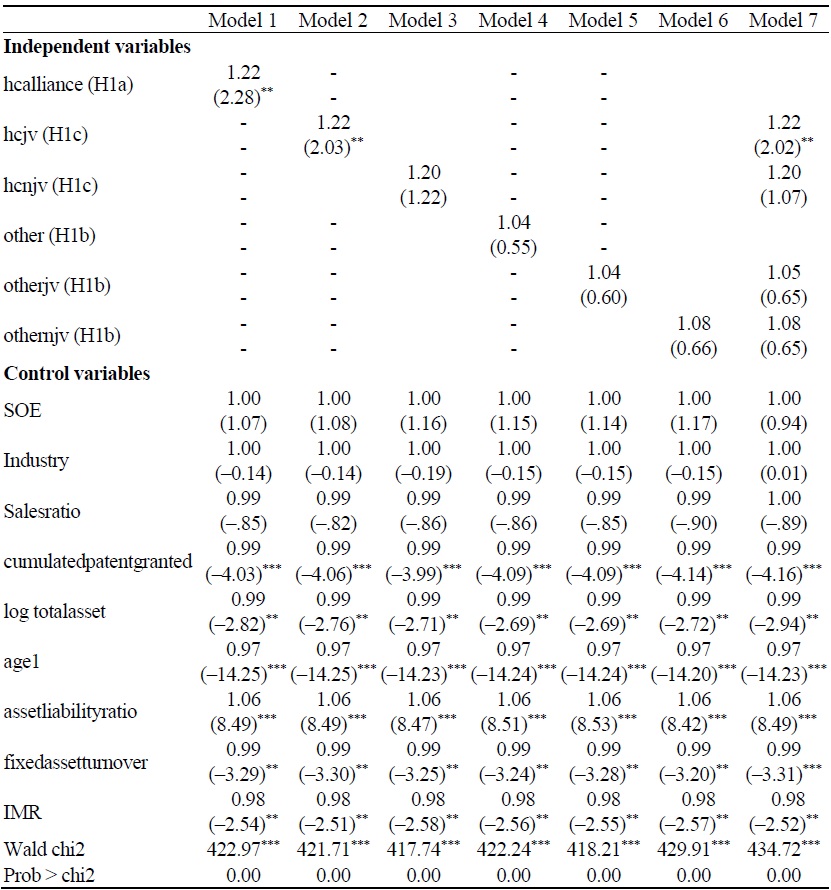

As can be seen from the Cox regression table, there are a total of 4,767 subjects with 4,767 observations, which means that there is only one observation for each subject. The likelihood ratio test refers to a comparison between firms with previous alliance experience with the host country and those that do not. According to the P-value, this model fits better than one without alliance experience. Inverse Mills Ratios are statistically significant which proved that it’s appropriate to use Heckman two stage estimation. Model one proved our Hypothesis 1a. For the variable

Models 2 and 3 agreed with our Hypothesis 1c—that if the previous alliance relationship with the focal host country is a joint venture rather than a non-joint venture, the company is more likely to make an initial investment as a wholly owned subsidiary in the focal host country. Building joint ventures with local partners enables MNEs to understand local markets more deeply (Chen et al., 2004), learn from foreign partners through institutionalized relationships, and develop mutual trust (Johanson and Vahlne, 2009). Based on the nature of the joint venture, it is more likely to build ‘insidership’ than a non-joint venture. ‘Insidership’ in relevant networks is important for internationalization and offers opportunities for trust building, learning, and commitment (Johanson and Vahlne, 2009; 2011).

Models 4 through 6 proved our Hypothesis 1b that if the previous alliance experience was obtained from a country other than the focal country, this would not have a significant impact on the company’s initial investment in the focal country. As can be seen from the results, although not significant, the hazard ratios for Hypothesis 1b are greater than 1. This indicates that if the firms have previous alliance experience, even if it is not with that focal host country, they may also have the potential to invest in that country. This may give us a hint that experience might be transferable between countries.

Control variables are the attribute of companies such as the number of patent granted to companies which represent innovation ability of the company; log form of total asset which represent the size of the companies etc. all of their hazard ratio are extremely close to one, thus the likelihood of initial entry choice is almost the same in both arms, in other words, they makes no difference whether the company choose the country they previously formed alliance as its initial entry or not.

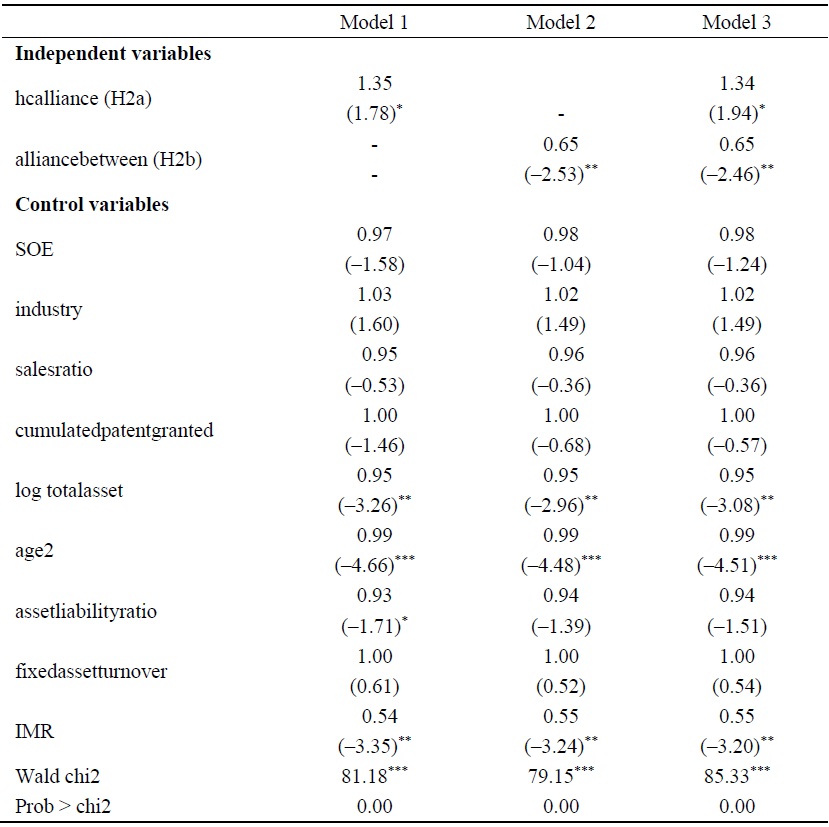

Based on the results presented in Table 3,

V. Conclusion and Limitations

The social capital gained from interfirm and intercountry linkages can play an important part in the location choices of Chinese MNEs. The paper pointed out that as long as Chinese MNEs have past experience (such as alliance experience) related to companies from a host country, this experience can have a significant impact on the initial and secondary location choices of Chinese MNEs. The social capital gained from previous alliance experience may include personal relationships, cognitive, reputation, which allows firms to gain useful information, cultural familiarity, and even a better reputation.

Based on the firm-specific advantages of Chinese MNEs, if companies from emerging economies, for example, China, had past alliance relationships with companies in the host countries, they will benefit from such connections, thus enabling them to more effectively achieve their goals in the host country with lower costs and more opportunities, regardless of whether the purpose of the MNE is to seek strategic assets or something else. Finally, this paper concludes that social capital can be derived from previous alliance experience with the host country before the initial entry, and it will have a positive and significant impact on initial and subsequent entries.

If the previous alliance experience is obtained from the joint venture form of alliance, it will have a greater impact on the location choices of Chinese MNEs than that obtained from the non-joint venture form of alliance. The alliance experience gained after the initial entry will have a negative impact on subsequent entries of wholly owned subsidiaries.

To sum up, this paper further verified that the gradual internationalization process explained by the IPM is effective in explaining the internationalization of Chinese MNEs. Based on the IPM, the paper explains the reasons behind the rapid growth of Chinese MNEs. This paper further expands the IPM by proving that the strategic alliance relationship can replace a strategy of gradually entering foreign markets, thereby increasing the survival rates of Chinese MNEs entering a host country for the first time (and making second investments within that focal host country). This paper also determined that this phenomenon may be due to the social capital gained from network linkages between Chinese MNEs and their foreign counterparts. If Chinese MNEs intend to enter a new line of business, it will be less likely for firms to make their second investment in the focal host country as a wholly owned subsidiary. For Chinese MNEs that intend to expand abroad, choosing countries with which they have previous associations may reduce the liability of their foreignness and shorten the adaption period.

As for the limitations of this paper, it does not include any subsidiary variable, which is extremely important when analyzing the performance of subsidiaries in the focal host countries. A subsidiary variable can be a key factor when analyzing the sequence of internationalization of Chinese MNEs. The result of subsequent entries cannot fully explain our theories for Hypothesis 2a, which may be due to the limited number of sample data on subsequent entries. In addition, although this paper focuses on the social capital obtained from previous alliances, it cannot specify exactly which social capital will affect the regional choices of Chinese MNEs, and how social capital will affect their internationalization sequence. Therefore, future studies may focus on how the social capital obtained from strategic alliances affects the performance or survival rate of subsidiaries in the host country.

Tables & Figures

Table 1.

Heckman Stage One Estimation Result: Dependent Variable Investment

Notes: Number of observations = 156,392; Z values are in parentheses.

*p < 0.1; **p < 0.05; ***p < 0.01.

Table 2.

Stratified Cox Regression Result of Initial Investment from A-share Listed Firms (Heckman Second-stage Estimation)

Notes: Number of observations = 4,767; Z values are in parentheses.

*p < 0.1; **p < 0.05; ***p < 0.01.

Table 3.

Stratified Cox Regression Model Result of Subsequent Entry from A-share Listed Firms (Heckman Second-stage Estimation)

Notes: Number of observations = 480; Z values are in parentheses.

*p < 0.1; **p < 0.05; ***p < 0.01.

References

-

Agarwal, S. and S. N. Ramaswami. 1992. “Choice of Foreign Market Entry Mode: Impact of Ownership, Location and Internalization Factors.”

Journal of International Business Studies , vol. 23, pp. 1-27.

-

Bolívar, L. M., Casanueva, C. and I. Castro. 2019. “Global Foreign Direct Investment: A Network Perspective.”

International Business Review , vol. 28, no. 4, pp. 696-712.

-

Buckley, P. J., Clegg, L. J., Cross, A. R., Liu, X., Voss, H. and P. Zheng. 2007. “The Determinants of Chinese Outward Foreign Direct Investment.”

Journal of International Business Studies , vol. 38, no. 4, pp. 499-518.

-

Casanova, L. and A. Miroux. 2016.

Emerging Market Multinationals Report (EMR) 2016 . Emerging Markets Institute, Cornell S.C. Johnson College of Business, Cornell University. -

Certo, S. T., Busenbark, J. R., Woo, H.-S. and M. Semadeni. 2016. “Sample Selection Bias and Heckman Models in Strategic Management Research.”

Strategic Management Journal , vol. 37, no. 13, pp 2639-2657.

-

Chang, S. J. 1995. “International expansion strategy of Japanese firms: Capability building through sequential entry.”

Academy of Management Journal , vol. 38, no. 2, pp. 383-407.

-

Chang, S. J. and P. M. Rosenzweig. 2001. “The choice of entry mode in sequential foreign direct investment.”

Strategic Management Journal , vol. 22, no. 8, pp. 747-776.

-

Chen, H. and T.-J. Chen. 1998. “Network Linkage and Location Choice in Foreign Direct Investment.”

Journal of International Business Studies , vol. 29, no. 3, pp. 445-467.

-

Chen, T.-J., Chen, H. and Y.-H. Ku. 2004. “Foreign Direct Investment and Local Linkages.”

Journal of International Business Studies , vol. 35, no. 4, pp. 320-333.

-

Cleves, M., Gould, W. and Y. V. Marchenko. 2016.

An Introduction to Survival Analysis Using Stata , Revised 3rd edition. College Station, Texas: Stata Press. -

Coleman, J. S. 1988. “Social capital in the creation of human capital.”

American Journal of Sociology , vol. 94, suppl., pp S95-S120.

-

Du, J., Lu, Y. and Z. Tao. 2012. “Institutions and FDI location choice: The role of cultural distances.”

Journal of Asian Economics , vol. 23, no. 3, pp. 210-223.

-

Duanmu, J.-L. 2014. “A Race to Lower Standards? Labor Standards and Location Choice of Outward FDI from the BRIC Countries.”

International Business Review , vol. 23, no. 3, pp. 620-634.

-

Dunning, J. H. 1997. “The European Internal Market Programme and Inbound Foreign Direct Investment.”

Journal of Common Market Studies , vol. 35, no. 2, pp. 189-223.

-

Gomes-Casseres, B., Hagedoorn, J. and A. B. Jaffe. 2006. “Do alliances promote knowledge flows?”

Journal of Financial Economics , vol. 80, no. 1, pp. 5-33.

-

Henisz, W. J. and J. T. Macher. 2004. “Firm- and Country-level Trade-offs and Contingencies in the Evaluation of Foreign Investment: The Semiconductor Industry, 1994-2002.”

Organization Science , vol. 15, no. 5, pp. 537-554.

-

Hong, S. J., and S.-H. Lee. 2015. “Reducing Cultural Uncertainty Through Experience Gained in the Domestic Market.”

Journal of World Business , vol. 50, no. 3, pp. 428-438.

-

Johanson, J. and J.-E. Vahlne. 1977. “The Internationalization Process of the Firm–A Model of Knowledge Development and Increasing Foreign Market Commitments.”

Journal of International Business Studies , vol. 8, no. 1, pp. 23-32.

-

Johanson, J. and J.-E. Vahlne. 1990. “The mechanism of internationalisation.”

International Marketing Review , vol. 7, no. 4.

-

Johanson, J. and J.-E. Vahlne. 2009. “The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsidership.”

Journal of International Business Studies , vol. 40, no. 9, pp. 1411-1431.

-

Johanson, J. and J.-E. Vahlne. 2011. “Markets as networks: Implications for strategy-making.”

Journal of the Academy of Marketing Science , vol. 39, no. 4, pp. 484-491.

-

Kang, Y. and F. Jiang. 2012. “FDI Location Choice of Chinese Multinationals in East and Southeast Asia: Traditional Economic Factors and Institutional Perspective.”

Journal of World Business , vol. 47, no. 1, pp. 45-53.

-

Knoke, D. 2009. “Playing Well Together: Creating Corporate Social Capital in Strategic Alliance Networks.”

American Behavioral Scientist , vol. 52, no. 12, pp. 1690-1708.

-

Kogut, B. 1983. “Chapter 2: Foreign direct investment as a sequential process.” In Kindleberger, C. P. and D. B. Audretsch. (eds.)

The multinational corporation in the 1980s . Cambridge, Mass.: MIT Press. pp. 38-56. -

Koka, B. R. and J. E. Prescott. 2002. “Strategic Alliances as Social Capital: A Multidimensional View.”

Strategic Management Journal , vol. 23, no. 9, pp. 795-816.

-

Kolstad, I. and A. Wiig. 2012. “What Determines Chinese Outward FDI?”

Journal of World Business , vol. 47, no. 1, pp. 26-34.

-

Kuo, C.-L. and W.-C. Fang. 2009. “Psychic distance and FDI location choice: Empirical examination of Taiwanese firms in China.”

Asia Pacific Management Review , vol. 14, no. 1, pp. 85-106 -

Lei, H.-S. and Y.-S. Chen. 2011. “The Right Tree for the Right Bird: Location Choice Decision of Taiwanese Firms’ FDI in China and Vietnam.”

International Business Review , vol. 20, no. 3, pp. 338-352.

-

Li, J., Li, Y. and D. Shapiro. 2012. “Knowledge seeking and outward FDI of emerging market firms: the moderating effect of inward FDI.”

Global Strategy Journal , vol. 2, no. 4, pp. 277-295.

-

Li, X., Quan, R., Stoian, M.-C. and G. Azar. 2018. “Do MNEs from Developed and Emerging Economies Differ in Their Location Choice of FDI? A 36-year Review.”

International Business Review , vol. 27, no. 5, pp. 1089-1103.

-

Luo, Y. and R. L. Tung. 2007. “International Expansion of Emerging Market Enterprises: A Springboard Perspective.”

Journal of International Business Studies , vol. 38, no. 4, pp. 481-498.

-

Luo, Y. and S. L. Wang. 2012. “Foreign Direct Investment Strategies by Developing Country Multinationals: A Diagnostic Model for Home Country Effects.”

Global Strategy Journal , vol. 2, no. 3, pp. 244-261.

-

Mathews, J. A. 2006. “Dragon Multinationals: New Players in 21st Century Globalization.”

Asia Pacific Journal of Management , vol. 23, pp. 5-27.

-

Meyer, K. E. and O. Thaijongrak. 2013. “The Dynamics of Emerging Economy MNEs: How the Internationalization Process Model Can Guide Future Research.”

Asia Pacific Journal of Management , vol. 30, no. 4, pp. 1125-1153.

-

Musteen, M., Francis, J. and D. K. Datta. 2010. “The influence of international networks on internationalization speed and performance: A study of Czech SMEs.”

Journal of World Business , vol. 45, no. 3, pp. 197-205.

-

Pananond, P. and A. Giroud. 2016. “Asian Emerging Multinationals and the Dynamics of Institutions and Networks.”

Asian Business & Management , vol. 15, no. 4, pp. 255-263.

-

Peng, M. W. and K. Meyer. 2011.

International Business . London: Cengage Learning EMEA. -

Quer, D., Claver, E. and L. Rienda. 2012. “Political Risk, Cultural Distance, and Outward Foreign Direct Investment: Empirical Evidence from Large Chinese Firms.”

Asia Pacific Journal of Management , vol. 29, no. 4, pp. 1089-1104.

-

Ruzzier, M. and M. K. Ruzzier. 2015. “On the relationship between firm size, resources, age at entry and internationalization: The case of Slovenian SMEs.”

Journal of Business Economics and Management , vol. 16, no. 1, pp. 52-73.

-

Smith, T. C., Smith, B. and M. AK Ryan. 2003. “Survival Analysis Using Cox Proportional Hazards Modeling for Single and Multiple Event Time Data.” Paper presented at the 28th Annual SAS Users Group International Conference. Seattle. March 30–April 2, 2003.

https://support.sas.com/resources/papers/proceedings/proceedings/sugi28/254-28.pdf (accessed May 20, 2022) -

Strange, R., Filatotchev, I., Lien, Y. and J. Piesse. 2009. “Insider Control and the FDI Location Decision: Evidence from Firms Investing in an Emerging Market.”

Management International Review , no. 49, no. 4, pp. 433-454.