- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 26, No. 2, 2022. pp. 95-117.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2022.26.2.406

Number of citation : 0Determinants of Termination of Anti-dumping Measures: The Case of Korea

|

GS Global |

|

|

Kyung Hee University |

Abstract

This paper empirically examines what factors affected the termination of anti-dumping measures in Korea during the 2006-2019 period. Employing a meticulous literature review, the paper investigates the WTO’s and Korea’s rules on the termination of antidumping measures and sets up the related variables in the Cox proportional hazards model. The empirical results show that the GDP growth rate, employment, and trade competitiveness in domestic industries had positive effects on the hazard of the termination of AD measures, while free trade agreements had negative effects. By industry, the hazard of the termination of AD measures was less prominent in the steel industry, while it was more prominent in the machinery industry. These results imply that AD measures in Korea had the properties of a proper trade remedy policy and, at the same time, a protectionism tool to sustain its domestic industries, depending on industrial characteristics and other trade policies.

JEL Classification: F13, F14

Keywords

Anti-Dumping Measures, WTO Anti-dumping Agreement, Survival Analysis

I. Introduction

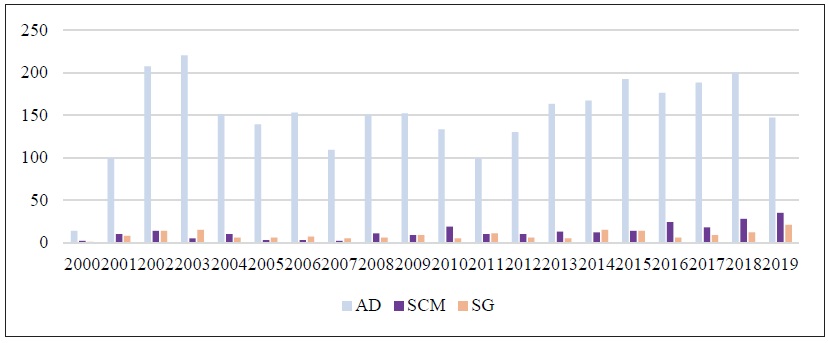

Under the regime of the World Trade Organization (WTO), trade remedy measures are the primary tools used to protect WTO members’ domestic industries from fair or unfair import penetration. WTO agreements introduce three main measures: antidumping (AD), subsidies and countervailing (SCM), and safeguard (SG) measures. These measures have their own targets and appropriate unilateral trade remedies with legitimacy. WTO members can impose AD and SCM when dumped and subsidized imports are causing harm to a domestic industry, respectively. WTO members can also impose SG to prevent or mitigate serious injury to a domestic industry from an unexpected increase in imports. Figure 1 shows the annual trend of trade remedies by WTO members from 2000 to 2019. In terms of the number of cases in force, AD measures are the most common trade remedy measure. WTO members levy import tariffs as AD duties in cases when the imported products cost less than their normal value. Accordingly, this paper focuses on AD rather than the other measures.

AD measures have been an important issue for both legitimacy and protectionism. From the point of view that an import tariff is a major instrument of traditional protection policies (Wall, 1999) and AD duties increase import prices and reduce import quantities (Sandkamp, 2020), AD measures are highly likely to be protectionist tools rather than providing legitimacy for trade remedies (Chang et al., 2019). Meanwhile, under the WTO regime, AD measures ensure fair competition by offsetting the effects of dumping which causes material injury to domestic industries (ICC, 2007). Dumping is qualified as being unfair and actionable (Müeller et al., 2009); thus, the WTO regime provides an international legal framework for AD.

The Korean government recognizes the importance of the trade remedy system for its small trade-dependent economy and is concerned about reducing the abusive use of AD measures. Korea is one of top 10 target countries in terms of AD.2 Egger and Nelson (2011) showed that the main AD users before 2000 were traditional industrial countries, such as the US, the EU, Canada, and Australia, while developing or transition countries, such as Argentina, Brazil, Mexico, Korea, and Turkey, became the main users after 2000. Accordingly, the Korean government attached considerable importance to AD measures in its free trade agreement (FTA) provisions (Sohn, 2020).

This paper empirically examines what factors affected the termination of AD measures in Korea from 2006 to 2019 in order to determine whether they were operated as protectionist or trade remedy measures. According to Blonigen and Prusa (2015), previous studies on AD issues mainly focused on the motivation for dumping and the role of AD measures in the structure of multilateral trade liberalization. Also, the WTO Regime and FTAs stipulate the procedures for the initiation and enforcement of AD measures in detail, but pay less attention to their terminations. Legal basis for determining the termination of AD measures is relatively deficient. It is surprising that little is known about the terminations of AD measures and their rationales in trade policies. In this context, this paper focuses on the determinants of terminating AD measures which have not received sufficient attention compared to other AD issues. In addition, the Korean government has been trying to alleviate AD issues through trade negotiations such as FTAs, yet WTO members have filed several AD disputes against Korea in the WTO.3 This implies that the Korean authority’s practices are under challenge based on consistency with the WTO’s AD rules. Thus, there is a need to determine whether AD measures in Korea are a protectionist tool or a trade remedy by examining the determinants of terminating AD measures as well as their motivations. As the WTO Regime and the Korean Customs Act emphasize various characteristics of a domestic industry for reviewing AD measures, we focus on them rather than other factors in Korea. Consequently, this is the first convergence research of Economics and law that empirically examines whether and how various characteristics of domestic industries affect the termination of AD measures in Korea, based on legal grounds.

This paper is organized as follows. In Section II, we delve into the WTO’s and Korea’s rules on AD, focusing in particular on the termination provisions, in order to identify the important factors. In Section III, we review previous literature and establish the econometric specifications. In Section IV, we estimate the determinants of terminating AD measures in Korea during the 2006-2019 period using the Cox proportional hazards model. In Section V, we summarize the empirical results and suggest some implications for AD policies for Korea as well as compliance with global strategies.

1)I-TIP,

2)According to the WTO I-TIP, the number of AD cases in force is 137 for Korea, which is the second greatest ones after China’s 645 cases as of June 30, 2021.

3)The examples of Korea’s WTO AD disputes as the respondent are: DS553: Korea — Sunset Review of Anti-Dumping Duties on Stainless Steel Bars, DS504: Korea — Anti-Dumping Duties on Pneumatic Valves from Japan, and DS553: Korea — Sunset Review of Anti-Dumping Duties on Stainless Steel Bars

II. Anti-Dumping Measures in the WTO’s and Korea’s Rules

1. The GATT/WTO Regime

Article 6 of the General Agreement on Tariffs and Trade (GATT) contains the definition of dumping and the conditions for imposing AD duties. The conditions include dumping activity, material injury to a domestic industry, and causation between them. In 1995, the WTO set up the Anti-dumping Agreement (ADA) to bind all WTO members on AD measures (Müeller et al., 2009). The WTO ADA clarifies the meanings of the key concepts in the GATT and provides practical guidance for WTO members (Matsushita et al., 2015). Hence, the legal framework on AD in the WTO regime mainly comes from Article 6 of the GATT and the WTO ADA. The important distinction between the WTO ADA and Article 6 of the GATT is that the former deals with termination procedures of AD measures, such as duration and review, while the latter does not include them. In paragraph 1 of Article 11, the WTO ADA establishes the principles on the duration of AD measures and addresses that AD duties shall remain in force only as long as needed and to the extent necessary to counteract a dumping which is causing injury.

Article 11 of the WTO ADA introduces two review procedures. In paragraph 2 of Article 11, the WTO ADA stipulates an administrative review of AD measures, stating that “authorities shall review the need for the continued imposition of the duty on their own initiative or … upon request by any interested party.” During the review process, authorities examine whether the injury would be likely to continue or recur if AD measures are removed. If AD measures are no longer warranted as a result of the review, they are to be terminated immediately. The other procedure is the sunset review outlined in paragraph 3 of Article 11 of the WTO ADA. The sunset review represents that any AD measure shall be terminated on a date not later than five years from its imposition. However, the provision also contains an exception to the sunset review. The exception clause stipulates that authorities can determine whether the expiry of the duty would likely lead to the continuation or recurrence of dumping and injury prior to the scheduled date. In addition, authorities can initiate the review on their own (self-initiated) as well as in response to requests from interested parties. Accordingly, the exception clause provides the legal ground to extend AD measures for WTO members. If authorities decide to maintain AD measures, their terminations are not mandatory. Thus, AD measures may stay in place for long periods.

Authorities should assess whether or not dumping and injury to a domestic industry happen and persist based on forward-looking predictions for what would be likely to occur if AD measures are terminated (Vermulst, 2005). The definitions of dumping and injury are clear in the WTO ADA.4 However, the provisions of the WTO ADA do not provide any standard to assess dumping and injury in review procedures for AD measures. With respect to calculating the dumping margin, authorities generally have a less stringent obligation in the review procedure than that in the original investigation. Furthermore, authorities are not required to demonstrate a causation between future dumping and injury in the review procedure; the authorities are obliged to consider the likelihood of dumping and injury, but not causation. Hence, the ambiguity of standards for review procedures may cause an abuse of AD measures as a protectionist tool. This is why we should empirically examine whether and how various factors affect the termination of AD measures.

The WTO Dispute Settlement Body (DSB) established the case laws for this issue. Based on these case laws, Mavroidis (2012) concluded that authorities should apply the standards in Articles 2 and 3 of the WTO ADA when assessing dumping and injury to a domestic industry in the review process to avoid inconsistencies with the WTO DSB case laws. Although the WTO DSB emphasizes that an original AD investigation cannot be automatically imported into a review process because they are distinct processes with different purposes, authorities must meet substantive requirements for any investigation. Paragraph 7.158 in the Panel Report of DS405 also addresses that a determination under Article 11.3 should be based on positive evidence, have a sufficient factual basis, involve a rigorous examination, and be supported by reasoned and adequate conclusions. Accordingly, we conclude that the substantive provisions of Articles 2 and 3 of the WTO ADA may well be relevant to an analysis in a review procedure under Article 11.3 so that authorities can make reasoned conclusions regarding the likelihood of continuation or the recurrence of dumping and injury. During the review stage, an analysis of causation from the original investigation is still valid and does not need to be reestablished under Article 11 of the WTO ADA. This ambiguity also provides the rationale behind the need for our empirical analyses.

2. The Customs Act of Korea

In Korea, the Customs Act5 stipulates the definitions, elements, and procedures of AD measures that Korean authorities, the Ministry of Economy and Finance (MOEF) and the Korea Trade Commission (KTC) should abide by. The main feature of the AD provisions in the Customs Act is very consistent with the WTO ADA. In particular, Article 56 of the Customs Act provides the provisions for the review and termination of AD measures. Paragraph 1 of Article 56 stipulates that, if necessary, the MOEF may review the assessment of AD, modify its details, and provide a refund. Paragraph 2 of Article 56 also stipulates that the assessment of AD shall become invalid 5 years after the date of its imposition. The WTO ADA also includes the same provisions.

Meanwhile, one of the notable provisions in the Customs Act is paragraph 2 of Article 52, which states that, if necessary, the KTC may consider enhancement of competitiveness in relevant industries, domestic market structure, price stabilization, and trade cooperation with trading partners when assessing AD measures. This provision grants a certain degree of discretion when assessing AD measures, focusing on trade competitiveness. However, the WTO ADA does not have this provision.

The Enforcement Decree of the Customs Act6 stipulates the detailed elements for AD measures. In particular, Article 70 of the Enforcement Decree sets out the detailed administrative proceedings for the review of AD measures. Paragraph 1 of Article 70 stipulates that the KTC should review an AD case when requested by any interested party providing evidential data or based on its own need. Paragraph 1 of Article 63 of the Enforcement Decree stipulates that the KTC should investigate material injuries when provided concrete evidence based on the following matters: import quantities, the price of the dumping good, the extent of the dumping margin, and other characteristics of a relevant domestic industry, including output, operating rate, inventory, sales, market share, price, profits, productivity, investment returns, cash flow, employment, wages, growth, capital financing, investment capability, and technological development. Paragraph 2 of Article 63 also stipulates that the KTC should consider the remarkable increasing rate of the dumping good, the substantial expansion of the production capacity, the effects on the price of similar products, and inventories of relevant products when determining whether injury is threatened by dumped imports. These industrial characteristics are detailed in paragraph 4 of Article 3 of the WTO ADA.

4)Article 2 of the WTO ADA defines dumping as introducing into the commerce of another country at less than its normal value. Also, Footnote 9 of the WTO ADA states that injury to a domestic industry can be material injury or threat of material injury or material retardation of its establishment.

5)Act No. 18583, December 31, 2021.

6)Presidential Decree No. 32449, February 17, 2022.

III. Literature Review and Econometric Specifications

1. Previous Studies

The initiation and enforcement of AD measures are precedent to their terminations. Thus, studies on the initiation and enforcement of AD measures will provide useful information for understanding which factors affect their terminations. Many studies have referred to the importance of both economic and political factors when adopting AD measures. Vandenbussche et al. (2008) empirically examined the determinants of the decision to adopt AD rules in 108 countries during the 1980-2003 period and found that retaliatory motives as a political variable were at the heart of their proliferation. However, they also found that high value added and the size of the agricultural sector as economic motives significantly affected the likelihood to adopt AD rules. Finally, they found that, after adopting AD rules, countries often used AD measures to protect intermediate inputs into the manufacturing process, which typically had smaller profit margins and a larger number of employees.

Using the panel data of AD cases in the US chemical industry during the 1976-1988 period, Krupp (1994) analyzed the likelihood of AD filing and found that total number of employees, average wages, the production index, and the import penetration ratio positively affected it. Similarly, Blonigen (2005) found that lower corporate profitability and higher unemployment increased AD filings in the US during the 1980-2000 period. Oliveira (2014) examined the applications of AD duties in Brazil using the panel data from 93 industrial sectors during the 1996-2007 period and found that imports had a positive effect with high statistical significance. Accordingly, they concluded that industries with greater productivity would be more competitive and able to sustain against import penetration, thereby making them less likely to seek AD measures.

Several studies have examined economic variables as evidence for protectionism. For example, Ahn and Shin (2011) analyzed major AD user countries during the 1995-2009 period and found that exports and GDP growth positively affected AD investigations whereas FTAs negatively affected them. Furthermore, they determined that the positive relationship between GDP growth and AD investigations was more prominent in developed countries and interpreted these results as strong protection-seeking activities and political demands from marginalized industries. In other words, interested parties in marginalized industries were likely to request protection and be easily granted because GDP growth led to greater import growth. Firme and Vasconcelos (2020) examined the determinants of AD measures for 46 AD-imposing countries during the 1995-2013 period and concluded that retaliation and imports growth increased AD cases. They found that AD-targeted countries were more inclined to initiate AD processes.

For trade policies, previous studies have shown that their effects on AD measures were diverse. Firme and Vasconcelos (2020) found that higher import tariffs increased the number of AD measures. Meanwhile, Sudsawasd (2012) analyzed 56 countries during the 1995-2007 period and found that the effects of tariff liberalization on AD measures varied across regions. For European, North American, and Latin American countries, a lower tariff rate induced more use of AD measures, which is inconsistent with the results from Firme and Vasconcelos (2020). Sudsawasd (2012) concluded that such AD measures emerged as a protection tool among trade liberalization regimes. Similarly, Bown and Tovar (2011) analyzed Indian cases during the 2000-2002 period and found that Indian authorities used AD measures as a substitute for tariffs. They concluded that the policies of trade liberalization in India were reversed with import-restricting measures such as AD.

Similar to our paper, several studies examined the determinants of terminating AD measures. Moore (2006) analyzed the US decision on the review of AD in 1998 and provided an econometric analysis of the sunset review. He showed that the determinants of AD withdrawal varied across industries. In particular, he found that domestic industries with higher wages and share of imports were more likely to remove AD measures and concluded that the review decisions were in accordance with the AD law. Rutkowski (2007) analyzed the withdrawals of complaints on EU AD cases through collusion during the 1996-2004 period and showed that domestic political economy, international strategic trade policy, international industry-level bargaining, and sectoral characteristics affected the probability of collusion for the withdrawals of AD measures. Gourlay and Reynolds (2012) analyzed the US AD cases during the 1995-2006 period and found that original AD measures with a higher deposit rate and/or a higher value of imports were less likely to be reviewed. For multiple countries, Choi (2017) empirically examined the determinants of terminating AD cases in the US, the EU, China, and India during the 1996-2015 period and showed that market shares, tariff rates, and dumping margins decreased the probability of termination whereas value added increased it. Accordingly, he concluded that WTO members regulated the overuse of AD measures, following Article 11 of the WTO ADA.

2. The Cox Proportional Hazards Model

Following Vandenbussche et al. (2008), Besedes and Prusa (2017), and Choi (2017), we consider Cox’s (1972) proportional hazards model (hereinafter referred as the Cox model) to empirically examine which factors affected the termination of AD measures in Korea. The Cox model is a survival analysis model that estimates the survival function of a survival time—namely, a time until failure. Suppose that the random variable

The survival function showing the probability that the spell is greater than

The hazard function

The hazard rate is the rate at which the spell is completed (or fails) after duration

Our objectives are to assess the association among several factors and the hazard of the termination. For this, one of the most popular regression techniques is the Cox model. Based on (1) through (3), the Cox model suggests a semiparametric regression method to measure the effects of covariates on the hazard of the termination.

In (4),

3. Econometric Equations

(4) can be transferred to the relative hazard, which is the ratio of the hazard to the baseline one at

where

AD measures are in force for the specific period of time before they are terminated or withdrawn in the next period of time. Following Choi (2017), the hazard rate is proxied as the duration of AD measures terminated during the sample period and, thus, a multiplication of two variables:

According to Article 11 of the WTO ADA, AD measures shall be terminated depending on the continuation or recurrence of dumping and injury without them. Thus, the termination of AD measures highly depends on variables related to the continuation of dumping and injuries to domestic industries. We consider these variables based on previous studies introduced in Section II. With the regression results, we can speculate whether Korean authorities regulate the overuse of AD measures as a protectionist tool.

We consider

The remaining variables represent various characteristics of industries in which products being subject to AD measures belong.

We consider two types of trade competitiveness indices: the Trade Specialization Index (TSI) and the Revealed Comparative Advantage (RCA). TSI is the value of trade balance divided by the sum of imports and exports for industry

Finally, in some regressions we consider dummies for four industries (

4. Data and Summary Statistics

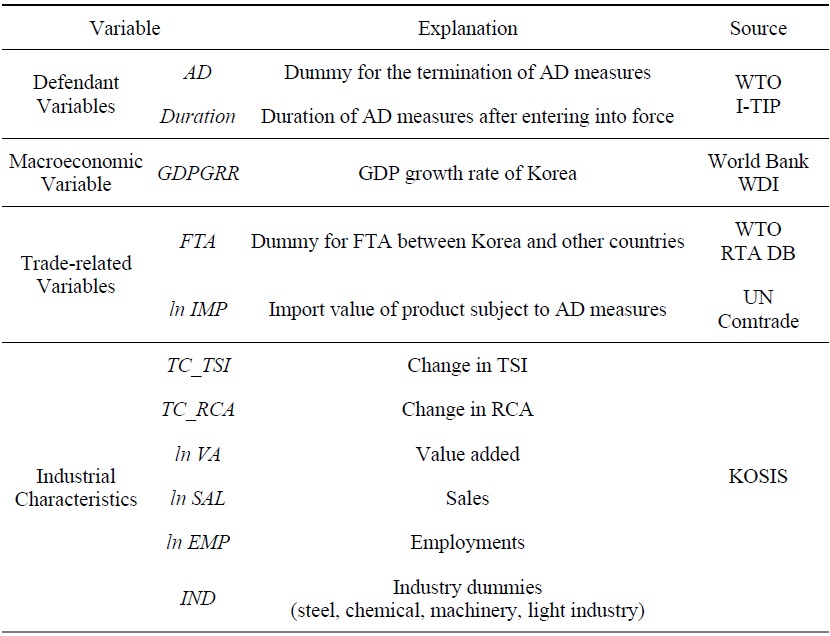

Table 1 lists the variables and their data sources. The data on Korea’s AD measures were extracted from the WTO Integrated Trade Intelligence Portal (WTO I-TIP), which provides information on trade remedies such as AD, SCM and SG, and nontariff measures (NTMs). All information in WTO I-TIP is based on WTO members’ notifications (Yotov et al., 2016). For AD measures, the Korean government provided information on durations in force and withdrawal, target countries, and products in the 6-digit Harmonized System (HS).

GDP growth rates of Korea were extracted from the World Bank’s World Development Indicators (WDIs). FTAs and import value were extracted from the WTO Regional Trade Agreement (RTA) and the UN Commodity Trade Statistics (Comtrade) databases, respectively. The Korean Statistical Information Service (KOSIS) provides RCA and TSI indices, value added, sales, and the number of employees using the 4-digit Korea Standard Industry Code (KSIC). As AD measures are based on the 6-digit HS, we converted them to the 4-digit KSIC with the correlation tables provided by the KOSIS.

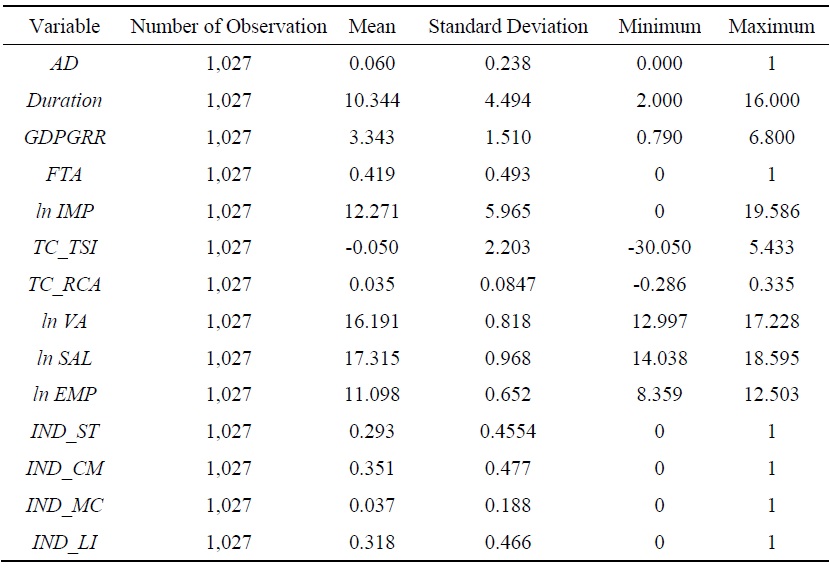

Table 2 reports the summary statistics.

7)Many previous studies considered both indices as major proxies for a level of trade competitiveness

IV. Empirical Results

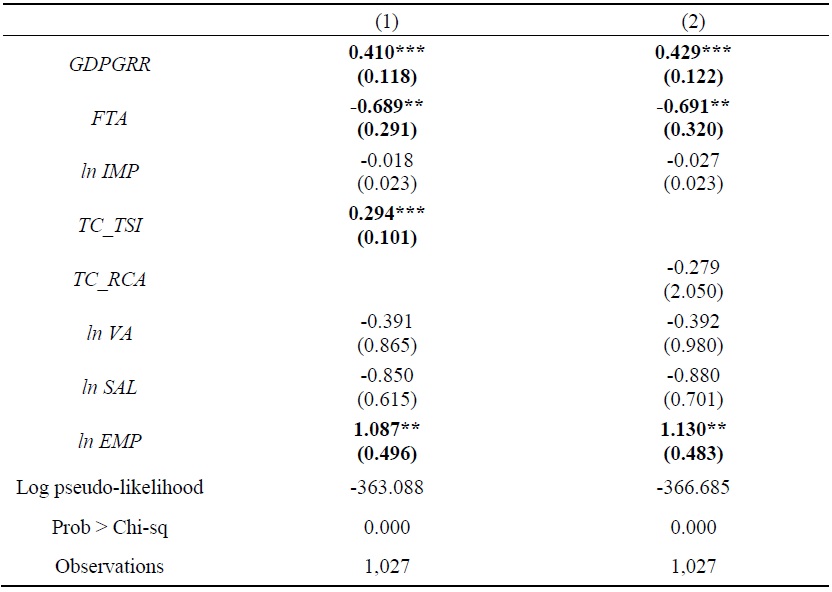

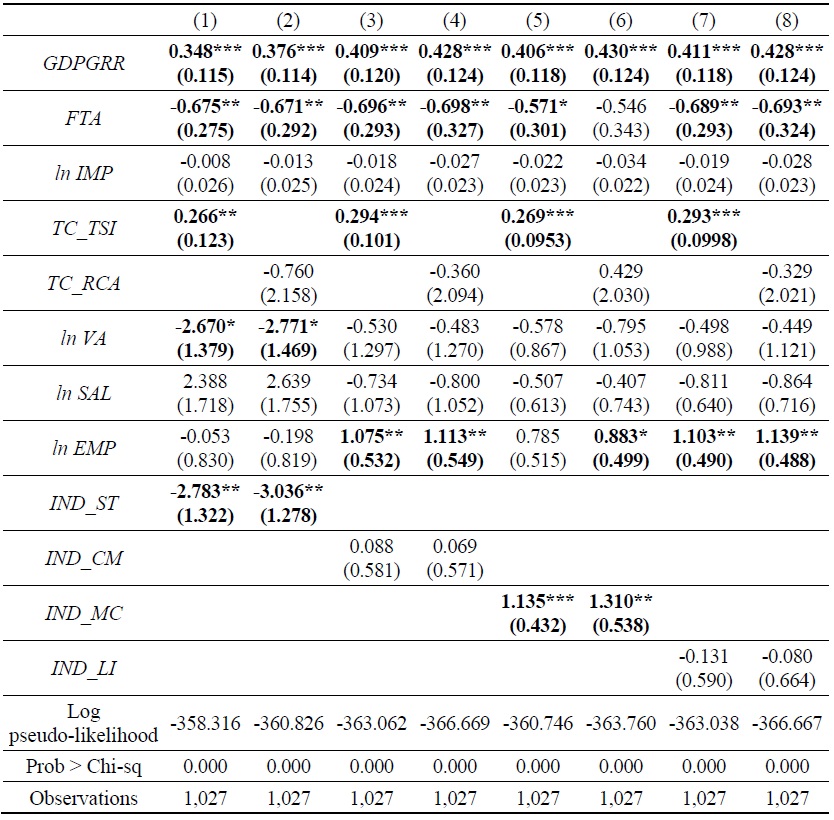

Table 3 reports the baseline results of the Cox model. Columns (1) and (2) show the results with TSI and RCA as proxies for trade competitiveness, respectively. The coefficient estimates of

For trade-related variables, the coefficient estimates of FTA are significantly negative in all columns, supporting argument of Sudsawasd (2012) and of Bown and Tovar (2011). Although Korea’s FTAs contain various WTO-plus provisions for AD measures, tariff reductions induced by FTAs may negatively affect the termination of AD measures as a protection tool among trade liberalization regimes. We speculate that the substitute effects of AD measures for tariff reductions dominated the complementary effects of WTO-plus provisions. In addition, AD provisions in Korea’s FTA did not include any content for the termination and were not legally binding. AD provisions for cooperation in Korea’s FTAs were mostly applied to initiation and investigation stages rather than the termination.

The coefficient estimates of

For variables of trade competitiveness, the coefficient estimates of

For variables of other industrial characteristics, the coefficient estimates of

Meanwhile, the WTO DSB’s view on AD matters is that authorities are required to appreciate evidence as a whole, not a selective assessment (Becroft, 2014). Moore (2006) addressed that the impact on wages and employment, rather than profits and sales, may play an important role in its broader decision-making processes. Accordingly, the positive coefficient estimates of

Table 4 adds four industry dummies (

In Table 4, the coefficient estimates of

Meanwhile, the coefficient estimates of

8)Also, we speculate that these different results, compared to

V. Conclusion

In this paper, we have empirically examined what factors affected the termination of AD measures in Korea during the 2006-2019 period. Based on our meticulous literature review and considering the articles of the WTO ADA and the Customs Act of Korea, we set up related variables and regression models for our empirical analyses. The estimation results of the Cox model show that the GDP growth rate, employment, and TSI as a proxy for trade specification in domestic industries had positive effects on the hazard of terminating AD measures. These results imply that, on one hand, Korean authorities mainly considered the economic performances of domestic industries when dealing with the termination of AD measures and thus used them as instruments for trade remedies under Article 11 of the WTO ADA and Article 52 of the Customs Act. On the other hand, the empirical results also show that FTAs that reduced tariffs had negative effects on the hazard of terminating AD measures. These results imply that Korean authorities seemed to use AD measures as a substitute for tariff reductions by FTAs; as a result, they emerged as a protection tool among trade liberalization regimes. By industry, the hazard of terminating AD measures was less prominent in the steel industry, implying that Korean authorities seemed to pursue a sustainable level of steel production given the overcapacity in the world market, thereby considering AD measures as a protectionism tool. Meanwhile, the hazard of terminating AD measures was more prominent in the machinery industry, implying that Korean authorities were less protective and had more open-door policies regarding it.

An AD measure is not necessarily a protectionist tool when it is effectively controlled by the WTO ADA. Through legal and empirical analyses, we found that AD measures in Korea had properties of a proper trade remedy policy, following Article 11 of the WTO ADA, and at the same time served as a protectionism tool to sustain its domestic industries based on industrial characteristics and other trade policies. Our results imply that the AD provisions of Korea’s FTAs did not affect Korean authorities’ positive decision on the termination of AD measures, although they had some WTO-plus contents. In other words, Korea’s FTAs played a weak role in the review process for AD measures. In the Mega FTA negotiations, rules and regulations in global economic governance are important issues (Chen et al., 2019). Hence, the Korean government should adopt more effective provisions for review procedures to mitigate abuses of AD measures as a protectionism tool in future trade negotiations.

The paper has several limitations in its econometric specifications. First of all, we did not consider characteristics of exporting countries such as their GDPs, import penetrations, and cumulative numbers of AD measures at this time. We recognize that they are also important variables, especially as political factors, and thus the estimation results may suffer from the potential endogeneity problem. In this paper, we focus on various characteristics of domestic industries according to our research objectives based on the WTO ADA and the Korean Customs Act. Also, countries that Korea imposed AD measures were very limited such as the United States, the European Union, China, and Japan. Meanwhile, it will be an interesting issue whether and how various characteristics of target countries may affect the termination of AD measures in Korea, especially focusing on political factors. We will leave these issues to future work.

Tables & Figures

Figure 1.

WTO Members’ Trade Remedies from 2000 to 2019

Source: WTO Integrated Trade Intelligence Portal

Table 1.

Variables and Data Sources

Table 2.

Descriptive Statistics

Table 3.

Hazard Regression: Baseline Results

Notes: 1. *, **, *** denote significance at 1%, 5%, and 10% levels, respectively.

2. Figures in parentheses are robust standard errors.

Table 4.

Hazard Regression: Including Industry Dummies

Notes: 1. *, **, *** denote significance at 1%, 5%, and 10% levels, respectively.

2. Figures in parentheses are robust standard errors.

References

-

Ahn, D. and W. Shin. 2011. “Analysis of Anti-dumping Use in Free Trade Agreements.”

Journal of World Trade , vol. 45, no. 2, pp. 431-456. - Bae, C., Kim, J., Keum, H. and Y. J. Jang. 2012. “The Impact of Free Trade Agreements on Economic Performance in Korea.” KIEP Policy Reference, no. 12-03, Korea Institute for International Economic Policy. (In Korean)

-

Balassa, B. 1965. “Trade Liberalisation and ‘Revealed’ Comparative Advantage.”

Manchester School , vol. 33, no. 2, pp. 99-123.

-

Becroft, R. 2014. “The WTO Standard of Review: A Means to Strengthen the Trading System.” In Frankel, S. and M. K. Lewis. (eds.)

Trade Agreements at the Crossroads . New York: Routledge. pp. 66-80. -

Besedes, T. and T. J. Prusa. 2017. “The Hazardous Effects of Antidumping.”

Economic Inquiry , vol. 55, no. 1, pp. 9-30.

-

Blonigen, B. A. 2005. “The Effects of NAFTA on Antidumping and Countervailing Duty Activity.”

World Bank Economic Review , vol. 19, no. 3, pp. 407-424.

- Blonigen, B. A. and T. J. Prusa. 2015. “Dumping and Antidumping Duties.” NBER Working Paper, no. 21573. National Bureau of Economic Research.

-

Bown, C. P. and P. Tovar. 2011. “Trade Liberalization, Antidumping, and Safeguards: Evidence from India’s Tariff Reform.”

Journal of Development Economics , vol. 96, no. 1, pp. 115-125.

-

Chang, C.-L., McAleer, M. and D.-K. Nguyen. 2019. “US Antidumping Petitions and Revealed Comparative Advantage of Shrimp-exporting Countries.”

Reviews in Aquaculture , vol. 11, no. 3, pp. 782-792.

-

Chen, L., Urata, S., Nakagawa, J. and M. Ambashi. 2019.

Emerging Global Trade Governance: Mega Free Trade Agreements and Implications for ASEAN . New York: Routledge. -

Choi, N. 2017. “Did Anti-dumping Duties Really Restrict Import?: Empirical Evidence from the US, the EU, China, and India.”

East Asian Economic Review , vol. 21, no. 1, pp. 3-27.

- Choi, N. and H. Lee. 2010. “Analysis of Comparative Advantage Patterns and Its Policy Implications.” KIEP Policy Analysis, no. 10-01. Korea Institution for International Economic Policy. (In Korean)

-

Cox, D. R. 1972. “Regression Models and Life-Tables.”

Journal of the Royal Statistical Society, Series B (Methodological) , vol. 34, no. 2, pp. 187-220.

-

Egger, P. and D. Nelson. 2011. “How Bad Is Antidumping? Evidence from Panel Data.”

Review of Economics and Statistics , vol. 93, no. 4, pp. 1374-1390.

- Eom, J. 2014. “Comparison & Analysis of Anti-dumping Provisions in the FTAs signed by Korea.” KIEP World Economy Update, no. 4-38. Korea Institution for International Economic Policy.

-

Firme, V. and C. Vasconcelos. 2020. “Main Determinants of Opening Antidumping Cases: A Poisson Analysis Using Panel Data.”

International Trade Journal , vol. 34, no. 4, pp. 387-414.

- Gourlay, S. and K. M. Reynolds. 2012. “Political Economy of Antidumping Reviews: The Impact of Discretion at the International Trade Administration.” Department of Economics Working Paper Series, no. 2012-15. American University.

- International Chamber of Commerce (ICC). 2007. “Anti-dumping in the Doha Development Agenda.” Policy Statement Document, 103/281 rev3 final EN.

-

Jang, Y. 2020. “The Impact of Input and Output Tariffs on Domestic Employment across Industries: Evidence from Korea.”

Journal of Korea Trade , vol. 24, no. 8, pp. 1-18.

-

Krupp, C. 1994. “Antidumping Cases in the US Chemical Industry: A Panel Data Approach.”

Journal of Industrial Economics , vol. 42, no. 3, pp. 299-311.

-

Liu, X. 2009. “GATT/WTO Promotes Trade Strongly: Sample Selection and Model Specification.”

Review of International Economics , vol. 17, no. 3, pp. 428-446.

-

Lorenz, M., Lässig, R., Brown, J. and B. Myerholtz. 2020. “Winners Are Green, Smart, and Digital.”

BCG.com , Dec 11. Boston Consulting Group. -

Matsushita, M., Schoenbaum, T., Mavroidis, P. C. and M. Hahn. 2015.

The World Trade Organization: Law, Practice, and Policy . Oxford: Oxford University Press. -

Mavroidis, P. C. 2012.

Trade in Goods: The GATT and the Other WTO Agreements Regulating Trade in Goods . Oxford: Oxford University Press. - Mercier, F., Hijikata, T., Burrai, V. and L. Giua. 2021. “Steel Market Developments Q2 2021.” OECD Directorate for Science, Technology and Innovation, DSTI/SC(2021)1/FINAL.OECD.

-

Moore, M. O. 2006. “An Econometric Analysis of U.S. Antidumping Sunset Review Decisions.”

Review of World Economics , vol. 142, no. 1, pp. 122-150.

-

Mukherjee, P. M. and D. Roy. 2010. “Global Competitiveness in the Steel Industry.”

Asia-Pacific Business Review , vol. 6, no. 4, pp. 12-17.

-

Müeller, W., Khan, N. and T. Scharf. 2009.

EC and WTO Anti-Dumping Law: A Handbook . Oxford: Oxford University Press. -

Oliveira, G. A. S. 2014. “Industrial Determinants of Anti-dumping in Brazil – Protection, Competition and Performance: An Analysis with Binary Dependent Variable and Panel Data.”

EconomiA , vol. 15, no. 2, pp. 206-227.

-

Rutkowski, A. 2007. “Determinants of Withdrawals of Anti‐Dumping Complaints in the EU.”

Journal of Economic Policy Reform , vol. 10, no. 2, pp. 89-109.

- Saltykova, Y. 2021. “The Chinese Steel Market Transformation Influenced by the Economic Recession.” IOP Conference Series: Earth and Environmental Science, no. 650. IOPscience.

-

Sandkamp, A. 2020. “The Trade Effects of Antidumping Duties: Evidence from the 2004 EU Enlargement.”

Journal of International Economics , vol. 123, pp. 1-18. -

Sohn, K.-Y 2020. “Assessment of Korea’s FTAs: Focusing on Trade Remedies Rules.”

Journal of Korea Trade , vol. 24, no. 7, pp. 107-124. -

Sudsawasd, S. 2012. “Tariff Liberalization and the Rise of Anti-dumping Use: Empirical Evidence from Across World Regions.”

International Trade Journal , vol. 26, no. 1, pp. 4-18.

-

Vandenbussche, H., Zanardi, M., Guiso, L. and C. Schultz. 2008. “What Explains the Proliferation of Antidumping Laws?”

Economic Policy , vol. 23, no. 53, pp. 94-138. -

Vermulst, E. 2005.

The WTO Anti-Dumping Agreement: A Commentary . Oxford: Oxford University Press. -

Wall, H. J. 1999. “Using the Gravity Model to Estimate the Costs of Protection.”

Federal Reserve Bank of St. Louis Review , vol. 81, no. 1, pp. 33-40. -

Wooldridge, J. 2016.

Introductory Econometrics: A Modern Approach . Boston: Cengage Learning. -

Yotov, Y. V., Piermartini, R., Monteiro, J.-A. and M. Larch. 2016.

An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model . Geneva: World Trade Organization; New York: United Nations. -

Yu, J.-S. and H. Ding. 2019. “The Qualitative Trade Competitiveness of China in IT Industry: A Comparison to Korea and USA.”

Journal of Korea Trade , vol. 23, no. 3, pp. 20-37