- EAER>

- Journal Archive>

- Contents>

- articleView

Contents

Citation

| No | Title |

|---|

Article View

East Asian Economic Review Vol. 26, No. 4, 2022. pp. 279-304.

DOI https://dx.doi.org/10.11644/KIEP.EAER.2022.26.4.414

Number of citation : 0Analysis of Dollarization Hysteresis among North Korean Consumers

|

Bank of Korea |

Abstract

This paper quantitatively analyzes the current status of North Korean consumer payment instruments through a questionnaire survey of 292 North Korean defectors. In the 2010s, it was found that the payment experience ratio of domestic currency cash and grain decreased, while the payment experience ratio of foreign currency cash increased. The use of foreign currency reached a stage where it was spread not only as a store of value but also as a medium of exchange. However, the most frequently used payment instrument by North Korean consumers was still domestic currency cash. By region, in inland urban areas both domestic currency cash and U.S. dollars are used and in the North Korea-China border region both domestic currency cash and Chinese yuan are used, while in inland rural areas dollarization does not occur because both domestic currency cash and grain are used. Meanwhile, despite the stable price trend during 2013-2019, the dollarization hysteresis effect is appearing, and both the purchasing power risk theory and the network externality theory are considered to have explanatory power for the cause. The results of this paper suggest that as dollarization is intensifying, it is expected that more costs such as shortages of commodities will be incurred than in the past if North Korea’s de-dollarization policy is reimplemented. Also, in the case of domestic currency cards, which the North Korean authorities introduced in 2015 as part of a means of financial reform, this paper suggests that it may continue to be difficult for domestic currency cards to normalize official finance under the dollarization hysteresis.

JEL Classification: F31, G50, O57

Keywords

North Korean Consumers, Payment Instrument, Dollarization Hysteresis

I. Introduction

Calvo and Vegh (1992) have studied the phenomenon of currency substitution in many countries. They have shown that in developing countries experiencing hyperinflation, foreign currency first replaces domestic currency as a store of value. Then the foreign currency begins to act as a unit of account, and finally the foreign currency becomes a medium of exchange. This phenomenon of currency substitution has been seen in Vietnam, Laos, Cambodia, Myanmar and other developing countries in Southeast Asia that are transitioning from a socialist to a capitalist system. In the case of North Korea, the use of foreign currency has spread during the economic crisis of the 1990s and the currency reforms of 2009. Nowadays, North Korean residents reportedly use foreign currency as a store of value and frequently use it in their daily transactions (Lee et al., 2012).

It is known that as the planned economy weakened after the economic crisis of the 1990s, informal trade and market circulation grew rapidly, and the use of foreign currency also increased. The use of foreign currency further increased as the North Korean cabinet adopted a policy of accepting marketization, and the value of the North Korean won declined starting with the “July 1 Economic Management Improvement Measures” in 2002. In particular, after the currency reform at the end of 2009, people’s distrust of the North Korean won greatly increased, and, in response, North Koreans increased their holdings and uses of foreign currency.

In the 2010s, along with the development of information and communication technology, new electronic payment methods such as “telephone money” and electronic payment cards began to be distributed across North Korea. “Telephone money” transfers are a method in which the buyer of a commodity transfers charging time of the mobile phone to the seller as a form of payment.

As the North Korean cabinet greatly increased the number of foreign currency service centers, foreign currency cards, such as the Foreign Trade Bank’s Narae Card, began to be distributed after 2010 to support payments. A foreign currency card is a prepaid card that replenishes cash in U.S. dollars and Chinese yuan, and has the advantage of solving the problem of giving change in foreign currency payments, which is insufficient in small denominations. In addition, it seems that the role of official finance in the field of payment and settlement is increasing through the introduction of these electronic payment methods.

As such, it seems that not a few changes have occurred in North Korea’s consumer payment instruments since 1990. Changes in the payment instruments can provide useful information for understanding the degree of openness1 of the North Korean economy and the reliability of the North Korean won. However, comprehensive information about the changes and scale of consumer payment instruments in North Korea is lacking. North Korea’s central bank, the Central Bank of DPRK, does not currently publish statistics on payment methods, so the unobservability problem can be seen to be very large.

This paper intends to quantitatively analyze changes in the payment instruments of North Korean consumers through a survey of North Korean defectors. In this paper, consumer payment is defined as a payment in the final consumption stage, such as in one of the

This paper is structured as follows. Following the introduction, Chapter II introduces previous studies of the quantification of consumer payment instruments in North Korea and explains the estimation method used in this paper. Chapter III reports the survey results and examines the characteristics of North Korean consumers’ use of payment instruments by region. Chapter IV analyzes the continual use of foreign currency from 2013 to 2019 when prices and exchange rates were stabilized. Chapter V summarizes the main results and describes the implications of the study.

1)Openness here refers to the expansion of formal and informal trade, dispatch of manpower abroad, and foreign direct investment, etc.

II. Estimation Method

1. Previous Research

Quantitative studies on the use of foreign currency in North Korea include Yang (2016), Lee (2016), and Mun and Jung (2017).

Yang (2016) conducted the first quantitative study on the use of foreign currency in North Korea. Yang conducted two surveys in 2012 and 2013 and published the results of their statistical analysis. In 2012, 926 North Korean defectors were surveyed to find out which currencies were most commonly used in the North Korean

In addition, a survey in 2013 of 828 North Koreans who defected between 2011 and 2013 about the share of trading currencies in the

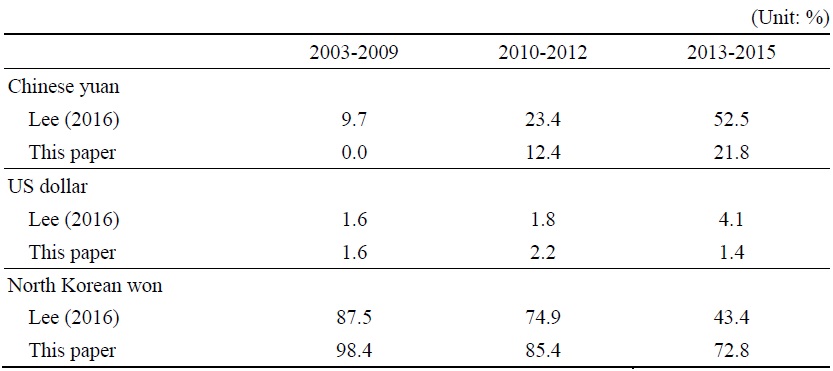

Lee (2016) surveyed 1,011 North Korean defectors on the currency that was most commonly used in North Korea.3 The survey found that the response rate for the domestic currency has dropped significantly, from 87.5% in the 2003-2009 period to 74.9% in 2010-2012, and to 43.4% in 2013-2015. The Chinese yuan response rate rose from 9.7% in 2003-2009 to 23.4% in 2010-2012, and then exceeded the domestic currency response rate by 52.5% during 2013-2015. The sample respondents in this study are the same as in Yang (2016), who are mainly from the North Korea-China border region. The study characterized the transactions under investigation not only by market consumption, but also by the purchase of consumables in the official sector, and the distribution transactions of individual wholesalers.

Mun and Jung (2017) quantitatively analyzed how much foreign currency North Koreans hold and use as a motivator for store of value and as a medium of exchange. Between 2006 and 2014, 231 North Korean defectors were surveyed about the proportion of domestic and foreign currency they use compared to the total amount of household expenditures. In addition, the proportion of foreign currency use was investigated for each major consumer product, such as rice and shoes. The survey found that in the area along the North Korea-China border, use of North Korea’s currency fell significantly from 76.7% in 2006-2009 to 42.1% between 2010 and 2014, while use of the Chinese yuan rose significantly from 22.1% in 2006-2009 to 57.4% in 2010-2012. In inland regions, use of domestic currency fell from 71.8% in 2006-2009 to 61.3% in 2010-2012, while use of the U.S. dollar rose modestly from 22.5% in 2006-2009 to 30.1% in 2010-2012. The study was characterized by an attempt to reduce the bias in the sample by increasing the proportion of people from inland areas among the respondents surveyed.

2. Estimation Method of This Paper

This paper conducts a survey of North Korean defectors to quantitatively estimate their consumer payment experiences when they resided in North Korea and examines the characteristics of their responses. Since the purpose of this paper is to identify the payment instruments used in the final consumption stages by North Korean residents, the transactions that North Koreans make to wholesalers as retailers and transactions paid to traders as wholesalers are excluded from the investigation.4

In the previous research, the value used by the payment instrument was included, and that had the advantage of faithfully expressing the reality of consumer payments in North Korea. However, preliminary investigations have confirmed that the limitations of retrospective investigations make it difficult to ensure the accuracy of the amounts. Accordingly, the main focus of this paper is on examining the existence or absence of a payment experience by individuals and the main payment instrument used.

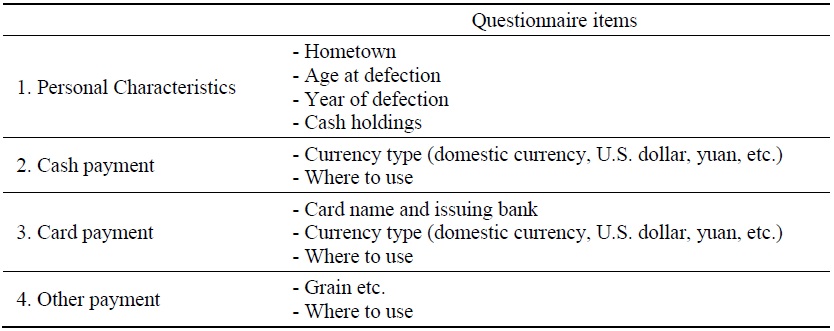

The survey was conducted by interview between Aug. 1, 2020 and Dec. 31, 2021. In the survey, the baseline year of defection from North Korea was defined as the last year of normal life in North Korea. In addition, North Korean defectors who were over the age of 20 in the baseline year of defection, which is believed to have had a minimum period of independent economic activity by age, were set as the subjects of the survey. The items investigated were cash payments, card payments, and other forms of payment, and the presence or absence of experience in the baseline year of defection from North Korea was investigated.

The national figures were calculated using regional weights. Considering that the regional bias of North Korean defectors is severe, the survey subjects were divided into three regions: the North Korea-China border area, the inland urban area, and the inland rural area. After obtaining an average value for each region, the weighted sum was calculated by the proportion of the population (10%, 43%, and 47%, respectively)5 of the regions to calculate a national average.

In Mun and Jung (2017), the concept of the North Korea-China border area was used as a metropolitan municipality encompassing North Hamgyong Province, Ryanggang Province, Jagang Province, and North Pyongan Province. In this paper, we would like to develop a discussion by defining the border area as cities and counties adjacent to the border. This is in consideration of the fact that the cities and counties adjacent to the North Korea-China border will have certain characteristics, such as the revitalization of trade and related service businesses, and a universal use of foreign currency, that other cities and counties within the same administrative province might not have. Therefore, even within Ryanggang Province, Hyesan-si and Daehongdangun, for example, are classified as North Korea-China border areas, whereas Baekamgun and Unheung-gun, for example, are classified as inland rural areas.6

The survey subjects were randomly sampled. Nevertheless, a bias resulting from the fact that the population is set to all North Korean defectors rather than simply to all North Koreans still remains.

3. Basic Statistics of Survey Respondents

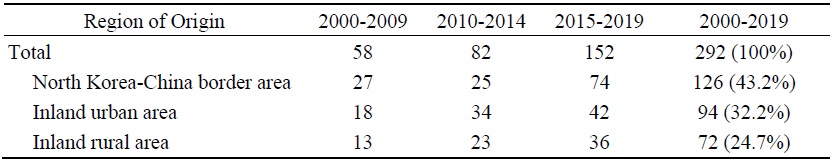

The number of respondents to the survey was 292 North Korean defectors who left North Korea between 2000 and 2019. By region of origin, 126 people were from the North Korea-China border area, 94 from inland urban areas, and 72 from inland rural areas. By year of defection, 58 left North Korea between 2000 and 2009, 82 between 2010 and 2014, and 152 between 2015 and 2019. Residents who defected after 2020 were excluded from the survey because the number was insignificant due to the effect of the border blockade implemented on Jan. 23, 2020.

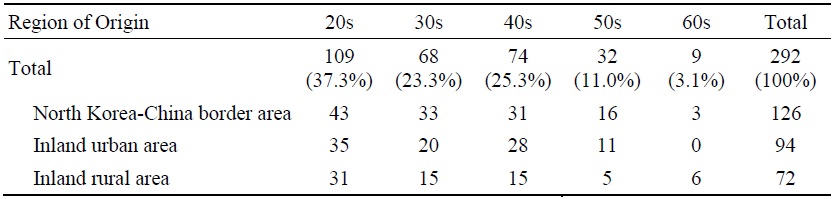

When the respondents are classified by age at defection, 109 people are in their 20s, 68 people in their 30s, 74 people in their 40s, 32 people in their 50s, and nine people in their 60s or older. Since the sample is somewhat biased toward those in their 20s, 30s and 40s, there is a bias that reflects the experiences of North Koreans who were in their 50s or older at the time of defection. According to the results of the DPRK 2008 Population Census by the United Nations, 33.8% of the population was in their 50s or over,7 which is different from the sample in this paper, where only 14.1% are in their 50s or older.

2)“The northern border region of North Korea, near China” here encompasses North Hamgyong Province, Ryanggang Province, Jagang Province, and North Pyongan Province. This is little bit different from that of this paper.

3)The regions of origin of the respondents were North and South Hamgyong Province (71.6%), Ryanggang Province (16.4%), Pyongan Province (3.2%), Hwanghae Province (2.9%), and Pyongyang City (2.6%). The proportion of people from Hamgyong Province and Ryanggang Province was high

4)In the previous study, transactions with wholesalers were not explicitly excluded as subjects of investigation, which is thought to have been the cause of the relatively high rate of foreign currency use by North Koreans.

5)Statistics Korea, Korean Statistical Information Service (KOSIS).

6)Regarding North Korean region issue, the classification in this paper is appropriate to a considerable extent because these regions show different characteristics from border areas. In fact, among those surveyed, people from Ryanggang province say that in the case of Unheung-gun, Baekam-gun, and Pungseo-gun, foreign currency is rarely used in retail transactions in the

7)Statistics Korea, Korean Statistical Information Service (KOSIS).

III. Estimation Results and Main Characteristics

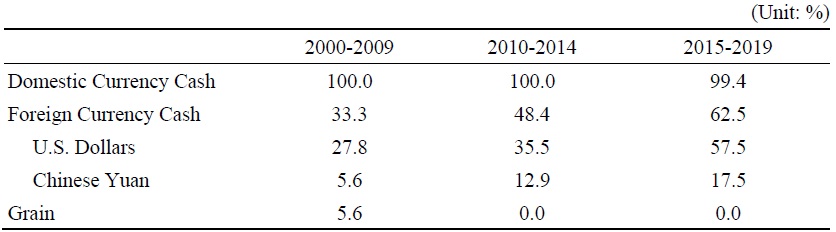

1. Increased Experience of Using Foreign Currency Cash

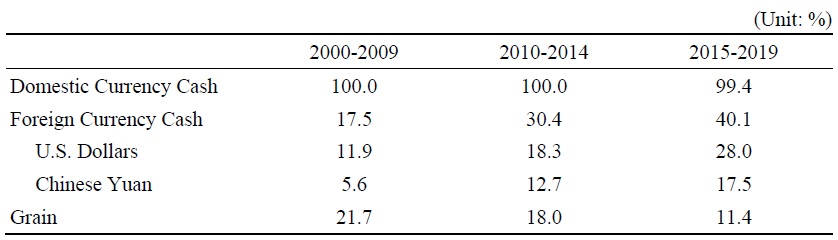

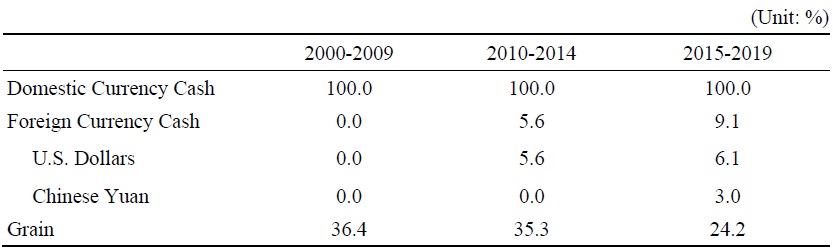

In the 2010s, North Koreans greatly increased their use of foreign currency cash for consumer transactions, while reducing their use of domestic cash or grain.

Foreign currency cash has the advantage of being of stable value and available in small volumes. The proportion of residents who have used foreign currency cash as a payment instrument in a

Since the 1990s, as the North Korean authorities took various measures to expand foreign trade to overcome the economic crisis, the use of foreign currency began mainly by those employed at trading companies. In the 2000s, as the high inflation rate occurred8 after the economic management improvement measures put into effect on July 1, 2002, foreign currency cash payments gradually increased.

In the 2010s, the payment of foreign currency became even more widespread. There was the confiscatory currency reform9 in terms of foreign currency demand. There was an active external economic relationship10 in terms of trade, and there was also the dispatching of overseas manpower in terms of foreign currency supply. In addition, although current North Korean law makes it illegal to use foreign currency cash, it is said that in the 2010s, police crackdowns were increasingly condoning the circulation of foreign currency cash by

However, it can be said that foreign currency cash has almost replaced domestic currency as a store of value,11 but it does not seem to have performed an important function enough to replace domestic currency as a medium of exchange. The percentage of experiences of using domestic currency cash decreased slightly from 100% in the 2000s and in the 2010-2014 period to 99.4% in the 2015-2019 period, but it was still overwhelming. This slight decline is presumed to be mainly attributable to the development of dollarization to such an extent that the Chinese yuan has replaced the domestic currency in the North Korea-China border area. Nevertheless, domestic currency cash still functions as the main consumer payment instrument across all of North Korea.

This is because official organizations such as state-run stores and convenience service centers12 stipulate payments in domestic currency, and low-income residents want to pay in domestic currency. In particular, low-income residents are aware of the possibility of devaluation in the domestic currency, but they are unable to earn a level of income that can be exchanged, so they have no choice but to own or use domestic currency.

On the other hand, in the case of grain, the percentage of experiences where people used it as a medium of exchange is on the decline from 21.7% in the 2000s to 18.0% in the 2010-2014 period, and to 11.4% in the 2015-2019 period. It is assumed that the decrease in the use of grain as payment is basically due to North Korean marketization gradually spreading from urban areas to rural areas.

2. Experience of Using Foreign Currency Varies Greatly by Region

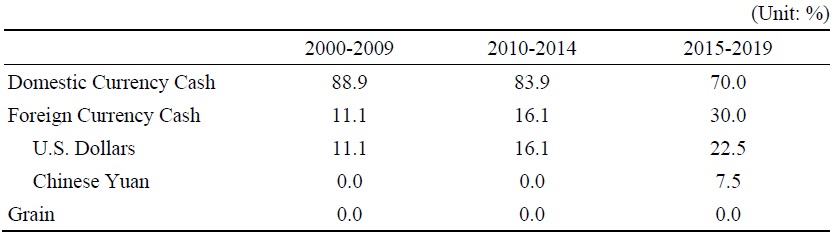

(1) Inland urban areas: coexistence of domestic currency cash and U.S. dollar cash as payment instruments

In inland urban areas, the percentage of consumers who have experienced dollar cash payments (multiple responses allowed) increased significantly from 27.8% in the 2000s to 35.5% in 2010-2014, and to 57.5% in 2015-2019. U.S. dollar cash is said to be the most preferred payment instrument for retail transactions by urban residents.

In the

On the other hand, it was found that consumers in inland urban areas still use domestic currency as the most common payment instrument. As of 2015-2019, the proportion of domestic currency use was 70.0%, the proportion of U.S. dollar use was 22.5%, and the proportion of Chinese yuan use was 7.5%. By time period, the dollar continued to increase from 11.1% in the 2000s to 16.1% in 2010-2014, and to 22.5% in 2015-2019, while domestic currency continues to decrease in its use.

However, there is a problem with the representativeness of the North Korean defector sample used in this survey. It is known that the proportion of defectors in the official sector is low compared to the total population of North Koreans, while the proportion of those who engage in informal economic activities is high.13 As informal economic activities and foreign currency use are closely related, it is necessary to interpret the survey noting the possibility of overestimation of foreign currency cash payment experiences among consumers in inland urban areas.

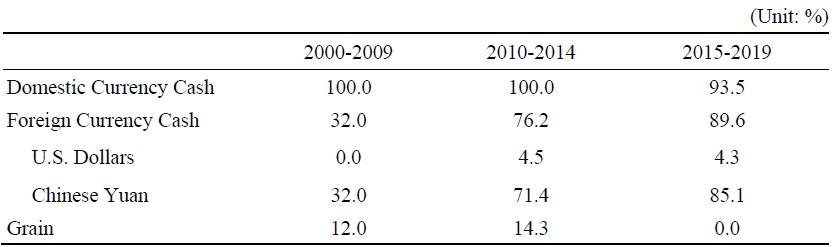

(2) North Korea-China border area: coexistence of domestic currency cash and yuan cash as payment instruments

In inland rural areas, the percentage of consumers who have made yuan cash payments increased significantly from 32.0% in the 2000s, to 71.4% in 2010-2014, and to 85.1% in 2015-2019.

In the case of foreign currency cash, different regions use different types of foreign currency, with inland urban areas mainly using the U.S. dollar and the North Korea-China border region, which has a high proportion of border trade and smuggling, mainly using the Chinese yuan.14 The fact that people in the North Korea-China border region use the Chinese yuan as a payment instrument is due to the fact that economic exchanges are active due to the proximity of the huge market in northeast China and a large number of residents in both regions have relatives on the other side. In the case of the Chinese yuan, unlike the U.S. dollar, it is said that some domestic goods, as well as imports, are paid for in Chinese yuan, as it is unlikely that there will be any problem of giving or receiving change.

On the other hand, use of domestic currency cash in the North Korea-China border region has decreased from 100.0% in the 2000s and in the 2010-2014 period to 93.5% in 2015-2019. This could be a result of the fact that some residents in the north-central border region have a tendency to use only Chinese yuan cash for consumer payments.

Meanwhile, the most commonly used payment instrument by consumers in the North Korea-China border region is Chinese yuan cash, which has increased significantly from 0.0% in the 2000s, to 35.3% in 2010-2014, and to 59.6% in 2015-2019. As of the 2015-2019 period, the yuan was used in 59.6% of transactions and the domestic currency was used only in 40.4% of transactions. In terms of the main payment instrument, the foreign currency is replacing the domestic currency. In recent years, the Chinese yuan has become the most preferred payment instrument between consumers and retailers in the North Korea- China border region, and it appears to be replacing domestic currency in all the functions of money, such as a store of value, a unit of account, and a medium of exchange.

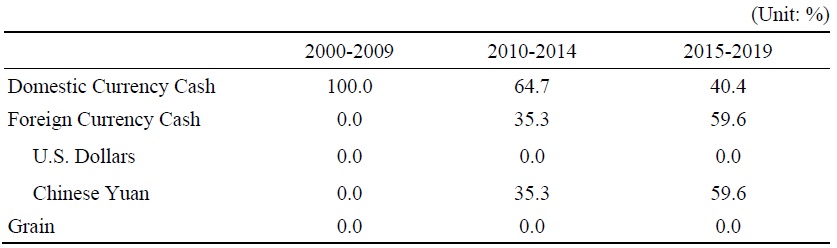

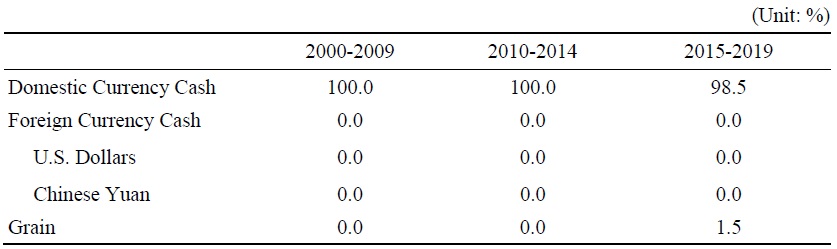

(3) Inland rural areas: negligible dollarization

After the currency reform in 2009, there has been a preference for holding and paying in foreign currency, even in rural areas. Between 2015 and 2019, the proportion of residents who experienced payment in U.S. dollars cash and in Chinese yuan cash was 6.1% and 3.0%, respectively, considered to be a negligible level.

Compared to the inland urban areas and the North Korea-China border area, it can be seen that in inland rural areas there is almost no dollarization.

On the other hand, in inland rural areas, there are many examples of the use of grain as a payment mechanism, such as rice or corn being used as a payment instrument. The proportion of residents who have used grain for payment (multiple responses allowed) fell relatively significantly, from 36.4% in the 2000s to 35.3% in 2010-2014, and to 24.2% in 2015-2019. This appears to be due to the progress of marketization and the accompanying monetization. Nevertheless, grain payment is still prevalent in rural areas because farmers hold relatively large amounts of grain and perceive grain as being a more stable store of value than any foreign currency.

On the other hand, the most commonly used payment instrument by consumers in inland rural areas that were surveyed here was North Korean domestic currency (98.5%) followed by grain (1.5%), as of 2015-2019. It is said that the continual use of domestic currency by most inland rural consumers as their primary payment instrument is mainly due to their inability to hold assets at a level that can be converted into foreign currency.

(4) Limitations as descriptive analysis

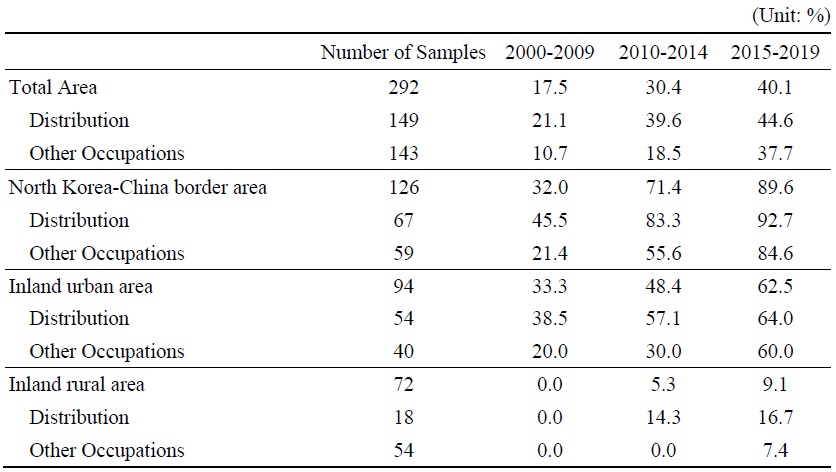

This paper certainly has limitations as descriptive analysis. Without taking into account other factors such as the occupation and gender of the sample, the variation in figures between periods is likely to be a chance result.

However, it is difficult to properly perform regression analysis due to insufficient sample numbers. Nonetheless, by calculating payment experience ratio by region and occupation, the impact of occupational factors may be identified to some extent. It can be seen in the following table that in all regions, foreign currency payment experience ratio of distribution workers but also of other workers has increased roughly. This means that foreign currency payment experience is unlikely to be affected by occupational factors.

Meanwhile, it seems very difficult to determine the influence of gender factors because men and women who have a distribution worker as their spouse are more likely to have higher foreign currency payment experience.

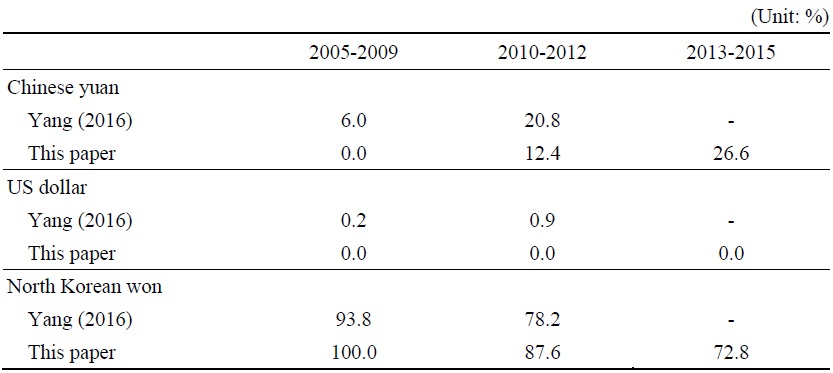

(5) Comparison with previous research

In order to be comparable with previous studies, the weight of each region in this paper was set equal to that of previous studies, and the comparison period was set the same, and the total figure was recalculated.

In the study of Yang (2016), the Chinese yuan response rate increased from 6.0% in 2005-2009 to 20.8% in 2010-2012. Compared to this paper, the trend was similar, but the level was slightly lower. Meanwhile, the North Korean won response rate showed a similar trend, but the level of this paper was slightly higher. Such a difference in level is presumed to be due to the fact that, in the study of Yang (2016), transactions between wholesalers and retailers, which have a high proportion of foreign currency payments, are included in

As a preceding study on the main means of payment in all retail stores, Lee (2016) reported that Chinese yuan response rate increased significantly from 9.7% in 2003 to 2009 to 23.4% in 2010 to 2012 and to 52.5% in 2013 to 2015. This is significantly higher than the 0.0% in 2003-2009, 12.4% in 2010-2012, and 21.8% in 2013-2015 surveyed in this paper. This difference is presumed to be mainly attributable to the fact that the study of Lee (2016) included payments to wholesalers whose foreign currency use was rapidly progressing.

8)Inflation worsened again after 2002 can be understood as a result of a large increase in fiscal expenditure following attempts to rebuild the official sector

9)It was carried out between November and December 2009. Old and new currencies were exchanged at a ratio of 100:1, and the limit of exchange was strongly restricted

10)A wide range of foreign currency inflow channels exist, including foreign trade workers, including smugglers, and overseas dispatch workers

11)For reference, this survey found that the proportion of residents who used foreign currency cash as a store of value among residents with surplus funds increased significantly from 32.9% in the 2000s to 89.5% in the 2010s. Meanwhile, in terms of amount, it was found that foreign currency accounted for 99.4% of the cash held by North Korean households between 2012 and 2018

12)Convenience service is a form of social service that guarantees living convenience and promotes health by satisfying the cultural and welfare needs of the people, and includes hygiene convenience service, beauty convenience service, and processing convenience service (Article 2 of the North Korean Convenience Service Act). As one of the survey respondents noted, “Convenience service centers usually have a sauna and swimming pool in the basement, a store on the first floor, a restaurant on the second floor, and a coffee shop on the third floor.” (Respondent P1, defected from North Korea in 2014)

13)

14)For reference, the rate of using Chinese yuan in inland urban areas and inland rural areas in North Hamgyong Province, Ryanggang Province, and North Pyongan Province was around 14.0% in the 2010s, up from 7.1% in the 2000s. This is a significant difference from the figure seen in North Korea-China border regions, which increased significantly from 32.0% in the 2000s to 80.3% in the 2010s. Judging from these results, we can begin to see that the inland urban areas and inland rural areas of North Pyongan Province, Jagang Province, Ryanggang Province, and North Hamgyong Province, and the North-Chinese border area constitute different economic environments. Meanwhile, the percentage of inland urban areas and inland rural areas in North Hamgyong Province, Jagang Province, North Pyongan Province, and North Hamgyong Province showed a similar figure to the North-Chinese border area, from 0.0% in the 2000s to 6.6% in the 2010s.

IV. From 2013-2019, Foreign Currency Use Continued albeit Price Stability

1. Dollarization Hysteresis Even with Price Stability

In North Korea, the use of foreign currency tends to increase significantly when the value of the North Korean won plummets in reaction to confiscatory currency reforms. This can be seen as a very natural phenomenon. However, even though North Korea’s prices have stabilized since 2013, the use of foreign currency has not decreased, and continues to spread.15

As such, the phenomenon of the continual use of foreign currency despite the fact that prices have stabilized is called dollarization hysteresis.16

North Korea’s prices and exchange rates soared after the confiscatory currency reforms at the end of 2009, and remained largely stable during 2013-2019.17 The price of rice, which represents North Korean prices more broadly, soared from 120 won in early January 2010 to 6,800 won in early January 2013, an average annual increase of 284%. Since then, it has fluctuated at the level of 4,000-7,000 won, but it is generally stable.

The black market exchange rate of the North Korean domestic currency with the U.S. dollar has fallen in value since it was at 120 North Korean won in early January 2010. It fell in value to 9,100 North Korean won in early January, recording an average annual decrease in value of 423%. Since then, between 2013 and 2019, the black market exchange rate has remained stable at around 8,200 North Korean won.18

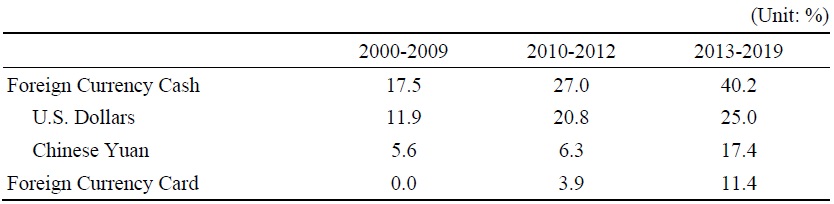

Despite the price stability seen from 2013-2019, the use of foreign currency cash as a payment instrument was still increasing. Shown in Table 14, the use of foreign currency cash as a payment method increased from 27.0% of all transactions in 2010-2012 to 40.2% in 2013-2019, as dollarization hysteresis occurred.

While the total foreign currency cash payment experience rate increased by 13.2%p during the two periods, by currency type, the Chinese yuan increased by 11.1%p, a higher rate of increase than the 4.2%p increase in the U.S. dollar. The rate of foreign currency card payment experience also increased by 7.5%p, from 3.9% in 2010-2012 to 11.4% in 2013-2019.

2. Causes of Dollarization Hysteresis

The causes of this phenomenon of dollarization hysteresis include purchasing power risk and network externalities on the demand side and foreign currency supply on the supply side, which are often discussed in the economic literature. It is necessary to assess the extent to which the above theories have explanatory power concerning North Korea’s dollarization hysteresis.

(1) Purchasing power risk

The theory of purchasing power risk, put forward by Craig and Waller (2004), argues that if a sharp decline in the value of a domestic currency, such as a confiscatory currency reform, is expected, dollar payments will be preferred.

Craig and Waller (2004) expressed the purchasing power risk of domestic currency as the possibility of a confiscatory currency reform. It was estimated that if the probability of a confiscatory currency reform increased from 0 to 0.125, the share of dollar payments would increase by 2.4%p. Here, despite the possibility of a decline in the value of the domestic currency, the failure of the U.S. dollar to completely replace the domestic currency is due to the incurring of transaction costs when using the dollar.

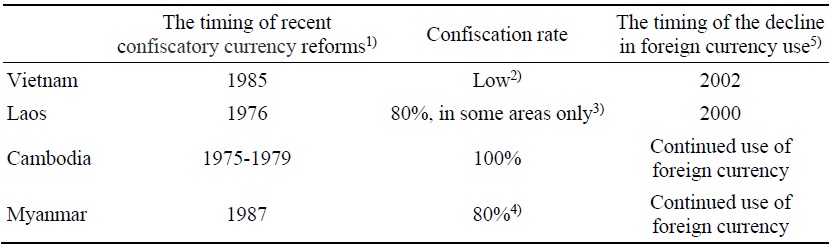

If you look at transitioning Southeast Asian economies that have experienced confiscatory currency reforms, dollarization continued to progress in most countries, and in the case of countries with high confiscation rates, dollarization continues to this day. In the case of Vietnam and Laos, where confiscation rates were low, these countries shifted toward a lower degree of dollarization in the 17 and 24 years after their currency reforms, respectively. On the other hand, in Cambodia and Myanmar, where the confiscation rates were very high, dollarization continues to exist even today, 42 and 34 years after their confiscatory currency reforms, respectively.

(2) Network externalities

The theory of network externalities, as presented in Uribe (1997), argues that the more that dollars are used, the more preference there is for dollar payments to occur, and the lower the transaction costs of making dollar payments.

The Uribe Model (1997) refers to the cumulative experience of an economy using U.S. dollars as a means of payment as “dollarization capital” and considers that the more this dollarization capital accumulates, the lower the transaction costs of a dollar payment in that economy. In this model, the transaction cost φ (θ, k) at the time of dollar payments is expressed as a function of the various goods traded in the economy (θ) and the experience accumulated in an economy with respect to the use of the dollar as a means of payment (k).

The model argues that the continuation of the dollarization phenomenon is not because a decline in the value of the domestic currency leads to the expectation of a sharp decline in the value of the domestic currency, but because dollarization leads to a decrease in transaction costs. If the transaction costs associated with the use of a foreign currency are lowered, and the transaction costs become smaller than the cost of inflation, dollarization becomes difficult to reverse.

Engineer (2000) considers that the transaction costs related to the use of foreign currency include exchange costs, counterfeit verification costs, as well as other expenses, and that the counterfeit verification costs are larger than the exchange costs. In addition, some countries have laws prohibiting the use of foreign currency, and there are additional costs associated with avoiding regulations.

Network externalities mean that if someone uses dollars as a means of payment, they will benefit from someone else’s dollar payments, too. There are cases initiated by the market, like the Uribe (1997), and by the government.

In the case of North Korea, there is also an aspect that has been forced from above.19 In response to the shortage of foreign currency, the government has greatly increased the number of restaurants, mobile phones, and taxis that accept foreign currency. Even in the Kim Jong-un era, the number of foreign currency service centers that charge a fee for the use of foreign currency is increasing.20

3. Evaluation of the Continued Use of Foreign Currency in North Korea

As for the continued use of foreign currency in North Korea, both the purchasing power risk theory and the network externality theory are seen to have considerable explanatory power.

Since 2010, the number of North Korean consumers who mistrust the domestic currency has increased. Over time, North Koreans’ concerns about a confiscation-type currency reform have not diminished, making the purchasing power risk theory applicable. Judging from the intensity of the impact on consumers, the confiscation-type currency reform of 200921 is estimated to have been incomparably greater than the currency reform of 1992. Therefore, most North Korean defectors have said that they used to keep their excess funds in foreign currency since 2010,22 and that even in the case of domestic currency held after the end of economic activity on the same day, if it exceeds USD $100, it would be converted into foreign currency on the same day and saved that way as cash.

In addition, as the volume of trade increases, the types of foreign currency use expand, and consumer experiences continue to spread. It is said that the transaction costs associated with the use of foreign currency have been significantly lowered, so the explanatory power of the theory of network externalities can be evaluated as being considerable. Regarding the cost of counterfeit verification, North Korean merchants, who experienced great damage caused by counterfeit U.S. dollars in the early 2000s, are said to have learned simple counterfeit dollar differentiation methods since the late 2000s, to shorten the time needed for counterfeit verification. It is also said that the cost of currency exchange has been continuously decreasing since 201023 due to the impact of the expansion of trade volume and the spread of mobile phones.

Meanwhile, in the 2020s, the foreign currency flow phenomenon may weaken due to the deterioration of the foreign currency balance due to UN sanctions against North Korea and the impact of border closures to prevent Covid-19. The absolute amount of foreign currency transactions appears to have decreased, but the news that the relative proportion of foreign currency transactions has decreased has not been reported by media specializing in North Korea.

15)

16)

17)Daily NK, North Korean market trends.

18)However, from November 2020 to June 2022, as imports fell sharply due to border closures, the exchange rate showed some rise in value to the level of 5,000 to 7,000 North Korean won.

19)

20)Examples include the Haedanghwa Hall (opened in May 2013) and the Mirim Equestrian Ward (opened in November 2013).

21)For one week, from November 30 to December 6, 2009, the North Korean authorities conducted a “currency exchange” project in which 100 won of old notes were exchanged for cash at the rate of 1 won for new notes and 10 won for old deposits at the rate of 1 won for new deposits.

22)“During the currency reform, I lost about 5 million North Korean won [equivalent to around USD $1,300]. Immediately after the currency exchange, I worried that there would be another round of currency reform, so I kept my cash only in dollars.” (Respondent J1, defected in 2011)

23)“In Pyongyang, a $5 fee was charged in 2008 to exchange $100 from a local money changer, but by 2013 it had dropped to $3.” (Respondent P1, defected in 2014) “I remember that in Hyesan, the exchange fee between the yuan and the DPRK won dropped from about 3% in 2008 to about 2% in 2013. After currency reform in 2009, there were many money changers, and people began to hold a lot of yuan.” (Respondent H2, defected in 2013)

V. Conclusion

Through a survey of North Korean defectors, this paper attempts to quantitatively measure the extent to which North Korean consumers use foreign currency as a means of payment and to identify its characteristics.

The status of payment instruments provides useful information to understand the openness of the North Korean economy to the outside world and the credibility of the North Korean won.

The survey respondents in this survey are 292 North Korean defectors who defected between 2000 and 2019. To overcome the problem of regional bias in the North Korean defector community, efforts were made to include as many respondents from inland areas as possible in the sample.

According to a survey of North Korean consumer payment instruments, it was found that as of 2015-2019, North Korean consumers are using domestic currency cash, U.S. dollar cash, Chinese yuan cash, and grain as physical payment instruments. and that in the 2010s, the use of domestic currency cash and grain decreased, while the use of foreign currency cash and electronic payment instruments increased.

The use of foreign currency has reached a point where it has spread not only as a store of value but also as a medium of exchange. The reason for the foreign currency demand is the confiscatory currency reform, and the reason for the foreign currency supply is the active foreign economic exchanges. However, in most regions the most commonly used instrument of payment by North Korean consumers is still domestic currency cash, except for the North Korea-China border area.

The survey showed clear regional differences. Consumers in inland urban areas use a mixture of domestic currency cash and U.S. dollar cash, but in the North Korea-China border area there is a use of domestic currency cash and Chinese yuan cash, resulting in a large amount of foreign currency usage.

The use of foreign currency cards has greatly increased due to their ease of use and stability of value. On the other hand, the use of domestic currency cards has remained at only 6.8% in 2015-2019 due to a lack of available stores in which they can be used, since they were only introduced in 2015.

Despite the fact that prices have stabilized between 2013 and 2019, the use of foreign currency cash and foreign currency card payments continues to increase, which can be interpreted as dollarization hysteresis. As for the causes of the dollarization hysteresis, both the purchasing power risk theory and the network externality theory can have considerable explanatory power.

Since 2010, the majority of the population has significantly reduced its confidence in the domestic currency, and the fear of a confiscatory currency reform by the North Korean authorities has not diminished over time, so the purchasing power risk theory is considered applicable. Judging from the intensity of the impact on consumers, the confiscation-type currency reform of 2009 is estimated to have been incomparably greater than the currency reform of 1992. In addition to this, as the volume of trade has generally increased, and as the use of foreign currency has broadened and continued to expand, the transaction costs of using foreign currency have decreased. It’s theorized that the effects of network externalities have occurred considerably, so the explanatory power of the network externality theory can be seen as being substantial.

Compared to previous studies, I believe that the contribution of this paper is that it has increased statistical significance through the introduction of regional weights and has extended the survey period until 2019. In Yang (2016) and Lee (2016), the sample respondents are mainly from the North Korea-China border region. Meanwhile, in Mun and Jung (2017), the survey period is only set until 2012. But there are limitations in that this paper lacks rigorous analysis method. However, in view of the fact that there are no official financial statistics on North Korea, the focus of this paper was on fact-finding research.

The results of this study’s research into North Korean consumer payment instruments can have the following implications concerning the dollarization that North Korea is currently facing. Dollarization in North Korea is not a temporary event, but is intensifying due to concerns about a confiscatory currency reform and the manifestation of network externalities. This suggests that if North Korea’s dedollarization policy is re-implemented, it would cost more now than it did at the end of 2009. De-dollarization here means direct regulation that as stipulated in North Korea’s foreign currency transaction law, individuals cannot trade foreign currency and foreign currency is confiscated in the event of a crackdown while trading.24 The de-dollarization policy implemented during the currency reform at the end of 2009 prevented individuals from holding U.S. dollars, resulting in a decline in imports, which led to significant economic difficulties, such as shortages of goods and rising prices. Also, in the case of domestic currency cards, which the North Korean authorities introduced in 2015 as part of a means of financial reform, this paper suggests that it may continue to be difficult for domestic currency cards to normalize official finance under the dollarization hysteresis.

24)Therefore, measures such as introduction of the payment card that may cause reflexive effects do not belong to de-dollarization policy.

Tables & Figures

Table 1.

Questionnaire Items of the North Korean Consumer Payment Survey

Table 2.

Number of Persons Surveyed

Note: The figures in parentheses are the percentage share of the total number of persons by region of origin.

Table 3.

Number of Survey Respondents by Age at Defection

Note: The figures in parentheses are the percentage share of the total number of persons by age at defection.

Table 4.

Payment Experience Ratio of North Korean Consumers

Notes: Multiple responses allowed. The national figure is calculated using the number of regional population as a weight.

Table 5.

Payment Experience Ratio of North Korean Consumers (in Inland Urban Areas)

Note: Multiple responses allowed.

Table 6.

Major Payment Instruments by North Korean Consumers (in Inland Urban Areas)

Table 7.

Payment Experiences Ratio of North Korean Consumers (in the North Korea-China Border Area)

Note: Multiple responses allowed.

Table 8.

Major Payment Instruments by North Korean Consumers (in the North Korea-China Border Area)

Table 9.

Payment Experience Ratio of North Korean Consumers (in Inland Urban Areas)

Note: Multiple responses allowed.

Table 10.

Major Payment Instruments by North Korean Consumers (in Inland Rural Areas)

Table 11.

Foreign Currency Payment Experience Ratio of North Korean Consumers by Occupation

Table 12.

Comparison of Major Means of Payment by North Korean Residents (in

Table 13.

Comparison of Major Means of Payment by North Korean Residents (in Retail Store)

Table 14.

Use of Foreign Currency as Payment Instruments

Notes: Multiple responses allowed. The national figure is calculated using the local population as weight.

Table 15.

Confiscatory Currency Reforms in Southeast Asian Economies in Transition

Notes: 1) In the case of Cambodia, it was time for the abolition of the currency by the Khmer Rouge regime.

2) Two weeks’ advance notice by the authorities gives the wealthy time to replace domestic currency with foreign currency, seriously reducing the effectiveness of confiscatory currency reform.

3) After the establishment of the Lao People’s Democratic Republic in 1976, the Revolutionary Army implemented a confiscatory currency reform of the currency that had been issued in the region under the control of the former Vientiane government.

4)

5)

References

-

AP. 1987. “Burma Demonetizes 80 Percent of Currency.” Journal of Commerce, September 8.

https://www.joc.com/article/burma-demonetizes-80-percent-currency_19870908.html -

Alvarez-Plata, P. and A. Garcia-Herrero. 2008. “To Dollarize or De-dollarize: Consequences for Monetary Policy.” Working Papers, no.0808, Banco Bilbao Vizcaya Argentaria.

https://www.bbvaresearch.com/en/publicaciones/to-dollarize-or-de-dollarize-consequencesfor-monetary-policy/ - Braiton, Nombulelo. 2011. “Dollarization in Cambodia: Causes and Policy Implications.” IMF Working Paper, no. WP 2011/049. International Monetary Fund.

- Calvo, G. and C. A. Vegh. 1992. “Currency substitution in developing countries: an introduction.” IMF Working Paper, no. WP 1992/040. International Monetary Fund.

-

Craig, B. and C. Waller. 2004. “Dollarization and Currency Exchange.”

Journal of Monetary Economics , vol. 51, no. 4, pp. 671-689.

-

Daily NK. n.d. “North Korea Market Trends [Data].”

https://www.dailynk.com/english/market-trends/ (accessed June 30, 2022) -

Dean-Leung, S. and T. T. Vo. 1996. “Vietnam in the 1980s: price reforms and stabilization.”

BNL Quarterly Review , vol. 49, no. 197, pp. 187-207. -

Engineer, M. 2000. “Currency transactions costs and competing fiat currencies.”

Journal of International Economics , vol. 52, no. 1, pp. 113-136.

-

Feige, E., Faulend, M., Šonje, V. and V. Šošić. 2002. “Chapter 2. Unofficial Dollarization in Latin America: Currency Substitution, Network Externalities and Irreversibility.” In Salvatore, D., Dean, J. W. and T. D. Willett. (eds.) T

he Dollarization Debate . New York: Oxford University Press. -

Kim, S.-J. 2010. “North Korea’s monetary reform through international comparisons.” KIET Industrial Economy Analysis. Korea Institute for Industrial Economic & Trade.

https://www.kiet.re.kr/research/economyDetailView?detail_no=876 (in Korean) -

Kim, S.-J. 2019. “Recent Research on the North Korean Economy: A Review Essay.”

Journal of Peace and Unification Studies , vol. 11, no. 1, pp. 33-78.https://doi.org/10.35369/jpus.11.1.201906.33 (in Korean)

-

Kim, Y.-N. 2014. “Hyeon-si-gi yu-hyu-hwa-pye ja-geum-gwa geu dong-won-li-yong [Current idle money funds and their mobilization use].”

Kyeong-Je-Yeon-Gu , vol. 4, pp. 61-99. Pyongyang: Science Encyclopedia Comprehensive Publishing House. (in Korean) -

Lee, J.-K. 2016. “Evaluation of North Korea’s Recent Economic Policy and Future Prospects” Policy Study Series, no. 2016-08. Korea Development Institute.

https://www.kdi.re.kr/research/reportView?pub_no=15210 (in Korean) -

Lee, J.-Y. and S.-M. Mun. 2020. “Study of Informal Finance in North Korea, with Analysis and Evaluation.” BOK Working Paper, no.2020-16. Bank of Korea.

https://www.bok.or.kr/imerEng/bbs/B0000196/view.do?nttId=10059125&menuNo=600341&pageIndex=3 (in Korean) -

Lee, S.-K., Kim, S.-J. and M.-S. Yang. 2012. “Analysis of North Korea’s Foreign Currency Use.” KIET Research Papers, no. 2012-653. Korea Institute for Industrial Economic & Trade.

https://www.kiet.re.kr/research/reportView?report_no=662 (in Korean) -

Levy-Yeyati, E. 2006. “Financial Dollarization: Evaluating the Consequences.”

Economic Policy , vol. 21, no. 45, pp. 61-118. -

Mas, I. 1995. “Things Governments Do to Money: A Recent History of Currency Reform Schemes and Scams.”

Kyklos , vol. 48, no. 4, pp. 483-512.

-

Melvin, M. and B. Peiers. 1996. “Dollarization in Developing Countries: Rational Remedy or Domestic Dilemma?”

Contemporary Economic Policy , vol. 14, no. 3, pp. 30-40.

-

Mun, S.-M. and D.-H. Lee. 2016. “Chapter 1. Characteristics of North Korean finance and changes in institutions and policies.” In Export-Import Bank of Korea.

North Korean Financial System and Its Challenges . Seoul: Oruem. pp.17-67. (in Korean) -

Mun, S.-M. and S.-H. Jung. 2017. “Dollarization in North Korea: Evidence from a Survey of North Korean Refugees.”

East Asian Economic Review , vol. 21, no. 1, pp. 81-100.

-

Statistics Korea. 2008. Korean Statistical Information Service-DPRK 2008 Population Census [Data].

https://kosis.kr/statHtml/statHtml.do?orgId=101&tblId=DT_IZGI05_005&vw_cd=MT_BUKHAN&list_id=101_101BUKHANB11_A_01&scrId=&seqNo=&lang_mode=ko&obj_var_id=&itm_id=&conn_path=MT_BUKHAN&path=%252FstatisticsList%252FstatisticsListIndex.do (accessed June 30, 2022. in Korean) - Son, K.-S. 2020. “Examples of North Koreans’ Use of Telephone Money.” KB Studies of North Korea, no. 2020-08. KB Research. (in Korean)

-

Uribe, M. 1997. “Hysteresis in a simple model of currency substitution.”

Journal of Monetary Economics , vol. 40, no. 1, pp. 185-202.

-

Valev, N. T. 2010. “The hysteresis of currency substitution: Currency risk vs. network externalities.”

Journal of International Money and Finance , vol. 29, no. 2, pp. 224-235.

-

Yang, M.-S. 2016. “Chapter 3. Dollarization in North Korea.” In Export-Import Bank of Korea.

North Korean Financial System and Its Challenges . Seoul: Oruem. pp. 113-142. (in Korean) -

Zang, H.-S. 2013. “Estimation of and Analysis on the Balance of Foreign Exchanges of North Korea for 1991-2012.”

Unification Policy Studies , vol. 22, no. 2, pp. 165-190. (in Korean) -

Zang, H.-S. and S.-J. Kim. 2019. “Estimation of the Balance of Foreign Exchanges and Foreign Exchange Reserves of the Kim Jong-Un Regime and Implications for North Korea-US Denuclearization Negotiations.”

Review of North Korean Studies , vol. 22, no. 1, pp. 8-43. (in Korean)