- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 26, No. 3, 2022. pp. 205-225.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2022.26.3.411

Number of citation : 0The Impact of Government Assistance to State-owned Enterprises on Foreign Start-ups: Evidence from Yangtze River Delta

|

Dongbei University of Finance and Economics |

|

|

Dongbei University of Finance and Economics |

|

|

Jiangsu University |

|

|

Harbin Institute of Technology Shenzhen |

|

|

Jiangsu University |

Abstract

Different types of corporate ownership may affect the environment among firms and could influence the decisions of new entities in the region. This study determines the role of state-owned enterprises (SOEs) in hindering new foreign manufacturing firms in the Yangtze River delta (YRD). The negative binomial regression is used for city-sector level data and the following points summarize the results: Firstly, the unique privileges that SOEs enjoy alongside governmental support create difficulties for foreign firms trying to establish themselves near existing SOEs. Secondly, although core cities are more attractive to foreign firms than peripheral cities, the role of core-periphery reveals that, in spite of all the regional advantages core cities could offer, whenever the share of SOEs is higher, the core-periphery system will have an adverse impact on new foreign firms. In other words, government preference for SOEs can suppress the attraction of foreign start-ups. However, after 2008, the governmental authorities finally succeeded in implementing their promising policy of fair treatment and competition in only the core cities.

JEL Classification: L60, F23, H79

Keywords

New Foreign Firms, State-owned Enterprises, Core–periphery, Yangtze River Delta

I. Introduction

The decision to invest in a new firm is based on analyzing various political, economic, and social factors, the weight of each depends on the foreign investor’s motivation (Sârbu and Gavrea, 2014). Myles Shaver and Flyer (2000) argued that agglomeration externalities influence firms’ location decisions. In agglomerations, different types of firms’ ownership can generate favorable or unfavorable environments for other firms, and eventually it will affect the decisions of new entities and their entry rates into the region. He and Wang (2012) found that in transitional economies like China, firms’ ownership is critical in the creation of industrial clusters. Another study has investigated the links between, ownership, the emergence of new businesses, and firms’ size (Rosenthal and Strange, 2003), and indicated that industrial structure has an impact on the benefits of agglomeration within a given industry. On the one hand, He and Wang (2012) argued that SOEs may be the least eager to benefit from agglomeration economies. Likewise, Fu and Hong (2011) revealed that urbanization and localization economies did not help SOEs in a study applied to a sample of manufacturing firms, since they enjoy government subsidies, institutional advantages, and other policy advantages that have made them survive. In general, SOEs are more likely to be influential than to be affected by agglomeration externalities. On the other hand, foreign enterprises are the most reliant on agglomeration benefits in China, given they face business uncertainty and significant information asymmetry (He, 2002, 2006). Vakhitov and Bollinger (2010) also studied the effect of ownership on agglomerations and found that foreign-owned firms benefit more from agglomerations than any other type of ownership.

SOEs can be important to agglomerations, even if they do not have the inducement to get involved in firms’ clusters. They might form the cornerstone for agglomerations; the government can depend on them with massive industrial projects and infrastructure that the market cannot do alone. SOEs’ existence can increase the chances for new businesses and encourage them regionally (Gabe, 2003, 2009; Alcácer, 2004; Artz et al., 2016). On the contrary, and given that SOEs have more privileges and comparatively higher creditworthiness than other types of ownership, they have greater market access than foreign-owned firms due to their connection with the government. SOEs’ relationships with legislators may secure their state funding and give them access to legislation and laws that can serve their goals. These priorities might be discouraging for other new foreign firms willing to start businesses in regions with many SOEs. Foreign investors will probably consider problems created by competition, inadequate market information, and governmental support for their competitors.

Since 2004, the Yangtze River Delta (YRD) has replaced the Pearl River Delta as the top national regional FDI recipient to take the lead as the top regional FDI destination in the country. Additionally, we have observed a decline in the number of new foreign firms in the region, particularly in the major cities of YRD. Therefore, we focused on this economic region and shed light on how new foreign firms react to the presence of Chinese SOEs. We are assuming that new foreign firms tend to be distant from regions with the presence of many SOEs. We also extended the investigation to check the effect of the regional division of the delta cities according to the system of core cities ‘in which the economic activity is strongly concentrated’ and the peripheral cities ‘adjacent to core cities, as an opposed term’ to investigate whether the core-periphery system can affect the relationship.

This study included all the manufacturing sectors and applied the negative binomial regression using city-sector level data extracted from the Chinese Industrial Enterprises database. Empirically, it is found that although core cities still have more attraction to foreign firms than the peripheral cities of YRD, the dominance of the market by SOEs and the government’s support make it difficult for new foreign firms to establish near them. This was stated by studying the effect of SOEs on new foreign entities and the role of the core-periphery system in this relationship. It was revealed that despite all the advantages of core parts, whenever the share of SOEs is higher, the core-periphery system will have an adverse impact on new foreign firms, as governmental and political influence can suppress the attraction of new foreign firms. The rest of this study is organized as follows: the second section reviews prior literature explaining the above theories. Section III presents the data source and the corresponding methodology. Section IV discusses the results, and Section V provides the research conclusion.

II. Literature Review and Hypothesis Formation

This study presents the impact of state-owned enterprises’ presence and policies that affect the birth of new foreign firms. Then it discusses the core-periphery theory and how firms are affected by the attraction forces from different parts of YRD. Hypotheses are formed after the discussions.

1. The Effect of State-owned Enterprises’ Presence

The fast development of SOEs has had a number of negative implications for China’s economy, primarily through impeding fair competition between SOEs and other enterprises of different ownership. Branstetter and Feenstra (2002) examined FDI in China on a provincial level by evaluating the structural parameters of the government’s welfare function using 29 provincial data from 1984 to 1995. They find that international companies compete with state-owned industries, and the Chinese government is attempting to hinder international companies’ ability to engage in the Chinese market. Indeed, Incentive policies for foreign companies are a significant consideration, particularly in developing nations (Sun et al., 2002; Ali and Guo, 2005). Although government efforts are attributed to largely attracting FDI, local authorities generally support local firms, even with the low efficiency of SOEs’ production (Lin et al., 1998; Firth et al., 2006), the Chinese economy was strongly dependent on the public sector (Lin et al., 2020), SOEs generally attempt to target both political and commercial objectives (Dewenter and Malatesta, 2001; Qi and Kotz, 2020) in order to ensure social stability and stimulate growth in the economy. In addition, SOEs have the ability to invest in capital-intensive industries and infrastructural projects that the market cannot achieve on its own since these investments require lump-sum payments, imports of equipment, and long-term commitments (Lin et al., 1998; Lin and Tan, 1999; Geng et al., 2009). SOEs have recently become a source of increasing concern between China and many of its international business relations. The key criticism from the international community is that the Chinese government provides SOEs preferential treatment. The SOEs’ dominance results in uneven market competition and political regulation between state and non-state sectors, as well as the SOEs’ preferential access to business information and policy changes, which can inhibit other industrial operations and limit equal opportunities. Government procurement policies, according to (Nolan and Xiaoqiang, 1999), are an essential tool for protecting state enterprises.1 Moreover, SOEs enjoy state cheap loans and land, and even governmental subsidies (Luo et al., 2010; Harrison et al., 2019), especially in recessions or losses, where SOEs have fewer risks than foreign firms, making them relatively more creditworthy with guaranteed lower interest rates. Indeed, the high protection by local authorities keeps them more secure in the market (Bai et al., 2004). However, SOEs are involved in monopolistic practices and abusive behavior of market power because of the lack of strict public accountability and fair competition. The SOEs have frequently exploited their market position by engaging in monopolistic pricing practices to establish excessive product and service prices. The government enterprises’ influence over key resources should not interfere with competitive markets or impede progress. This demonstrates that the dominance of SOEs over critical sectors and their monopolistic activities preclude private and international companies from competing on an equal playing field throughout the Chinese market. SOEs have also developed into a powerful association, which has been further strengthened through institutionalization. So far, the dominant SOEs have been extremely effective in fending off efforts to subject them to new rules and policies (Yu, 2014).

Growing concerns are aroused by the expansion of SOEs outside their defined domains. Recently, government enterprises have aggressively extended their operations beyond their designated fields and competed strongly with foreign companies, from critical and pillar industries to other contestable sectors such as food manufacturing. The fast development and substantial presence of SOEs are evident across a vast number of industrial sectors. The growing pressure on foreign rivals has resulted in a competitive disadvantage. Some foreign firms complain about the unfair competition caused by local protectionist policies. Their concerns about unequal competition and the presence of market access barriers do occasionally happen when local governments protect or benefit local businesses, including SOEs.

China has made a pledge to create a marketing environment for equal competition and ensure non-discriminatory provisions for firms of all types of ownership for the purpose of offering credit, tax incentives, and government regulations and policies. Some of the government’s controversial policies have also been explained. For example, foreign firms are now subject to the structural transformation of industry and revitalization programs, along with recognition requirements for innovative indigenous goods to prevent claims of unequal treatment. The government’s procurement policy promoting innovative indigenous goods has been scrapped. Nevertheless, the success of local governments in enforcing equal treatment for all firms is mainly dependent on how they implement their policies. Thus, we formed the following hypothesis:

2. The Role of Core-periphery Regions

Basically, in the fast-growing market of YRD, FDI firms search for better investment locations to obtain more comparative advantages (Belkhodja et al., 2017; Ramasamy et al., 2012; Jean et al., 2011; Luo et al., 2008; Du et al., 2008; Barry et al., 2003; Krugman, 1991). Outward relocations of manufacturing firms from the core cities, such as Shanghai, to the neighbouring Zhejiang, Anhui and Jiangsu Provinces and other cities have remained prominent since the 1990s (Wu et al., 2018). Moreover, when large-scale competition amongst businesses in core cities contributes to creating upward pressure on land and labour costs, the diffusion of manufacturing investment activities from the centre to the peripheral cities will be primarily driven by resource-based and labour-intensive manufacturing sectors (Wu et al., 2018). Major institutional and economic reforms in the YRD included government incentives for foreign direct investments to drive foreign firms from the coastal cities to the western and inner parts of China (Shi et al., 2014). However, the effect of government incentives on foreign investment flow is still low. Studies show that even when large incentives are available, complying with the subnational geographic distribution of FDI investors is difficult given the underlying framework (Cantwell and Mudambi, 2005; Mudambi, 1998). The core areas of the market have more attractive qualities, especially for some industries like capital-intensive and high-tech manufacturing industries (Wu et al., 2018), and they are difficult to overcome by economic policies aimed at expanding FDI to peripheral cities.

However, the interaction between new foreign firms and SOEs might also be influenced by the core-periphery system. The proportion of state-owned enterprises reflects the government's influence in a certain region, and therefore it reflects the institutional framework. Because of the competitive advantages and market proximity, core cities are more attractive to new foreign firms. (McDonald et al., 2018; Huang and Wei, 2016; Sun et al., 2002). However, when SOEs are highly concentrated in a region, local governance will be more dominant, and the regional regulations and laws can be carried out in favour of SOEs. Even in core regions, it might have a negative impact on new foreign firms, as government involvement can limit the incentives for foreign investors.

In general, the dominance of SOEs along with the upward pressure on start-ups in core cities may affect the birth of new foreign firms in these regions. On the other hand, foreign entities might cope with the challenges and choose core regions for their location and market advantages. We are not sure what the core-periphery effect might be in the YRD. Since this relationship has not been investigated regarding its effect on SOEs, our next hypothesis is formed as follows:

1)These challenges were evident after China fail to adopt the WTO’s Government Procurement Agreement (GPA), which mandates treating domestic and international suppliers equally when it comes to government sales and procurement to cover SOEs, see

III. Data and Methodology

1. Data Collection and Indicators

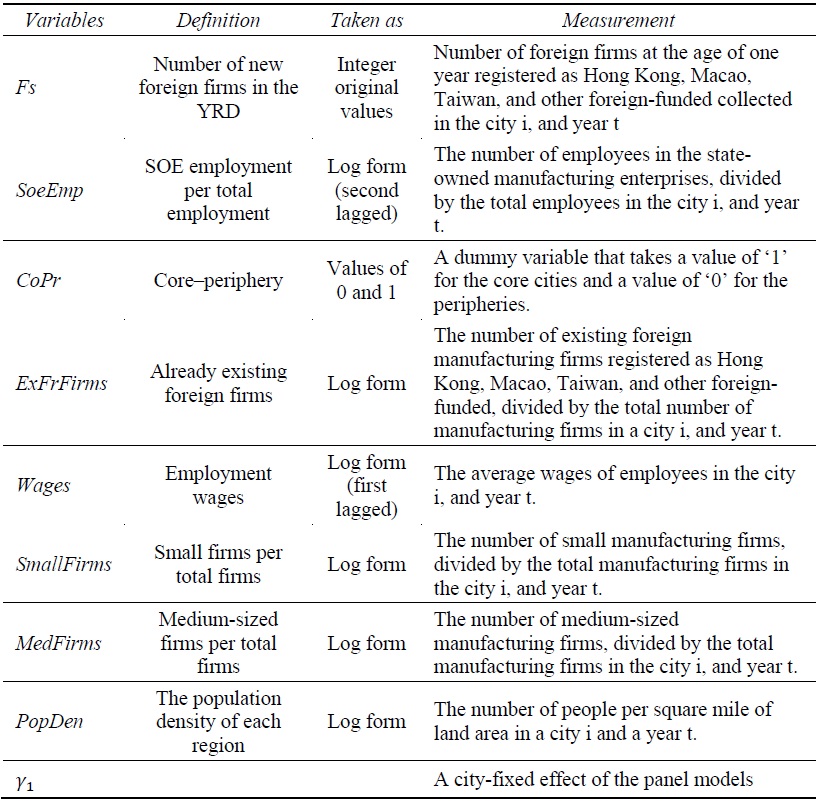

To examine the proposed hypotheses, we used data from the Chinese Industrial Enterprises database collected by the National Bureau of Statistics of China. This data mainly comes from the annual reports submitted by enterprises to the local Bureau of Statistics. The database boasts extremely high-quality research, and it can provide a comprehensive view of the manufacturing sectors in the YRD. However, there is no recent data in this database. Therefore, due to its limited availability and in order to obtain a consistent dataset, we took the firms whose opening years ranged from 1998 to 2013. and similar to (Shi et al., 2020), we applied several procedures to effectively utilize this database. Firstly, we obtained all firm-level data for the study period, then applied multiple procedures to omit repeated registrations throughout the years and unified the SIC code into the 2002 format for the years 1998-2001 and 2011-2013. Subsequently, we used the classification provided by the State Statistical Bureau of China to define ownership for different types of firms. On the basis of this classification, we divided the firms into two categories: state-owned companies (registration codes: 110, 141, 143, and 151); Hong Kong, Macao, Taiwan, and other foreign-funded companies (registration codes: 210, 220, 230, 240, 310, 320, 330, and 340). The sample size reached 526,424 firm-level observations. The state-owned enterprises’ percentage was 50.7% (266,723 firms), whereas the foreign firms’ share was 49.3% (259,701 firms). Amongst them, HMT-owned firms accounted for 26.4% (139,209 firms), and the other foreign firms’ share was 22.9% (120,492 firms). And that was for manufacturing industries whose SIC digit codes are from 1310 to 4210. Finally, we generated a completed and effective sample data set at the city-manufacturing sector level of the YRD, containing 33 cities in Zhejiang, Jiangsu, and Anhui Provinces in addition to Shanghai Municipality. We coded “Shanghai, Suzhou, Nantong, Nanjing, Hangzhou, Ningbo, and Hefei” cities as the core parts of the YRD, which is in accordance with the classification of the first and second levels of the tiered city system in China. Other cities were coded as “peripheries”. Also, following Guo et al. (2016), we classified the firms according to the number of employees, where small firms have fewer than 50 employees and medium-sized firms have 51 to 200 employees. Table 1 shows the definition and measurement of variables, as well as the control variables included in the analysis.

2. Model Specification and Estimation Methods

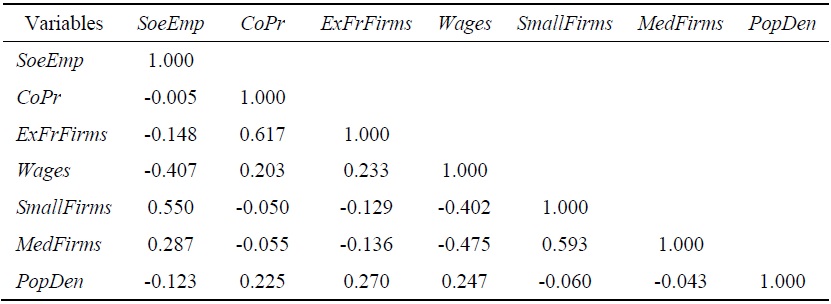

In general, the correlation coefficients do not indicate any significant problem of multicollinearity amongst the variables (see table 2).

We found Poisson regression as the standard method. Given that, our dependent variable is measured as a ‘non-negative integer’, and contains numerous values of zeros. However, the Poisson distribution assumes that the mean is equal to the variance, and in this case, the mean of the dependent variable is 95.79 whereas the standard deviation is 199.15, which concluded that the variance is much greater than the variance. In addition, since the probability of likelihood- ratio test of Alpha is below 0.05, we can safely reject the idea of equality between mean and variance. Therefore, this study followed Guo et al. (2016) by using negative binomial regression, as a standard method used to model over-dispersed data. In addition, we employed the city-year fixed effect to explain the temporal variation as follows:

The second model is added to examine the interaction effect of SOEs with the core-periphery as follows:

where the

IV. Results and Discussion

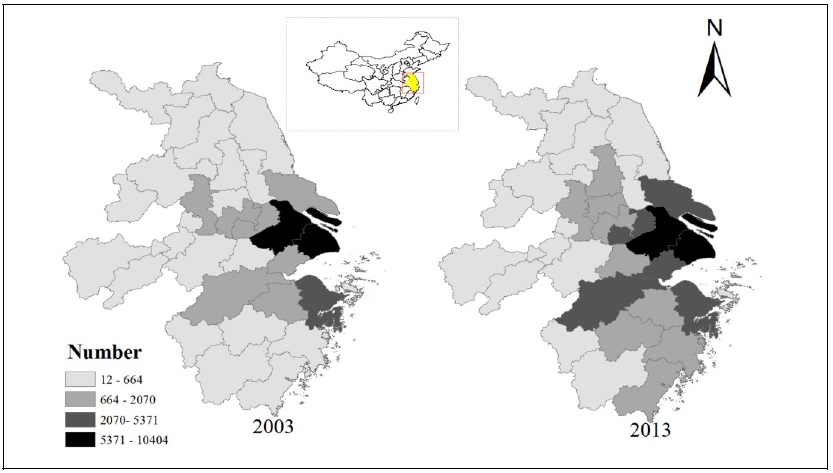

The following map presents how foreign firms are distributed in the delta region; it shows how they were expanding from core cities to the other parts. In 2003, right after China acceded to the world trade organization (WTO), Shanghai and Suzhou cities were the most concentrated with new foreign firms; after that, foreign investors targeted cities in the north and south of the core cities (Figure 1).

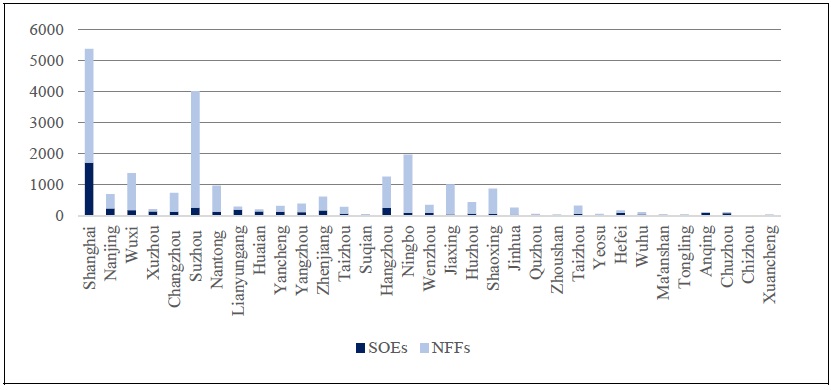

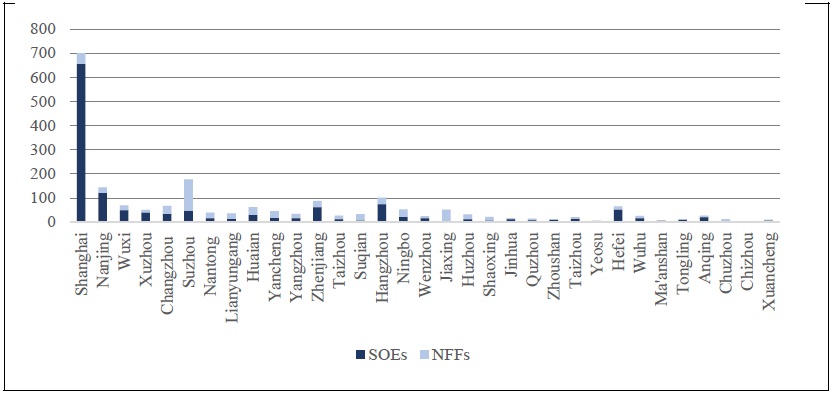

In order to view the effect of SOEs’ presence on the new foreign-owned firms, Figures 2 and 3 show the number of SOEs in two different periods, followed by the number of new foreign firms for the next three years. Some cities comparatively reveal a reverse pattern from the foreign firms toward SOEs. However, the effect is not apparent in most of the other cities. The two figures do not explain how this effect works and do not account for the core-periphery classification of cities. Therefore, this study used the negative binomial regression model to examine the proposed hypotheses.

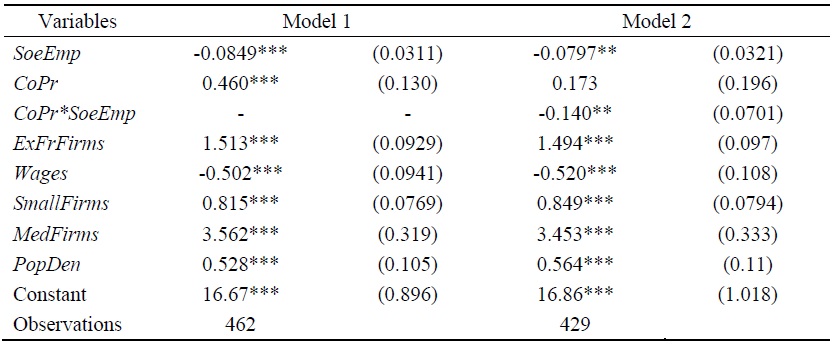

1. The Negative Binomial Regression Model

To explore the effect of SOEs’ concentration on new foreign firms, we used the proportion of employees in SOEs amongst all the manufacturing firms’ employees in a city

The dummy variable has a significant positive value, indicating that foreign firms are still preferring core cities to peripheral cities; the core parts still have the dominating significance to foreign firms in advantages, such as knowledge spillovers, intermediate goods transportation, labour pooling, proximity to ports and markets, and technological and infrastructure improvements. At the same time, peripheral cities suffer from a lack of attraction. However, core parts face relatively more challenges, as represented by market competitiveness, high wages, and local policies and controls. In addition, we used the model coefficients of core-periphery, state-owned enterprises, and the interaction term of core-periphery and SOEs to investigate the influence of core-periphery indicator with SOEs. The (lagged) interaction variable at time

2. Robustness Checks

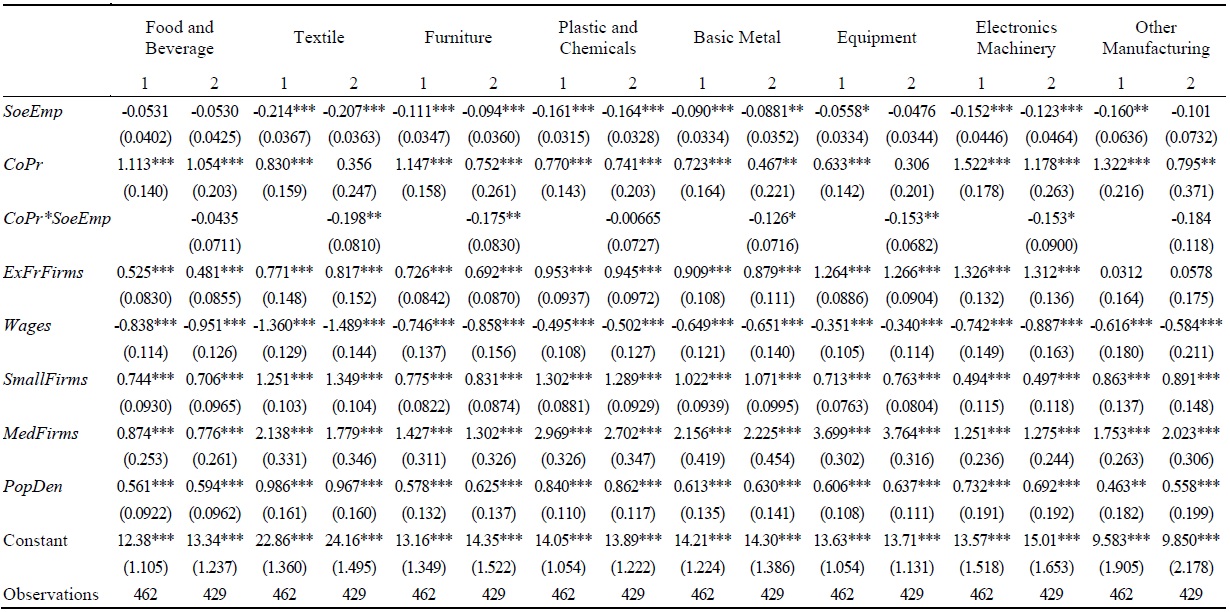

Firstly, one might be concerned that our results reflect the influence of different manufacturing sectors. That is, it might be that the foreign firms are favouring the presence of SOEs in some manufacturing sectors, and the total effect is neglecting the positive effect of SOEs on these sectors. For this, we measure the variables according to each manufacturing sector, then we run the tests on each of the eight two-digit SIC code manufacturing sectors, as shown in Table 4, the effect of SOEs is negative among all sectors. Although the coefficients of

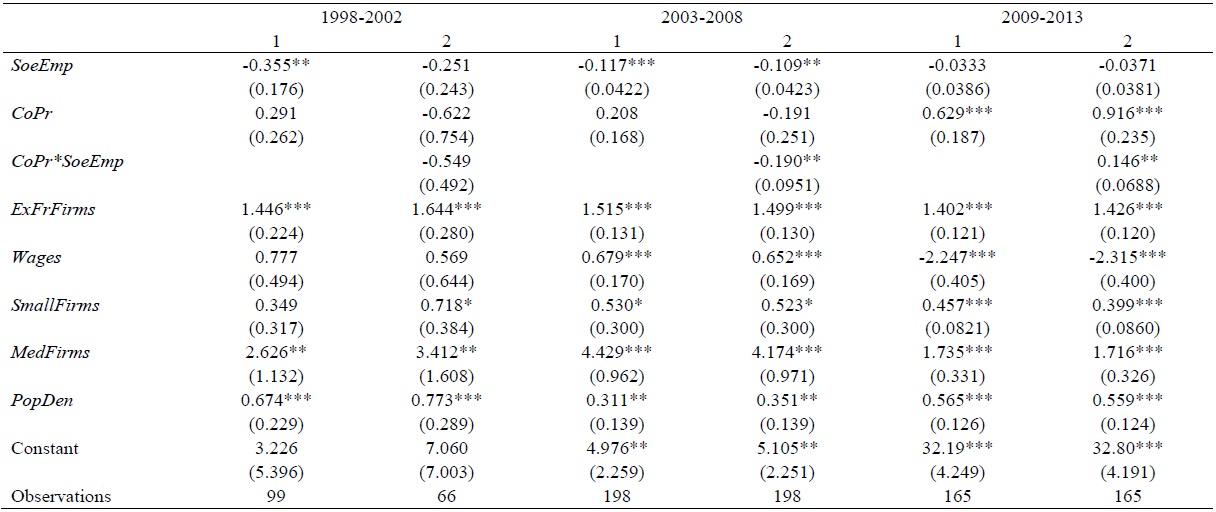

Secondly, since different periods can lead to different consequences, and in order to check how the YRD region is moving towards liberalization, it was necessary to run a time-dependent robustness test; we divided the period according to two events that could mainly affect FDI inflow into the YRD region, namely, China’s accession to the world trade organization in late 2001 and the global financial crisis in 2008. As shown in Table 5, the results support our initial hypothesis in the three periods and are consistent with those that we reported in Table 3. Although, until 2009, the influence of core cities was relatively larger than that of peripheral cities. It is worth noting that the influence of state-owned enterprises is declining over time, indicating that the dominance of SOEs has been shrinking, which corresponds to the historical trend of liberalization and comes in line with the results in Table 3 in the study of Branstetter and Feenstra (2002). Also, it is noticed that after 2008, the effects of SOEs in the core cities have started to turn positive. It means that the core cities of YRD are succeeding in implementing equal competition and fair treatment between foreign firms and SOEs.

The other coefficients are consistent with the coefficients in Table 3, except for the wages. Where after China’s accession to the World Trade Organization and the large inflow of foreign direct investment, it was necessary for the exporting companies to produce good-quality products. Thus, skilled workers were required in foreign companies. For example, Hong Kong companies in the manufacturing sector were willing to pay higher wages to good-quality employees. Assuming that, higher levels of wages are more likely to result in a higher quality workforce (Sun et al., 2002). This may explain why the resulting Wages coefficients are positive in the first two periods. Anyway, labor wages were low in China. likely, Branstetter and Feenstra (2002) indicated in their model that foreign investment is attracted to China not only for the low wages.

V. Conclusion

Foreign investors may be greatly influenced when deciding where to position their firms, especially with regard to market competition and comparative advantages. In general, some firms may prefer to reap the benefits of agglomeration, whereas others may avoid them due to market uncertainties or a discouraging environment that gives preferences to firms of different ownership. This study has tried to shed light on a possible inhibitor that can affect the birth of new foreign firms. We have studied the effect of SOEs’ presence on the new foreign firms in addition to the core-periphery impact on this relationship.

Although the governments’ policies are attributed to largely attracting foreign investments, local authorities are more likely to support local government businesses. As a result, tensions still exist between foreign start-ups and SOEs, especially in peripheral cities. And that for reasons of preferential treatment, uneven competition, and accessibility to business information and policy changes. Moreover, the higher creditworthiness of SOEs, along with guaranteed lower interest rates, enable them to obtain more benefits from cheaper loans and land.

The local governments in the YRD region have not yet succeeded in enforcing equal treatment in peripheral cities, despite the government's efforts to create an environment with equal competition and non-discriminatory provisions for different ownership firms. This is probably because of SOEs’ expansion outside their designated domains, their monopolistic practices, and the abusive behavior of market power that inhibits fair competition. In addition, through SOEs’ institutionalization, they have developed into a powerful group, and the dominant SOEs are managing to resist complying with new policies and reforms. The regional government’s involvement can overcome the advantages of peripheral cities and limit the incentives for foreign investors. Fortunately, in core cities, government and local policies are succeeding in their attempts to achieve fair treatment for foreign entities, where the SOEs’ presence has started to show a positive effect on new foreign firms. We recommend further studies with updated data to check to what extent the Chinese economic regions are being liberalized.

Overall, we think that building a fair environment with equal opportunities in the Chinese market is very important to maintaining a sustainable inflow of new foreign firms. Our results may provide insights for policymakers to improve their strategies for attracting foreign investors into the YRD region. Local authorities are recommended to be unbiased toward SOEs and, likewise, to be more cooperative with foreign investors. Implementing effective practices is essential to ensure equitable treatment among firms. This study may also assist planners in preparing for better infrastructure and relevant policies.

Tables & Figures

Table 1.

Definition and Measurements of the Variables

Table 2.

Matrix of Correlations

Figure 1.

The Distribution of New Foreign Firms in the YRD

Figure 2.

SOEs Presence in YRD Cities in the Year 2000 and the New Foreign Firms in the Years 2001 to 2003

Figure 3.

SOEs Presence in YRD Cities in the Year 2010 and the New Foreign Firms in the Years 2011 to 2013

Table 3.

The Negative Binomial Regression Results

Notes: Dependent variable is the New Foreign Firms ‘NFFs’. Estimated Coefficient are reported, standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

Table 4.

Robustness Test for the Manufacturing Sectors’ Effect

Notes: Dependent variable is the New Foreign Firms ‘NFFs’. Standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

Table 5.

Robustness Test for Different Periods

Notes: Dependent variable is the New Foreign Firms ‘NFFs’. Standard errors in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

References

-

Alcácer, J. 2004. “Location choices across the value chain: How activity and capability influence agglomeration and competition effects.”

Academy of Management Proceedings , vol. 2004, no. 1.https://doi.org/10.5465/ambpp.2004.13863283

-

Ali, S. and W. Guo. 2005. “Determinants of FDI in China.”

Journal of Global Business and Technology , vol. 1, no. 2, pp. 21-33. -

Artz, G. M., Kim, Y. and P. F. Orazem. 2016. “Does agglomeration matter everywhere?: New firm location decisions in rural and urban markets.”

Journal of Regional Science , vol. 56, no. 1, pp. 72-95.https://doi.org/10.1111/jors.12202

-

Bai, C.-E., Du, Y., Tao, Z. and S. Y. Tong. 2004. “Local protectionism and regional specialization: evidence from China's industries.”

Journal of International Economics , vol. 63, no. 2, pp. 397-417.https://doi.org/10.1016/S0022-1996(03)00070-9

-

Barry, F., Görg, H. and E. Strobl. 2003. “Foreign direct investment, agglomerations, and demonstration effects: An empirical investigation.”

Review of World Economics , vol. 139, no. 4, pp. 583-600.https://doi.org/10.1007/BF02653105

-

Belkhodja, O., Mohiuddin, M. and E. Karuranga. 2017. “The determinants of FDI location choice in China: A discrete-choice analysis.”

Applied Economics , vol. 49, no. 13, pp. 1241-1254.https://doi.org/10.1080/00036846.2016.1153786

-

Branstetter, L. G. and R. C. Feenstra. 2002. “Trade and foreign direct investment in China: A political economy approach.”

Journal of International Economics , vol. 58, no. 2, pp. 335-358.https://doi.org/10.1016/S0022-1996(01)00172-6

-

Cantwell, J. and R. Mudambi. 2005. “MNE competence-creating subsidiary mandates.”

Strategic Management Journal , vol. 26, no. 12, pp. 1109-1128.https://doi.org/10.1002/smj.497

-

Dewenter, K. L. and P. H. Malatesta. 2001. “State-owned and privately owned firms: An empirical analysis of profitability, leverage, and labor intensity.”

American Economic Review , vol. 91, no. 1, pp. 320-334.https://www.jstor.org/stable/2677913

-

Du, J., Lu, Y. and Z. Tao. 2008. “Economic institutions and FDI location choice: Evidence from US multinationals in China.”

Journal of comparative Economics , vol. 36, no. 3, pp. 412-429.https://doi.org/10.1016/j.jce.2008.04.004

-

Firth, M., Fung, P. and O. M. Rui. 2006. “Corporate performance and CEO compensation in China.”

Journal of Corporate Finance , vol. 12, no. 4, pp. 693-714.https://doi.org/10.1016/j.jcorpfin.2005.03.002

-

Fu, S. and J. Hong. 2011. “Testing urbanization economies in manufacturing industries: Urban diversity or urban size?”

Journal of Regional Science , vol. 51, no. 3, pp. 585-603.https://doi.org/10.1111/j.1467-9787.2010.00702.x

-

Gabe, T. 2003. “Local industry agglomeration and new business activity.”

Growth and Change , vol. 34, no. 1, pp. 17-39.https://doi.org/10.1111/1468-2257.00197

-

Gabe, T. 2009. “Chapter 6: Impact of Agglomerations on the Economy.” In Goetz, S. J., Deller, S. and T. Harris. (eds.)

Targeting Regional Economic Development . London: Routledge. pp. 106-122. -

Geng, X., Yang, X. and A. Janus. 2009. “State-owned enterprises in China: Reform dynamics and impacts.” In Garnaut, R., Song, L. and W. T. Woo. (eds.)

China’s new place in a world in crisis: Economic, Geopolitical and Environmental Dimensions . Canberra: ANU E Press. pp. 155-178. -

Guo, Q., He, C. and D. Li. 2016. “Entrepreneurship in China: The role of localisation and urbanisation economies.”

Urban Studies , vol. 53, no. 12, pp. 2584-2606.https://doi.org/10.1177/0042098015595598

- Harrison, A., Meyer, M., Wang, P., Zhao, L. and M. Zhao. 2019. “Can a tiger change its stripes? Reform of Chinese state-owned enterprises in the Penumbra of the state.” NBER Working Papers, no. 25475. National Bureau of Economic Research.

-

He, C. 2002. “Information costs, agglomeration economies and the location of foreign direct investment in China.”

Regional studies , vol. 36, no. 9, pp. 1029-1036.https://doi.org/10.1080/0034340022000022530

-

He, C. 2006. “Regional decentralisation and location of foreign direct investment in China.”

Post- Communist Economies , vol. 18, no. 1, pp. 33-50.https://doi.org/10.1080/14631370500505131

-

He, C. and J. Wang. 2012. “Does ownership matter for industrial agglomeration in China?”

Asian Geographer , vol. 29, no. 1, pp. 1-19.https://doi.org/10.1080/10225706.2012.662312

-

Huang, H. and Y. D. Wei. 2016. “Spatial inequality of foreign direct investment in China: Institutional change, agglomeration economies, and market access.”

Applied Geography , vol. 69, pp. 99-111.https://doi.org/10.1016/j.apgeog.2014.12.014

-

Jean, R.-J. B., Tan, D. and R. R. Sinkovics. 2011. “Ethnic ties, location choice, and firm performance in foreign direct investment: A study of Taiwanese business groups FDI in China.”

International Business Review , vol. 20, no. 6, pp. 627-635.https://doi.org/10.1016/j.ibusrev.2011.02.012

-

Krugman, P. 1991. “Increasing returns and economic geography.”

Journal of Political Economy , vol. 99, no. 3, pp. 483-499.https://doi.org/10.1086/261763

-

Lin, J. Y., Cai, F. and Z. Li. 1998. “Competition, policy burdens, and state-owned enterprise reform.”

American Economic Review , vol. 88, no. 2, pp. 422-427.http://www.jstor.org/stable/116960 -

Lin, J. Y. and G. Tan. 1999. “Policy burdens, accountability, and the soft budget constraint.”

American Economic Review , vol. 89, no. 2, pp. 426-431.https://doi.org/10.1257/aer.89.2.426

-

Lin, K. J., Lu, X., Zhang, J. and Y. Zheng. 2020. “State-owned enterprises in China: A review of 40 years of research and practice.”

China Journal of Accounting Research , vol. 13, no. 1, pp. 31-55.https://doi.org/10.1016/j.cjar.2019.12.001

-

Luo, L., Brennan, L., Liu, C. and Y. Luo. 2008. “Factors influencing FDI location choice in China’s inland areas.”

China & World Economy , vol. 16, no. 2, pp. 93-108.https://doi.org/10.1111/j.1749-124X.2008.00109.x

-

Luo, Y., Xue, Q. and B. Han. 2010. “How emerging market governments promote outward FDI: Experience from China.”

Journal of World Business , vol. 45, no. 1, pp. 68-79.https://doi.org/10.1016/j.jwb.2009.04.003

-

McDonald, C., Buckley, P. J., Voss, H., Cross, A. R. and L. Chen. 2018. “Place, space, and foreign direct investment into peripheral cities.”

International Business Review , vol. 27, no. 4, pp. 803-813.https://doi.org/10.1016/j.ibusrev.2018.01.004

-

Mudambi, R. 1998. “The role of duration in multinational investment strategies.”

Journal of International Business Studies , vol. 29, no. 2, pp. 239-261.https://doi.org/10.1057/palgrave.jibs.8490035

-

Myles Shaver, J. and F. Flyer. 2000. “Agglomeration economies, firm heterogeneity, and foreign direct investment in the United States.”

Strategic Management Journal , vol. 21, no. 12, pp. 1175-1193.https://doi.org/10.1002/1097-0266(200012)21:12<1175::AID-SMJ139>3.0.CO;2-Q -

Nolan, P. and W. Xiaoqiang. 1999. “Beyond privatization: Institutional innovation and growth in China's large state-owned enterprises.”

World Development , vol. 27, no. 1, pp. 169-200.https://doi.org/10.1016/S0305-750X(98)00132-6

-

Qi, H. and D. M. Kotz. 2020. “The impact of state-owned enterprises on China’s economic growth.”

Review of Radical Political Economics , vol. 52, no. 1, pp. 96-114.https://doi.org/10.1177/0486613419857249

-

Ramasamy, B., Yeung, M. and S. Laforet. 2012. “China’s outward foreign direct investment: Location choice and firm ownership.”

Journal of world business , vol. 47, no. 1, pp. 17-25.https://doi.org/10.1016/j.jwb.2010.10.016

-

Rosenthal, S. S. and W. C. Strange. 2003. “Geography, industrial organization, and agglomeration.”

Review of Economics and Statistics , vol. 85, no. 2, pp. 377-393.https://doi.org/10.1162/003465303765299882

-

Sârbu, M.-R. and I. M. Gavrea. 2014. “Forms and Motivations of Foreign Direct Investment.”

SEA: Practical Application of Science , vol. 2, no. 1 (issue 3), pp. 532-540. - Schonberg, A. 2021. “Government Procurement and Sales to State Owned Enterprises in China.” US-China Business Council.

-

Shi, J., Sadowski, B., Li, S. and Ö. Nomaler. 2020. “Joint effects of ownership and competition on the relationship between innovation and productivity: Application of the CDM model to the Chinese manufacturing sector.”

Management and Organization Review , vol. 16, no. 4, pp. 769-789.https://doi.org/10.1017/mor.2020.13

-

Shi, W., Sun, S. L., Pinkham, B. C. and M. W. Peng. 2014. “Domestic alliance network to attract foreign partners: Evidence from international joint ventures in China.”

Journal of International Business Studies , vol. 45, no. 3, pp. 338-362.https://doi.org/10.1057/jibs.2013.71

-

Sun, Q., Tong, W. and Q. Yu. 2002. “Determinants of foreign direct investment across China.”

Journal of International Money and Finance , vol. 21, no. 1, pp. 79-113.https://doi.org/10.1016/S0261-5606(01)00032-8

- Vakhitov, V. and C. Bollinger. 2010. “Effects of ownership on agglomeration economies: Evidence from Ukrainian firm level data.” Discussion Paper Series, no. 24. Kyiv School of Economics and Kyiv Economics Institute.

-

Wu, J., Wei, Y. D., Li, Q. and F. Yuan. 2018. “Economic transition and changing location of manufacturing industry in China: A study of the Yangtze River Delta.”

Sustainability , vol. 10, no. 8.https://doi.org/10.3390/su10082624 -

Yu, H. 2014. “The Ascendency of State-owned Enterprises in China: Development, controversy and problems.”

Journal of Contemporary China , vol. 23, no. 85, pp. 161-182.https://doi.org/10.1080/10670564.2013.809990